Aoifinn Devitt – Chief Investment Officer

As we write today, more earnings numbers are rolling in and, as so often this year, the word on the street from “Main Street” is somewhat incoherent. While some consumer staples stocks started to focus on lower-priced products (e.g. Coke), others saw supply chains loosen and robust demand (e.g. GM customer demand for pick-ups). In broad terms, companies continue to beat estimates, but fewer companies are doing so, and those that do are on average doing it by less – but this only indicates that the telegraphing of what is to come, and the managing of expectations is getting better. As we noted last week, the markets have clearly reached their fill of “surprises” and when it comes to company earnings – there would appear to be no excuse to have them.

Home prices are slowing, according to the Case-Schiller National Home Price Index which fell 1.1% in August after a decline of 0.3% in July, suggesting a direct flow through of the Fed’s tightening agenda. This has, in turn, led to a fall in the 10-year yield (to 4.08% from 4.23%), but notably, not the 2-year, which still sits at around 4.4% as we write, showing a sharply inverted shape.

Inverted yield curves traditionally point to a slow-down in the economy, but this time, when viewed against a backdrop of inflation expectations, the position is a bit more complex. It is clear that investors expect inflation to stay high in the short term (say, 2-year, timeframe), but to moderate after that. It is natural to demand more for shorter-term paper over this timeframe, when inflation is as good as baked in at current levels, while in the longer term, it is generally expected to fall. So, is it necessarily a recession that this inverted yield curve is predicting – or a reversion to the mean in terms of inflation? The reason I ask? Wouldn’t current conditions suggest the recession is already here?

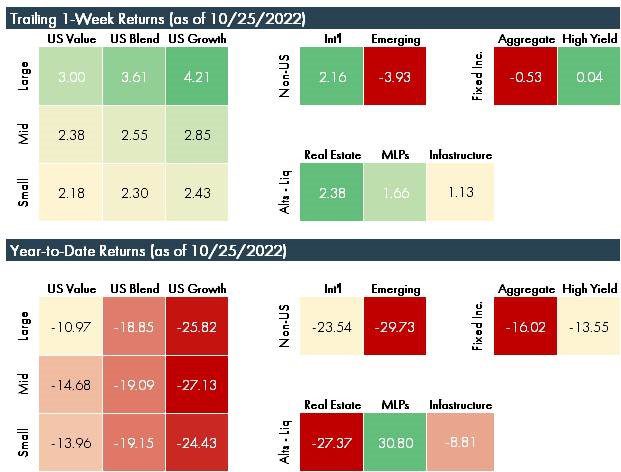

As the chart below shows, though, markets have been somewhat more positive in the last week, reflecting the lower bond yields, which tend to favor indices such as the Nasdaq, and the more positive corporate earnings trend.

On the global stage, a new Prime Minister, Rishi Sunak, did not sugarcoat the “profound economic crisis” facing the country, while in Italy, new Prime Minister Georgia Meloni rejected “fascism” as she took office, but continued to face scrutiny for her hard-line cultural views. Across the globe in China, we saw the confirmation of Xi Jinping for an unprecedented third term and the likelihood that he will use this to tighten his grip on policy The response to the first two developments was relatively positive – the bond yields on both UK and Italian government debt closed a little tighter but investors “voted with their feet” on China, leading to dramatic sell-offs both in Hong Kong and in US-listed ADRs of Chinese companies, as well as marked asset outflows from Emerging Market Funds, and those dedicated to China-only equities.

© 2022 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.