Aoifinn Devitt – Chief Investment Officer

It is common to start a new year with a sense of hope and anticipation. This year, however, the scars of a bruising equity and bond market are still felt. 2022 displayed the worst equity performance in US equity markets since 2008, and when the bond market performance was added, it was particularly challenging for traditionally balanced portfolios.

As we start the new year, uncertainty continues to percolate – whether it is surrounding a downturn to come in earnings, or the pervasive evidence of corporate woes. Trading warnings such as that of Party City and Bed Bath & Beyond may have been a long time coming, but the evidence that limping companies are running out of road will be a milestone of sorts. While 2020 and massive disruptions in consumer activity were met with bailouts and subsidies, this, together with the distorted nature of consumer behavior – fewer parties/more home improvement, less demand for services/a boom in online shopping – probably artificially prolonged the life of impaired companies. We expect that these two entities will not be the last to struggle in the months ahead.

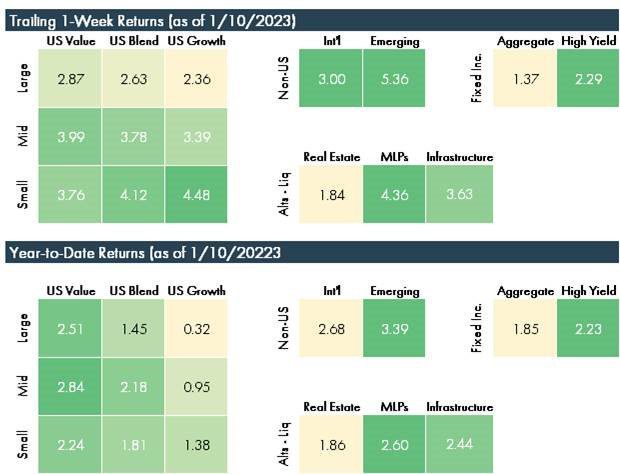

Equity markets turned upwards in the last few days, following a lackluster end to the year, with value outperforming growth and defensive areas such as infrastructure performing well.

This echoes our theme of safety for the first half of 2023 – we believe that given the overhang of company earning outlooks, investors will likely do well to focus on defensive sectors – like healthcare, utilities, consumer staples – and to expect further volatility in higher growth sectors such as technology and consumer discretionary. The dramatic downturn of Tesla may well be a bellwether for a lower confidence level in projections and growth plans.

News of layoffs, most recently from financial services firms such as Goldman Sachs, will further weigh on consumer sentiment, and already it appears that 4Q earnings will be delivered with a strong dose of caution.

The labor market remains strong though. The December employment report showed 223,000 jobs added in non-farm employment and the overall unemployment rate declining to 3.5% – while this is still positive news, the number of jobs added has slowed since the first half of 2022 when the monthly pace of growth averaged 444,000. This less frothy employment picture may give the Fed some comfort that their unprecedented rate of interest rate hikes (seven in 2022) are being felt in terms of deflating consumer demand and combatting inflation. The Fed minutes of December confirmed that the Committee had made “significant progress” in getting policy to a sufficiently restrictive stance but remained committed to “ongoing increases” in the overnight rate as appropriate. They noted their preference to retain “flexibility and optionality”, which is not particularly surprising, but it gives them cover to not take anything (further rate hikes, further deceleration or even a pause) off the table.

Overall, we believe bonds look increasingly attractive at these levels, particularly as inflation starts to become unstuck. We will be watching the coming December inflation number with interest and we expect to see a continuation of the downward trend evinced in recent months.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.