History Supports Staying the Course with Your Financial Strategy

How much of an impact do presidential election years have on financial markets? Investors, looking to best position their portfolios, grapple with this question every four years. While the answer may differ between individuals based on political beliefs, historical data provides a far simpler answer. Historically, presential election years have had little impact on financial markets long-term.

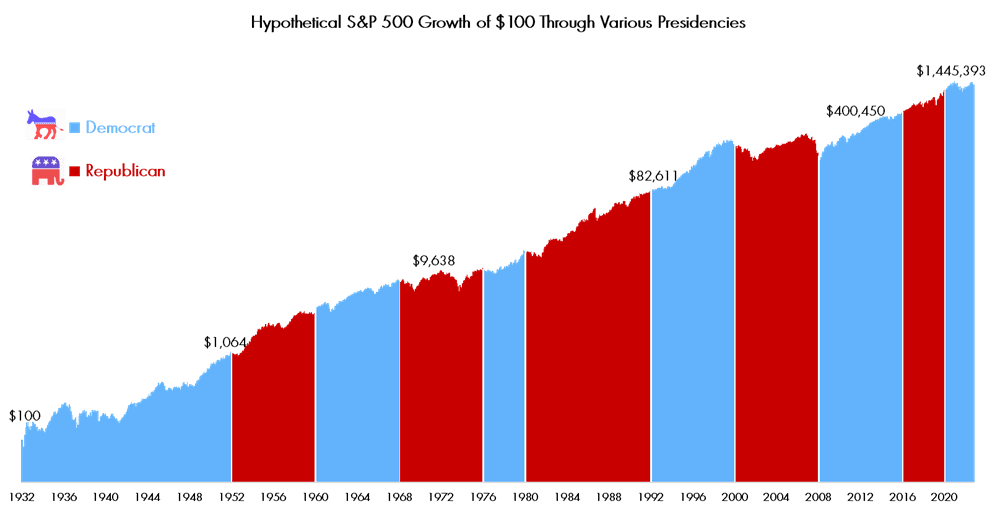

Long-term, equity markets have trended upwards regardless of the reigning political party. As an example, simply investing $100 into the S&P 500 Index, a widely used benchmark tracking 500 of the largest companies in the US, in 1932 and staying invested until 12/31/23 would result in a holding value of $1,445,393. Moreover, there is no consistent pattern of higher or lower returns under Democratic or Republican presidents. In fact, the best and worst 10-year periods for the S&P 500 occurred under both parties.

To be sure, the market is driven by many factors that are beyond the control of any single person or party. These factors include economic growth, corporate earnings, interest rates, inflation, consumer sentiment, geopolitical events, technological innovation, and more. While the president can influence some of these factors through policies and regulations, he or she cannot determine the outcome of all of them. Furthermore, the president must work with Congress and the judiciary, which can limit or modify his or her agenda.

Moneta has long promoted the philosophy of thinking long-term, yet that is far easier said than done. Our portfolio construction fundamentals are based on diversification and staying invested. Even temporary moves away from one’s long-term asset allocation due to geopolitical fears can have a drastic impact on long-term performance.

In conclusion, there will always be ongoing events that draw headlines and raise questions about financial markets. While it can be difficult to tune out the noise created by these events, the impact tends to be short-lived. We continue to believe investors are more likely to achieve their long-term financial goals by adhering to their long-term investment strategy.

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.