[et_pb_section fb_built=”1″ _builder_version=”3.22″ da_disable_devices=”off|off|off” global_colors_info=”{}” da_is_popup=”off” da_exit_intent=”off” da_has_close=”on” da_alt_close=”off” da_dark_close=”off” da_not_modal=”on” da_is_singular=”off” da_with_loader=”off” da_has_shadow=”on”][et_pb_row _builder_version=”4.9.7″ _module_preset=”default” min_height=”328.9px” custom_margin=”|auto|-114px|auto||” custom_padding=”23px|||||” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.9.7″ _module_preset=”default” global_colors_info=”{}”][et_pb_testimonial _builder_version=”4.9.7″ _module_preset=”default” global_colors_info=”{}”]

Are Special Purpose Acquisition Companies (SPACs) too good to be true, or a leveling of the playing field in early stage investing?

[/et_pb_testimonial][et_pb_image src=”https://monetastl.com/wp-content/uploads/2021/08/Screen-Shot-2021-08-06-at-4.48.52-PM.png” title_text=”Moneta CIO Aoifinn Devitt interviews Peter Early, Head of Business Development at Exosa, a next generation fin-tech platform for B2B institutional finance about SPACs.” _builder_version=”4.9.7″ _module_preset=”default” global_colors_info=”{}”][/et_pb_image][et_pb_blurb _builder_version=”4.9.7″ _module_preset=”default” global_colors_info=”{}”]

Moneta CIO Aoifinn Devitt interviews Peter Early, Head of Business Development at Exos, a next generation fin-tech platform for B2B institutional finance about SPACs.

[/et_pb_blurb][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”3.25″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”3.25″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_text _builder_version=”4.9.7″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” inline_fonts=”Verdana” global_colors_info=”{}”]

By Aoifinn Devitt, Moneta CIO

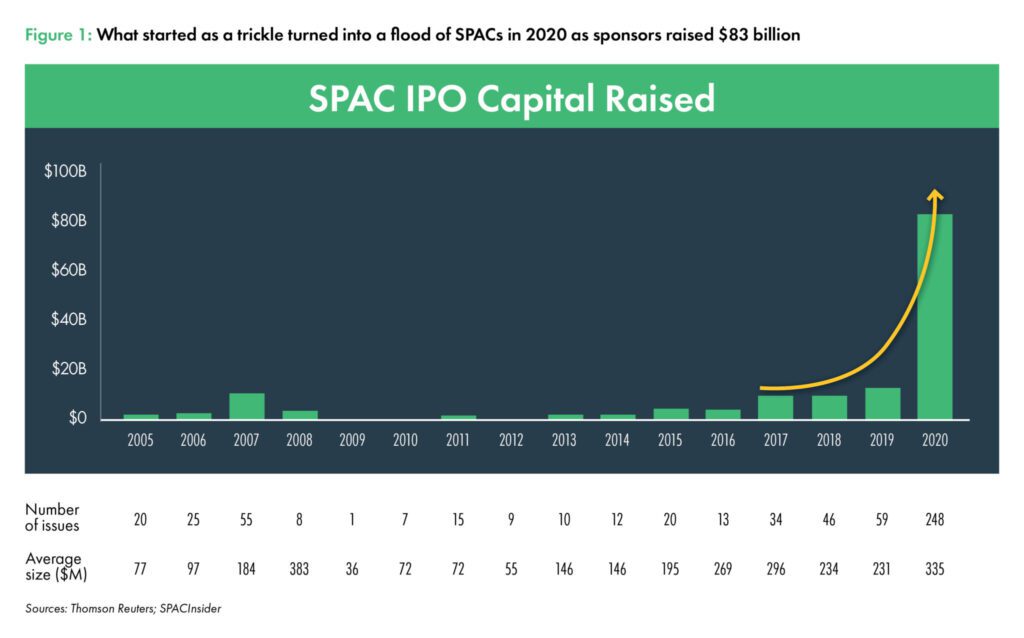

The Special Purpose Acquisition Company (SPAC) sensation continues to grip markets. There were 248 SPAC IPO transactions last year, up from 59 in 2019. The count for 2021 already exceeds 300, with many more in the pipeline. Some of the well-known names that have already gone public include DraftKings and Virgin Galactic. Celebrities are even getting in on the act. But is this a well-overdue democratization of early stage investing? Is it good news for retail investors? Are the risk rewards too good to be true?

I sat down with Peter Early, who is Head of Business Development at Exos, a next generation fin-tech platform for B2B institutional finance, to discuss SPACS (Special Purpose Acquisition Companies) – primarily, what kind of opportunity these “blank check” companies present for retail investors.

In the podcast, we start by setting out the SPAC landscape and looking at the three main parties: the investor that purchases units in the SPAC, the sponsor and the acquisition target.

The investor may purchase units of a SPAC at the IPO Price or in the open market at a discount or premium. The investor remains entitled to its pro rata share of the trust account, which will be based on the IPO price. This acts as a “floor” or as downside protection. If the investor elects to redeem its shares upon an acquisition transaction, or the SPAC “times out” and fails to execute a transaction within a specific time period, the investor will at least receive its share of the trust plus a modest rate of interest, as it is invested in government bonds

The real upside on the transaction lies in the warrants that the investor obtains upon a business combination, which will have significant divergence in value based on the success of the underlying company.

Acquired Company:

When a SPAC executes a merger, the investor has the right to become a shareholder of the combined company. Certain companies perform well after acquisition and others struggle, and indeed there are statistics that between January 2019 and June 2020 SPACS lost 12% of their value within six months of the merger 40% of 2020 SPACS lost an average of 32% post-merger. It is important to remember, however, that while these numbers look stark, they are not, arguably, that different from typical market volatility especially in more speculative, early stage or high growth names.

Sponsor:

The sponsor’s role in the SPAC is a crucial one – they are paid a promote based on a percentage (usually 20%) of the transaction, and Peter argued that while a conflict of interest can be present in this role it is no different from a typical investment banking fee in an IPO, and that given the aim is usually to purchase a target at a significantly higher valuation than the SPAC this fee diminishes as an overall percentage once the transaction is executed. For some market observers this fee is unpalatable, however, and recent deals have sought to reduce the conflict of interest and ensure less shareholder dilution.

Other participants – the SPAC mafia and celebrities

We spoke about the other participants in this market – which include both highly sophisticated institutional investors such as hedge funds (termed the “SPAC mafia”) as well as large institutional groups which may provide the PIPE (Private Investment in Public Equity) financing in order to get the actual deal done. I asked whether retail investors should be concerned that they might be at a disadvantage relative to these experts. Peter suggested that the involvement of these highly sophisticated investors can provide some comfort that scrutiny and due diligence are occurring at high levels, but that obviously piggybacking on this work should not be encouraged.

As far as the involvement of celebrities Peter commented that this area was no different from other asset classes also seeing a wave of exuberance today (e.g., growth stocks and cryptocurrency). He argued that their popularity was capitalism at work – a natural response to an attractive risk/reward and cheap optionality.

A New Frontier?

Peter’s view is that SPACs should be viewed as simply a vehicle to go public, and should not be viewed through the ultimate success of the acquired company. He conceded that the disclosures required for a SPAC were far less prescriptive than those required in an IPO – for example projected earnings can be used, a company can go public even the IPO window is closed in markets and management may sell a greater share of the company while avoiding a lock-up period. He also pointed out that because the mechanism allows companies to go public earlier than, say, via an IPO, that they can be used as a public proxy for late stage venture capital. This might give support to the democratization of early stage investing and making it more accessible to a wider range of investors.

The process of assessment of the company post-merger can be a complex one, as can the monitoring of the exercise of warrants. Peter suggests that it can be time consuming and difficult to manage passively. These are all factors to bear in mind for investors when investing in SPACs.

©2021, Moneta Group Investment Advisors, LLC. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. You cannot invest directly in an index. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]