[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button]

Senior Advisor, Benjamin Trujillo J.D., LL.M. –

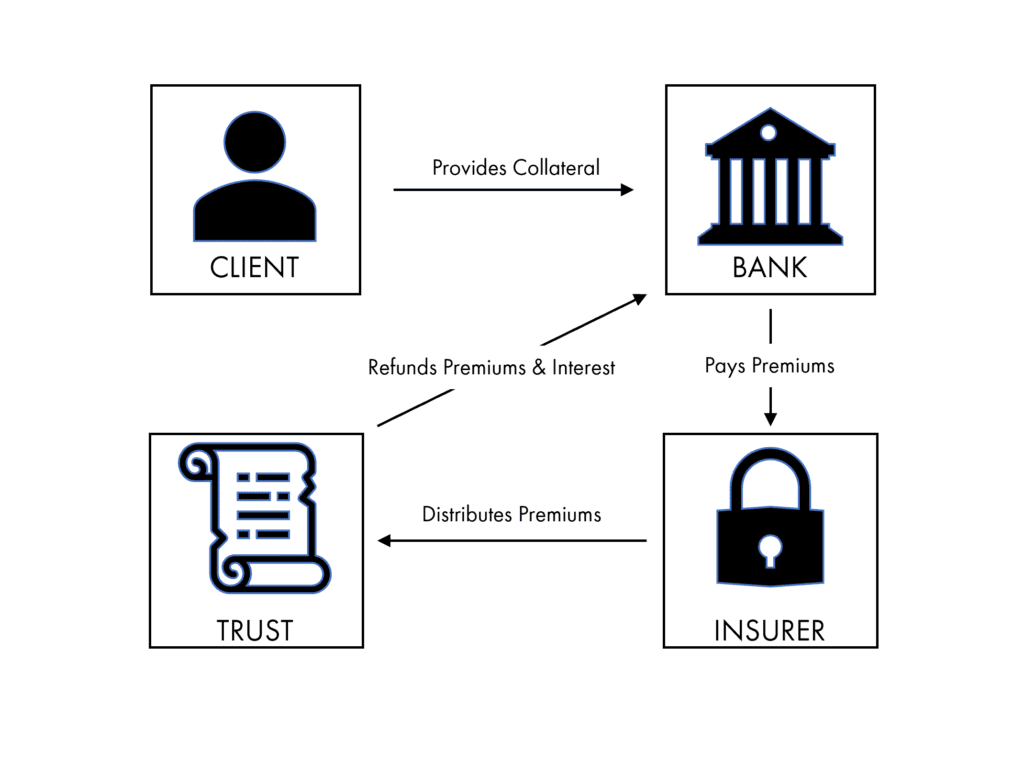

Premium financing is a technique that can be used in estate planning to allow individuals and families to leverage life insurance at a lower cost than traditional policy ownership. The basic idea is that when a family needs life insurance but believes cash flow is limited or would rather invest policy premiums somewhere they expect a higher rate of return, they can turn to a third-party lender to provide the funds to pay the premiums on the insurance policy. The policy owner pays interest annually and repays principal at the death of the insured. If the policy owner’s non-insurance investment grows at a rate that is higher than the interest rate on the loan for the premium while continuing to meet their loan obligations, the plan is generally regarded as successful. However, as interest rates rise, some experts are questioning whether premium financing is still a good planning technique.

One of the main benefits of premium financing is that it can allow individuals to purchase larger life insurance policies than they would otherwise consider. This can be especially useful for estate planning purposes, as life insurance can be a powerful tool for transferring wealth to future generations. However, as interest rates rise the cost of borrowing money for premium financing will also increase, making it more expensive for individuals to use this technique, especially if their investments don’t provide returns that match or exceed the interest rate on the premium loan.

One of the main benefits of premium financing is that it can allow individuals to purchase larger life insurance policies than they would otherwise consider. This can be especially useful for estate planning purposes, as life insurance can be a powerful tool for transferring wealth to future generations. However, as interest rates rise the cost of borrowing money for premium financing will also increase, making it more expensive for individuals to use this technique, especially if their investments don’t provide returns that match or exceed the interest rate on the premium loan.

Another potential concern with premium financing is that it can be risky for the policy owner. Interest rates for premium loans are short-term, and typically refinanced each year. This makes them highly affected by rising interest rates. Moreover, if the policy owner is unable to meet their interest payment obligations, the lender may have the right to take ownership of the policy, which can have serious consequences for the policy owner’s overall estate plan. Additionally, if interest rates rise faster than expected, the policy owner may end up paying significantly more than they would have if they had paid the premiums themselves.

Despite these concerns, some experts argue that premium financing is still a good planning technique in a rising interest rate environment. For example, life insurance policies are expected to provide a death benefit that can be used to pay off the loan, which can mitigate much of the risk for the policy owner. Additionally, rising interest rates can be managed by borrowing from the cash value of the underlying policy to help meet debt obligations in the short-term.

Ultimately, whether premium financing is a good planning technique in a rising interest rate environment will depend on the individual’s specific circumstances. It’s likely worth consulting with a financial advisor or insurance professional to evaluate your options and find the best strategy for your needs. They can help you to determine whether premium financing is the right choice for you, considering factors such as your financial situation, your estate plan, and your risk tolerance.

Premium Financing can be a complex technique that may not be suitable for everyone. We encourage you to speak with a financial professional about this technique before deciding if it is right for your individual situation. It’s important to understand the risks and benefits involved and to make sure the policy is structured in a way that meets your specific needs and goals.

The professionals at Compardo, Wienstroer, Conrad & Janes are equipped to answer any questions you have and can help you decide if this technique could fit your specific estate planning needs.

If you have questions, feel free to contact me at 314-735-9106 or at btrujillo@monetagroup.com.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.