Family Office Strategist – Elizabeth Sheehan, J.D.

Every business venture is unique, and so are the individual circumstances of each business owner. Factors such as business structure, family dynamics, anticipated sale timeline, and desired retirement lifestyle all play a pivotal role in shaping the financial journey ahead. Depending on your specific situation, a seasoned financial planner may recommend a range of strategic options to optimize tax efficiency in preparation for a business sale. These tailored approaches can prove particularly advantageous when undertaken well before the actual sale.

Recognizing that proactive planning can significantly influence eventual outcomes, beginning your preparations for a prospective sale sooner rather than later is key. While various tax planning and gifting tactics remain viable until signing a letter of intent, their potential financial gains may be notably amplified when initiated well in advance. It’s worth noting that certain strategies may yield limited benefits if executed in proximity to the company sale, underscoring the importance of timely implementation for optimal results.

Strategic Gifting to Family Members

One prudent step involves embracing the concept of gifting early and consistently to your family members. By leveraging the annual gift tax exclusion, you may be able to effectively shield company stock transfers from gift taxes. This avenue permits annual gifting of assets valued up to $18,000 to numerous recipients, exempt from gift tax or IRS reporting requirements. Further, the lifetime gift and estate tax exemption affords an opportunity to protect gifts surpassing the annual exclusion. This exemption reached an all-time high of $13,610,000 per individual in 2024.

-

- It’s advised to bestow gifts of company stock to the next generation, ideally within a trust structure that offers added benefits. Undertaking these gifts at present valuations holds significance, as it facilitates the transfer of the stock’s current value and its anticipated appreciation over time.

- Engaging a professional valuator to assess the stock’s worth is wise. This valuation should encompass factors such as lack of marketability and control discounts, which can reduce the stock’s value for gifting purposes, thus minimizing the impact on your lifetime exemption.

- An intriguing alternative involves surpassing your federal exemption limit and paying gift tax upfront. While this may deviate from traditional thinking, it essentially permits the appreciation of gifted shares to elude transfer taxes. Moreover, the decision to pay gift tax now is a strategic move, as it’s a more cost-effective choice than confronting estate tax implications down the line. By doing so, the gift tax paid, along with the appreciation, is deducted from the business owner’s overall estate, thereby reducing the assets subject to potential future taxation—potentially at higher rates than the current ones.

Value “Freezing” Techniques for Estate Tax Management

Implementing strategies to “freeze” the company’s value for estate tax purposes can yield substantial benefits:

-

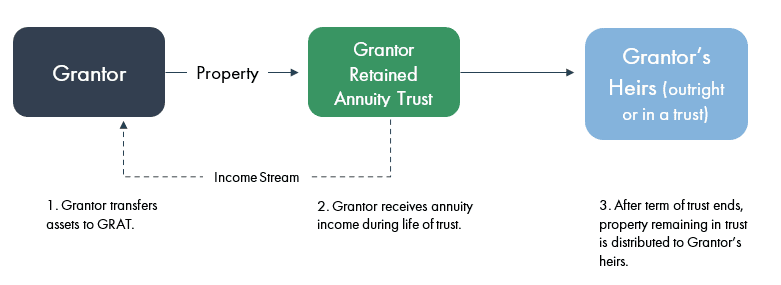

- Grantor Retained Annuity Trusts (GRATs): These trusts entail transferring company stock to the trust while retaining a fixed annuity paid over a specified period. Upon the trust’s termination, any stock appreciation exceeding the IRS Section 7520 interest rate is gifted tax-free to the trust beneficiaries. Throughout the trust’s term, the business owner pays income tax on the stock owned by the trust, effectively channeling tax-free gifts to the beneficiaries.

-

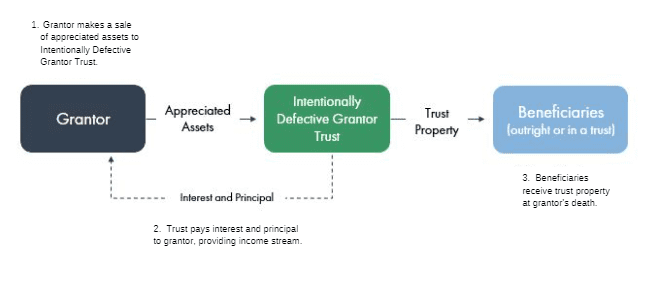

- Sales to Intentionally Defective Grantor Trusts (IDGTs): Through this strategy, business owners transfer company stock to a trust benefiting their family in exchange for a promissory note. Appreciation beyond the federal rate is then transferred to beneficiaries, free from transfer tax obligations. Like GRATs, the business owner covers income tax from the stock owned by the trust, essentially effecting tax-efficient gifts.

-

- Preferred Stock Recapitalizations: Employing this technique involves segregating ownership into “common” and “preferred” stock classes. By gifting a substantial portion of the common stock to heirs, the owner effectively “freezes” the company’s value for future estate tax considerations while redistributing appreciation in common stock to heirs. Remarkably, the owner retains managerial control of the enterprise.

Charitable Giving Strategies

Donating shares of company stock to private foundations, donor-advised funds, charitable trusts, or charitable organizations is another viable avenue. This approach can yield charitable deductions and lessen capital gains taxes upon eventual stock sale. However, meticulous timing is crucial to maximize benefits. If charitable giving is executed in close proximity to a business sale, potential capital gains taxes could still apply to shares held by the charitable entity. Given the complexities arising from business structure, donated share basis, and charitable vehicle type, navigating this path with astute attention is essential. There may also be restrictions imposed on private stock.

Donating shares of company stock to private foundations, donor-advised funds, charitable trusts, or charitable organizations is another viable avenue. This approach can yield charitable deductions and lessen capital gains taxes upon eventual stock sale. However, meticulous timing is crucial to maximize benefits. If charitable giving is executed in close proximity to a business sale, potential capital gains taxes could still apply to shares held by the charitable entity. Given the complexities arising from business structure, donated share basis, and charitable vehicle type, navigating this path with astute attention is essential. There may also be restrictions imposed on private stock.

In conclusion, it is evident that implementing these meticulously crafted strategies can offer the most benefit when done well in advance of putting your business up for sale, often requiring months or even years of preparation. Engaging the services of a skilled financial planner and an estate planning attorney at the outset of this journey is of utmost importance. This proactive approach can offer many benefits, such as maximizing the proceeds from the sale and optimizing tax efficiency. Furthermore, it’s essential to emphasize that these strategies are not limited to business sales alone; they can also play a pivotal role in successfully transitioning your business to the next generation, providing a versatile and valuable tool for business owners.

If you have any questions, please reach out to me at esheehan@monetagroup.com

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.