Benjamin Trujillo J.D., LL.M – Partner

Planning your legacy? Understanding the various tax exemptions available, including the gift tax, estate tax, and generation-skipping transfer (GST) tax, is crucial. These exemptions allow you to pass on wealth to future generations with reduced tax burdens. However, the current exemptions are set to expire at the end of 2025. Here’s a comprehensive guide to help you navigate these exemptions before they sunset.

Part 1: The Lifetime Gift Tax Exemption

What is the Lifetime Gift Exemption?

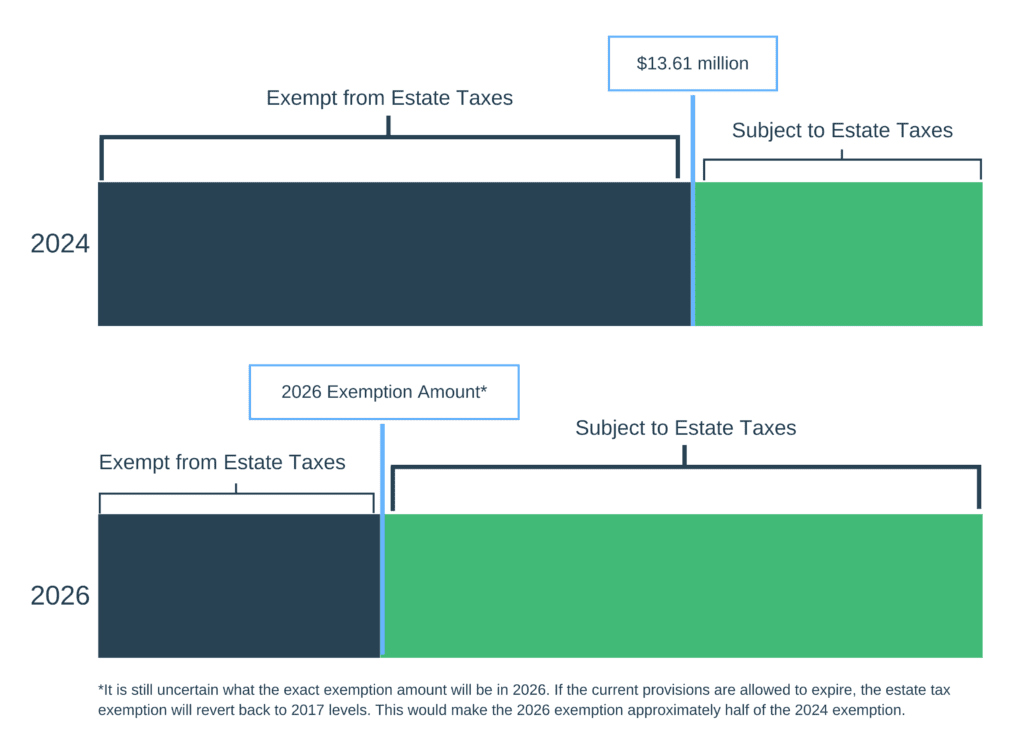

The lifetime gift exemption allows you to gift up to $13.61 million (for 2024) throughout your life without having to pay gift tax on it. For married couples, each spouse gets the $13.61 million exemption, meaning a combined total of $27.22 million before any gift tax applies. This exemption is scheduled to sunset at the end of 2025, which would significantly lower the exemption amount.

Figure 1: Tax Exemption Amount Changes 2024 vs. 2026

Note: The data for Figure 1 is from Fidelity (https://www.fidelity.com/learning-center/wealth-management-insights/TCJA-sunset-strategies)

How Does This Work with Annual Exclusion Limits?

In addition to the lifetime gift exemption, there’s an annual gift exclusion limit of $18,000 per recipient for 2024. Any gifts exceeding this annual limit will reduce your lifetime gift/estate tax exemption. This strategy allows you to make significant tax-free gifts annually without affecting your overall exemption limit.

How Can You Use the Lifetime Gift Exemption?

Utilizing the lifetime gift exemption can be an effective estate planning strategy. By gifting assets during your lifetime, you can reduce the size of your taxable estate, thereby minimizing the estate tax burden. For example, you can gift assets to family members or set up trusts to manage and distribute these gifts effectively, ensuring that your wealth is transferred according to your wishes and protected from potential creditors.

Part 2: The Estate Tax Exemption

What is the Estate Tax Exemption?

The federal estate tax applies to estates worth more than $13.61 million (for 2024). Each spouse is allowed the $13.61 million exemption, so a married couple can effectively exempt $27.22 million from estate taxes. This exemption is tied to the lifetime gift exemption, meaning any lifetime gifts that exceed the annual exclusion limits will reduce the estate tax exemption available at death.

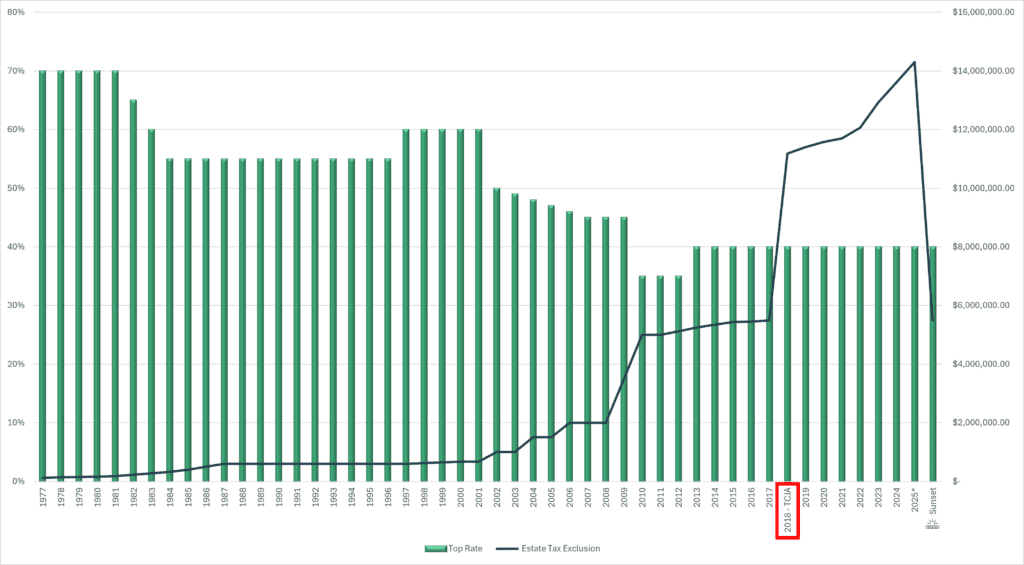

Figure 2: Estate Tax Exemption Over Time

Note: Data for Figure 2 is from Evans Estate Law Resources (https://resources.evans-legal.com/?p=3627)

Implications of the Estate Tax Exemption

The estate tax exemption is crucial for high-net-worth individuals. By planning effectively, you can utilize this exemption to pass on more wealth to your heirs. However, this exemption is also set to sunset at the end of 2025, reducing the exemption amount significantly. Planning now can help mitigate the potential increase in estate taxes when the exemption amount decreases.

How Can You Use the Estate Tax Exemption?

To maximize the benefits of the estate tax exemption, consider strategies such as setting up trusts, making charitable donations, and utilizing the lifetime gift exemption. These methods can help reduce the size of your taxable estate and ensure that more of your wealth is passed on to your beneficiaries.

Part 3: The Generation-Skipping Transfer (GST) Tax Exemption

What is the GST Tax Exemption?

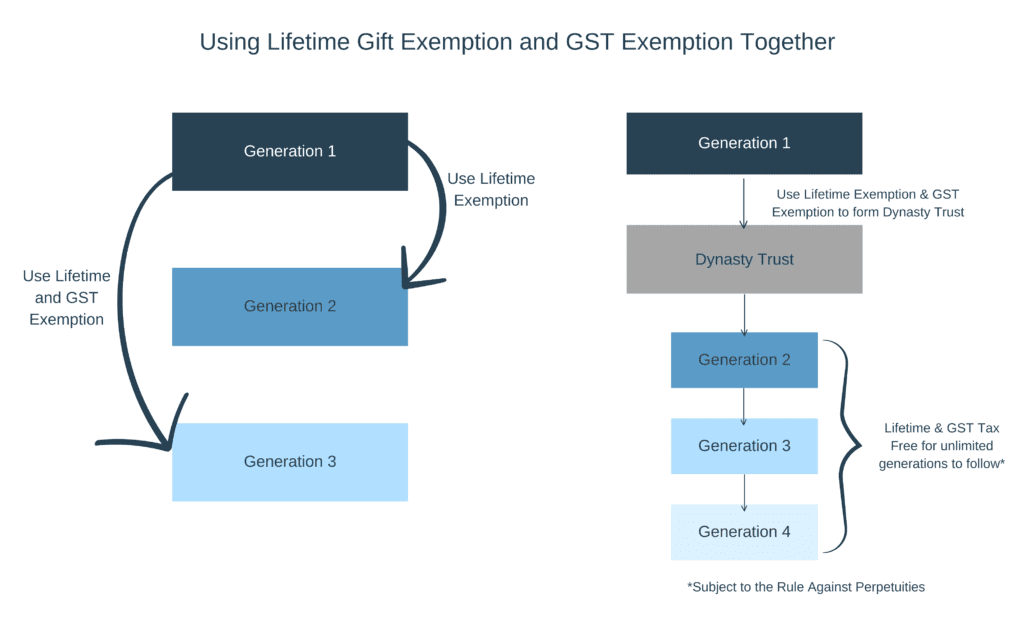

The GST tax applies to assets you transfer by gift or inheritance to someone two or more generations below you, such as grandchildren or great-grandchildren. Without proper planning, these transfers could be subject to a hefty tax rate of 40%, potentially in combination with the gift and estate tax, resulting in a total tax burden of up to 80%.

The GST tax exemption acts as a shield, allowing you to transfer a specific amount of wealth to skip generations without incurring this tax. In 2024, the GST exemption amount is $13.61 million per person (and $27.22 million for married couples).

How Can You Use the GST Tax Exemption?

Using the GST exemption effectively can help you provide for your grandchildren’s education or future home purchases without worrying about the GST tax. You can set up trusts that benefit your children and grandchildren, controlling how and when they receive the assets. This approach not only utilizes the GST exemption but also the gift and estate tax exemptions, potentially removing these assets from the transfer tax system permanently.

Figure 3: Using Lifetime Gift Exemption and GST Exemption Together

Note: Figure 3 created by Elizabeth Sheehan, J.D.

Part 4: What to Do Before the Exemptions Expire?

With the current high GST tax exemption and lifetime gifting exemption scheduled to return to pre-2017 levels (around $7 million) at the end of 2025, it’s crucial to act now. Here are steps you can take:

- Review Your Estate Plan: Consult with a legal, tax, or financial advisor to ensure your current plan utilizes the GST exemption effectively. They can help determine if adjustments are needed before the end of 2025.

- Consider Gifting Strategies: If you have a large estate and want to take advantage of the current high exemption, discuss available gifting strategies with your advisor. The annual exclusion of $18,000 per recipient allows for certain tax-free gifts that don’t count against the GST exemption.

- Prepare for Potential Changes: While the future of the GST tax exemption is uncertain, it’s prudent to plan for a lower exemption amount.

Don’t let this valuable opportunity slip away! If you have questions about the GST tax exemption, lifetime gift tax exemption, or estate tax exemption, or if you want to discuss how they can benefit your estate plan, we can help you navigate the complexities of the tax code and develop a personalized strategy for passing on your legacy effectively. Consulting with a qualified advisor is essential for personalized guidance and maximizing the benefits of these tax advantages.

Contact CWJ at: cwj@monetagroup.com

Figure 1: Fidelity – https://www.fidelity.com/learning-center/wealth-management-insights/TCJA-sunset-strategies

Figure 2: Evans Estate Law Resources https://resources.evans-legal.com/?p=3627

Figure 3: Created by Elizabeth Sheehan, J.D.

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.