Starting in 2018, the Tax Cuts & Jobs Act limited the State and Local Tax (SALT) deduction on individual taxpayers’ Schedule A – Itemized Deductions to a maximum amount of $10,000. Before 2018, individuals could deduct taxes paid for all state withholding, city taxes, state estimated tax payments, real estate taxes, personal property taxes, or the like.

The new $10,000 SALT limitation affected a large percentage of high-earning taxpayers, causing many to now take the standard deduction versus itemizing their deductions on Schedule A. Individuals in highly taxed states were the most impacted. For example, an individual earning $1,000,000 and taxed in California at the highest rate of 12.3% could lose over $100,000 of a state income tax deduction – a big difference from an individual residing in a no income tax state like Florida or Texas.

Since it was enacted, several states with a personal income tax have been looking for a workaround to the SALT limitation. This limitation is where the state Pass-Through Entity (PTE) tax comes into play. Typically, Pass-Through Entities, such as Partnerships or S Corporations, push out all their income to the individual shareholders and any taxes due are paid on shareholders’ personal tax returns. The PTE tax concept is where a Pass-Through Entity pays the income tax allocable to shareholders at the company level resulting in net income that is net of state tax. This outcome is a net federal taxable income number allocated to shareholders that is more comparable to prior law.

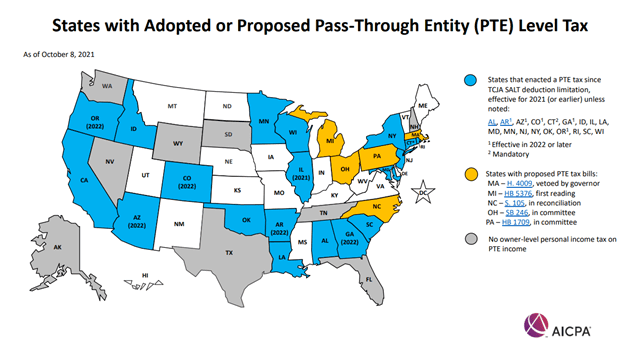

Initially, only a handful of states enacted some form of a PTE workaround. Once the IRS and Treasury gave it the green light in a notice issued in November of 2020, additional states have been aggressively passing PTE workarounds of their own.

Please see here for the map source and updates.

While the upside is that taxpayers can deduct their state taxes on their allocable portion of pass-through income at the Federal level, several factors should be considered. One downside is that the rules for each state can be vastly different. Each state has its own rules on what entities qualify, how taxpayers make the election, how the taxes are deducted, etc.

Also, in addition to the amount of work necessary to calculate each state’s PTE taxes for those entities with shareholders in multiple states, there is no consistency among all states on how to claim the PTE benefit. Some states exclude from income the amount of PTE tax paid, and other states provide a credit. There is also the chance that some nonresident owners may be denied any type of tax benefit on their resident state tax return. Therefore, it is critical that pass-through entities with shareholders in multiple states understand if their resident state will recognize either the income exclusion or credit. Additionally, the PTE tax isn’t applicable for W-2 income, so many high W-2 earners aren’t getting their state taxes deducted.

Congress is still discussing the possibility of updating or removing the $10,000 SALT cap, but the House did not include any change in its most recent proposal.

Many representatives from high-income states, which lean Democratic, have mentioned they won’t support tax reform that doesn’t include a repeal of the SALT Cap. This possibility is important to note since the Democratic Party has a razor-thin majority in the House and a split Senate and would need all (or almost all) of the Democratic votes to pass the tax reform. However, with the passing of the PTE tax in many of these states, it’s unclear if any of these representatives have changed their minds, or what provisions will make it into the final legislation at this point.

This is the time for year-end planning. There are many proposals for tax reform that require action now. Talk to one of our Advisors today.

© 2021 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified; trademarks and copyrights of materials linked herein are the property of their respective owners. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise.