Aoifinn Devitt – Chief Investment Officer

Markets meandered somewhat aimlessly over the past week with the now familiar mix of resilient “hard” economic data and waning consumer sentiment. And it is clear that Chairman Powell is not liking what he is seeing. This week, he continued what has almost become an “apology tour” for the last 25 bps rate rise – and suggested that the Fed might well look to increase rates beyond what markets currently expect. In his testimony before the Senate Banking Committee, he forecast that inflation’s long road to 2% would be a bumpy one with the destination far from sight, and this poured a dose of cold water on markets.

The evidence of inflation is, as ever this year, frustratingly bumpy itself. The purchasing managers index is showing renewed price support, and this, combined with a robust consumer suggests that inflation could remain elevated for some time. On the other hand, forecasts are for commodity prices to weaken and the fact that the mild winter is now coming to an end suggests that that component may at least be no longer as relevant. Supply chain problems are as good as resolved too, suggesting that any dislocations that these created will be “transitory”, and last week we noted the slackening of the cost of “shelter”.

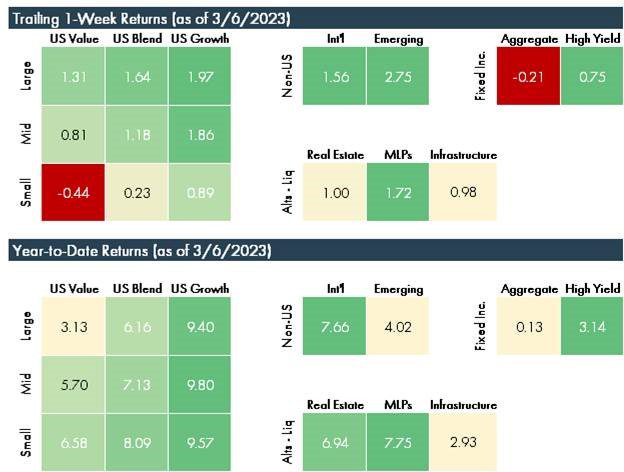

Recent market performance was dented by the reaction to Chairman Powell’s testimony, but overall, the last week has been somewhat positive:

The verdict is in on 4Q earnings. In the S&P 500, they declined on average 4.9% over the same quarter last year, marking the first quarterly decline since the third quarter of 2020. While large tech names attracted some attention for the sizeable drops in earnings they turned in, energy bucked the trend showing earnings growth of over 50% in the 4th quarter – leading all 11 sectors.

Although news of layoffs continue to pepper the financial press – the latest being from Meta – there is persistent evidence that corporations themselves continue to be in rude health. The spread of US investment grade credit is at record low relative to 6-month T bills, suggesting that default risk is perceived as low and that credit investors are secure in assessing corporates creditworthiness. This would square with the backdrop that differentiates the current economic backdrop from the Great Financial Crisis. Corporates simply are not as over-extended as they were then – leverage levels are lower and overall risk-taking has been far more subdued than in the run-up to 2008. This might explain why defaults just have not materialized in the current economic climate. Of course, ever-higher interest rates might start to choke off sources of lending, although maybe corporate treasurers have learned to term out their debt, have locked it in at lower rates, and have learned to work with their lending partners. As the recent spate of press releases show, companies (particularly retailers) are learning that it is prudent to be prudent – to be cautious and manage expectations down. So, can the investor believe everything they hear? Or do they need to read between the lines? It is likely that we will have much practice in doing this in the murky months ahead. We will embrace the challenge.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.