Tim Side CFA | Research Analyst

Introduction

In April 2022, we put out a piece titled “Revisiting the Emerging Markets Allocation.”[1] In this writeup, we addressed a litany of questions surrounding Moneta’s investment in emerging markets while providing several reasons for maintaining an allocation to the asset class. Specifically, those reasons included valuations, long-term total return expectations, diversification, and growth expectations. Given its outsized weighting, it is hard to talk about emerging markets without talking about China, so we also included a brief rationale for the inclusion of China in our portfolios. Namely, we pointed to their outsized presence in the index (roughly 30% of emerging market indexes), which tends to necessitate an allocation, combined with the use of active managers who can make the “on the ground” investment decisions.

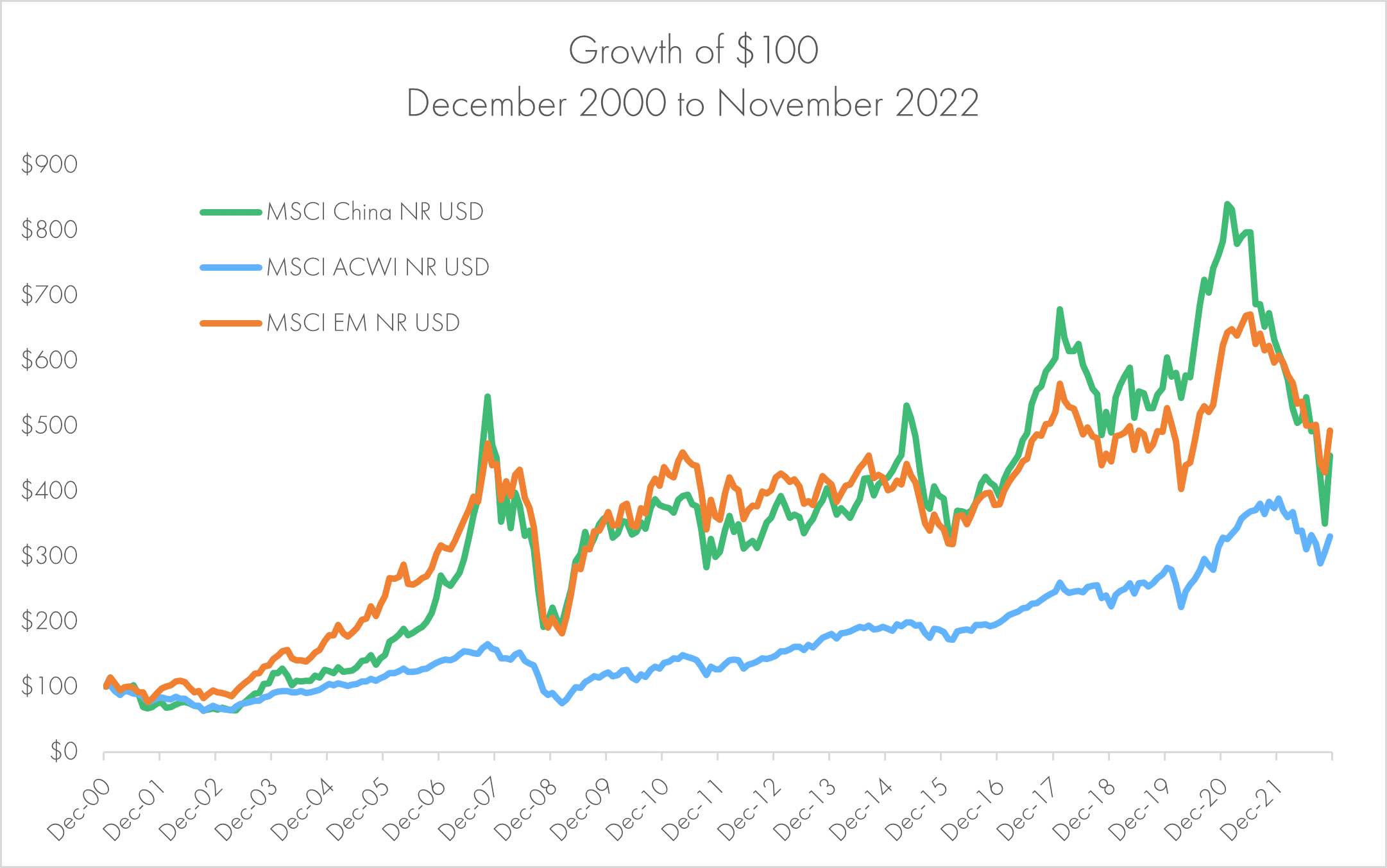

Emerging markets, especially China, have continued to be turbulent since we posted the paper, although November’s strong performance has marginally eased the pain. From April 1st through the end of November, the MSCI Emerging Market Index fell 12.9%, the MSCI China Index fell 13.5%, while the S&P 500 Index only fell 8.9%. The comparison of trailing annualized 15-year returns is even more stark, as the MSCI EM Index annualized 0.8%, MSCI China Index annualized -0.2%, and the S&P 500 Index annualized 9.2% as of 11/30/2022. It is no longer simply a “lost decade.”

The concerns around an investment in China are numerous. Tariffs, human rights violations, intellectual property theft, and the outbreak of Covid-19 are individually concerning, but since the regulatory crackdown of tech and education companies that began in late 2020, the long-held investment thesis for China has been coming under renewed scrutiny. The situation only further deteriorated as China’s overleveraged property market crashed, a resurgence in Covid cases shut down major cities due to a continued pursuit of their Zero Covid Policy, and the likelihood of a military conflict with Taiwan (and therefore the U.S.) increased. The flow of bad news built to a crescendo in early November when General Secretary Xi Jinping secured a third term of leadership (breaking the two-term precedent) and further consolidated power by stacking senior leadership with loyalists during the Communist Party of China’s 20th Party Congress. Just when investors thought they may have had a reprieve, protests against the country’s zero-tolerance to Covid-19 sent markets in a tailspin once more, though as we write, lock-down measures are easing in Beijing.

Given the magnitude of concerns amidst a changing regime, we undertook a thorough review of our exposure to China, seeking to answer two critical questions: (1) Has the fundamental investment thesis for China changed? (2) Given the risks, should we make any changes within our emerging markets exposure?

Fully answering these questions requires an ongoing understanding of history, geopolitics, investing, and human behavior. By digging beneath the headlines, we can focus on the detail and the nuance that fits the complexity of the China thesis. It is important to note that investment decisions are constantly under review and could change as new information is realized, but our current findings are set out below.

Has the fundamental investment thesis for China changed?

Historical Context

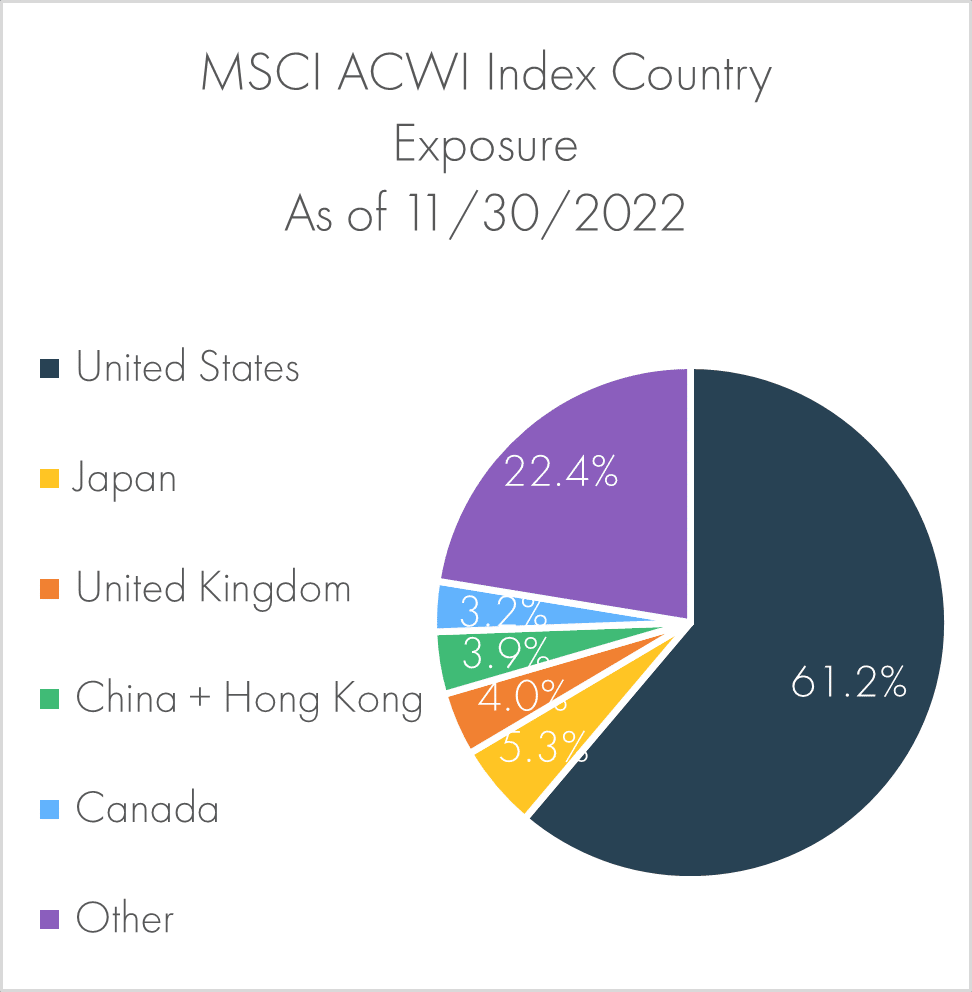

A simple, but powerful, investment thesis is tied to the size of China’s market, which makes up roughly 30% of emerging market indexes and 4% of global equity markets, as measured by the MSCI Emerging Markets Index and MSCI ACWI Index respectively, as of 11/30/2022. While Moneta does consider market weights when building an asset allocation, we don’t believe in blindly investing in an index, since those indexes themselves require some degree of active decision making.

Beyond general diversification benefits, there were two propositions put forth in the early 2000s that help frame the broad thesis of Western investment in China: (1) In a speech on March 9th, 2000, President Bill Clinton stated: “By joining the W.T.O., China is not simply aggressing to import more of our products. It is agreeing to import one of democracy’s most cherished values, economic freedom.”[2] (2) On November 30th, 2001, Jim O’Neill, Head of Global Economic Research at Goldman Sachs, put forward a research paper that projected four emerging market economies would achieve higher real GDP growth than that of the G7. These four countries included Brazil, Russia, India, and China; hence the acronym “BRIC” was formed.[3]

Put simply, China represented an opportunity of economic growth built on the same foundations and values of the West.

The following years appeared to support this argument, as equity performance of China and broad emerging markets outperformed the U.S. and broad developed markets. While many likely remember the 2008 Summer Olympic Games (hosted in Beijing) for the records broken by Michael Phelps and Usain Bolt, it is noteworthy that the slogan for the games was “One World, One Dream,” further supporting the idea that economic growth would lead to a more democratic mindset.

Investors’ mettle was put to the test during the Global Financial Crisis, as the region was not immune from the volatility that roiled markets globally from 2007 to 2009. During that time, the Hang Seng Index (local currency) lost 59.1%.[4] However, over the index’s longer history back to 1964, large drawdowns were nothing new and each time, markets eventually returned to new highs. While painful, this drawdown did not test the thesis of economic growth built on Western values.

In 2012, After 27 years of working his way through the ranks as a provincial leader, Vice President Xi Jinping replaced Chinese President Hu Jintao as General Secretary of the Communist Party and in 2013 Xi began his first five-year term as President of China. A cloud of mystery surrounds Xi Jinping. This is likely by design, as he hides emotion and does not give interviews to Western journalists or hold solo press conferences.[5] With the benefit of hindsight, we can highlight his strong belief in the importance of state control and security, but when he first came to power, it seemed likely that he would continue the status quo of economic growth while cracking down on rampant corruption amongst senior officials.[6]

In 2013, a confidential document, known as Document No. 9[7], was circulated amongst the Chinese Communist Party (CCP) and leaked to the public a few months later. This document addresses seven “noteworthy problems related to the current state of the ideological sphere.” As stated, the issues included (1) promoting Western constitutional democracy: an attempt to undermine the current leadership and the socialism with Chinese characteristics system of governance, (2) promoting “universal values” in an attempt to weaken the theoretical foundations of the Party’s leadership, (3) promoting civil society in an attempt to dismantle the ruling party’s social foundation, (4) promoting Neoliberalism, attempting to change China’s basic economic system, (5) promoting the West’s idea of journalism, challenging China’s principle that the media and publishing system should be subject to Party discipline, (6) promoting historical nihilism, trying to undermine the history of the CCP and of New China, and (7) questioning reform and opening and the socialist nature of socialism with Chinese characteristics.

This document, at minimum, indicated that irrespective of what Western businesses and investors believed, China’s government was not interested in growing democracy in tandem with economic growth. However, had investors read this document and pulled out of China, they would have likely missed out on one of the best performing emerging market countries in the late 2010s, driven by an explosion in major tech and ecommerce businesses such as Alibaba and Tencent.

There were hiccups along the way, including a crash in 2015, trade tariffs in 2018, and the outbreak of Covid-19 in late 2019, but each time, the market recovered and while investors would debate the merits of investing in China, the idea of “uninvestability” never seemed to gain widespread traction. In late 2020, cracks in the thesis began to form when China’s State Administration of Market Regulation introduced draft rules to regulate internet platforms.[8] The Politburo of the Chinese Communist Party, the decision-making body of the CCP, quickly announced its support for these rules and in 2021, a string of fines and crackdowns occurred across the spectrum of tech companies who were behind China’s rapid equity market growth in the preceding years.[9]

The pain for Chinese equities continued in 2022. Following Russia’s invasion of Ukraine in February, China’s refusal to explicitly denounce Putin’s actions combined with increasing tensions between China, Taiwan, and the U.S., raised concerns that an invasion of Taiwan, previously seen as unthinkable, was now a possibility. Meanwhile, government regulations enacted in 2020, that were intended to reign in China’s overleveraged property market, made headlines as developers failed to finish building homes that many buyers had already begun making payments on. With real estate being major component of Chinese citizens’ wealth, the property market challenges have been a significant drag on the Chinese economy with Evergrande’s default in 2021 being labeled “China’s Lehman Moment” by the Financial Times.[10] These challenges have been exacerbated by stringent Covid lockdowns which have only further stifled economic growth.

So, as we look back at the last 20+ years of investing in China, has the broad Western investment thesis for China changed? We would argue that yes, the thesis has partially changed, but we would also argue that the thesis was misunderstood from the start.

Source: Morningstar as of 11/30/2022; returns calculated monthly beginning on 12/31/2000; see important disclosures at the end of this article.

The Misunderstanding

In the May-June 2021 Issue of the Harvard Business Review, Rana Mitter, a professor at Oxford, and Elsbeth John, a senior lecturer at MIT, published a piece that noted three fundamental misconceptions that the West has about China.[11] Their “Idea in Brief” is included below:

The Problem: Politicians and business leaders continue to misread China’s strategy and politics.

Why it Happens: They make three plausible but false assumptions: Democracy is an inevitable consequence of economic development; authoritarian regimes are never seen as legitimate; and the Chinese think, behave, and invest much like anyone in the West.

The Solution: Accept that economic development in China will not inevitably lead to democracy; acknowledge that the Chinese regard their government as both legitimate and effective; and recognize that while Chinese consumers have short-term horizons, their rulers are focused on the country’s long-term security.

In a country where media is controlled by the state and opposition to state views is quickly, and sometimes brutally, eliminated, it is rather difficult to truly assess satisfaction amongst Chinese citizens. What we can objectively assess though, is that China has leapfrogged the world in consumer tech and modern infrastructure, at least in the major cities. From those who have on the ground experience, we hear of incredible infrastructure feats, including a connection of cities with a high-speed train system and seamless integration of consumer technology, that are far more advanced than developed countries.[12]

The flaw in the original thesis is the assumption that to be economically successful, China would adapt and move closer to Western values. From China’s perspective, economic success for all can best be achieved under strict state control. Philosophically, America and China are very different, but that does not necessarily mean that both can’t have successful economies. It does mean, though, that a special expertise may be needed when investing in Chinese stocks.

What has Changed

From China’s perspective, broadly speaking and Covid aside, nothing has changed. An emerging market equity manager, who has spent many years studying and investing in China, proposed that China’s growth can be framed in three stages:

- China 1.0 (2001): China joins the W.T.O and begins down the path of urbanization.

- China 2.0 (2011): Focus on digitalization, rapid growth of infrastructure and technology.

- China 3.0 (today): Focus on inclusion, bringing up the low-income earners who were left behind in the initial stages of growth.

China’s policy appears to be increasingly focused on sustainable, quality growth. From China’s perspective, they have taken actions to reduce corruption, minimize the fallout from an over-extended property sector, and properly regulate “out-of-control” industries. On the surface, these all sound like noble actions, but with the incredible power that the state wields, comes higher uncertainty in general and a greater risk of policy missteps since there is effectively no opposition to the party in control.

In many ways, China can operate more “efficiently” than most developed countries, in that they operate on a five-year schedule where policy makers can set objectives and then achieve them without political resistance. Contrasting with the U.S. where, by design, decisions are made via legislation by policy makers who have been democratically elected. This makes it harder to get policies through but removes the power from a concentrated group of people. From China’s perspective, they are continuing down the same path of state controlled, economic growth in order to achieve common prosperity across the country.

From the West’s perspective, China has seemingly changed course from a trajectory of capitalistic globalization to a tightly controlled economy. The warning signs have been there: corruption, joint venture requirements, Document No. 9, data surveillance, intellectual property theft, etc. These issues have long been a part of investing in China, but for a time, they may have been overlooked given the investment opportunity. Investors were caught off guard when China quickly and thoroughly capped some of the fastest growing companies, eliminating the “blue sky” potential for these companies’ growth.[13],[14]

There are critical nuances to each of these cases, but the general change in the thesis is that policy changes can happen quickly and with little warning (termed “regulatory whiplash” by some market commentators), which creates a higher degree of uncertainty regarding regulatory risk.

The issue of China and Taiwan remains somewhat of a wildcard. Given that these tensions go back decades, it is hard to argue that there has been a fundamental change, but certainly tensions have risen. To be sure, there are differences, but what was once unthinkable has now become, at minimum, plausible.

We claim no unique insight to whether or not China will invade Taiwan and we certainly possess no ability to predict what will happen should that occur. If we use Russia’s invasion of Ukraine as a proxy, we can say that an outright military invasion of Taiwan would be catastrophic on a global scale due to the size and integration of China with the global economy.[15] On one hand, one could argue that Russia’s invasion of Ukraine has actually reduced the probability of a military conflict between China and Taiwan, since doing so would clearly isolate China and devastate their economy.[16] On the other hand, we have just proposed that philosophically the U.S. and China are not the same, so it would be unwise to assume that it’s impossible for China to act in a way that the U.S. would deem irrational if it were in China’s shoes.

As best as we can ascertain at this time based on conversations with multiple asset managers, macro research providers, and former military personnel, it seems that China likely has little to gain and much to lose by pursuing military action in Taiwan. As seen in the 20th Party Congress, security is an ever-growing focus of China,[17] but this includes economic and physical security. With caution, we conclude that it is more likely for China to grow its global power via economic incentives, such as the One Belt One Road initiatives, but we do not take the risk of military action lightly.

Lastly, China’s draconian approach to mitigating the spread of Covid-19 has drawn much criticism and many investors see these policies as the key source of China’s stagnant economic growth at present. Given the extremely positive responses from markets at even the slightest hint that Covid measures are being relaxed, it is fair to say that at least part of the drawdown can be attributed to China’s continued lockdowns. However, we would put the Covid response under the broader “state control” risk rather than its own risk in the fundamental investment thesis.

Should we make any changes within our emerging markets exposure?

The Context

As of 11/30/2022, China and Hong Kong domiciled stocks made up 3.9% of the MSCI ACWI Index. This is down from the beginning of the year, when they collectively made up 4.3% of the index.

In a hypothetical 60% MSCI ACWI Index and 40% Bloomberg Aggregate Index portfolio, an investor would have 2.3% of their portfolio directly invested in Chinese stocks (including Hong Kong).

There is a high degree of complexity when it comes to share classes and domicile. In short, the A-shares represent stocks of mainland China-based stocks and have tighter restrictions on foreign investors. B-shares and ADRs trade outside of mainland China and are more easily accessible.

One global asset manager recently estimated that if all China A-shares and Hong Kong listed stocks were included in the MSCI indexes, the size would increase to roughly 50% of the MSCI EM Index. In other words, from a true market cap perspective, completely passive investors are likely underweight to China.

Source: Morningstar as of 11/30/2022; see important disclosures at the end of this article.

Change in Thesis

As we’ve discussed, aside from a strictly passive argument, the original investment thesis in China has partially changed as (1) the likelihood of government stepping in and regulating businesses is higher than it was before and (2) the risk of military conflict between China and Taiwan, while arguably minimal, is higher than before.

However, just because the thesis has changed, does not mean the thesis has no merit. As we have discussed,

China has realized economic growth under the leadership of the CCP. We do believe that investment opportunities exist in countries with different, and even corrupt, political structures and with 1.4 billion people and more than 6,000 listed stocks, China is no different. As best as we can ascertain from our research, China wants to continue their economic growth, but in a more stable way. As such, it may be prudent to reduce growth expectations but not eliminate them. Theoretically, tighter controls could also reduce volatility, but given market reactions to the recent controls that may be too optimistic.

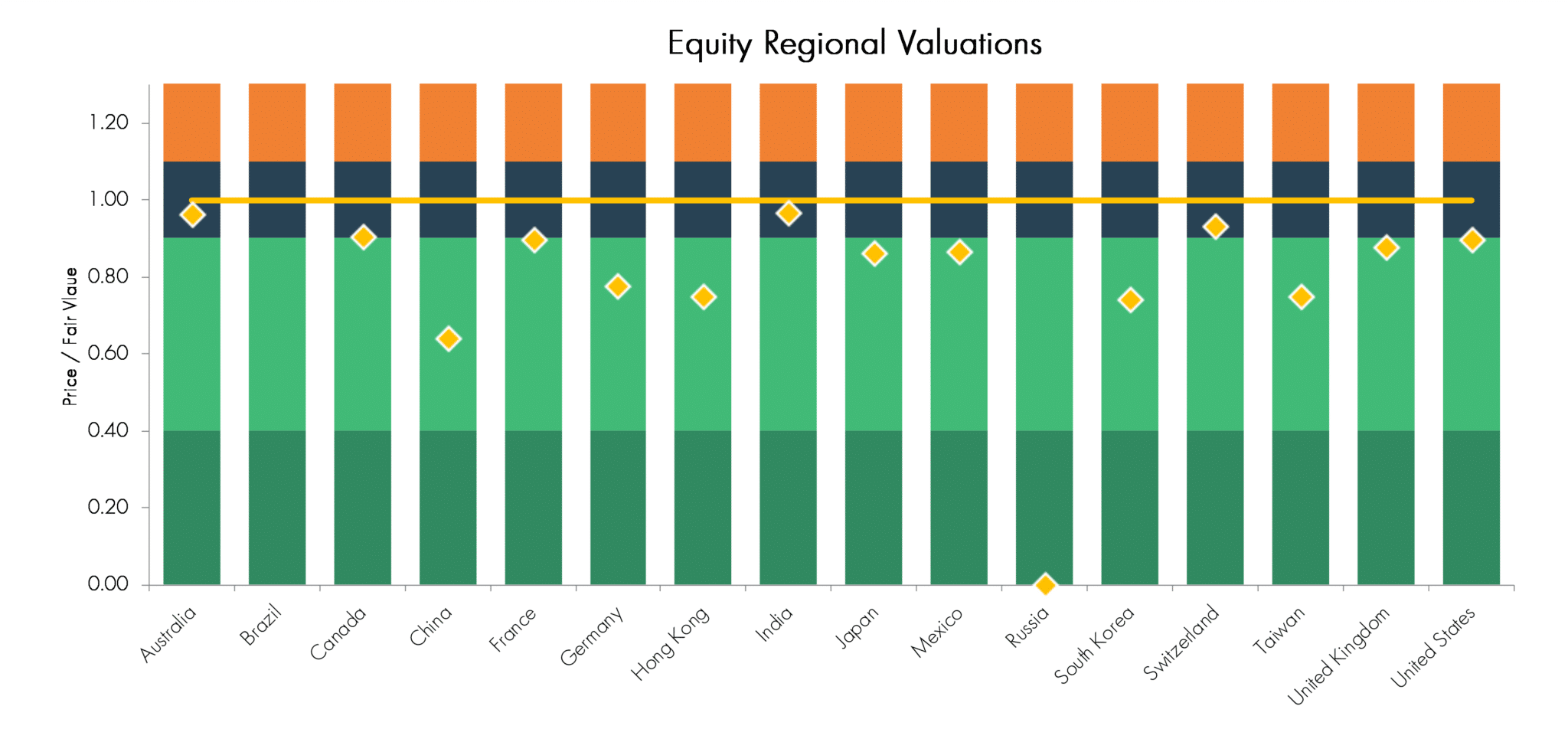

Another component that cannot be ignored is valuations. As of 11/30/2022, the MSCI China NR USD Index was down 45.9% from its last peak in January of 2021. The pain is somewhat masked by strong November performance, since as of 10/31/2022 the index was down 58.3%. As we noted earlier, using the longer history of the Hang Seng Index, we can see that drawdowns of this magnitude are nothing new. Strictly from a quantitative perspective, it hardly seems like a good time to abandon China.

Source: Morningstar; Relative valuations based on Morningstar price-to-fair value estimates; as of 11/30/2022; see important disclosures at the end of this article.

Allocation Conclusions

Modern portfolio theory is built on the principle of maximizing returns with an acceptable level of risk. We currently believe that there is an investment case for Chinese equities, but we do acknowledge the elevated risk, from both an investment perspective and emotional perspective for U.S. based clients. Our historical approach has been to mitigate these risks from both the bottom-up and top-down. This includes using active managers who can diversify emerging markets exposure across countries and who select stocks based on their individual investment merits rather than simply buying the index or beta. We also seek to mitigate this risk by sizing our emerging markets exposure appropriately for a given risk tolerance.

At this time, we have concluded that no change to our emerging market allocation is necessarily required, and in a broadly diversified portfolio, an optimal asset allocation will typically include exposure to Chinese equities.

Conclusion

It is rather difficult to summarize the second largest economy in a few sentences, especially when said economy is run under fundamentally different values from our own. In the information age, it is easy to find a story or data point that “clearly” supports an argument for or against an investment in China. As investors, it is important to understand the nuances while not missing the big picture. A deep dive into the nuance of China reveals a very complex country with a very different historical perspective from the United States; this complexity creates opportunity. At a high level, China is a state-controlled country, run by leaders who are unafraid to move quickly and sometimes brutally to eliminate opposition in the name of a greater good; strict state control creates risk. In short, with opportunity, comes risk.

As November illustrated, timing cycles can be very difficult, which is why, as long-term investors, we maintain strategic allocations that don’t simply change because a near-term outlook is cloudy or because recent performance is poor. We continue to believe in diversification benefits, while recognizing that sometimes these diversification benefits can take decades to play out. After re-examining the investment thesis for China, we conclude that the investment thesis from 20 years ago has somewhat changed, but was likely flawed from the start. At this time, we do not believe the investment thesis has so deteriorated that we need to make a change to our recommended allocations, but no investment decision is made in perpetuity, and we will continue to monitor it closely

Disclosures

© 2022 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise

DEFINITIONS

The S&P 500 Index is a free-float capitalization-weighted index of the prices of approximately 500 large-cap common stocks actively traded in the United States.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies.

The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets. As of May 2022, it covers more than 2,933 constituents across 11 sectors and approximately 85% of the free float-adjusted market capitalization in each market. The index is built using MSCI’s Global Investable Market Index (GIMI) methodology, which is designed to take into account variations reflecting conditions across regions, market cap sizes, sectors, style segments and combinations.

The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 717 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization.

The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong. The components of the index are divided into four subindices: Commerce and Industry, Finance, Utilities, and Properties. The index was developed with a base level of 100 as of July 31, 1964.

[1] https://monetastl.com/blog/revisiting-the-emerging-markets-allocation/

[2] https://www.nytimes.com/2000/03/09/world/clinton-s-words-on-china-trade-is-the-smart-thing.html

[3] https://www.goldmansachs.com/insights/archive/building-better.html

[4] Bloomberg as of 11/7/2022; returns calculated monthly from 11/30/2007 to 2/28/2009; see important disclosures at the end of this article.

[5] https://www.economist.com/newsletters/drum-tower/preview#!

[6] For a historical perspective on Xi Jinping, we would suggest listening to an eight-part podcast series by the Economist, titled “The Prince.”

[7] https://www.chinafile.com/document-9-chinafile-translation

[8] https://www.reuters.com/article/china-regulation-ecommerce/china-publishes-draft-competition-rules-for-online-platforms-idUSL1N2HW06M

[9] https://www.cnn.com/2021/11/22/tech/alibaba-tencent-fines-intl-hnk/index.html

[10] https://www.ft.com/content/e9e8c879-5536-4fbc-8ec2-f2a274b823b4

[11] https://hbr.org/2021/05/what-the-west-gets-wrong-about-china

[12] These testimonies have been collaborated from conversations with numerous asset managers whose portfolio managers and analysts (including Chinese and non-Chinese citizens) have spent a significant amount of time in mainland China.

[13] See footnote 9

[14] https://www.reuters.com/world/china/chinas-tal-education-expects-hit-new-private-tutoring-rules-2021-07-25/

[15] https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=CN

[16] https://www.cnn.com/2022/11/16/asia/g20-summit-day-2-russia-intl-hnk/index.html

[17] https://www.confluenceinvestment.com/weekly-geopolitical-report-november-7-2022/