Aoifinn Devitt | Chief Investment Officer

Second Quarter 2021

Five Considerations Impacting the Remainder of 2021

- Vaccine Rates and Reopening: As we head into the second half of the year, vaccine rates are largely determining the emergence of countries into the post-COVID era. Unfortunately, the pattern is far from uniform. As the Delta variant rages through Europe and developing countries, it is particularly younger people who are becoming infected, but this is putting pressure on businesses striving to reopen for the popular tourist season.

- How “Real” is the Market Growth to Date? The desire to write the next chapter of the recovery and economic growth is real, but, for now, things remain a little distorted by the “base effect.” With buoyant economic growth forecasted for the balance of 2021, we are still trying to pick apart if this represents just a recovery from a low base (in 2020) or a re-establishment of the strong growth trajectory that persisted since the financial crisis of 2008.

- Familiar Market Uncertainty: There is also a mild sense of whiplash as the COVID recovery narrative seems to have been twisted by the rise of the Delta variant, at times referred to as a pandemic for the unvaccinated. Faced with this ongoing uncertainty, markets seem to be less plumbing for a bottom than fishing for answers. The noise of bitcoin and other cryptocurrencies as well as meme stocks, while a spectacle, is unlikely to move the needle much for mainstream investors who have broadly steered clear of this area.

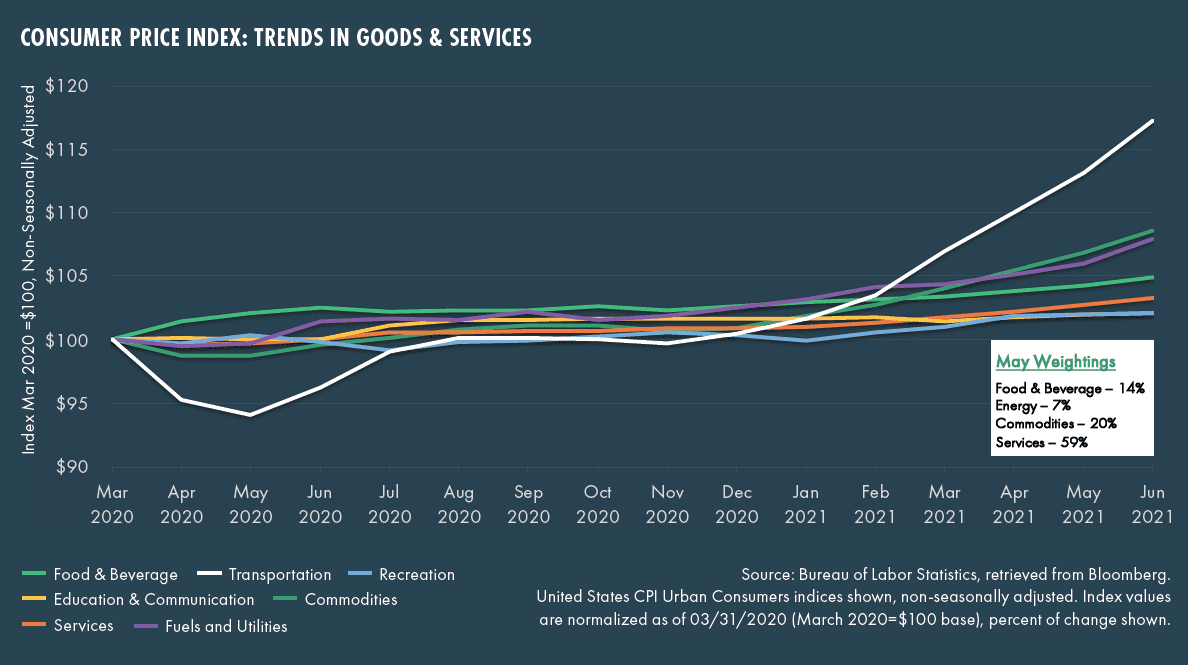

- The Looming Concern Over Inflation: Supply chain disruptions and rising energy prices have stoked inflationary concerns again, although the US Fed remains steadfast that this is a transitory phenomenon not currently meriting a policy response.

- Mixed Signals Between Equity and Bond Markets: Equity markets continue to inch higher, although perhaps with a few more jitters over past weeks. Bond yields have also headed lower, reflecting strong demand and little wariness of imminent rate rises. Lower yields have been a catalyst for increased demand for private assets.

Current Macro Snapshot

Driving in the fog:

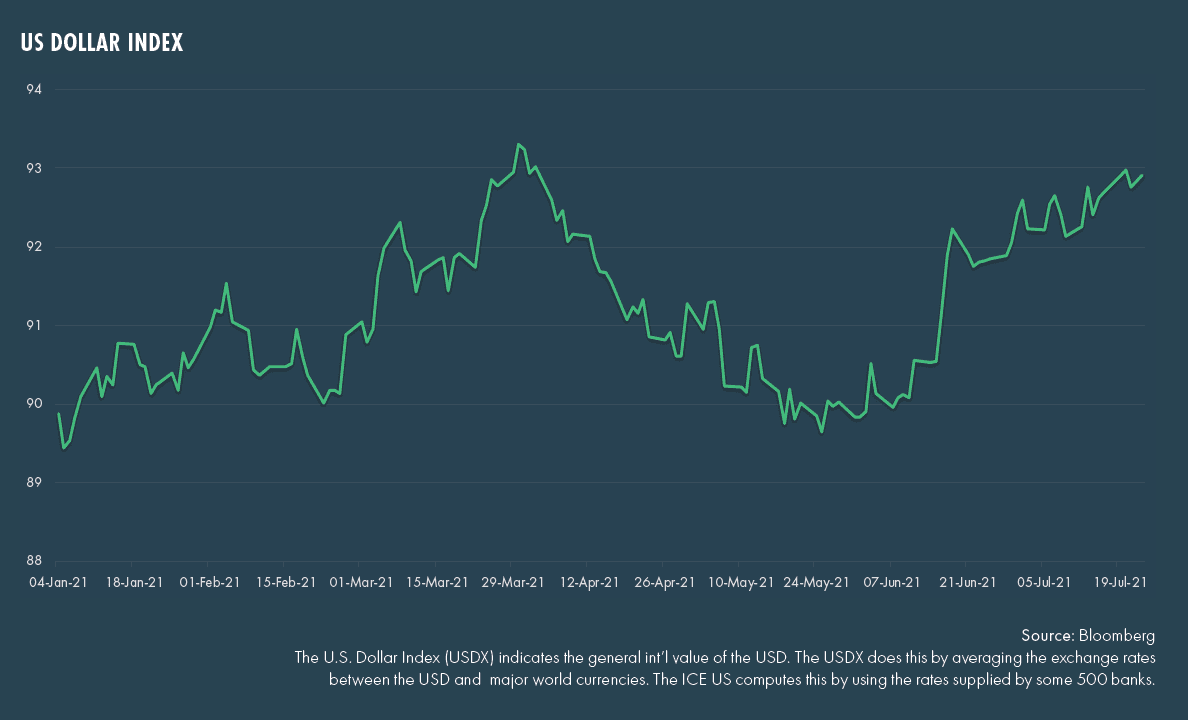

There is a concept of the “fog of war,” defined as the uncertainty in situational awareness as to one’s own capability, adversary capability and adversary intent during an engagement, operation or campaign. Just as the fight against COVID-19 was couched as a war, perhaps there is still some fog remaining there too. The COVID-recovery period in markets has been ripe with ambiguities, both during and following the vaccination rollout – ambiguities such as the sustained strength in bonds (resulting in low yields), the recent rally in the USD as well as the strength in tech and so called “stay at home” stocks, even while consumers no longer seem to be staying at home.

Inflation – transitory or not?

The dominant macro story of the quarter continues to be the stubborn persistence of higher-than-trend inflation. The year-on-year figure for June’s Consumer Price Index (CPI) was 5.4%, the highest year-on-year increase since August 2008, which was not a particularly auspicious time for markets. While the Fed has resolved to not react in a knee-jerk fashion and regards most of the current inflation impulses to be “transitory” – arising out of temporary supply chain disruptions or the recommencement of economic activity – markets, at times, seem unwilling to take them at their word. When this happens, jitters prevail.

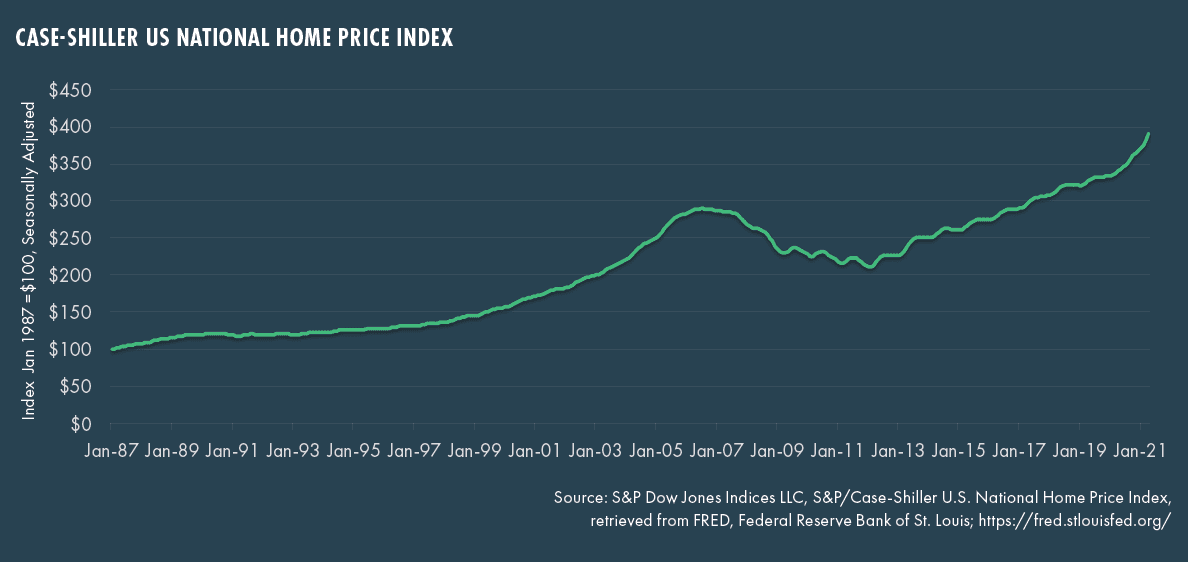

There is also rising chatter about worker shortages, and it is clear that there is also abundant froth around house prices, with housing prices continuing their surge higher given low mortgage rates and ample demand:

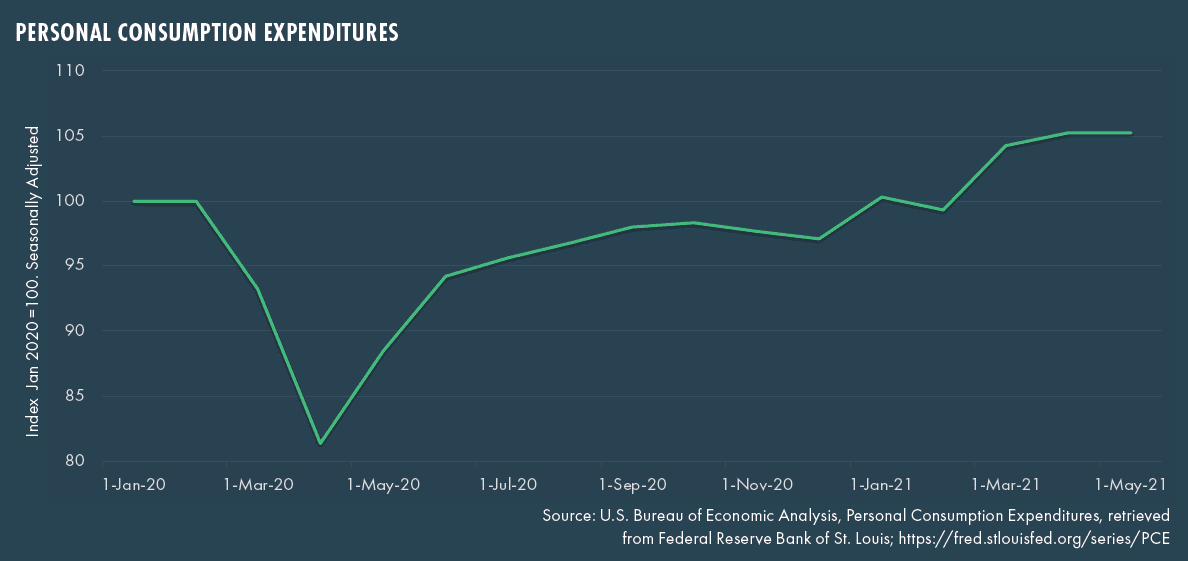

It is also quite clear that the consumer is back and spending at levels higher than seen prior to the pandemic’s shutdown of the economy:

Flows continue – boosting risk assets:

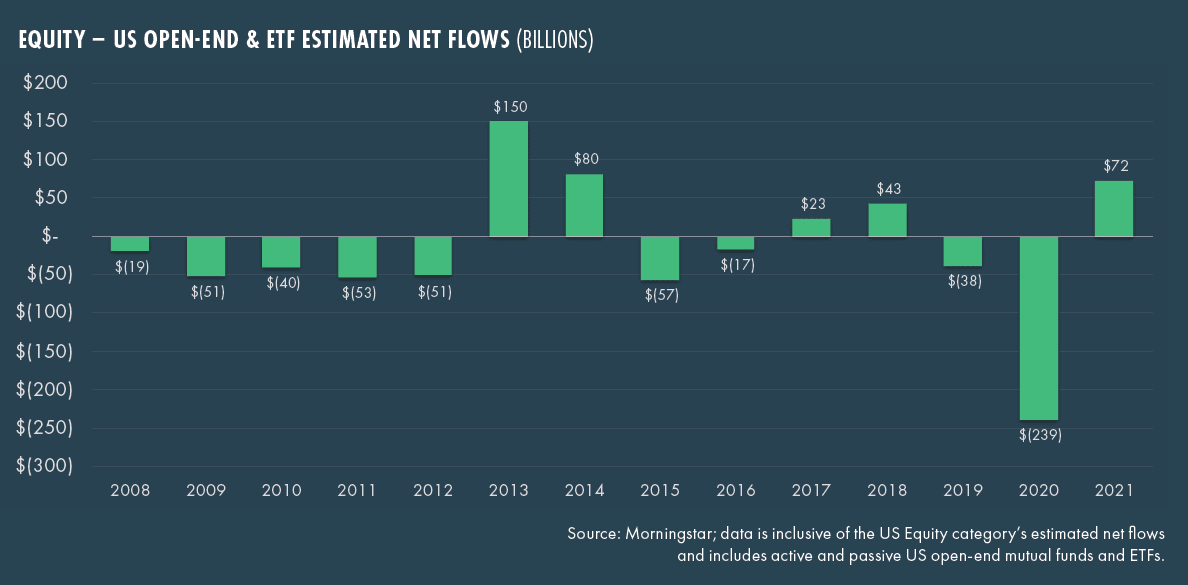

The stock market has stayed buoyant, perhaps discounting the strong growth projections for 2021, and even hinted at bubble valuations as it reached new highs. Buoyancy is reflected both by flows and the readiness of investors to discount bad news and base valuations on an expected rebound and future forecasts. Equity inflows have shown no sign of abating, driven by both retail and institutional flows. The fascination with “meme” stocks – such as Gamestop and AMC – has not abated either. This segment saw intense activity during recent months, as did cryptocurrency-related stocks, which were seen to be heavily sensitive to sentiment around the entire area.

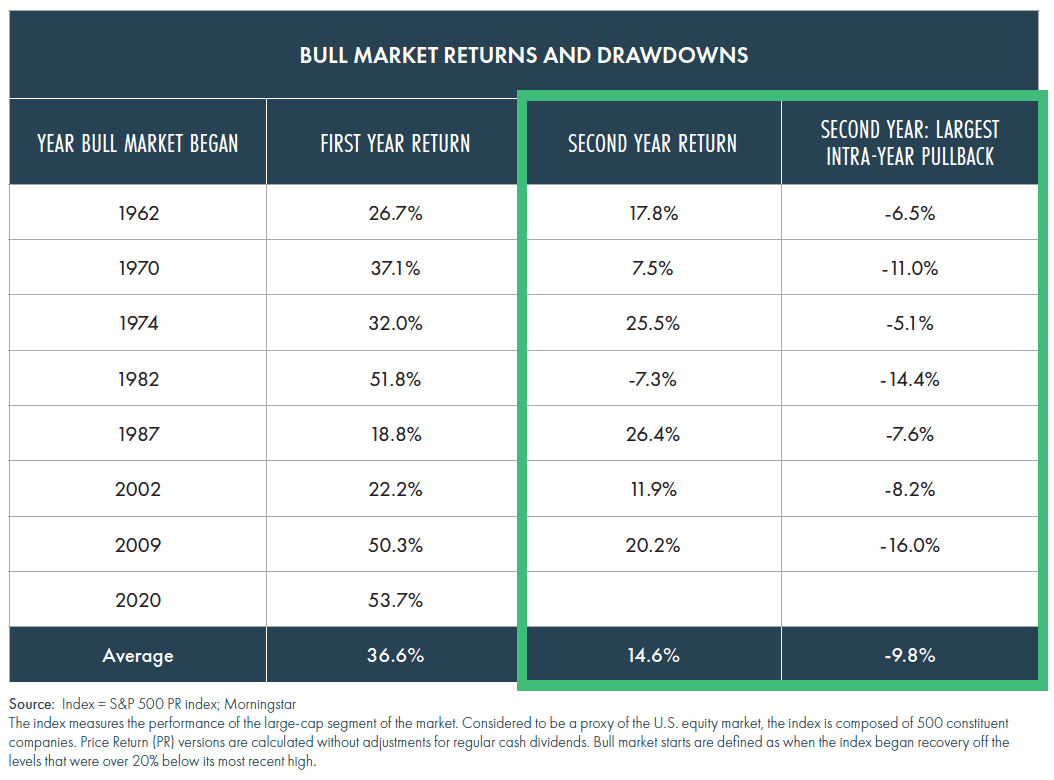

What kind of a correction is “normal” in a bull cycle?

Any hint of a correction throughout the quarter was driven by rising inflation concerns. The fall in the more speculative cryptocurrency sector was even more spectacular. Charts such as this one started to appear, reminding investors (again) of the fact that, even in strong markets, meaningful corrections could be witnessed, particularly in its second year (which is what we are in).

US and Global Policy Perspective:

In the US, policy changes in the form of tax reform and infrastructure spending seem to send a set of mixed messages – while child benefit payments and infrastructure spending will have a stimulus effect in different ways, the tax reform may cause some pre-emptive corporate activity and chill markets later. This quarter, the global themes have been more about global divergences in economic activity than flashpoints – although unrest in both Cuba and South Africa seems to have been amplified by COVID hardship. Vaccine levels are driving much of the divergence.

Individual Asset Class Performance:

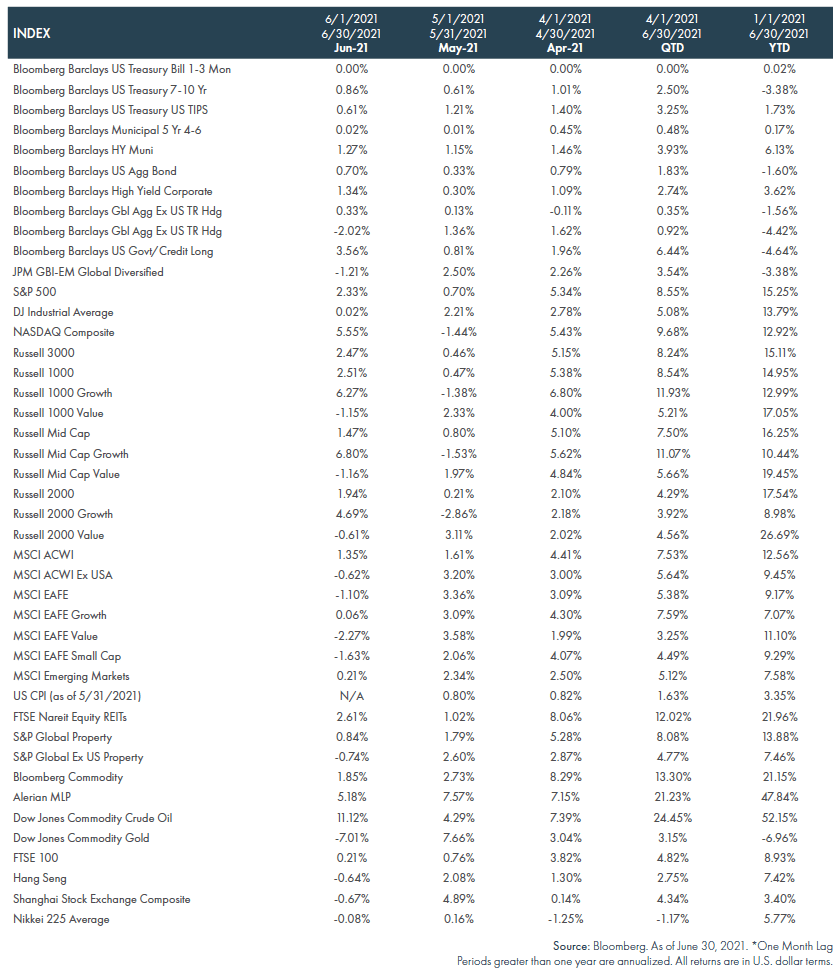

Up 15.3% YTD as of June 30th, the S&P 500 finished the quarter with its 34th record close of the year. The value-rotation trade continued its momentum as we started the second quarter but stalled in the latter half of the quarter. Concerns over potential slowing economic momentum, impact of the Delta variant, and potential return to lockdowns, helped growth stocks much as they did in the early days of the pandemic in 2020. US markets outperformed international developed and emerging markets due to disparities in vaccination rates and inability to fully reopen non-US economies.

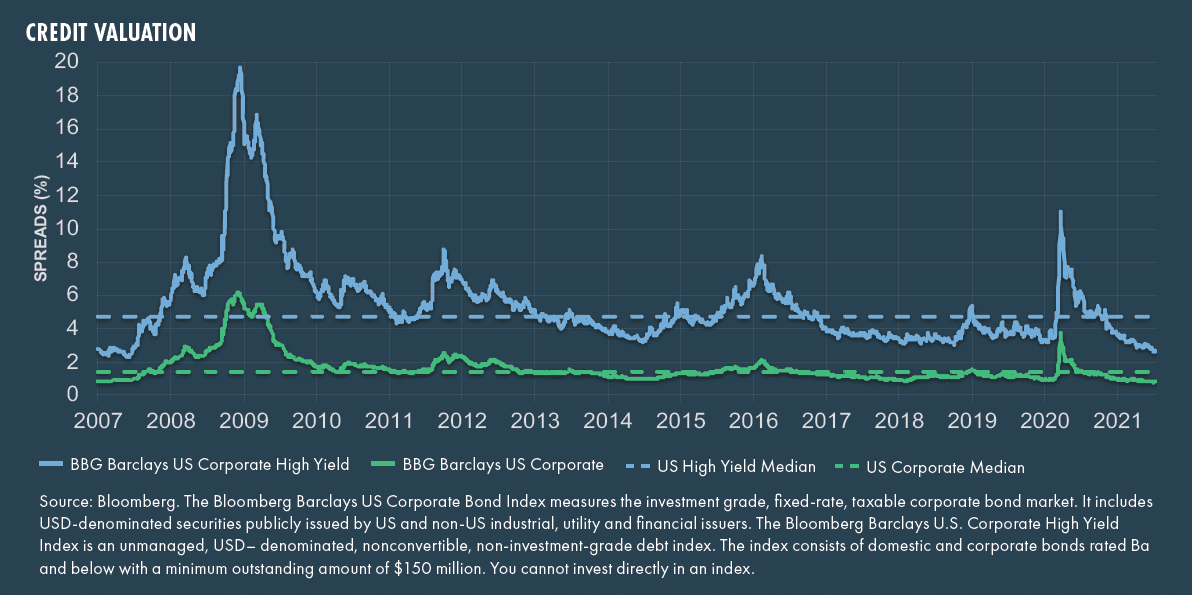

The 10-year Treasury yield fell sharply off year-to-date highs and finished the quarter at 1.44%, which is seemingly at odds with the record levels in equity markets. Typically one would expect yields to rise as equities rise alongside a recovery in economic activity, but we are not in a typical environment. This pointed to an underlying consternation in the market over the outlook for the recovery as we rounded out the quarter. The “scourge” of low risk-free yields is exacerbated by tight corporate spreads as the demand for higher-yielding fixed income continues unabated.

In real assets, oil prices rose sharply higher as consumers hit the road or the skies as lock-downs eased. The momentum there helped boost prices in MLPs which continued to recover off pandemic lows and rose 21% for the quarter. Equity REITs also enjoyed another banner quarter, up 12%, bringing its year-to-date return to nearly 22%.

Outlook

In the months ahead, it will be interesting to watch for the following:

- Maintaining a lookout for a different kind of recovery from a different kind of recession. There was a K-shaped nature to the recovery in the immediate aftermath of COVID; while knowledge workers generally thrived and amassed savings in a seamless shift to remote work, lower paid workers, particularly in the service industry, suffered the most setbacks in terms of income and job security. Now, as economies reopen, this segment remains under strain, although unemployment numbers have dropped from 15% at their peak to only 6%, and there are staff shortages anticipated for lower paid roles. Other positive indicators are the relatively high savings and low debt levels, not just for consumers, but also among corporations. These are significant differences with the previous recession in 2008, in which financial institutions were in the crosshairs of the crisis. This time, they remain well capitalized and supported, and the pain is more generally being felt in consumer-facing businesses.

- What policy issues will matter most if/when COVID recedes? It has been a bit of a whiplash summer. As soon as rising vaccination rates and economy re-openings started to feel normal, fears of the Delta variant led to the re-introduction of mask mandates and a lower conviction in the changes. So, it may be too early to call the end of COVID dominating policy decisions. But, if it does recede from prominence, it will be interesting to see what other issues start to dominate – tax reform, infrastructure spending, geo-political risk?

©2021, Moneta Group Investment Advisors, LLC. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. You cannot invest directly in an index. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.