Tim Side – Research Analyst

Markets were roiled last week following the collapse of Silicon Valley Bank, the 16th largest U.S. bank with more than $200 billion in assets. Depositors went into the weekend with little clarity on what the status of their deposits beyond the $250,000 FDIC limit would be come Monday. The turmoil continued to escalate through the weekend, as regulators closed Signature Bank, another large bank with $110 billion in assets. A brief reprieve was felt Sunday evening, when the FDIC released a joint statement by the Department of the Treasury, Federal Reserve, and FDIC, stating that depositors at Silicon Valley Bank and Signature Bank would have access to all funds on Monday. These actions appear to have stabilized markets for the time being, although volatility and uncertainty have significantly increased.

The situation remains extremely fluid. Attempts to provide updates have become quickly outdated as new information continues to be released. While minute-by-minute updates are best provided by major news outlets, we wanted to provide a quick update and look through the noise to see how this might affect our long-term investment thesis.

Historical Context

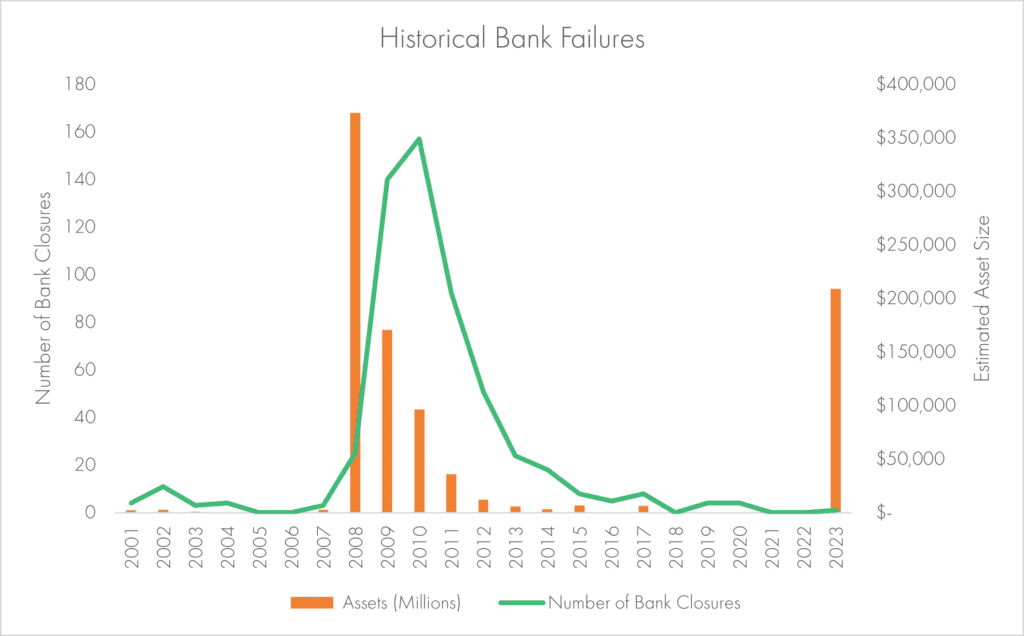

Bank closures are nothing new, although the number and magnitude of closures has certainly fallen post-Global Financial Crisis (GFC):

In most cases, the failed bank’s deposits are assumed by another bank, making depositors whole and helping maintain faith in the U.S. banking system. During the GFC, the government stepped in, taking extraordinary measures to protect “systemically important” institutions. Using lessons learned from the GFC, the Federal Reserve acted quickly and emphatically through the depths of the Covid crisis, and they, in conjunction with the FDIC and Treasury Department, are following the same playbook today: acting quickly and emphatically to stave off broader contagion fears by backstopping major financial institutions.

An important distinction between then and now, is that most banks, especially large national banks, remain well capitalized due to tighter regulations in a post-GFC world. Silicon Valley Bank was in a “unique” situation due to the make up of its depositor base, asset base, and customer base. Critically, 86% of deposits were above FDIC insurance limits whereas most banks are closer to 50%. Combined with poor asset management, which loaded their asset portfolio with long-dated Treasuries whose value fell significantly with higher rates, and a slowdown in business from a concentrated customer base, the stage was well set for a bank run. While other banks, such as Signature Bank and First Republic face similar issues, most major banks are in much better financial condition.

Current Environment

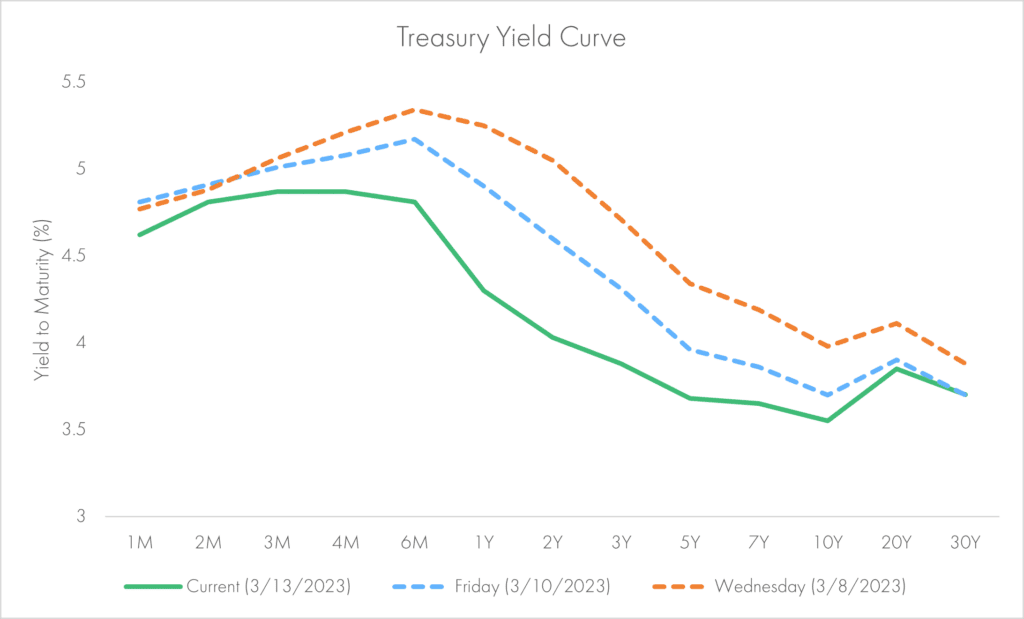

Just last Wednesday, investors were pricing in expectations of higher rates as Fed Chair Jerome Powell delivered a hawkish message to Congress. In his remarks, Powell left the door open for a 50 basis point hike in March and a potential increase in the Fed’s 2023 median target. Markets quickly reacted to his comments, pricing in a total of four to five 25 basis point hikes by July. On Friday, these expectations started shifting, and now markets have priced in just one, 25 basis point hike in March and then a pause until July, when markets expect the Fed to cut rates. These movements help illustrate the rapidly changing environment, and the yield curves below show the speed and magnitude of the moves.

Investment Implications

Despite regulatory efforts made over the last decade to improve the strength of financial institutions, cracks still existed, but were overlooked in an ultra-low-rate environment. Historically, when rates have risen, things tended to break. We don’t always know where or how the next crisis will occur, which is why we believe it is important to maintain a diversified portfolio that can better withstand shocks such as a major bank collapsing.

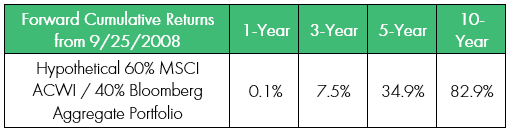

As long-term investors, it is important to look through the short-term noise and volatility. While it is tempting to sell now, timing the market is a notoriously difficult endeavor, as it requires knowing when to get out and when to get back in. On September 25th, 2008, Washington Mutual Bank collapsed, which remains the largest bank failure in history. While the next several years were very painful for equity investors, a hypothetical, globally diversified portfolio of stocks and bonds would have still had positive returns:

While markets continue to fluctuate, and newly released inflation data further complicates the Fed’s potential actions next week, U.S. equity markets appear to have stabilized for the time being as the S&P 500 Index finished Monday just 0.15% lower, which further emphasizes the strategy to stay calm and stick to long-term investment plans. As always, we continue to monitor the situation closely.

DISCLOSURES

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.