[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button]

Senior Advisor, Benjamin Trujillo J.D., LL.M. –

Estate planning is an important aspect of financial planning that helps individuals and families protect and manage their assets. However, changes in the economy, including rising interest rates, can have a significant impact on estate planning strategies.

Common trust strategies may need to be re-evaluated –

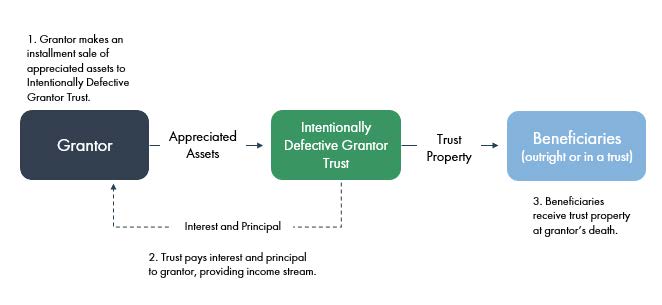

One of the ways in which rising interest rates can impact estate planning is by making certain types of trusts less attractive strategies. For example, a sale to an intentionally defective grantor trust (IDGT) is a popular estate planning tool that can possibly be used to remove the growth of appreciating assets from an individual’s estate. However, the sale to an IDGT requires the use of the applicable federal rate (AFR), which is tied to prevailing interest rates. As interest rates rise, the AFR also increases, which can increase what ultimately remains in the estate as interest rates approach the growth rate of the assets in the trust.

Borrowing money is more expensive –

Another way in which rising interest rates can impact estate planning is by making it more expensive for individuals to borrow money for estate planning purposes. For example, some individuals may use a buy-sell agreement to transfer ownership of a business to a family member or partner. However, as interest rates rise, the cost of borrowing money to fund the buy-sell agreement may also increase, making it more difficult to finance the transaction.

Certain assets may decrease –

In addition to these impacts, rising interest rates can also affect the value of other assets in an estate, such as bonds and fixed-income investments. As interest rates rise, the value of these types of assets may decrease, which can affect the overall value of the estate. Conversely, rising interest rates can make bonds a more attractive investment and can require trustees to reevaluate the investments they are managing.

Possible opportunities –

While rising interest rates can have a negative impact on estate planning, there are also opportunities for individuals to take advantage of these changes. For example, individuals may consider investing in assets that are likely to benefit from rising interest rates, such as real estate or making loans. At a minimum, individuals should consider reviewing and updating their estate plan in light of changes in the economy to ensure that their assets are adequately protected and managed effectively.

What can I do to protect my assets?

Overall, rising interest rates can have a significant impact on estate planning and it’s important for individuals to be aware of these changes and to review and update their estate plan accordingly. Whether you’re interested in protecting your business or your family, it’s probably worth consulting with a financial advisor or estate planning attorney to evaluate your options and find the best strategy for your needs.

If you would like to learn more, you can contact me at 314-735-9106 or at btrujillo@monetagroup.com.

Sign-up to receive these educational pieces straight to your inbox here.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.