If you are a client of Moneta Group, you may have heard our investment team or your advisor mention something called “Modern Portfolio Theory” and if you’ve been browsing our website, you may have seen that the “Investments” section of our website says the following:

Moneta Group’s approach to selecting investments is different from traditional financial service providers. An experienced in-house investment department, unmotivated by commissions, provides expert objective advice based upon what is in your best interest.

Based on Modern Portfolio Theory, your Moneta Family CFO will help you construct unique asset allocation strategies specifically tailored for your portfolios. The allocation will take into consideration your time horizon and level of risk tolerance. Moneta Group will provide an ongoing review of your asset allocations and recommend appropriate changes. We also provide the rebalance discipline necessary to help you capitalize on the inherent volatility of the financial markets.

But, have you ever wondered what exactly Modern Portfolio Theory was? I’d like to take a few moments today to share more information on MPT with you.

What is modern portfolio theory?

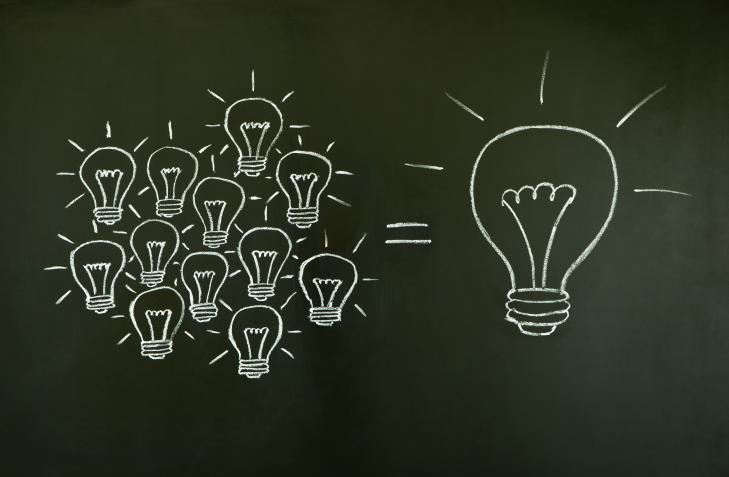

In 1952 while studying at the University of Chicago Harry Markowitz put forth new concepts on investing. In his paper, “Portfolio Selection” he posited that by combining investments that act differently or have low correlations but have similar expected returns, you could lower the risk of the overall portfolio. This became the foundation of his idea, which came to be known as Modern Portfolio Theory (though, interestingly enough, Markowitz refuses to call it Modern Portfolio Theory stating “there is nothing ‘modern’ about it”).

Today, the exact definition of Modern Portfolio Theory is “a theory of finance that attempts to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets.”

At Moneta, we approach investing with this theory in mind, determining a client’s risk tolerance and then designing a portfolio to maximize return for that level of risk. Having an understanding of different investments expected returns, and risk an investor can either optimize return for a given level of risk, or optimize risk for a given level of return.

One shortfall of Modern Portfolio Theory is that it assumes correlations are constant. The correlation between one investment and another is measured on a scale from -1 (perfectly inversely correlated) to 1 (perfectly correlated). As an example, if investment A and investment B have a correlation of -1, if investment A is up 5% you would expect investment B to be down 5%. When we step out of theory and into the real world we see that correlations are constantly changing. More importantly, correlations among different types of stocks tend to approach 1 at the exact time you want them to be different. In 2008 all types of stocks fell over 30% and diversification among different types of stocks offered little risk reduction.

Because of this correlation and the lack of risk mitigation associated with equity investments, many advisors recommend the use of Alternative Investments in client portfolios. These strategy-based investments are generally designed to offer diversification and are designed to be used in most cases as a risk mitigation tool.

Thirty-eight years after Harry Markowitz published his paper Portfolio Selection, he was awarded the Noble Prize in Economics for his theory. We believe that nobody before, or since, has developed a better foundation to be used in portfolio construction—and that is why we root our investing structure on this basis.