Compardo, Wienstroer & Janes at Moneta –

Election years are notoriously turbulent, not only in the political arena but also across financial landscapes. The potential for a shift in leadership brings an air of uncertainty that permeates the economy, affecting everything from market stability to tax policies. Unlike non-election years, when economic conditions tend to be more predictable, election years present a unique challenge: how do financial planners navigate the noise and remain steadfast in guiding their clients toward long-term financial success? The answer lies in understanding the broader implications of political developments and maintaining a holistic approach that encompasses all aspects of financial planning—from investments and taxes to estate planning and retirement strategies.

Both leading candidates for the presidency in the upcoming election have extensive track records in office. This historical context provides a valuable lens through which we can anticipate potential policy changes and their economic impacts. With this in mind, let’s delve deeper into the key areas we are focusing on during this election year and how these considerations inform our comprehensive financial planning strategies.

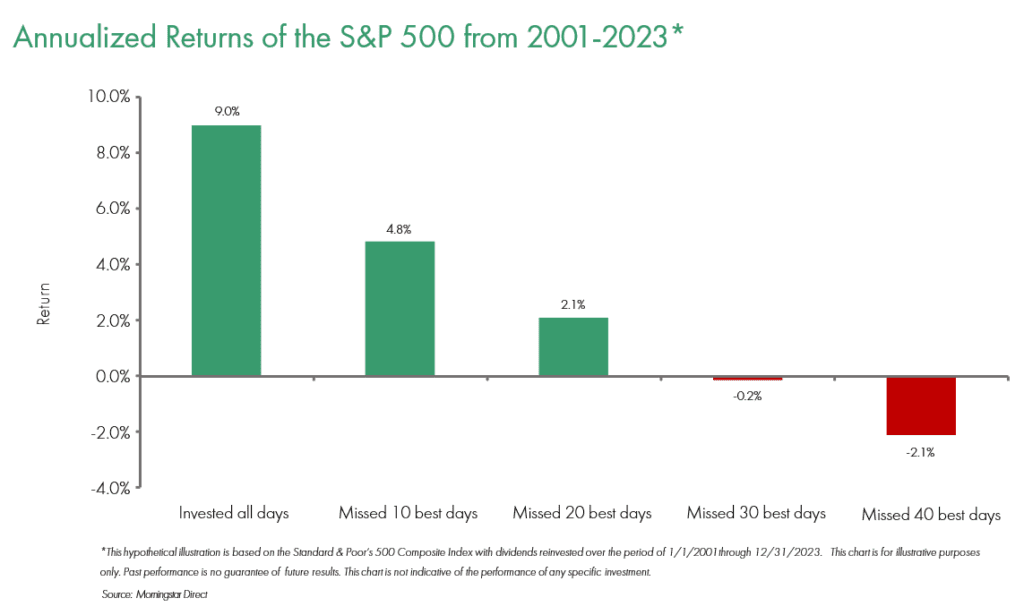

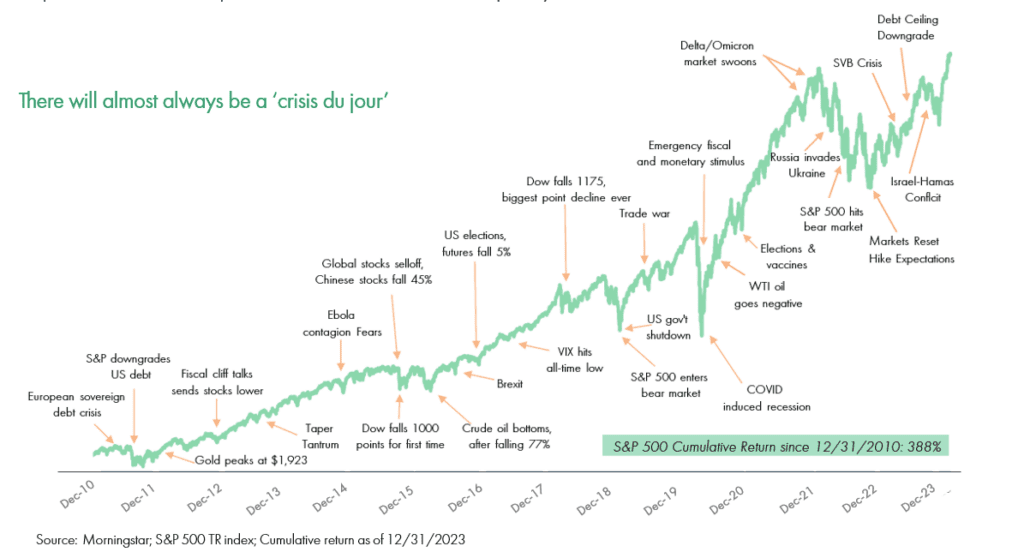

1. Market Volatility and Behavioral Finance: Staying the Course

Election years often bring heightened market volatility, reflecting the emotional rollercoaster experienced by both investors and the general public. The anxiety surrounding potential policy shifts, geopolitical risks, and economic uncertainties can lead to unpredictable market movements. However, our role as holistic financial planners is to help clients avoid common pitfalls of emotional decision-making.

Actionable Insight: During periods of heightened volatility, we focus on “behavioral coaching” to keep clients from making impulsive decisions that could harm their long-term financial health. For example, instead of reacting to short-term market swings, we might rebalance a portfolio to align with a client’s risk tolerance and long-term goals. This approach ensures that our clients remain on track to achieve their financial objectives, regardless of market fluctuations.

2. Federal Reserve Policies and Comprehensive Economic Planning: Preparing for Shifts

While the electoral process captures public attention, the Federal Reserve’s policies often have a more immediate impact on the broader economic landscape. The Fed’s stance on interest rates, quantitative easing, and other monetary tools can signal shifts in economic policy that outlast any single administration.

Actionable Insight: We advise clients to review their debt management strategies and fixed-income holdings in light of potential interest rate changes. For example, if a rise in interest rates seems likely, we might recommend refinancing debt or adjusting the duration of bond portfolios to mitigate interest rate risk. This proactive approach helps clients navigate the changing landscape more effectively.

3. Tax Policy Uncertainty and Proactive Planning: Mitigating Risks and Seizing Opportunities

Tax policy is frequently a focal point of election debates, with candidates proposing varying approaches to corporate and individual tax rates. For financial planners, the challenge lies not just in predicting these changes but in understanding their broader economic impact and preparing comprehensive strategies for clients.

Actionable Insight: We conduct detailed tax scenario analyses to help clients understand potential impacts on their income, investments, and estate plans. This could involve accelerating income or deferring deductions in anticipation of future rate changes, or exploring strategies such as Roth conversions if favorable tax conditions are expected to change. This level of proactive planning ensures that our clients are prepared to act swiftly, rather than reactively, to new tax laws.

4. Sector-Specific Impacts and Strategic Positioning: Identifying Winners and Losers

Different sectors of the economy respond uniquely to political shifts, particularly those closely tied to government policy, such as healthcare, defense, and energy. For example, a change in healthcare policy could dramatically impact pharmaceutical companies and insurers.

Actionable Insight: We analyze potential policy changes and identify sectors that might benefit or suffer as a result. For example, if a candidate’s platform suggests increased defense spending, we may advise reallocating assets to defense stocks or related funds. Conversely, if there is a risk of new regulations in a sector like energy, we might recommend reducing exposure. This targeted approach allows us to capitalize on potential growth opportunities while mitigating risks.

5. Diversification as a Defensive Mechanism: Beyond Just Investments

Diversification remains a cornerstone of risk management, especially during periods of uncertainty like election years. However, for financial planners, diversification goes beyond asset allocation in an investment portfolio. It includes diversifying income sources, tax strategies, and even estate planning techniques to manage risk comprehensively.

Actionable Insight: We work with clients to develop a “personal balance sheet” that assesses all aspects of their financial lives—from liquid investments to real estate and business interests. This helps identify areas where diversification can reduce risk and increase resilience. For example, diversifying tax-advantaged accounts can provide flexibility in managing withdrawals and optimizing tax outcomes in retirement.

6. Maintaining a Long-Term Perspective Amid Short-Term Noise: Avoiding Reactionary Pitfalls

In an election year, the news cycle becomes saturated with political analysis, speculation, and, often, sensationalism. While it’s important to stay informed, it’s equally crucial to maintain a focus on long-term financial goals that encompass all aspects of a client’s financial life.

Actionable Insight: We encourage clients to revisit their financial plans regularly to ensure they are still aligned with their long-term objectives. This could involve periodic portfolio reviews, but also checking in on estate plans, retirement strategies, and even insurance coverage to ensure comprehensive protection. Keeping a clear, long-term perspective helps avoid the pitfalls of short-term decision-making.

7. Economic Indicators as a Broader Context: Informed Decisions for Holistic Planning

Beyond the election itself, we pay close attention to a range of economic indicators, including GDP growth, unemployment rates, and inflation. These metrics provide a broader context for understanding economic conditions and help us make more informed decisions about comprehensive financial planning strategies.

Actionable Insight: By monitoring these indicators, we provide clients with timely advice on how to adjust their financial plans. For example, if inflation appears to be on the rise, we might recommend increasing exposure to inflation-protected securities or revisiting cash flow strategies to ensure clients’ purchasing power remains intact.

Conclusion

Election years present a unique set of challenges and opportunities for financial planners and their clients. By focusing on key areas such as market volatility, Federal Reserve policies, tax changes, sector-specific impacts, and economic indicators, while maintaining a steadfast commitment to long-term, comprehensive financial planning, we strive to ensure that our clients’ financial plans remain robust and well-positioned for future growth. Our holistic approach to financial advising—encompassing everything from investment strategies to estate and tax planning helps prepare our clients for any eventuality.

Next Steps: To see how our tailored, holistic strategies can help you navigate the complexities of the current political and economic landscape, we invite you to schedule a complimentary consultation with our team. Contact us at thecwjteam@monetagroup.com to begin a conversation about securing your financial future with confidence.

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.