Tax Strategies

-

Erin Hadary MBA, CFP®, CAP® | Partner Real estate can be an excellent investment opportunity for those who want to diversify their portfolio. But capital gains taxes can eat into your proceeds when you sell…

-

By Brighton Samet, Moneta Tax Planning Consultant This is the time of year that you should be receiving copies of all your necessary tax documents. Besides the normal W-2s and 1099s, this year many taxpayers…

-

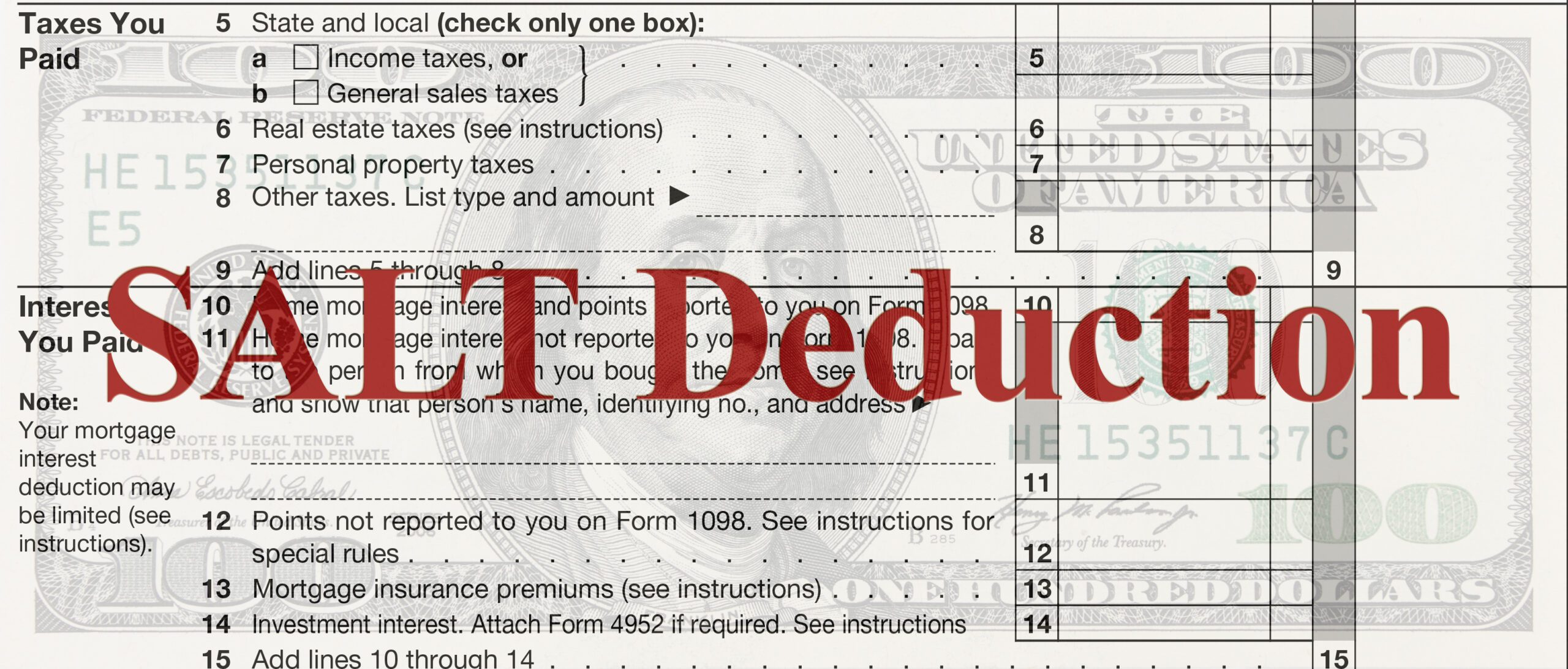

Starting in 2018, the Tax Cuts & Jobs Act limited the State and Local Tax (SALT) deduction on individual taxpayers’ Schedule A – Itemized Deductions to a maximum amount of $10,000. Before 2018, individuals could deduct…

-

By Lauren Hunt, Moneta Advisor With year-end quickly approaching, taxpayers still have a few months left to plan ahead with strategies that could provide meaningful tax savings. Increase your 401(k) contributions For the 2021 tax…

-

Many estate plans need to be adjusted after the government made major changes to how retirement plans are accessed, taxed and distributed with the “Setting Every Community Up for Retirement Enhancement Act” (SECURE Act). This…