Markets continue to be noisy this week – as they digest market jitters at the end of last week (when the SPX fell by the most in one week – 1.6%, since October, and lost 1.5% on Friday alone). The escalation in regional tensions in the Middle East between Israel and Iran, were somewhat diffused by the time markets opened on Monday, but, again, there is a process of digestion in place as actual war games play out. Investors have been war gaming around Fed movement, inflation direction and the health of the economy for months now, although there may finally be some signal emerging from the noise.

Firstly, there seems to be a bit of evidence behind the Vibecession – or the disconnect between the strong “hard” economic data, and the weak consumer sentiment and general feeling of being overwhelmed by cumulative inflation. Earnings from trucking companies this week provided evidence of soft freight rates due to an oversupply of trucks and customers scaling back inventories. According to the Wall St. Journal average rates in the spot market have fallen 6.5% since the start of the year. [1] This, coupled with stories of overcapacity in China, particularly in car factories, was further evidence of slower demand there, and more and more anecdotes of the same thing are cropping up in our discussions with managers. It is too early at this stage to see slower demand appear in corporate earnings – but it will factor in with the usual lag.

As we write the S&P had closed its fifth consecutive losing day, and oil was hovering close to a three week low. “Higher for longer” is back as the usual refrain – with the probability of a rate cut in June falling to only 15% (v. 55% only a month ago). The economic data is just too good for that it seems and even the Fed seems to be concerned that inflation is “stuck” at the current levels.

The round trip in interest rate expectations has been tiring – given that we have ended up roughly where we started six months ago, but one positive that has emerged is the growing visibility at what might be a stable rate of interest at least in the short-medium term. This is unlocking more borrowing and lending – according to bankers – and this is music to their ears. More music to their ears is the transaction and M&A volume that is picking up as a result, and combined with the pick up in trading volume that characterized recent banking earnings. Within the property sector investors have been patiently waiting for transactions to start to clear, and as we noted last week, some signs of bottoming are in evidence there, particularly around the apartment and office segments.

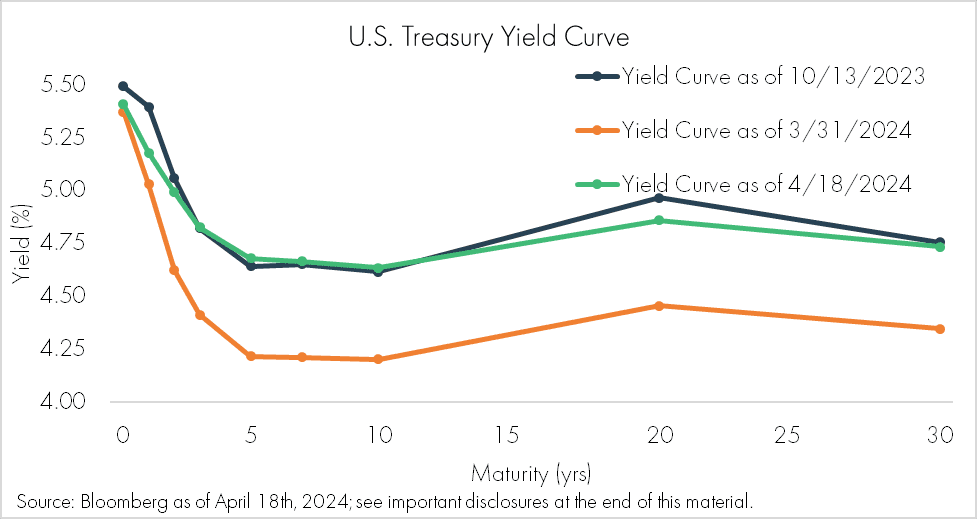

The chart below shows the recent movement in Treasury yields, which have recently risen to reflect the return to the higher rate expectations.

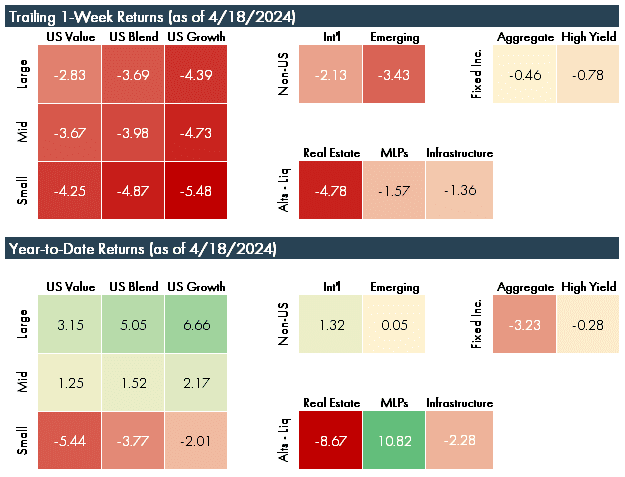

Recent stock market performance has been mixed as the chart below shows:

As we pay attention to the quarter end round up, expert conversations are dominated by geo-political analysis, with the Middle East far in the lead as the most concerning flashpoint. Intelligence has so far been on point – there have been few abject surprises around the timing and nature of attacks. Many conflicts, like the level of inflation and markets themselves, seem to be “stuck”, just as borrowing, transaction volume and real estate sales are becoming “unstuck”. So markets are giving and taking at the same time. While it remains noisy, it is a great time for balanced portfolios to start proving their utility.

[1] https://www.wsj.com/articles/trucking-oversupply-is-weighing-on-carriers-earnings-outlooks-b538be7f?mod=article_inline

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.