[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button]

Advisor – Matt Schaller MBA, CFA, CFP®

Economic indicators are, in their most simple terms, a statistic or data point about economic activity. They tell a story about what happened in the economy and can be used to get a sense of where the economy is heading. Typically, you will hear about two main types of indicators (though there are more), which are “lagging indicators” and “leading indicators.” Lagging indicators tend to be data points that follow (or “lag”) a change in the economy. Leading indicators tend to change ahead of (or “lead) a change in the economy. There is also a third type called coincident indicators. This type changes pretty much in lockstep with the overall economy. While various economic indicators and data points can be measured, each important in its own way, I would like to highlight a few of the more common economic data points you often hear about in the news.

This blog will cover consumer spending, which is generally a coincident indicator (the type that typically changes in real-time with the economy). It’s no secret that the United States is a consumer-driven economy. This means consumer spending can be important to pay attention to when trying to predict where the overall economy is heading.

Definitions you will want to know:

Gross Domestic Product (GDP) – is a measure of the value of all finished goods and services produced in a given time period. It can be thought of as a “scorecard” or “gut check” to help measure the overall economic health of a country (not just the United States).

Consumer spending – is the total money individuals and households spend on goods and services.

In the United States, consumer spending accounts for 70% of GDP, so it is an economic indicator you will hear a lot about in the news. Put simply, when consumer spending is strong, the economy has a good chance of strengthening, while when consumer spending is declining, the economy is also typically heading in that direction.

As a coincident indicator, consumers tend to adjust their spending up or down based on economic health. When the economy is strong, households have the income to spend and confidence in the economy’s overall direction, so they will tend to spend more. Think about your own household. If you have a reliable income (or just got a raise), are secure in your job, and are confident in the overall economy, you are likely to spend money (or spend more). This could be buying a new house, a new car, or adjusting your day-to-day spending on stuff like going to restaurants more or purchasing more items on your “wants” list (vs. your “needs” list).

If, on the other hand, the economy is weakening, goods cost more (through inflation), or your personal income may not seem secure, you tend to see consumers spending less or changing spending habits. You may change habits in your household by shopping less at the more expensive grocery stores and more at discount grocers. You may keep your car for an extra year or two instead of buying a new one. You may shop less at high-end retailers or cut that part of spending completely. You may cut travel, drive instead of fly, or visit a place for 4 days instead of 6, etc.. Your “wants” list will typically adjust and may be put on the back burner.

Consumer spending directly impacts a company’s bottom line and, thus, the overall economy. If the economy is in a recession, a business owner owning a discount grocer will fare differently than a high-end jeweler. Conversely, in a strong economy, an entrepreneur may decide there is unmet demand for high-end jewelry and look to open a business, hire employees, etc.

All these data points, whether trending positively or negatively, leave breadcrumbs for economists to gauge how the economy is doing.

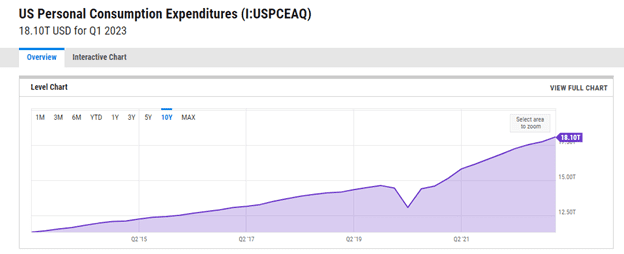

The Bureau of Economic Analysis analyzes and releases data on consumer spending, the most common measure being Personal Consumption Expenditures (PCE). Currently, PCE has been trending higher over the last several quarters and is sitting at an all-time high, as you can see from the chart below:

Taken on its surface, you can see that, while we are currently experiencing some uncertainty in the economy as well as dealing with inflation, consumer spending remains strong, and thus is a reason that we have, at least for now, avoided a deep recession. There are many reasons for this that we won’t go into too much depth, but a few include pent-up demand (from COVID), a still-strong labor market (people still have jobs and employers still need workers), and lower interest rates in COVID – a lot of people bought cars and houses over the last few years, which means they need to purchase furniture, electronics, everything that goes along with it.

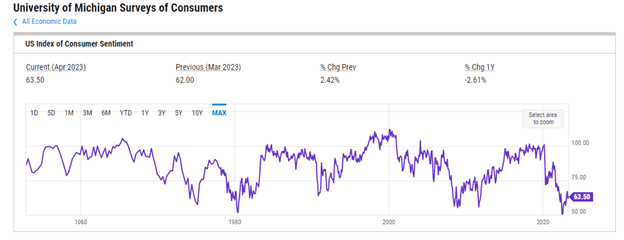

The University of Michigan conducts surveys of consumers and asks them questions regarding their current and future financial standings, as well as their thoughts on the economy now and in the future. This is known as the University of Michigan Survey of Consumers. It is a closely watched indicator by economists and market participants as it attempts to look into the future to see if consumers are still comfortable in the economy. Just like with the stock market, there will be inflection points, and consumers can feel “overexuberant” or “overly pessimistic” at specific times, so while the data itself is important, a low data point does not mean a recession is near just as much as a high data point does not imply a recession is impossible.

Overall, by monitoring economic indicators, economists can gather valuable information about the state of the economy. While no single data point tells the whole story, they collectively provide breadcrumbs for assessing economic trends and informing decision-making in various sectors. Keeping a pulse on consumer spending offers a broader perspective on the economy’s overall direction, aiding individuals, businesses, and policymakers in making informed choices.

If you would like to learn more, you can contact me at 314-735-9143 or by email at mschaller@monetagroup.com.

SIGN-UP TO RECEIVE THESE EDUCATIONAL PIECES STRAIGHT TO YOUR INBOX HERE.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.