[button link=”https://monetastl.com/cwcj/cwcj-insider/#signup” type=”big” color=”black”] Sign-up to receive these pieces in your inbox[/button]

Senior Advisor, Benjamin Trujillo J.D., LL.M. –

Individual Retirement Accounts (IRAs) have long been a popular tool for retirement savings, with many people relying on them as a key source of retirement income. However, recent changes to the rules for IRAs have significant implications for estate planning. In this article, we will explore these changes and what they mean for individuals looking to plan their estates.

The SECURE Act of 2019 –

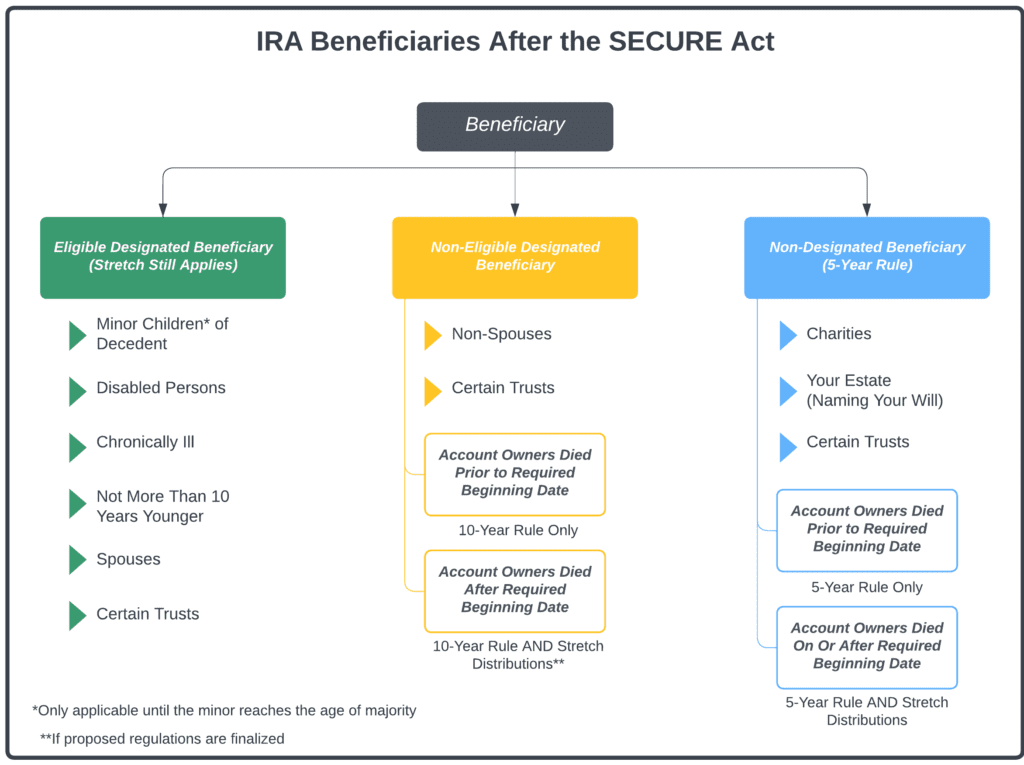

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law in December 2019 and has been further modified by Congress in recent years. SECURE includes several changes to the rules governing IRAs. One of the most significant changes is the elimination of the “stretch” IRA provision. Previously, beneficiaries of IRAs could stretch out distributions over their lifetimes, allowing for tax-deferred growth over a longer period of time. However, under the new rules, most non-spouse beneficiaries must withdraw the entire IRA balance within 10 years of the account owner’s death. In some instances, especially those involving charitable beneficiaries or when there is a failure to name a beneficiary at all, complete withdrawal may be required within 5 years, resulting in significant (and unnecessarily high) tax bills.

These changes have important implications for estate planning. For example, if you had named a grandchild as the beneficiary of your IRA, they would no longer be able to stretch out the distributions over their lifetime. Instead, they would be required to withdraw the entire balance of the IRA within 10 years of your death. This could result in a larger-than-expected income tax bill or put the beneficiary into a higher-than-desired tax bracket.

Many people choose to name their spouse as the primary beneficiary of their IRA and a trust as the contingent beneficiary. There are many advantages to designating a trust as the beneficiary of an IRA, including adding restrictions to how assets can pass out to a beneficiary to protect distributions from creditor claims, ex-spouses, and more. However, when naming a trust as a beneficiary, it is important to ensure that the trust qualifies as a designated beneficiary. Failure to qualify the trust will result in the IRA being fully distributed within 5 years.

Required Minimum Distributions (RMDs) –

The IRS has also recently released proposed regulations governing RMDs for inherited IRAs. After SECURE many practitioners understood that an inherited IRA could be held until and distributed in year 10. This is still the case for some IRAs, but under the proposed regulations, if the owner of the IRA was receiving Required Minimum Distributions (RMDs) before death, then the beneficiary of the inherited IRA must also take annual RMDs, even if they are under the required beginning date (the date they are required to start RMDs). The RMD will be calculated on the beneficiary’s life expectancy, or in the case of a trust with more than one beneficiary, on the life expectancy of the oldest trust beneficiary.

There are many ways to optimize distributions of IRA assets when using a trust, including being attentive to methods to avoid the 5-year rule, ensuring RMDs are calculated based on each individual beneficiary’s life expectancy, and limiting distributions from the trust. In light of this, it is important to review your estate plan and ensure that it is up to date and doesn’t contain any terms that would cause your IRA to be distributed faster than necessary or be exposed to the claims of creditors.

Converting traditional IRA to a Roth IRA –

Another option for estate planning with IRAs is to convert traditional IRAs to Roth IRAs. Roth IRAs are not subject to required minimum distributions during the account owner’s lifetime, and distributions to beneficiaries are tax-free. By converting a traditional IRA to a Roth IRA, you can pay the taxes now and ensure that your beneficiaries will not be subject to taxes on distributions in the future. When combined with the generally lower tax brackets that resulted from the 2017 tax cuts, converting during a down market can come at a lower tax cost than converting at other times.

In summary, the changes to the rules for IRAs under the SECURE Act have significant implications for estate planning. If you have an IRA, it is important to review your estate plan and ensure that it is up to date. Consider converting traditional IRAs to Roth IRAs and consult an estate planning attorney to determine whether any changes are necessary. With careful planning, you can ensure that your IRA is distributed in a tax-efficient manner and that your estate plan meets your goals and objectives.

If you want to learn more, you can contact me at 314-735-9106 or btrujillo@monetagroup.com.

SIGN-UP TO RECEIVE THESE EDUCATIONAL PIECES STRAIGHT TO YOUR INBOX HERE.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.