“Time is the friend of the wonderful business, the enemy of the mediocre.”

– Warren Buffett, Chairman & CEO Berkshire Hathaway

EXECUTIVE SUMMARY

Private Equity – Private equity deal activity surged in 2024, marking the strongest capital deployment in two years. However, a sluggish exit environment is prolonging holding periods, challenging investors’ ability to commit new capital. As a result, the landscape is increasingly favoring well-established funds with a reputation for successful deals, who continue to attract the majority of capital inflows. Technology and AI remain center stage, with many funds pivoting towards these sectors in response to anticipated long-term growth, particularly in areas such as generative AI (Artificial Intelligence) and cybersecurity, which are forecasted to see significant demand over the next decade.

Venture Capital – The venture capital (VC) market continues to face headwinds. Activity remains subdued, a stark contrast to the boom years of 2021 and 2022. VC investors are increasingly moving away from backing young, unproven startups with minimal business plans and short-term exit strategies. The focus has shifted toward companies with clear growth trajectories, proven leadership, and a path to profitability.

Private Credit remains a robust asset class in 2024, bolstered by stricter banking regulations that favor non-traditional lending. Companies increasingly appreciate the speed, certainty, and flexibility of private credit solutions, leading to more deal flow and broader market participation. Investors continue to have high demand for private credit in portfolios, with the direct lending market projected to exceed $2 trillion by 20271.

Real Estate has been a mixed bag in 2024. Industrial real estate, driven by digitization and eCommerce, continues to see strong demand, especially for logistics and data centers. Multifamily remains resilient despite slowing rent growth, supported by economic and demographic trends, including steep homeownership costs. Commercial office spaces are adjusting to hybrid work models, with top-tier properties in prime locations still sought after, while some other office assets are beginning to feel distress. Retail real estate shows mixed results, but high-end and experiential retail centers are proving resilient, despite the ongoing shift to online retail.

PRIVATE EQUITY

Steady Deal Flow: Deal-making has rebounded, marking the strongest half since 2022, though still trailing pre-pandemic levels.

Valuation Balance: Valuations are becoming more reasonable, narrowing the gap between buyers and sellers and creating a more attractive market for new investments.

Economic and Geopolitical Influences: Ongoing economic uncertainties and geopolitical tensions continue to make investors cautious, which has contributed to the market remaining below its pre-pandemic peak.

Fundraising Challenges and Opportunities: Fundraising remains a hurdle, with the average time to close a private equity fund extending to 18 months2. Despite these challenges, well-established managers continue to attract significant capital. Investors prefer the stability and proven track records these managers offer, leading to a concentration of investments among the top-tier firms. Additionally, there’s a noticeable shift towards more conservative investment strategies, with a focus on revenue growth and margin expansion – key areas that can lead all-weather returns.

What’s Happening Inside Portfolio Companies?

Behind the scenes, PE-backed companies are undergoing significant transformations to adapt to market conditions.

Operational Efficiency Drives: Many portfolio companies are prioritizing operational efficiencies, streamlining processes, and cutting unnecessary costs. This is particularly true in sectors where margins are tight, such as manufacturing and retail. For example, companies are investing in automation to reduce labor costs and increase productivity.

Digital Transformation: Technology is playing a pivotal role in value creation. Companies in PE portfolios are increasingly investing in digital transformation initiatives, such as enhancing their e-commerce platforms, implementing advanced data analytics, or adopting AI-driven tools to optimize supply chains and customer engagement. These initiatives can help improve operational efficiency and may position the companies for long-term growth in a rapidly evolving digital landscape.

Talent Retention and Leadership: Amidst the still competitive market, talent retention has become a critical focus. PE firms are often involved in leadership transitions within their portfolio companies, bringing in experienced executives who can drive growth and execute strategic plans. Moreover, there is a strong emphasis on aligning management incentives with performance, ensuring that leadership teams are motivated to achieve the desired outcomes.

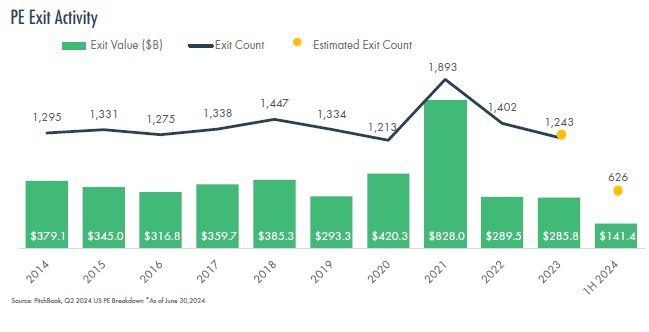

Exit Environment and Future Prospects

While the number of exits remains relatively low, there are promising signs of recovery. Exit values are projected to rise by 17% compared to 20233, driven by:

Innovative Exit Strategies: Techniques such as secondary sales and continuation funds are helping firms navigate the exit landscape more effectively.

Reopening IPO Markets: A resurgence in initial public offerings (IPOs) provides new avenues for exits, especially for late-stage startups.

Increased Corporate Deals: More corporate mergers and acquisitions, along with sponsor-to-sponsor transactions, are creating profitable exit opportunities.

These market developments are expected to boost investor confidence and attract more capital, setting the stage for a more dynamic and robust market in the coming quarters and years.

VENTURE CAPITAL

The venture capital (VC) market continues to face headwinds. Activity remains subdued, a stark contrast to the boom years of 2021 and 2022. VC investors are increasingly moving away from backing young, unproven startups with minimal business plans and short-term exit strategies. The focus has shifted toward companies with clear growth trajectories, proven leadership, and a path to profitability.

Inside VC-Backed Startups: What’s Changing?

Inside many startups, particularly those with venture backing, a new reality is setting in. The days of aggressive expansion with little regard for profitability are fading, as both startups and investors alike have shifted toward more sustainable business models. Here’s what’s happening under the surface:

Path to Profitability is Now Paramount: Startups are being pushed to move faster towards profitability. For many, this means reassessing burn rates, adjusting growth expectations, and cutting non-core initiatives. This shift is particularly pronounced in sectors like fintech and consumer tech, where early exuberance is being tempered by the need for solid financials.

Operational Discipline: Companies that previously relied on consistent fundraising rounds are now operating in a more disciplined manner. Founders and leadership teams are emphasizing cost controls and operational efficiency. Startups are no longer given free rein to burn cash at unsustainable rates, and runway extension strategies, such as slowing down hiring and freezing large-scale marketing spends, are becoming more common.

Leadership Evolution: The importance of experienced leadership has never been greater. Investors are no longer just looking at the potential of a startup’s product or market; they want to see seasoned executives who have navigated economic challenges before. For example, startups are increasingly appointing CFOs with public company experience, with an eye toward preparing for future IPOs or other exit strategies.

AI and Tech: The Golden Child of VC Funding: Despite challenges in the broader market, specific sectors such as artificial intelligence (AI) remain resilient. AI is attracting significant investment due to its potential to revolutionize industries ranging from healthcare to logistics. The surge of interest in generative AI, robotics, and machine learning startups highlights a clear shift toward tech-driven innovation as the key driver of VC funding. Startups in these spaces are rapidly expanding their technological capabilities to keep pace with market demand.

REAL ESTATE

The private real estate market remains a mixed bag, with varying performances across sectors. Despite some challenges, the sector continues to adapt, with key areas presenting strong opportunities as we head into 2024.

Industrial: Demand for logistics and warehouse spaces has remained robust, driven by the ongoing digitization of the economy. Emerging technologies like AI, eCommerce, streaming, and 5G are accelerating the need for data centers, though supply constraints could create lucrative investment opportunities.

Multi-Family: While rent growth in 2024 has slowed, largely due to a surge in new supply, multifamily remains a favored asset class. Long-term, economic strength and demographic trends – particularly migration patterns and the steep cost of home ownership – are expected to sustain demand, making this sector a resilient option for investors.

Commercial/Office: The office market continues to face challenges, with hybrid work models reshaping demand. However, top-tier spaces in prime locations are still sought after, and distressed properties are beginning to attract attention through repositioning efforts. Key macro themes—such as technology, globalization, and affordability—are expected to redefine the sector’s long-term growth prospects.

Retail: Retail real estate has experienced mixed results in 2024. High-end retail and experiential shopping centers have shown surprising resilience, supported by the scarcity of new construction. Looking ahead, these factors may drive an improvement in fundamentals as the sector rebalances.

PRIVATE CREDIT

Private Credit has continued its upward trajectory, with activity remaining robust. Private lenders remain attractive to borrowers in many situations, thanks to stricter regulations and the speed and reliability of execution which private lenders offer.

Market Size: The private lending market for middle-market companies is currently valued at approximately $1.5 trillion and is projected to surpass $2 trillion by 2027, according to Preqin.

Resilience During Volatility: When compared to public markets, private credit is less vulnerable to the short-term volatility and price fluctuations caused by interest rate hikes or macroeconomic uncertainties. Investors who gain exposure to floating-rate loans benefit from rising rates, providing a hedge against inflationary pressures.

Tailored Solutions for Borrowers: Private lenders often offer bespoke lending solutions that are more tailored to the needs of borrowers. This flexibility can lead to more frequent deal activity, as businesses opt for financing structures that fit their unique circumstances, particularly in times of uncertainty or growth.

Contributors

Sourcing Information

- Bass, Matthew. “Private Credit Outlook: The Heat is On”. July 12, 2024.

- Lynn, Alex. Private Equity International. “Private equity fundraising sees modest rebound in H1 2024 as timelines soar – updated. July 23,2024.

- PitchBook, Q2 2024 US PE Breakdown *As of June 30,2024

Important Disclosures and Information

© 2024 The Finerty Team

All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Exposure to an asset class represented by an index may be available through investable instruments based on that index. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change.

Investment Advisory services offered through Moneta Group Investment Advisors LLC, an SEC-registered investment adviser. Registration does not imply any skill or training.