[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button]

Advisor – Matt Schaller MBA, CFA, CFP® –

As we continue in our CWCJ Insider Series, some key economic indicators followed by economists surround mortgages. We will explore how mortgages are used to measure economic health and why they are considered a vital economic indicator.

Why Mortgages Matter for the Economy:

Mortgages, in simple terms, are loans taken out by individuals or businesses to purchase real estate. These loans allow people to finance their homes or invest in property. More importantly, tracking mortgages allows economists and businesses to forecast the economy’s overall health, as mortgages serve as a valuable barometer for measuring the health and stability of the economy. There are many reasons behind this, but mortgages tend to impact several different industries. Of course, the bank originating the mortgage will be impacted as they charge interest on the loans for the house purchase. But they are far from the only benefactor.

Think about the last time you (or someone you know) purchased a home. When purchasing a home, there tend to be a lot of other purchases that go along with it. When you buy a home, you need to furnish the home, so new furniture, drapes, paint, etc., tend to follow. You may need to upgrade your electronics (buy a new TV, install a new sound system, etc.). You may need to renovate an area of the house, so you might need lumber, tools, drywall, etc. You may look to employ companies to help with landscaping, redo your kitchen, etc. The construction industry will monitor to see if new homes need to be built to satisfy demand, affecting infrastructure companies, engineers, architects, plumbers, electricians, etc. There is even a strong correlation between buying a new home and buying a new car. All told, there are a large number of industries that are impacted (positively or negatively) when people are purchasing (or not purchasing) homes, and therefore tracking mortgages is one way economists track the overall health and direction of the economy.

Housing Market Activity:

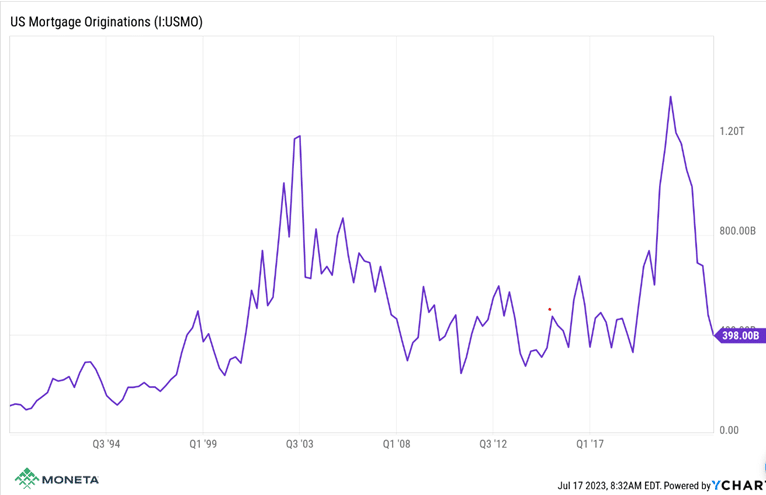

Mortgage originations are one metric used to track housing market activity. As the name suggests, this metric tracks the number of mortgages being originated, and the volume of mortgage lending provides insight into the activity levels within the housing market. When the economy is strong, and consumers are confident in its continued strength, individuals and businesses are more likely to pursue homeownership or invest in real estate. Interest rates can factor into a housing decision, but economic strength and confidence have a greater impact.

Conversely, a slowdown in mortgage lending may indicate a sluggish housing market, which can be a warning sign of an economic downturn, since a slowdown in mortgages can trickle down to the other industries affected. Reduced mortgage activity may be caused by factors such as tighter lending standards (harder to be approved for a loan), a decrease in consumer confidence, or rising unemployment. Rising interest rates have an effect here, too, though they tend to affect the price consumers are willing to pay more so than whether or not someone wants to purchase a house at all. Monitoring these trends allows economists (and the companies that benefit from mortgages) to identify potential risks and take appropriate measures.

Over the last few years, demand has remained robust and resilient, though supply has decreased, making it harder for those wanting to purchase a house to actually do so. There are a few reasons behind this, but higher interest rates now may mean those “on the fence” about moving will stay put (i.e., why move out of our house with a mortgage rate in the 2s?), leading to fewer homes being listed for sale. There is also a notable shortage of homes being built across the country, especially in markets experiencing high population growth. This impacts the supply and, as a result, mortgage originations as well. These both tie into another factor affecting originations, which is housing prices. Prices have been rising for some time but have really accelerated over the last few years. COVID made remote work more prevalent, meaning some employees could move to another city without having to find a new job in that city, increasing those moving that may not have otherwise done so. Record low interest rates also factored into some people’s decision to move, as lower interest rates meant that their monthly payments could stretch further than before.

It’s important to keep historical context in mind too. Currently, mortgage originations are down compared to the last few years, but on the whole, are still trending toward their long-term average. While there will be some consumers that either stay put or “wait it out”, the supply/demand mismatch has, at least for now, kept mortgage originations closer to their long-term average. And while it can feel like mortgage rates are high, they too are close to their long-term average.

Financial Stability:

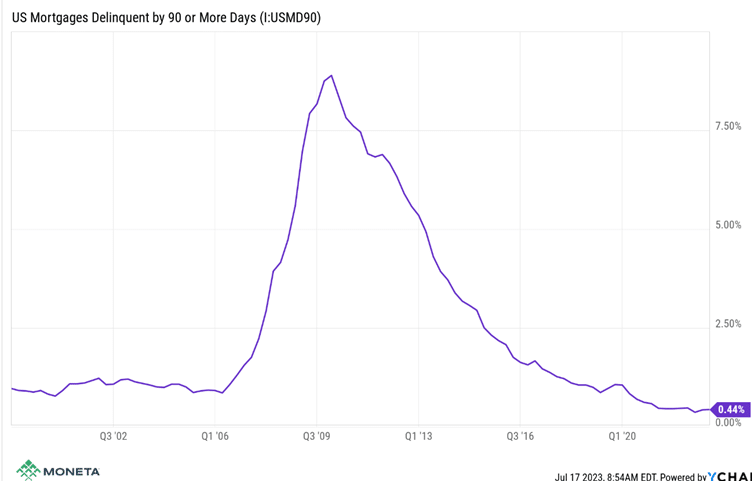

Mortgage market conditions can also shed light on the financial stability of households. During periods of economic stress, such as a recession, homeowners may struggle to make their mortgage payments, leading to increased delinquencies and foreclosures. This can have a ripple effect, negatively impacting the banking sector and overall economic stability.

By analyzing mortgage delinquency rates and foreclosure data, economists can gauge the financial health of households and identify potential vulnerabilities in the banking system. High delinquency rates may indicate a broader economic problem while declining delinquencies can signal economic recovery and stability.

Delinquency rates have fluctuated over the last three years since the beginning of the pandemic. Initially, the pandemic brought unprecedented disruptions, leading to concerns over mortgage delinquencies and foreclosures. However, the government stepped in with stimulus measures to offer financial assistance and played a significant role in supporting homeowners and stabilizing the housing market. Even as the stimulus ceased, mortgage delinquencies remained near their all-time lows.

Due to the sheer number of businesses, industries, and families that rely on mortgage originations, monitoring the data and the trends can provide valuable insights to companies and policymakers alike. By understanding the dynamics of the mortgage market, economists can assess the overall economic outlook, identify potential risks, and take appropriate actions to support sustainable economic growth.

If you would like to learn more, you can contact me at 314-735-9143 or by email at mschaller@monetagroup.com.

SIGN-UP TO RECEIVE THESE EDUCATIONAL PIECES STRAIGHT TO YOUR INBOX HERE.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.