Senior Advisor – Grant Edmunds, CFP®

After years of anticipation, the first spot Bitcoin ETFs (Exchange-Traded Funds) have landed in the U.S., marking a landmark moment for the digital asset world. Let’s unpack what this new kid on the block brings to the table.

What is a Spot Bitcoin ETF?

Unlike Bitcoin futures ETFs, which track the price of Bitcoin contracts, spot ETFs hold the actual cryptocurrency itself. Think of it like a basket of Bitcoin shares, traded on stock exchanges like any other ETF. This means investors can gain exposure to Bitcoin’s price movements without directly buying or storing the cryptocurrency themselves.

How Does it Work?

These ETFs buy and hold physical Bitcoin through specialized custodians, ensuring secure storage and transparency. When you buy shares of the ETF, you’re essentially buying a stake in that pool of Bitcoin. You can then trade those shares just like any other stock throughout the day, benefiting from Bitcoin price fluctuations.

The SEC’s Shift: From Skepticism to Approval

The road to these ETFs wasn’t smooth. The SEC historically rejected spot ETF proposals, citing concerns about fraud and manipulation within the Bitcoin market. According to Bloomberg, the lack of a “regulated exchange with adequate monitoring capabilities” was a key sticking point. Additionally, the existence of Bitcoin futures markets further muddied the waters for the commission.

However, things recently shifted. The SEC acknowledged the Chicago Mercantile Exchange’s (CME) comprehensive surveillance system for its Bitcoin futures market, which, despite its “not significant size” compared to spot markets, could assist in detecting fraudulent activity within the context of approved ETFs. In addition, a recent court ruling vacated their previous denials of Bitcoin ETFs and forced the SEC to reconsider the applications.

What Does this Mean for Investors?

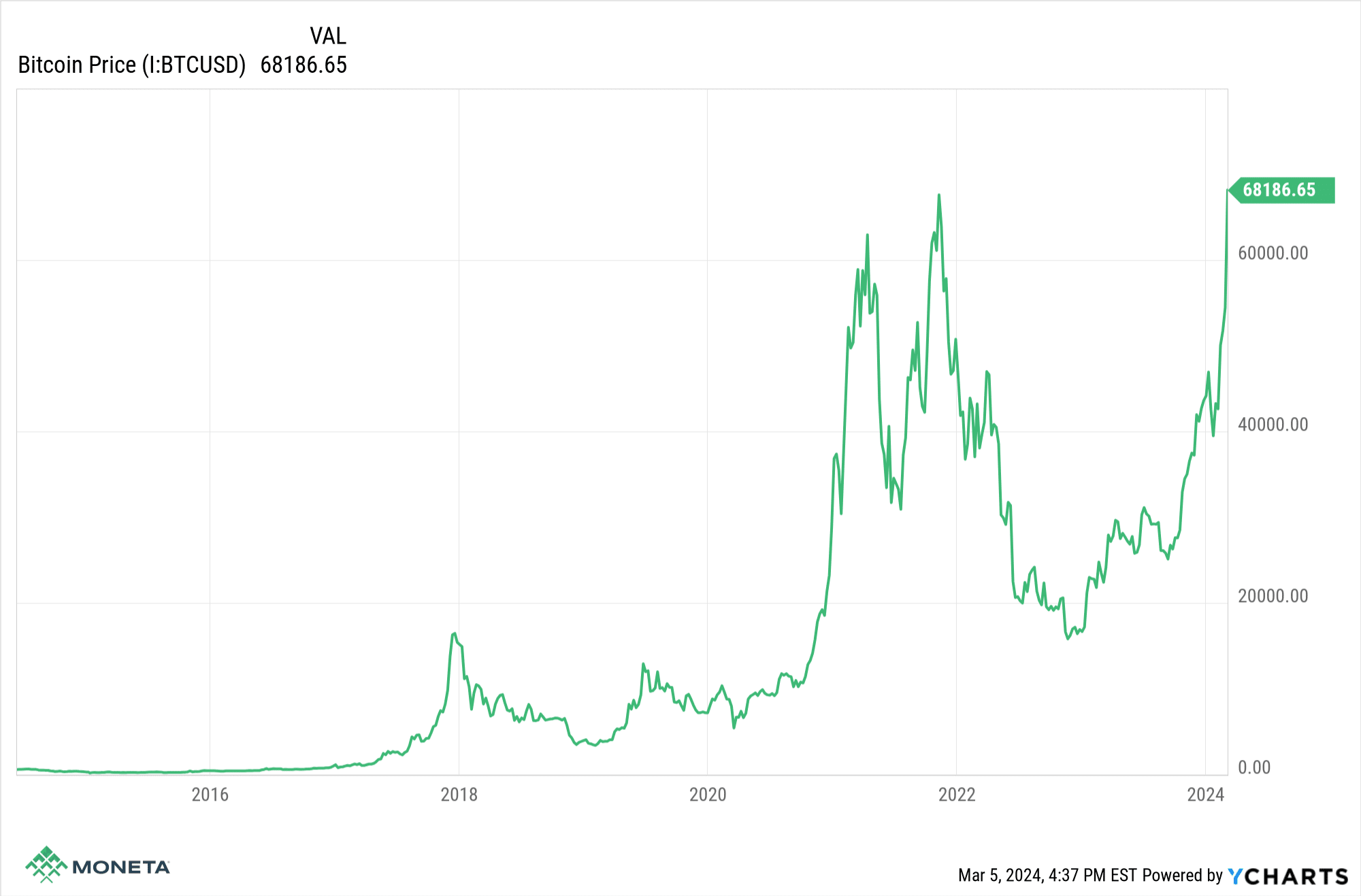

For many traditional investors, this is a game-changer. It adds a layer of accessibility and familiarity to Bitcoin, allowing them to incorporate it into their portfolios through regulated, familiar channels such as Blackrock or Fidelity, at a fraction of the previous cost. This could potentially attract a large chunk of new capital to the cryptocurrency market, boosting liquidity and potentially impacting Bitcoin’s overall price.

Reminder: Proceed with Caution

While approving these ETFs marks a significant step, SEC Chair Gary Gensler’s statement emphasizes a crucial point: this is not an endorsement of Bitcoin itself. He reiterates the agency’s stance on investors needing to beware of the inherent risks associated with Bitcoin and crypto products.

While the excitement is understandable, it’s crucial to remember that Bitcoin remains a speculative asset. Investing in any ETF, including one tied to Bitcoin, carries risks. Do your research, understand your risk tolerance, and never invest more than you can afford to lose.

The Bottom Line:

The launch of spot Bitcoin ETFs is a pivotal moment for both Bitcoin and the broader cryptocurrency market. It opens new avenues for investors, boosts legitimacy, and paves the way for further evolution. However, it’s essential to approach this new frontier with caution and a healthy dose of research.

This post is for informational purposes only and should not be construed as financial advice. Please seek advice from a financial advisor before making any investment decisions.

Contact Grant Edmunds at: gedmunds@monetagroup.com

Contact CWJ at: thecompardoteam@monetagroup.com

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.