Aoifinn Devitt – Chief Investment Officer

Markets have digested a volley of information in the past week. This ranged from a surprising – and still not fully resolved – Mid-term Election result, to better-than-expected inflation data, to mixed messaging from Fed officials over the weekend about the future pace of monetary policy.

To this was then added the fall from grace of FTX, the crypto-exchange which had been positioned as a mainstream way to access crypto as well as a solid “picks and shovels” crypto-infrastructure trade. The intriguing, and unlikely, villain (Sam Bankman-Fried) at the center, as well as the known names in his orbit (Larry David and Tom Brady among others), made for a gripping tale of “how the mighty have fallen”. When the drama fades, though, it is clear that the repercussions of this incident will likely undermine confidence in the entire digital asset space and could have contagion beyond it.

Last Friday saw bond markets closed for Veteran’s Day, and it is timely, as year-end nears, to take stock of where we were 12 months ago. Then, the markets were only starting to fray at the edges, the interest rate raising cycle had not yet begun, markets were wrestling with the spread of the Omicron Covid variant, and Holiday parties were in jeopardy. The debate still raged as to whether inflation was transitory or had sticky elements, and Russia had not yet invaded Ukraine. Supply chain constraints were in place due to Covid, but we had not seen the massive interruption of commodity and energy prices that the Russian invasion precipitated. It is remarkable how far markets have come, and how much has been digested – and normalized – in terms of market-moving news flow since then.

As we look to year-end, it is clear that the tolerance for surprise is very low in markets. That might explain why the reaction to the election results (signifying no mass rejection of current policy and no desire for upheaval) was relatively sanguine. Markets responded well to news of a thawing of diplomatic relations between China and the US as well as with Europe, evidenced by the meeting in Bali of Presidents Xi and Biden and evidence of a joint commitment to avoid another Cold War style relapse into tensions. Today’s news of an escalation of Russia missile strikes in Ukraine were a wake-up call for those for whom that conflict had receded into background noise, and markets, somewhat predictably, rejected risk as a reaction to that surprise.

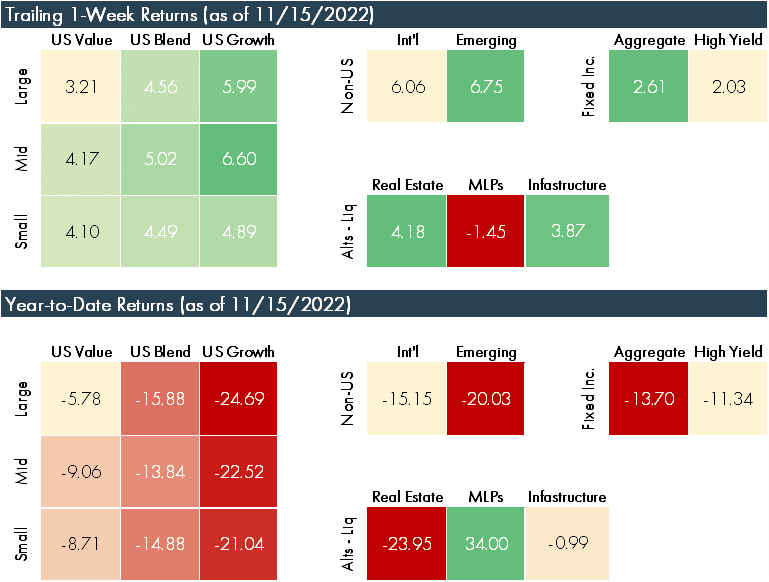

On the inflation front, it is now safe to say “the jury is out”. Early indications of it moderating (inflation rose at an annual 7.7% rate in October, down from 8.2% in September and 0.4% on a month-on-month basis) were met with a surge in US indices, which saw their biggest daily gains since the Spring of 2020 (the NASDAQ rose 7.4%, the S&P 500 was up 5.5% and the Dow added 3.7%). Similar moves accompanied positive trends in Chinese economic openness and willingness to relax some Covid restrictions, especially with respect to travel. The Fed, of course, cautioned about markets getting too far ahead of themselves in expecting a pivot or a deceleration of Fed policy, but markets are clearly firmly pointed in one direction at this stage. That direction is Hope, however fragile.

© 2022 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.