We are a far cry from 2022’s mid-term elections when investors were hit with four-decade high inflation levels, a new war in Europe, and tightening monetary conditions. Flash forward to 2024 and while inflation is lower, and the Fed has paused their rate hiking for the time being, war continues in Europe and a new multi-dimensional conflict has arisen in the Middle East. What has not changed is politics, though instead of mid-term elections to contend with, we have a presidential election. As with each presidential election cycle, investors typically ask how the various outcomes could affect their portfolio and if any changes should be made ahead of the elections. While it may seem comforting to enact a portfolio adjustment to “hedge” out one’s fear of the election outcome, history has shown that investors should remain steady through the elections. In this short piece, we will recap the current election landscape and discuss why investors should remain committed to their long-term asset allocation despite what should be an “entertaining” election season.

Current Election Expectations

As polls stand currently, odds point to a rematch of former Republican President Donald Trump and the Democratic incumbent, Joe Biden. After the caucus in Iowa and New Hampshire primary, Trump is leading by a wide margin versus the remaining Republican candidate, Niki Haley1. Florida Governor, Ron DeSantis, ended his campaign and endorsed Trump after the latter took Iowa handily. Late January’s New Hampshire primary election saw Trump win handily, with 54% of the casted votes vs. Niki Haley’s 43%. The next Republican primary will be in South Carolina on February 24th; a win here by Donald Trump will likely secure his nomination, though the Republican candidate will not be formally decided until the summer when the Republican National Convention kicks off on July 15th. That said, Trump faces potential hurdles arising from legal cases targeting his eligibility to run for President. The U.S. Supreme Court will ultimately hear the arguments for and against the recent ruling by the Colorado Supreme Court, which recently ruled that Trump is ineligible; they cited Section 3 of the 14th Amendment which prohibits those deemed to have “engaged in insurrection” from running for office.

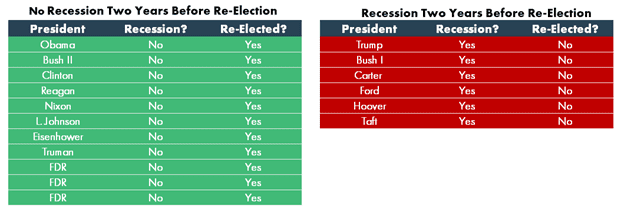

Despite this and other legal troubles for Trump, most national polls assessing the front-runners’ current standing among voters has Trump ahead of Biden currently, though these can vary depending on which poll you look at2. However, a win by Trump would go against recent history, when considering the economic conditions as they stand today. Recessions appear to historically influence the results of presidential re-elections, dating back to William Howard Taft’s presidency in 1909. In the two years when a recession has not preceded an election year, the sitting president has been re-elected in 11 instances. In the two years where a recession has preceded an election year, the sitting president has not been reelected in six instances.

To be sure, there is much consternation in the electorate which could upend the past pattern. Issues such as border security and the growing fiscal debt burden are dividing voters young and old.

Markets During Presidential Election Years

The natural question for investors during any election cycle is: what does it mean for the markets and their portfolio specifically? In a year such as 2024, investors are no less likely to be skittish than in prior years. To help alleviate some fears, we have provided some historical perspective on previous election years. The next few charts and comments will provide this perspective from a variety of angles.

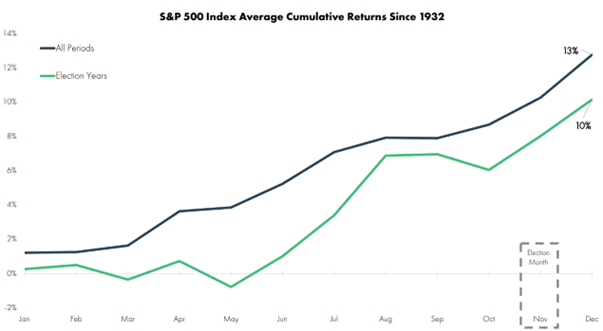

First, since 1932, the first five months of election years have historically had lower average returns and higher volatility for the S&P 500. This is likely driven by the uncertainty around primary elections, as the month of May has averaged -1.49% during election years. After primaries, markets have historically bounced back and returned to an upward trajectory. October has been the notable exception with an average monthly return of -0.86% during election years.

Source: Bloomberg; S&P 500 Index. Returns calculated monthly during presidential election years from 1932 to 2022. Returns displayed are from the S&P 500 Index from 1932-2023; from 1932 to 1957 the index uses return data from the Standards Statistics Company 90-stock index to create a return stream prior to the index’s inception in 1957.

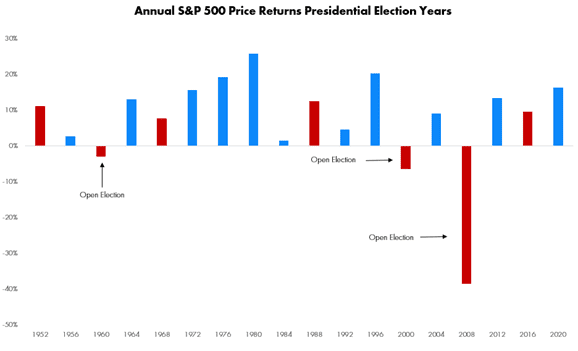

Second, analyzing the yearly performance of the S&P 500 in re-election years since 1952 reveals a consistent trend of positive returns, with no instances of decline observed, except for open (no incumbent running) election years. The last recorded instance of the S&P 500 experiencing a decrease during a re-election year dates back to 1948.

Source: Strategas Macro Institutional Research

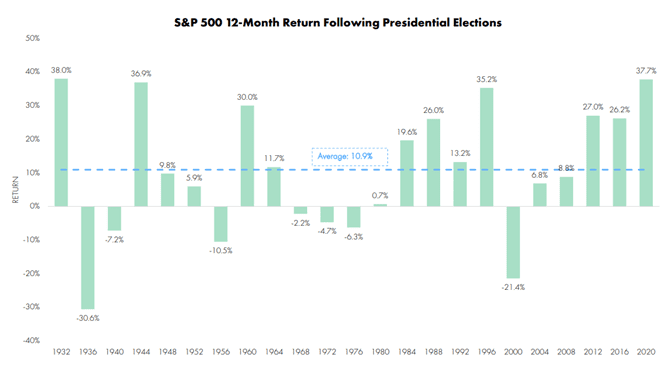

Third, concerns abound leading up to elections as markets evaluate the implications of changing political dynamics. However, as can be seen in the chart below, the equity market has produced a positive return 12-months following the election 70% of the time since 1932.

Source: Bloomberg; S&P 500 Index. Returns calculated daily using November 5th as proxy for starting point of presidential election. Returns displayed are from the S&P 500 Index from 1932-2023; from 1932 to 1957 the index uses return data from the Standards Statistics Company 90-stock index to create a return stream prior to the index’s inception in 1957.

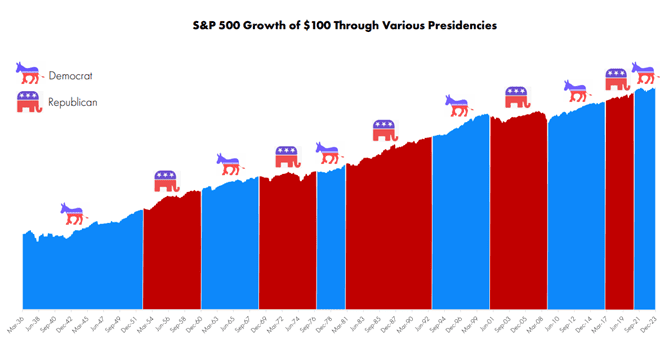

Finally, in the end, markets will always fret about politics, especially around Presidential elections every four years. The uncertainty associated with potential changes to regulatory, tax, economic, or fiscal policy can rightfully create much consternation for individuals and corporations. That said, equity markets have generally maintained an upward multiple of the trajectory through Presidencies, regardless party in power.

Source: Morningstar; S&P 500 PR Index; As of 12/31/2023

To sum up, political leadership of the U.S. government is only one part of the larger equation of factors that can influence the direction of markets. Government leadership change is inevitable, and despite the various party affiliations and subsequent policies of the elected Presidents, markets have marched on through changing policy preferences as elections come and go.

Therefore, investors should continue to use their own investment objectives, risk tolerances, and liquidity needs to dictate their appropriate long-term investment allocation. History shows that allowing the uncertainty of the political winds to induce large shifts in one’s investment objectives, could prove costly.

Sources:

Morningstar

Bloomberg

1 & 2: https://projects.fivethirtyeight.com/polls/president-primary-r/2024/national/

Definitions:

The S&P 500 Index is a free-float capitalization-weighted index of the prices of approximately 500 large-cap common stocks actively traded in the United States.

Disclaimer

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.