[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button]

Manager of Marketing & Business Intelligence – Megan Merriss

Generations have unique experiences and perspectives shaped by their historical context and societal influences. When it comes to money and investing, each generation—Gen Z, Millennials, Gen X, and Baby Boomers— often exhibit distinct attitudes and behaviors driven by factors such as economic conditions, technological advancements, and cultural shifts. This blog will delve into a comparative analysis of how these generations tend to view money and investing.

Generation Z:

Born between the late 1990s and early 2010s (ages 11 – 24), Gen Z is the first generation to grow up in a fully digital era. They are characterized by their innate technological aptitude, diversity, and social awareness. In terms of money and investing:

- Financial Pragmatism: Gen Z may have felt the fear or impact on families of the 2008 financial crisis, as they tend to see the importance of financial stability. According to a recent study by TransAmerica Center for Retirement Studies, over 30% of Gen Z is prioritizing retirement savings, and 67% of those offered a retirement plan are saving for it.

Tech-Savvy Investors: Gen Z is comfortable using online platforms for financial activities. They are more likely to use apps and digital tools for banking, investing, and budgeting. This inclination is further demonstrated by their interest in purchasing cryptocurrency, which is considerably higher among Gen Z than other generations.

Tech-Savvy Investors: Gen Z is comfortable using online platforms for financial activities. They are more likely to use apps and digital tools for banking, investing, and budgeting. This inclination is further demonstrated by their interest in purchasing cryptocurrency, which is considerably higher among Gen Z than other generations.- Entrepreneurial Spirit: This generation values autonomy and is open to unconventional career paths. Many Gen Z individuals seek to create their own income streams through side gigs, freelancing, and entrepreneurial ventures.

- Social Impact Investing: Gen Z is concerned about social and environmental issues. They are more inclined to align their investments with their values, pushing for socially responsible and sustainable investing practices. Their desire for positive change extends beyond individual actions and into their investment decisions. (Image: Piper Sandler Survey 2023)

- Eager to Learn: Gen Z values financial education. A study by Raddon found that Gen Z were up to 3x more likely to have taken a financial education course than millennials.

Millennials:

Born between the early 1980s and mid-1990s (ages 25 – 43), Millennials are known for navigating the transition from analog to digital technologies. Their financial perspectives include:

- Debt Burden: Millennials often carry student loan debt and entered the job market during the aftermath of the 2008 financial crisis. A study by Northwestern Mutual indicates that student debt is weighing heavily on younger generations. 10% of Millennials cited personal education loans as their top source of debt compared to Generation X at 3% and Boomers at 1%.

- Digital Financial Management: Millennials embrace technology to manage their finances. They use apps for budgeting, investing, and tracking expenses. The ease of access to financial information online has empowered them to take control of their financial decisions in ways that previous generations could not.

- Investment Trends: Millennials seem to be more comfortable with alternative investments, which have gained popularity over the last 15-20 years. According to a Bank of America study, 80% of young investors are looking to alternative investments, such as private equity, commodities, real estate, and other tangible assets, compared to 21% of older respondents.

- Socially Responsible Investing: Millennials are more likely to invest in companies with a strong environmental or social record. In the same Bank of America survey above, 75% of millennials reported investing in sustainable products and ventures.

Gen Z and Millennials Views of Estate Planning:

Gen Z and Millennials are estimated to inherit $30 trillion by 2045. A Bank of America study of wealthy Americans found that many consider it a top financial goal to pass their wealth onto future family members – but the youngest generations were found to set this as a higher priority than their elder counterparts.

(Source, data collected May – June 2022)

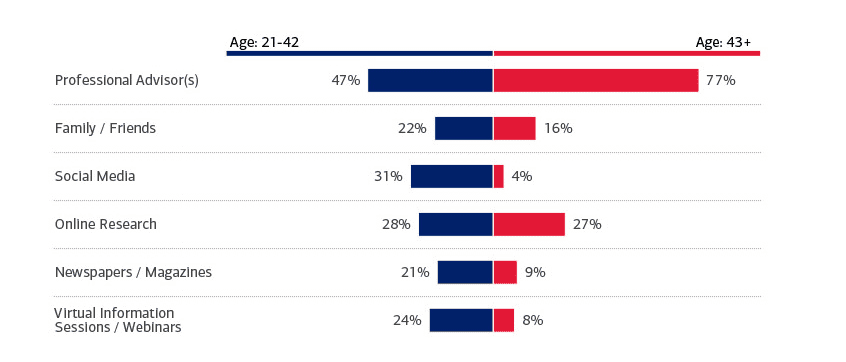

There is also a difference in where generations seek advice for estate planning. Younger generations are more likely to look to family members, friends, and social media for advice. This is opposed to their older relatives, who are more likely to seek advice from a more traditional source, such as a professional advisor.

(Source, data collected May – June 2022)

Generation X:

Born between the early 1960s and late 1970s (ages 44 – 56), Gen X experienced economic fluctuations and technological advances during their formative years. Their financial perspectives include:

- Balancing Act: Gen X is often referred to as the “sandwich generation” as they balance supporting aging parents and financially dependent children. A study by Pew Research Center found that 54% of Americans over the age of 40 have a living parent age 65 or older and are either raising a child under 18 or have an adult child they helped financially in the past year.

- Investing Savvy: Having witnessed the rise of technology, Gen Xers are comfortable with online investing platforms. They are more likely to manage their investments independently. A study by Allianz Life found that 64% of Gen Xers are confident in their investment knowledge.

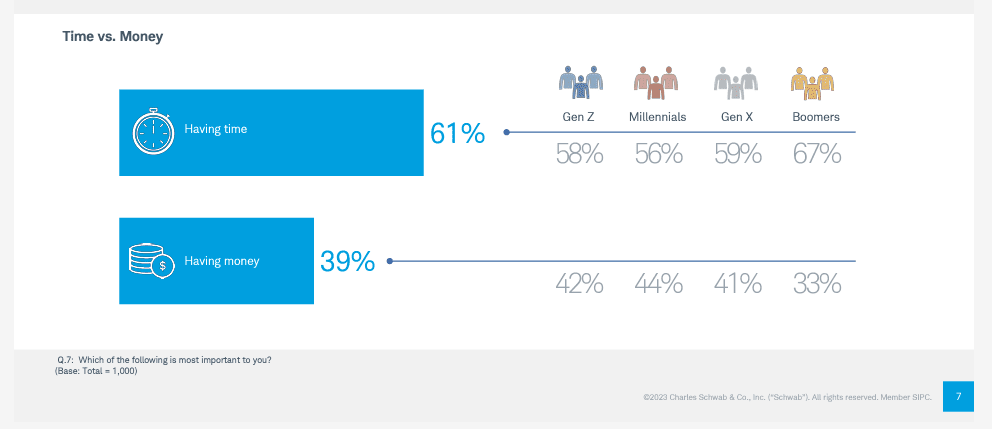

- Work-Life Balance: Gen Xers value work-life balance and prioritize saving for their children’s education and retirement. In a survey by Charles Schwab in 2023, all generations said having time was more important than having money. 59% of Gen X respondents said time was more important than money, which was slightly higher than their younger counterparts.

- Financial Responsibility: This generation is often characterized by a strong sense of financial responsibility, shaped by experiences of economic downturns and changing societal norms. They are focused on building financial security for themselves and their families.

Baby Boomers:

Born between the mid-1940s and early 1960s (ages 57 – 75), Baby Boomers lived through periods of post-war economic growth. Their financial perspectives include:

- Traditional Investing: Baby Boomers often favor traditional investment vehicles like stocks and bonds. According to an April survey by Gallup, nearly 67% of U.S. adults age 65 and older own equity in individual stocks, mutual funds, or retirement savings accounts. This number was only about 50% for the same age group before the 2008 financial crisis

- Retirement Concerns: Many Baby Boomers are at or approaching retirement age and are concerned about having enough savings to sustain their lifestyle. Many factors have started putting pressure on retirement preparedness. People are living longer, which requires their savings to last for a longer period of time. The switch from pensions to 401(k)s has put more responsibility on individuals to save and additional savings priorities, such as saving for a child’s college education (which prices have increased dramatically over the years) and future health costs.

- Wealth Transfer: With the largest intergenerational wealth transfer in history underway, Baby Boomers are passing down assets to younger generations. This transfer has implications for estate planning, wealth preservation, and intergenerational financial discussions.

Gen X and Baby Boomers Views of Estate Planning:

Baby Boomers are found to not be confident that their children are prepared to inherit their estate. Among wealthy Baby Boomers, only 45% believe their children are ready. Most parents have had discussions with their children about estate matters. However, those figures tend to correlate with a family’s wealth level.

family’s wealth level.

$3M – $5M – 6 in 10 have talked to their children

$10M+ – 8 in 10 have talked to their children

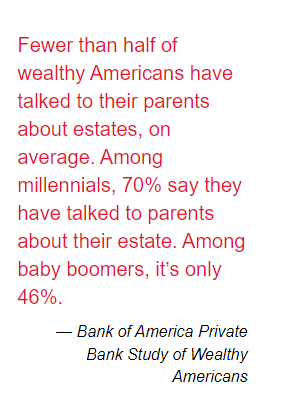

However, the conversation seems to be one sided. On average, less than half of wealthy Americans have talked to their parents about estates. Digging deeper, a new story emerges among younger generations. Seventy percent of millennials say they have talked to parents about their estate while only 46% of baby boomers have done the same.

Generations carry unique financial experiences and attitudes shaped by their time’s historical events and technological advancements. From Gen Z’s cautious approach due, in part, to the impact of the 2008 financial crisis to Millennials’ interest in socially responsible investing, and from Gen X’s investment independence to Baby Boomers’ focus on traditional investment avenues, each generation’s perspective on money and investing provides valuable insights into their financial choices and priorities. Understanding these differences can help bridge the generational gap and inform financial education, planning, and investment strategies.

No investment portfolio is the same as another. A good advisor takes the time to get to know you and your priorities before making investment decisions in your best interest. Your own experiences can shape your portfolio and dictate your specific needs. It’s important not to use a “one-size-fits-all” approach if you want to succeed in the investment market. CWCJ at Moneta takes the appropriate time to understand you and your family and your financial goals. This way, we can tailor a plan specific to you to meet your needs.

To learn more about our investment approach, read more here.

SIGN-UP TO RECEIVE THESE EDUCATIONAL PIECES STRAIGHT TO YOUR INBOX HERE.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.