Aoifinn Devitt | Chief Investment Officer

Chris Kamykowski, CFA, CFP® | Head of Investment Strategy and Research

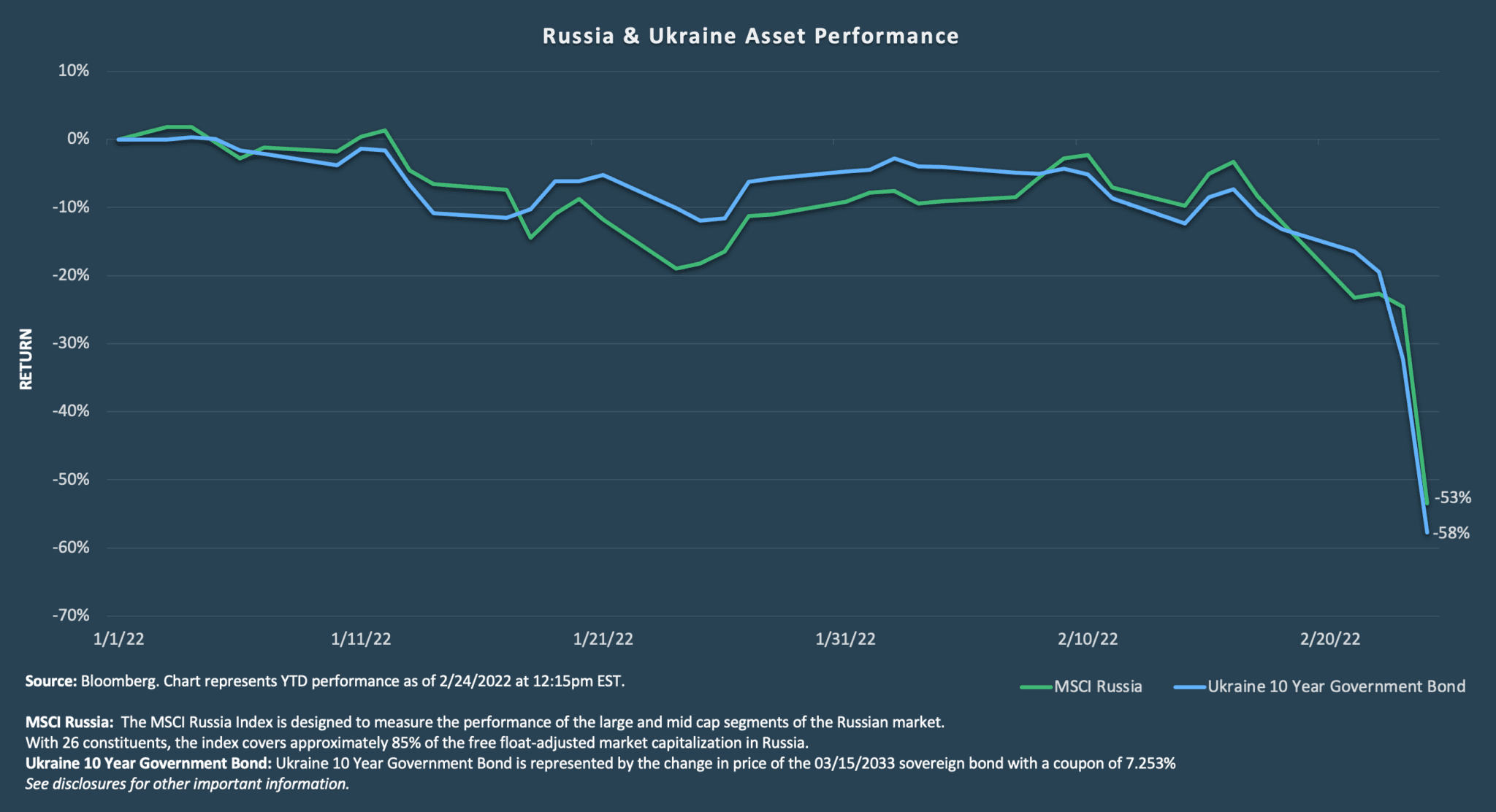

As the Russia/Ukraine situation took a tragic turn overnight, governments are jostling to respond to the most blatant act of aggression in Europe since World War II. As the rhetoric moves beyond sanctions to fear of casualties, cyber-attacks and an upending of world order of the past 30 years, Russian and Ukrainian assets have plummeted.

We do not profess to have any edge on the outcome of the conflict. With the path of Western intervention far from certain, and diplomatic overtures dead in the water, there are many different scenarios that could unfold. We can, however, speak to why markets are reacting as they are and what lessons investors should draw from history in order to ride out the current volatility.

Markets abhor uncertainty and even though the current crisis has been building since October 2021, the events still had a feel of “surprise’ given the diplomatic wrestling to the 11th hour.

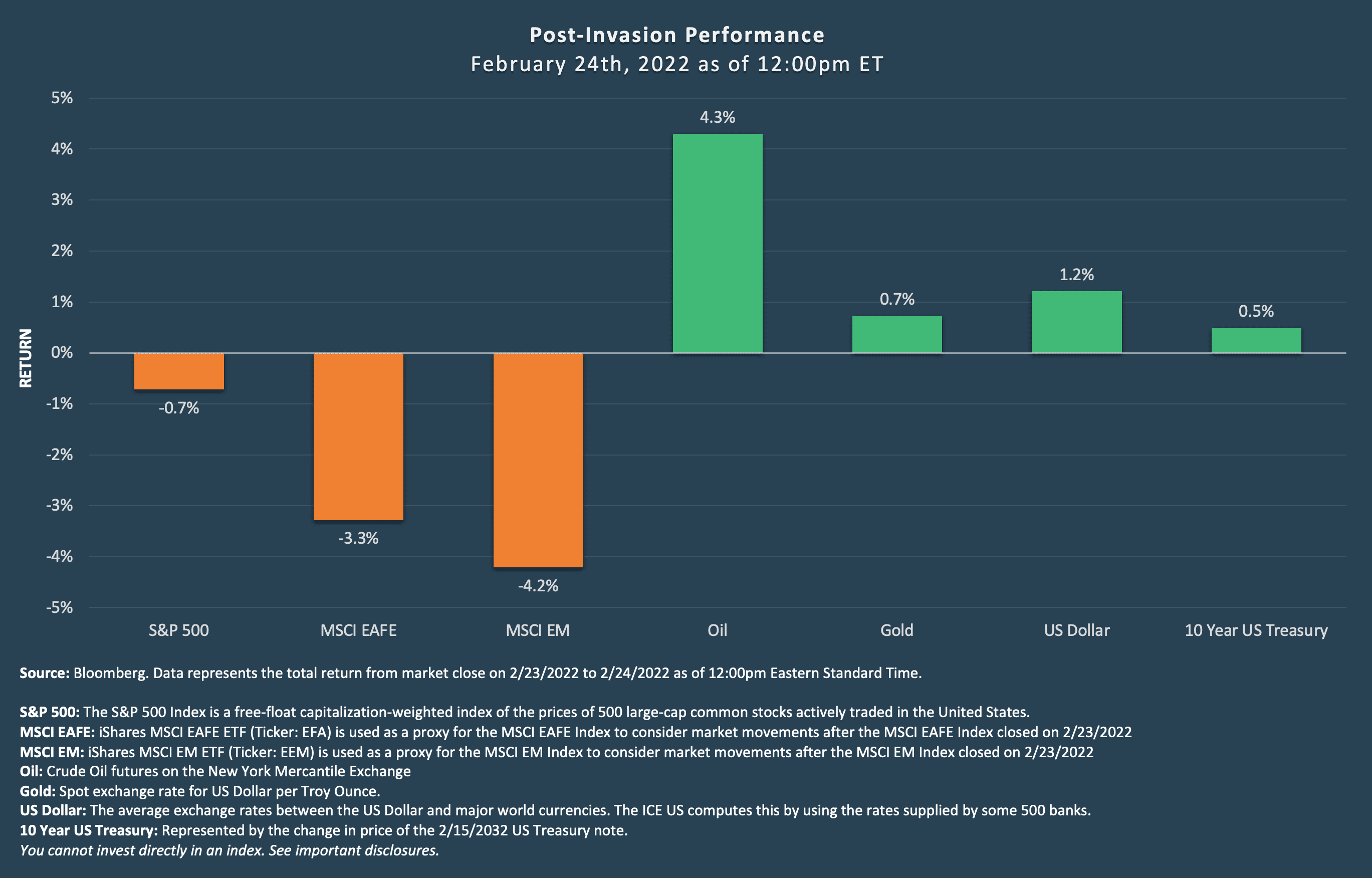

The ramifications for the commodities complex are real and are already being reflected in the oil price which is currently over $103 per barrel as we write.

Russia produces over one third of the world’s oil supply and 40% of its natural gas, so events suggest a strain on already stretched energy markets. Ukraine is a significant exporter of iron ore and serves as a “breadbasket” within European agriculture with its output estimated to feed over 600 million people.

History suggests that geo-political conflicts typically only compound the dynamics that were already in place in markets; in this case, markets were already fragile, displaying sharp volatility and sitting at or near the technical definition for a market correction (-10%) as seen in the S&P 500 and the Nasdaq. Since mid-December 2021, they have been jostled by inflation fears, the new assertive stance from the US Fed towards pending rate rises, and a cooling off sentiment towards high growth tech stocks. However, the sell-off has not been universal. “Old economy” stocks such as energy names, as well as financials which would benefit from higher interest rates, have been well-supported, although to date energy is the only S&P sector in positive territory.

While the sell-off in Russian and Ukrainian assets has been stark developed markets are showing weakness but not severe losses so far through mid-day on 2/24/2022. Additionally, safe haven assets, such as the US Dollar and gold, are modestly higher on the day.

Given the levels of uncertainty currently, markets will need some days to digest the developments and assess what the likely next steps are. Just as in the case of the 2001 terrorist attacks, the closures from Covid-19, and other geo-political shocks, there will be a period of panic, one of taking stock, and a re-setting of expectations. They key drivers of the economic recovery post-Covid remain the same. Current events in Ukraine certainly turn up the dial on energy prices and inflation, but there are relief valves for those too – such as releasing energy reserves. We do not believe these events will affect US employment, consumer spending, or technology trends. The threat of cyber-attacks as acts of war may paralyze some services, but we expect that these will be isolated and not widespread.

Therefore, we recommend not trying to trade this event – but staying close to the news flow, retaining balance across portfolios (watching the diversifying effect of inflation hedges and low-risk fixed income) and staying the course.

©2022, Moneta Group Investment Advisors, LLC. Trademarks and copyrights of materials referenced herein are the property of their respective owners. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. You cannot invest directly in an index. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.