St. Louis Business Journal

-

First Quarter Investment Report

Following 2023’s sweeping comeback performance, 2024 wanted a piece of the action. It was a quarter of warm springs and chill winds from the Middle East and Russia/Ukraine. Japan continued to rise, while China continued to present a muddied picture. All eyes remained on AI and its ramifications, while economic strength was the gift that…

-

Moneta Merges in Third Colorado Firm, Expanding National RIA into Boulder

ST. LOUIS — March 6, 2024 — Moneta, a 100% partner-owned Registered Investment Adviser (RIA) firm, announces the addition of Amy Hiett and Mike Walsh as Partners. The team formerly known as Juniper Wealth Advisors joins Moneta from Wells Fargo with about $279 million in assets under management (AUM), bringing Moneta up to approximately $34 billion…

-

An Assessment of Geopolitics and Changing World Order – Part 3

“The problem isn’t getting rich, it’s staying sane.” -Charlie Munger[1] The current environment is rife with uncertainty. Following two seismic events, the COVID-19 pandemic and the first ground war in Europe since World War II, investors have also had to grapple with the most rapid rate hiking cycle from the Federal Reserve since 1980, deteriorating…

-

Why It May Make Sense to Convert Traditional IRAs to Roth IRAs Sooner Than Later

CWCJ – Senior Advisor This could be the perfect time to convert a traditional Individual Retirement Account (IRA) to a Roth IRA. Roth IRAs have often provided significant benefits to investors. Money in these accounts grow tax-free, there are no required minimum distributions (RMDs) beginning at age 72 and no income tax is due on…

-

CWCJ Announces Two Promotions Within Their Athlete & Entertainment Services

In 2014, our team’s Athlete & Entertainment Service was born with the addition of Jordan Janes CFP®. Jordan quickly advanced in his career with CWCJ and was promoted to Partner in 2018. The practice has been on a steady growth trajectory ever since, and to support this growth, CWCJ brought on board Kevin Nelson and…

-

Clarifying the Opaque World of Estate Planning: An Introductory Glossary

Family Office Strategist – Elizabeth Sheehan, J.D. Estate planning is a complicated process filled with legal terms that can be overwhelming. Developing some familiarity with the various documents and roles typically involved in a straightforward estate plan may make the topic easier to understand. In the following paragraphs, we outline some of the standard legal…

-

Secure Act 2.0: Retirement Planning

Senior Tax Strategist – Abby Donnellan CPA The SECURE 2.0 Act of 2022, signed into law on 12/29/2022, builds on the prior SECURE Act of 2019 and focuses on helping Americans save for retirement. Below are some of its key provisions: Catch-Up Contributions In 2023, the catch-up contribution limit for those 50 and older…

-

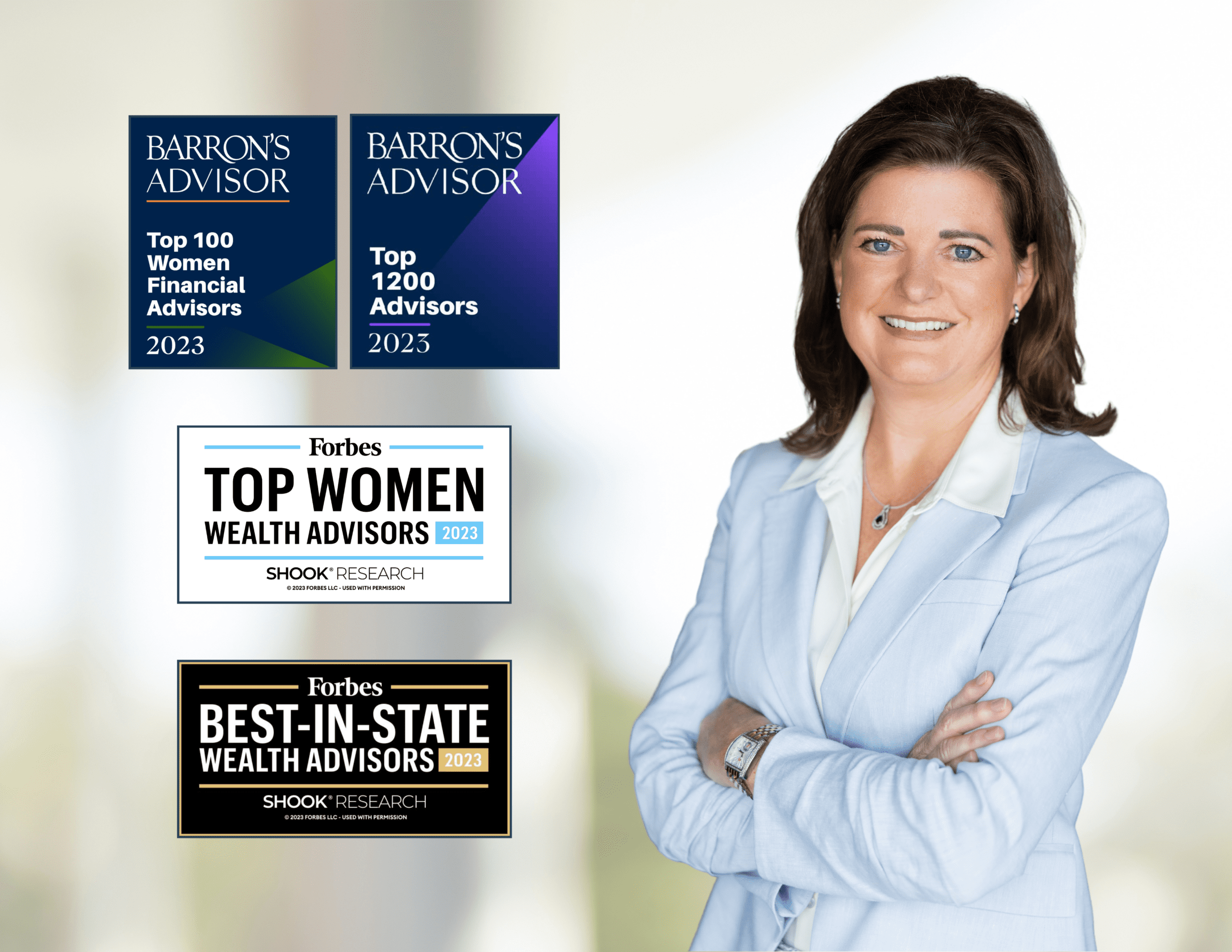

Diane Compardo Recognized Four Times in 2023 as a Top Advisor by Barron’s and Forbes

Diane Compardo & Mark Conrad Named to Forbes Best-In-State Wealth Advisors List in 2023.

-

Estate Planning Insider: Is it Time for Irrevocable Life Insurance Trusts to Make a Comeback?

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Senior Advisor, Benjamin Trujillo J.D., LL.M. – An irrevocable life insurance trust (ILIT) is a trust that is designed to hold a life insurance policy to take care of the trust’s beneficiaries. These trusts were quite popular until the late 2000’s. As interest…

-

Estate Planning Insider: What Impact Do Rising Interest Rates Have on Estate Planning?

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Senior Advisor, Benjamin Trujillo J.D., LL.M. – Estate planning is an important aspect of financial planning that helps individuals and families protect and manage their assets. However, changes in the economy, including rising interest rates, can have a significant impact on estate planning…

-

Estate Planning Insider: Is Premium Financing Still A Good Planning Technique as Interest Rates Skyrocket?

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Senior Advisor, Benjamin Trujillo J.D., LL.M. – Premium financing is a technique that can be used in estate planning to allow individuals and families to leverage life insurance at a lower cost than traditional policy ownership. The basic idea is that when a…

-

Estate Planning Insider: Updated Rules for IRAs and Their Effect on Estate Planning

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Senior Advisor, Benjamin Trujillo J.D., LL.M. – Individual Retirement Accounts (IRAs) have long been a popular tool for retirement savings, with many people relying on them as a key source of retirement income. However, recent changes to the rules for IRAs have significant…

-

Estate Planning Insider: Benefits and Pitfalls of Spousal Lifetime Access Trusts

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Senior Advisor, Benjamin Trujillo J.D., LL.M. – A spousal lifetime access trust (SLAT) is a type of irrevocable trust that offers numerous benefits for married couples. In general, the purpose of a SLAT is to provide financial security and estate planning benefits while…

-

Estate Planning Insider: What is a Qualified Spousal Trust?

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Senior Advisor, Benjamin Trujillo J.D., LL.M. – Qualified Spousal Trusts (QSTs) are a type of estate planning tool in certain states, like Missouri and Arkansas, that can provide married couples with a range of benefits, including asset protection, estate tax optimization, and discrete…

-

Economic Indicators: Consumer Spending

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Advisor – Matt Schaller MBA, CFA, CFP® Economic indicators are, in their most simple terms, a statistic or data point about economic activity. They tell a story about what happened in the economy and can be used to get a sense of where…

-

Economic Indicators: Employment

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Advisor – Matt Schaller MBA, CFA, CFP® In our last CWCJ Insider, we discussed economic indicators in general, as well as consumer spending and how that impacts the overall economy. Today, we will focus on a different economic indicator – employment. Employment itself…

-

Economic Indicators: Mortgages

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Advisor – Matt Schaller MBA, CFA, CFP® – As we continue in our CWCJ Insider Series, some key economic indicators followed by economists surround mortgages. We will explore how mortgages are used to measure economic health and why they are considered a vital…

-

The Psychology of Money: Navigating Biases

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Manager of Marketing & Business Intelligence – Megan Merriss As a marketer by trade, I spend a lot of my day trying to put myself in the minds of my team’s clients. What is most important to them? What do they enjoy doing?…

-

The Psychology of Money: Generational Perspectives on Investing and Estate Planning

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Manager of Marketing & Business Intelligence – Megan Merriss Generations have unique experiences and perspectives shaped by their historical context and societal influences. When it comes to money and investing, each generation—Gen Z, Millennials, Gen X, and Baby Boomers— often exhibit distinct attitudes…

-

The Psychology of Giving: Money and Generosity

[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button] Manager of Marketing & Business Intelligence – Megan Merriss Gift-giving has been an enduring aspect of human culture for centuries. Whether it’s a birthday, a holiday, or a spontaneous act of kindness, the act of giving carries emotional significance for both the giver…

-

New Retirement Security Rule Reinforces Fiduciary Standards for Investment Advisors

On April 23, 2024, the Department of Labor (DOL) announced a significant overhaul to the Retirement Security Rule that strengthens fiduciary responsibilities for financial advisors dealing with retirement plans and IRAs. This comprehensive update to the fiduciary definition under the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code is scheduled to take…

-

Executive compensation is complex. How can you be sure you’re making the right financial moves?

If you’ve been juggling your work life, family life, and financial life, you’re not alone. Cognitive dissonance can be both ironically humorous and deeply unsettling depending on how long you think about it. As a corporate executive, you help drive the organization’s growth and profitability. At home, however, managing your own wealth feels like a…

-

The First Steps Towards Selling Your Business When It Already Feels Too Late to Start Planning

You were so busy building your business that you never took time to consider an exit plan – now what? So far away, and yet so close. That’s probably how the time horizon for selling your business feels. You keep telling yourself that you have plenty of time to plan your exit because, let’s face…

-

The Three Ages of Retirement

Think you know your retirement number? Think again. More specifically, think differently. The concept of a singular retirement age isn’t helpful once you start thinking about it. A one-size-fits-all standard would be particularly absurd, but even isolating a magic number specific to your own individual circumstances and goals can hinder your preparation for crossing that…

-

Giving Circles: Fostering Learning, Increasing Impact

For newer philanthropists and seasoned donors seeking to make an impact, Giving Circles can serve as a terrific source of sector knowledge and insights about community needs. Giving Circles create opportunities for donors to pool their individual, smaller contributions. Working together, members of the group can make thoughtful, collective decisions about allocating the funds to…

-

A Career at Moneta Gives You More. And Gives Back to the Community.

“With a mission to foster financial literacy and increase economic access, as well as supporting organizations that help our communities to thrive, the Moneta Charitable Foundation provides grant dollars and amplifies nonprofit service opportunities in the places where we live and work.” Eric Kittner, CEO, Moneta A job, let alone a career, is more than…