By Bill Hornbarger, Chief Investment Officer at Moneta

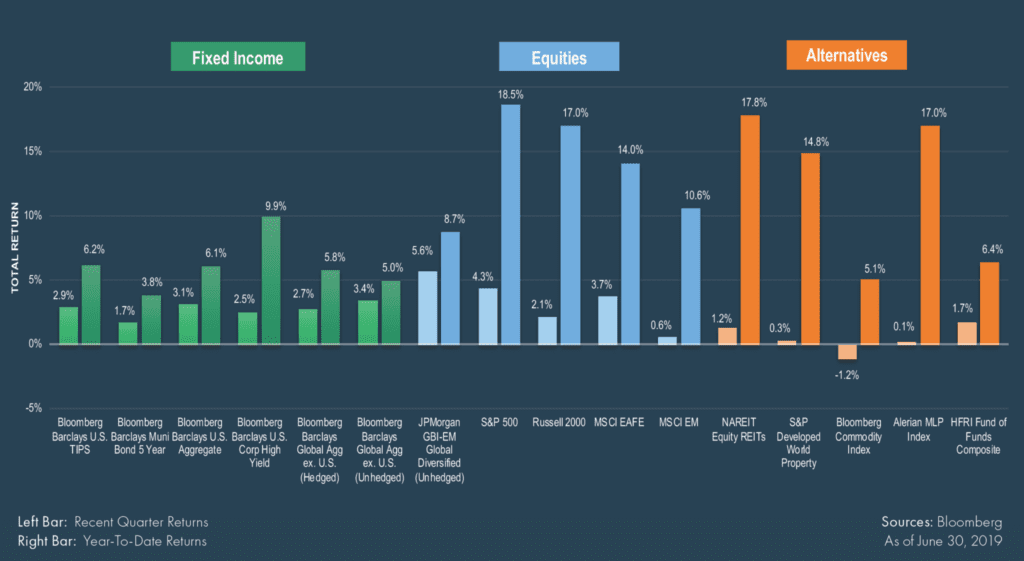

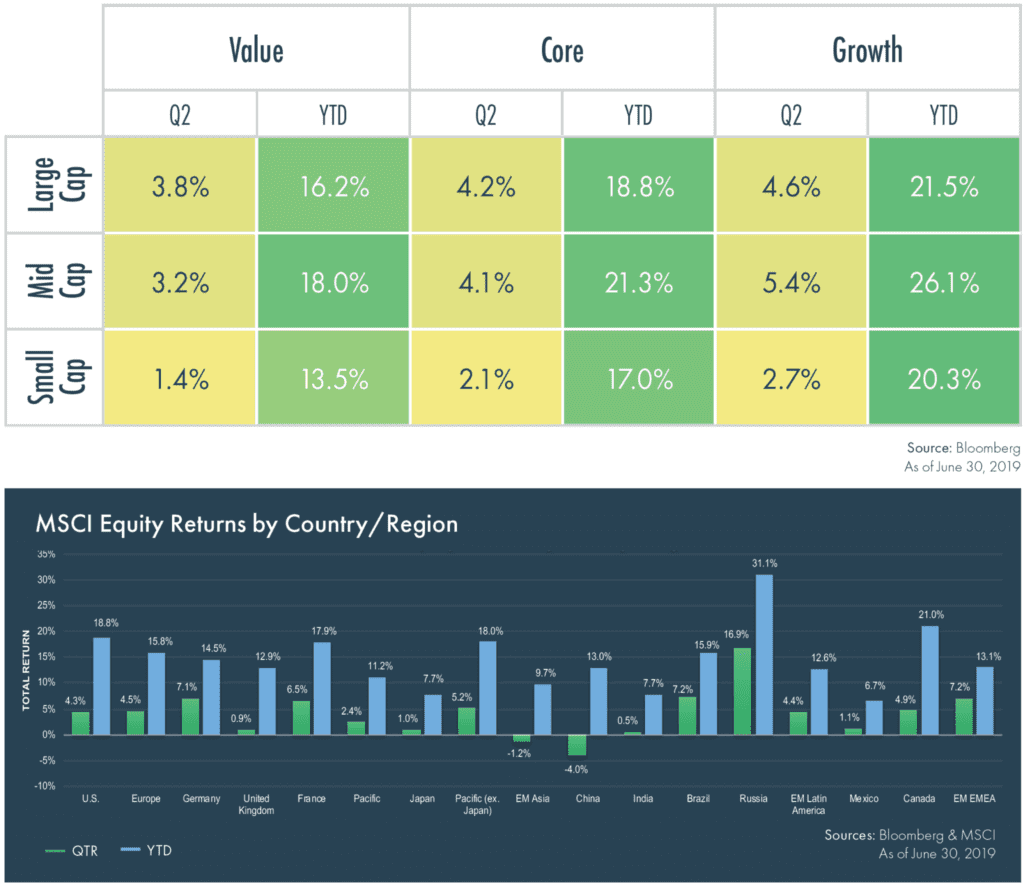

The first half of 2019 is in the books and the markets shrugged off any lingering concerns by posting strong gains. After a dismal end to last year, every broad equity market and fixed income index we track recorded gains during the past six months. The gains in equities were very broad based and robust, with most of the widely tracked indices up double digits. Domestic mid-cap growth was the best performer. Consistent with performance since the Global Financial Crisis, growth stocks in general outperformed value stocks while domestic stocks outperformed international stocks.

In recent sessions, several of the more widely followed indices (including the S&P 500 and Dow Jones Industrial Average) hit record highs. It is natural in that environment to both worry and wonder what will happen next. While it is impossible to know the future, let’s quickly review the current economic and market environment.

In almost any economic environment, it is possible to find both positive and negative trends. Today is no different.

Topping the list of U.S. investors’ concerns:

- The moderation in the Institute of Supply Management manufacturing survey

- Signs that consumer confidence is rolling over (particularly at lower income levels)

- Persistent low inflation

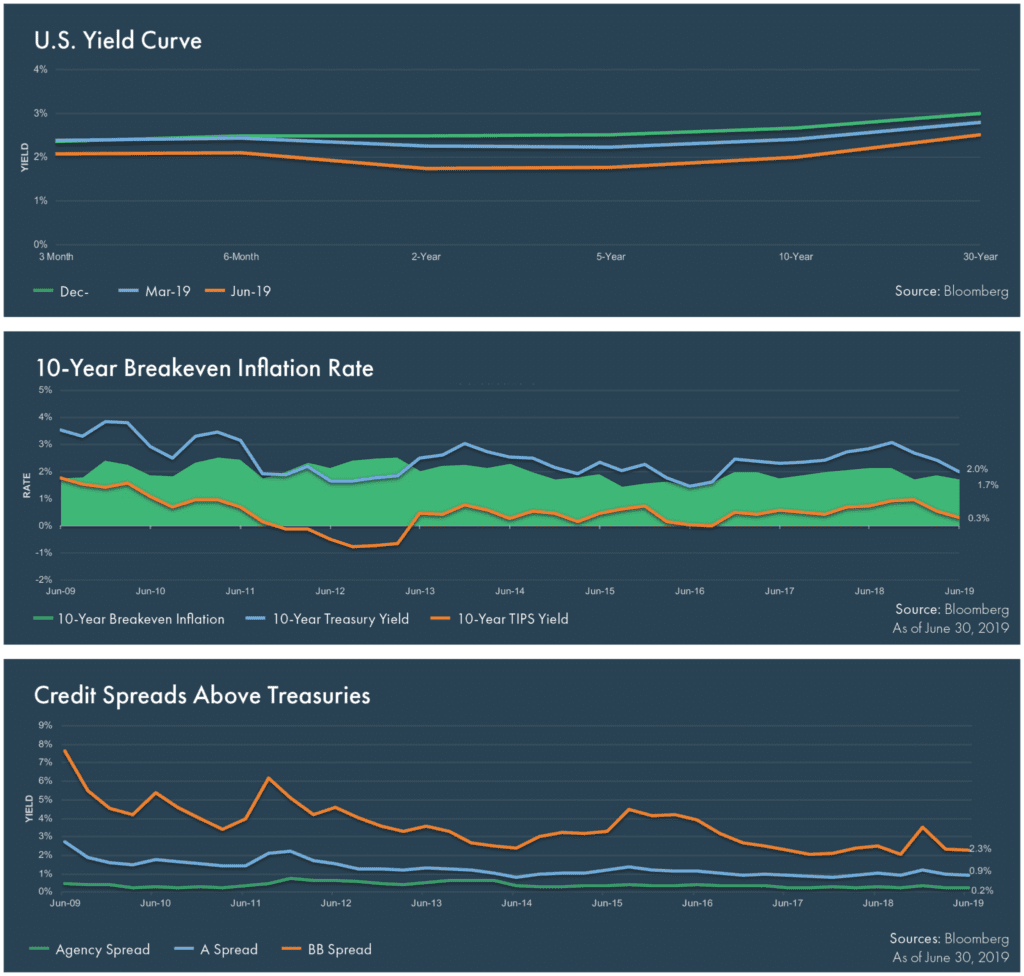

- The decline in bond yields

- The inversion of the short and intermediate portion of the U.S. Treasury yield curve

- Uncertainty surrounding tariffs and global trade impacts

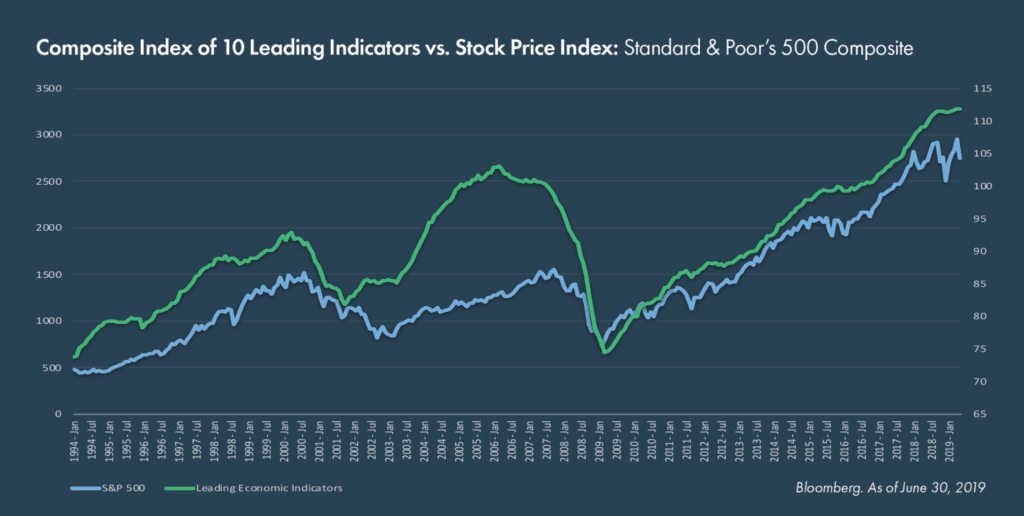

These trends are counterbalanced by a continued strong employment situation, continued growth in the leading economic indicators (see chart below), a “friendly” yield and monetary policy environment, and, for stocks, few attractive alternatives for investment dollars seeking returns in excess of inflation. Pre-presidential election years are also typically positive for the markets, with only one down year in the third year of a presidential term since the beginning of World War II.

Forecasting the markets is impossible for any sustained period. However, we would put forward the following thoughts:

- Global bond yields remain low and the Fed has indicated a willingness to reduce interest rates this year. This argues that domestic bond yields will likely stay low for at least the intermediate term.

- Equity valuations are above long-term average across most size and style segments. This is most pronounced in U.S. large cap stocks

- Equity valuations relative to fixed income (the so-called Fed model) are below long term averages.

- Yield curve models have shown an increase in the probability of a recession while econometric models continue to signal growth.

- While the economy appears to slowing, a recession does not appear imminent per most economic surveys.

The news headlines can remain somewhat unsettling. Trade wars, tariffs, a dysfunctional and vitriolic political environment, and increased saber rattling from Iran all are in the recurring news cycle. Despite this, equities climbed the proverbial wall of worry to make new highs and interest in stocks appears to remain high. While it is always tough to be bullish at market highs, little has changed in the market outlook. The economy continues to grow at a moderate pace, earnings growth is also moderately positive, and bonds provide low nominal returns. With the prospects of a near-term recession low, the environment appears generally neutral to supportive of the equity markets.

Market Snapshot

FIXED INCOME

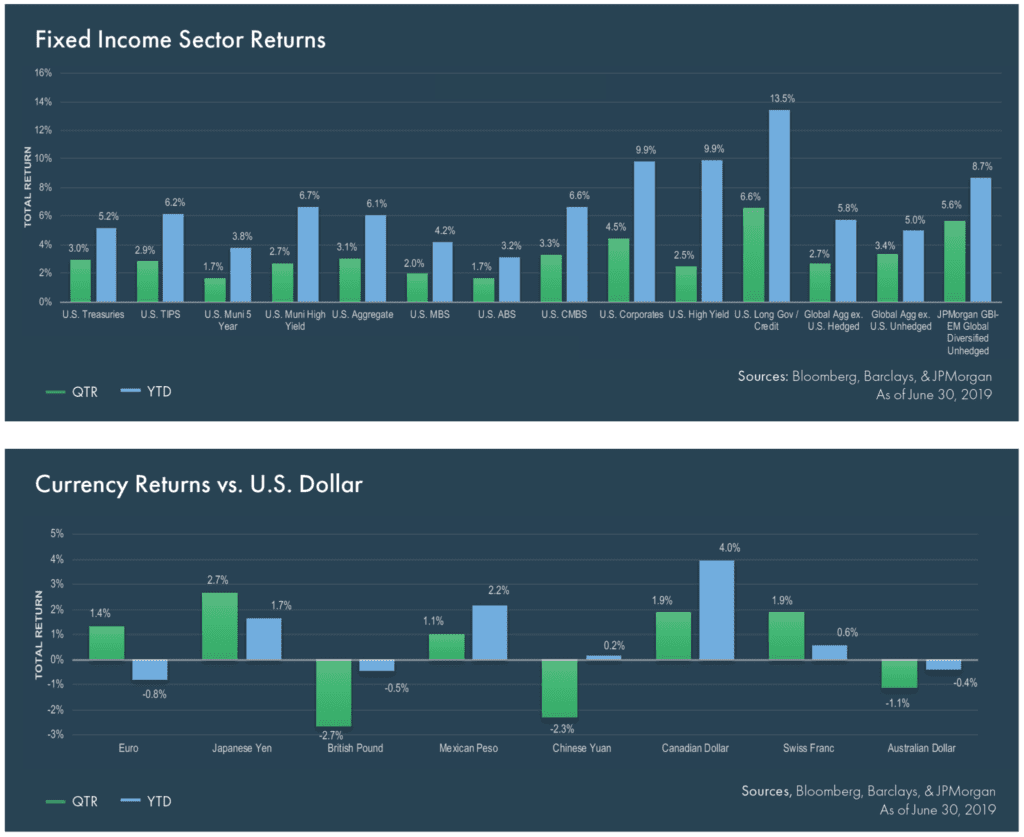

- Fixed income markets finished the quarter higher, led by emerging markets debt, which benefited from central banks broadly signaling a willingness to adopt more accommodative monetary policies and the U.S. Dollar depreciating relative to most emerging markets currencies.

- Credit and longer-dated bonds outperformed for the quarter. The Fed took an increasingly dovish stance at its June meeting, raising market expectations for a rate cut in the second half of 2019.

EQUITIES

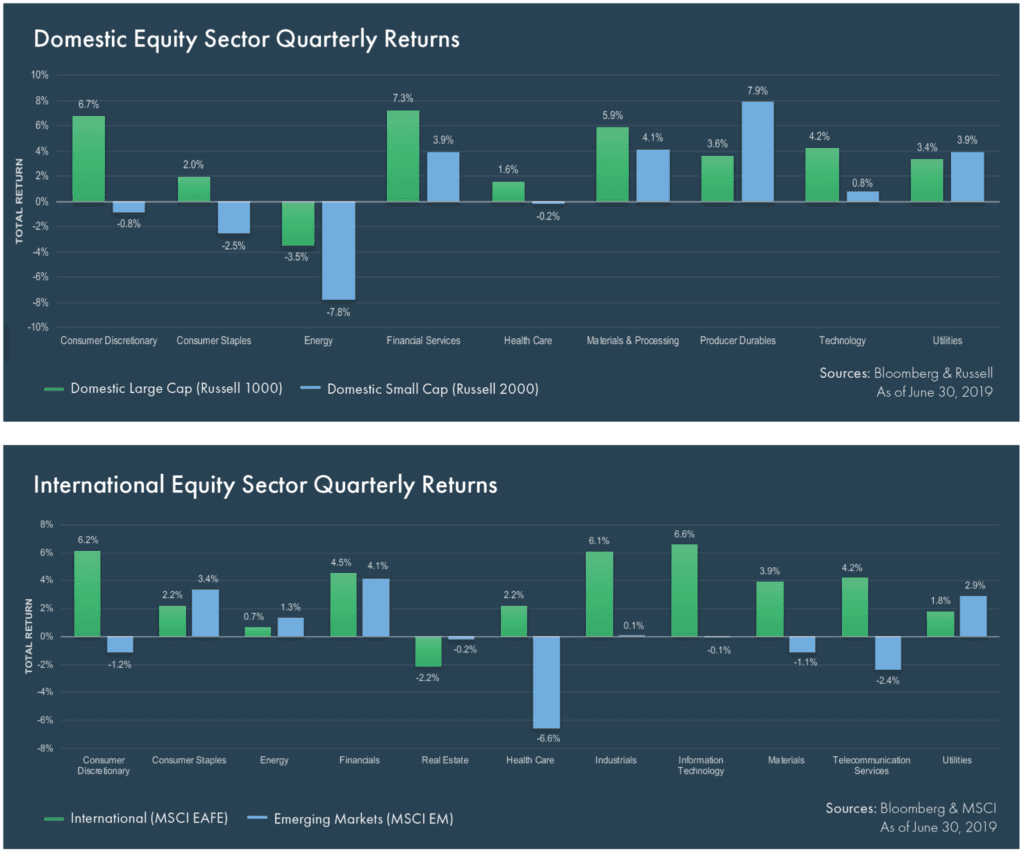

- Equity markets built on their first-quarter performance and continued to generate strong returns during the quarter. Domestically, growth stocks outperformed value stocks and large-cap outperformed small-cap stocks.

- International developed equities posted strong returns for the quarter, but still lagged domestic equities. Emerging markets increased marginally during the quarter, led by Argentinian and Russian equities while Chinese stocks widely underperformed.

REAL ASSETS

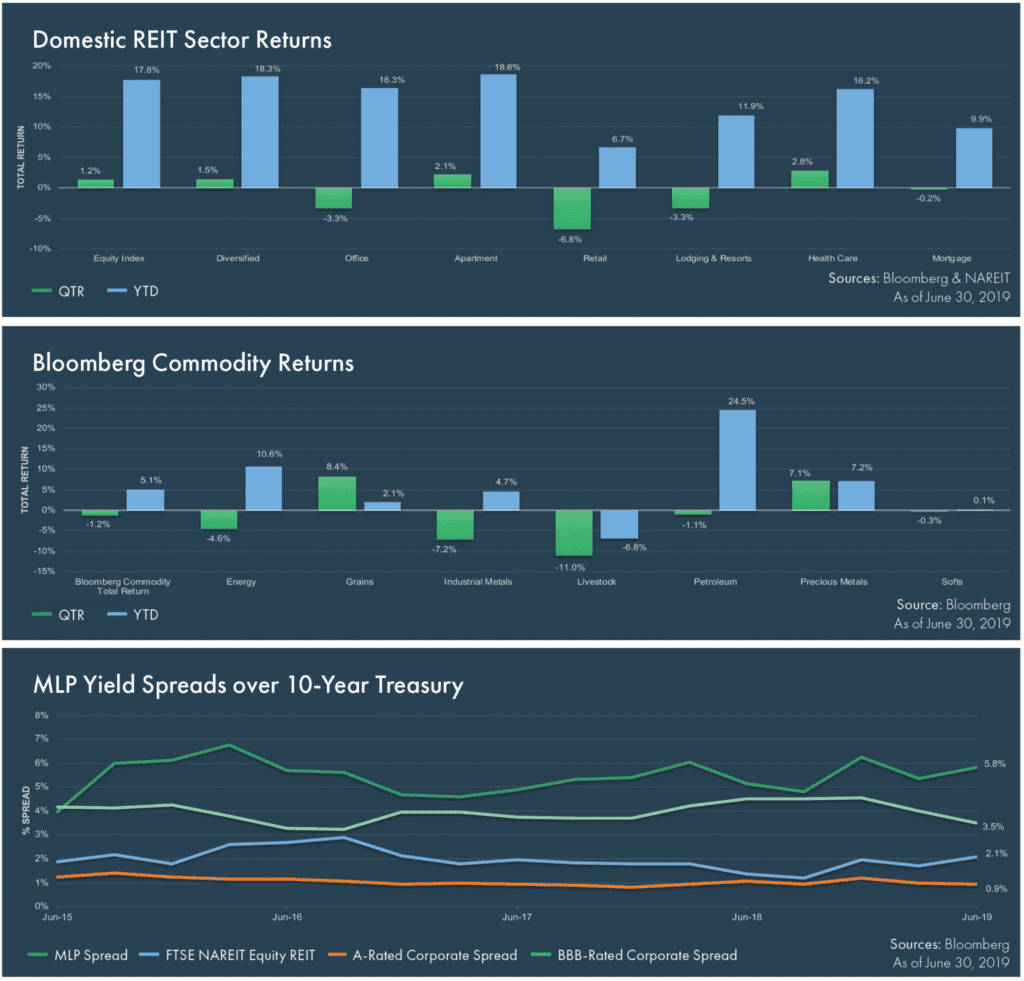

- Real assets posted relatively flat returns for the quarter following their strong performance last quarter. REITs increased slightly while midstream energy remained relatively unchanged and commodities declined marginally during the quarter.

- Domestic REITs outperformed international, led by strong performance in the healthcare and residential sectors.

- Hedge funds generated positive returns, but underperformed equities and fixed income while outperforming real assets.

Year-Over-Year U.S. Economic Update

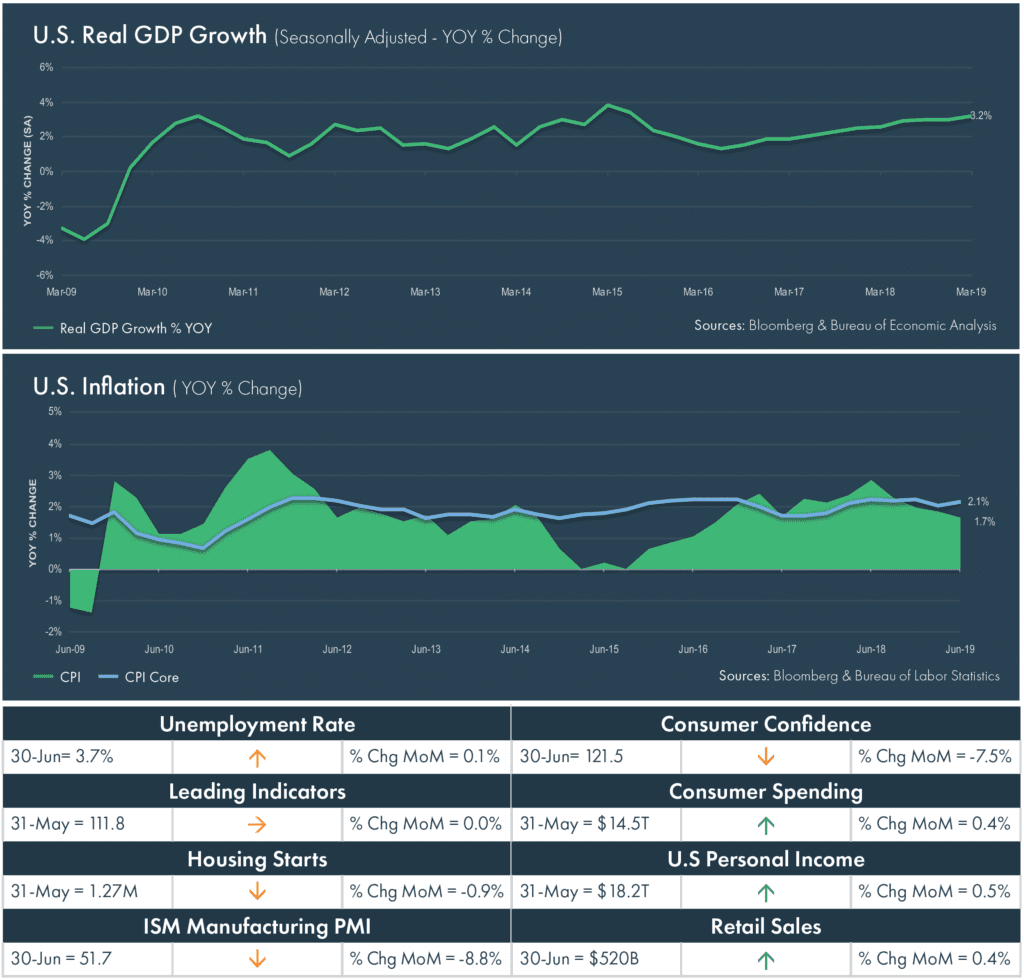

- First quarter real Gross Domestic Product (real GDP) increased at an annual rate of 3.1% on a quarter-over-quarter, seasonally-adjusted (QoQ, SA) basis according to the Bureau of Economic Analysis, an increase from the 2.2% growth rate realized in the fourth quarter.

- The Federal Open Market Committee (FOMC) voted at its June meeting to maintain the target Federal Funds rate between 2.25% and 2.50%. The Fed signaled its intention to leave rates unchanged in 2019 and cut rates next year. However, eight FOMC members currently favor a rate cut this year and bond markets expect at least one rate cut this year.

- The Core Consumer Price Index (CPI) rose 2.00% on a year-over-year, seasonally-adjusted (YoY, SA) basis in May while Core PCE, the Fed’s preferred measure of inflation, increased 1.60% (YoY, SA), falling short of the Fed’s 2.00% target. At the Fed’s June meeting, Fed officials’ median forecast for 2019 Core Inflation declined to 1.80%.

Global Economic Update

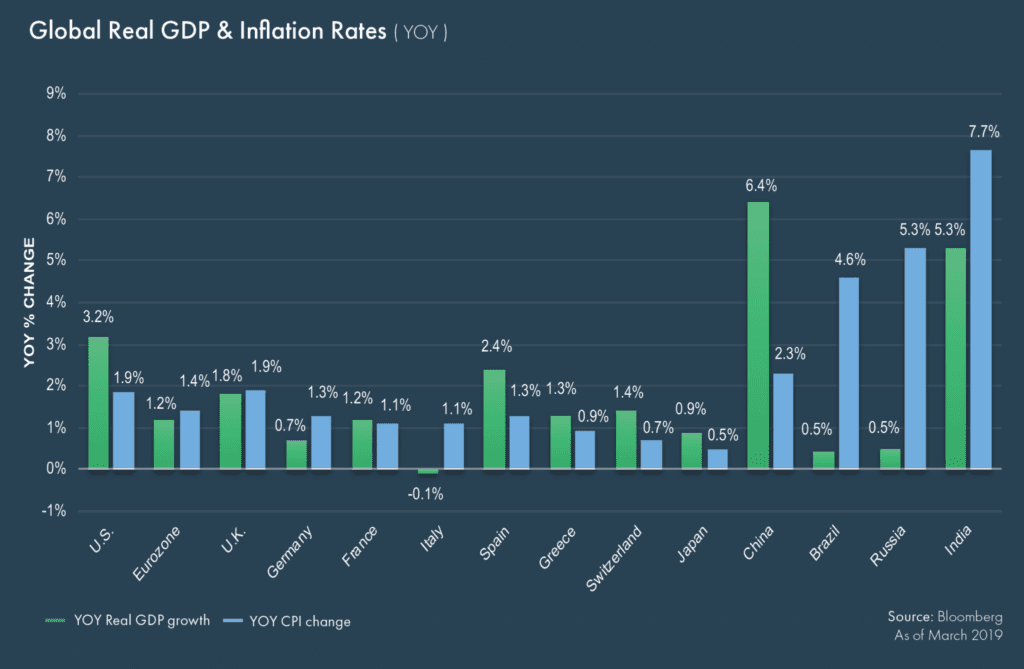

- China’s official Manufacturing Purchasing Managers’ Index (PMI) remained unchanged from February at 49.4. The unofficial Caixin/Markit Manufacturing PMI, a private survey focused more on small- and medium-sized businesses, declined to 49.4 in June from 50.2 in May, indicating a contraction in the manufacturing sector. The U.S. and China agreed to resume trade negotiations, but uncertainty remains over the timing and scope of any potential trade deal.

- First quarter real GDP increased at a 1.6% annualized rate (QoQ, SA) in the Euro Area, but continued uncertainty over trade policy and reduced global demand clouded the economic outlook. Signs of a weakening economy surfaced in the Euro Area’s largest economy as German manufacturing orders declined 2.2% on a month-over-month, seasonally-adjusted basis (MoM, SA) in May while exports only grew 1.1% (MoM, SA) after contracting 3.7% (MoM, SA) in April.

- The European Central Bank (ECB) lowered its forecasts for real GDP growth in 2020 and 2021 to 1.4% and 1.5%, respectively, at its June meeting while also reducing its 2020 inflation forecast to 1.4%. The ECB maintained its main refinancing operations and deposit facility rates at 0% and -0.4% and expects to leave rates unchanged until mid-2020. The ECB also signaled a willingness to provide additional monetary stimulus to support the economy.

Global Fixed Income

- Fixed income indexes across global markets were positive during the quarter. Interest rates domestically continued to move downward with the 10-year U.S. Treasury closing the quarter at 2.01%.

- Despite underperforming investment grade assets during the quarter, risk assets rallied in June after a steep May pullback to continue rallying year-to-date.

- The dollar fell against several emerging economy currencies following signals from the FOMC indicating a possible rate cut. The result was a substantial rally in emerging markets debt denominated in local currencies.

U.S. Fixed Income

- The yield curve remained inverted across the majority of maturities. The spread between three-month Treasury Bills and 10-year Treasury bonds finished the quarter at -8 basis points.

- Investment-grade and below-investment-grade credit outperformed during the quarter as high yield spreads continued to compress despite a steep pull back in May.

- TIPS performed relatively in line with U.S. Treasuries despite the Fed referencing decreasing forward looking inflation expectations. Breakeven inflation rates closed the quarter at 1.70%.

Global Equity Markets

- Within U.S. equities, the financial services and consumer discretionary sectors were the top performers. Growth stocks broadly outperformed value stocks while large-cap stocks outperformed mid-cap stocks across all investment styles except for growth. Small-cap stocks underperformed across the entire market capitalization spectrum. Energy and healthcare were

the worst-performing sectors. - International equities rose but did not keep pace with domestic stocks. German and French equities generated the strongest returns in developed markets while stocks in the U.K. and Japan underperformed.

- Russian equities substantially outperformed, and the relative outperformance was strongest within emerging markets. China underperformed in emerging markets as concerns over its economic growth persist and the trade dispute with the U.S. remains unresolved and continues to weigh on economic growth.

Quarterly Equity Sector Returns

Real Assets

- Real assets were largely unchanged during the second quarter following strong first quarter performance in all categories amid a heightened geopolitical environment.

- REITs moved slightly higher as economic growth remained stable. Healthcare and apartment REITs were among the bestperforming property types while retail, office and hotel all underperformed.

- The Alerian MLP Index was flat during the second quarter. The midstream space saw its first IPO since November 2017, as Rattler Midstream Partners (RTLR) started trading in May.

- Commodities fell slightly as natural gas prices declined more than 16% during the quarter despite oil prices remaining stable. Grains rose as expectations for corn production declined.

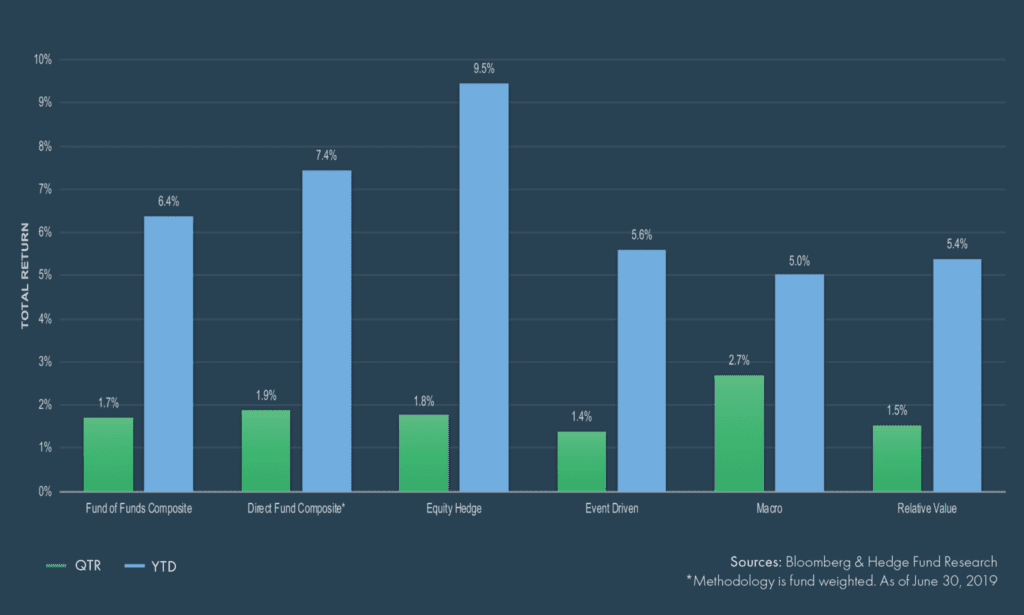

Hedge Funds

- The HFRI Fund Weighted Composite Index was positive during the second quarter, slightly underperforming most fixed income and equity indices, but outperforming real assets.

- Equity Hedge strategies underperformed the broader hedge fund universe with strong returns concentrated in value-oriented strategies and negative returns in market neutral strategies.

- Event Driven strategies were in line with the broader hedge fund universe with special situation and activist managers leading the group and multi-strategy funds trailing the benchmark.

- Unlike the first quarter, Macro strategies were the strongest performer amongst the broader hedge fund universe as discretionary and multi-strategy managers posted strong returns while commodity managers faltered.

- While Relative Value modestly underperformed the broader hedge fund universe, fixed income corporate managers performed well within the space.

Financial Market Performance

Periods greater than one year are annualized. All returns are in U.S. dollar terms.

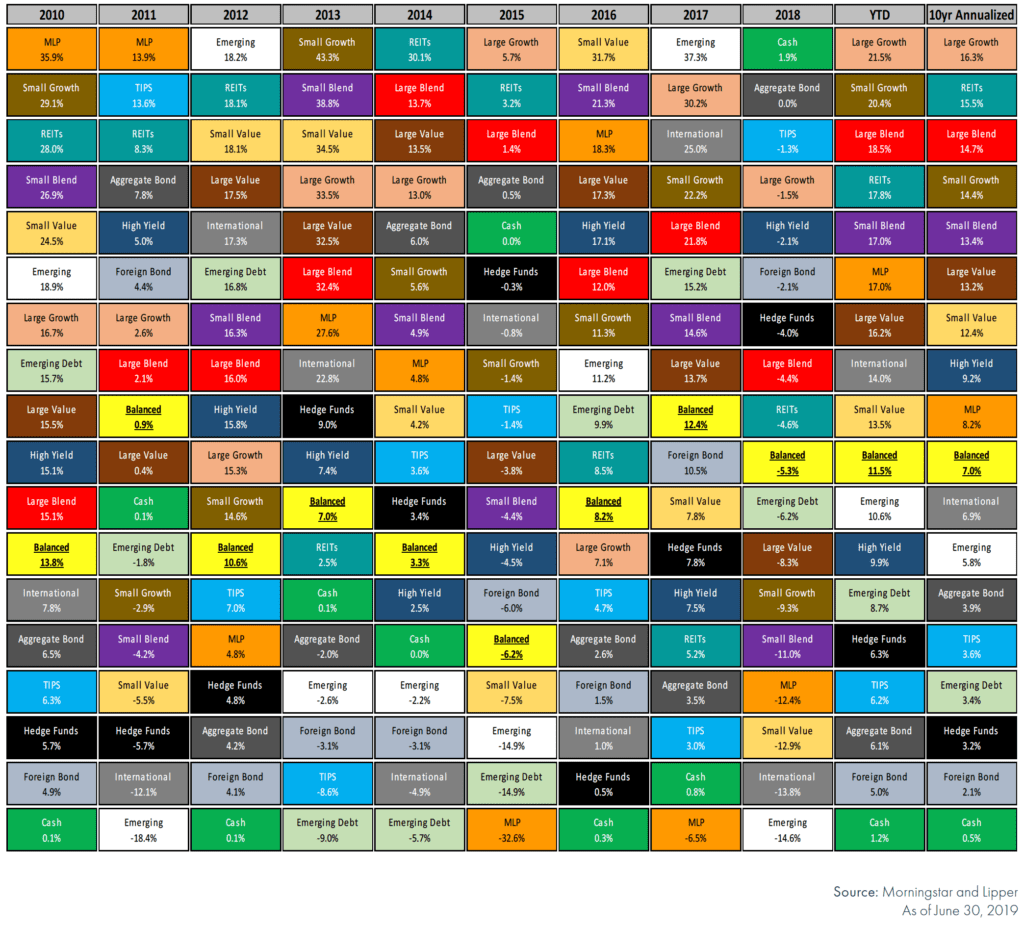

Why Diversify?

YEAR-BY-YEAR PERFORMANCE RANKINGS OF ASSET CLASSES

These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.