Aoifinn Devitt – Chief Investment Officer

As we move to February and the Super Bowl beckons this weekend, a groundswell of positive economic indicators – so called hard data, is starting to edge out the soft data of consumer sentiment. This sentiment had been doggedly pessimistic over recent months. Now, however, the glass seems to be half full.

Last week, the Fed implemented its 8th consecutive rate hike – but, notably, only 25 bps. Is 25bps the new zero? Markets certainly seemed to react that way. The signs of deceleration of the pace of tightening by the central bank as well as murmurings of “disinflationary” forces taking hold cheered markets who saw that a corner had been turned. With supply chain problems easing, the only pockets of concern now are in the labor market, which remains tight in terms of supply, but not that significant in terms of upwards wage pressure, as well as isolated supply chains such as that of chickens and eggs. One is tempted to ask which came first, but regardless of that answer, it is putting further pricing strain on restaurants, bakeries, and other users up the chain.

The jobs report of last Friday was described as a blowout. It showed the US adding 517,000 jobs in January and revising the November and December numbers upwards by 71,000. Unemployment fell to 3.4%, the lowest number since 1969. This, together with signs of easing inflation, are starting to build a base under markets which are increasingly “braced” for impact.

This might explain why both the quasi-hawkish tones of Chairman Powell, as well as caution by large technology companies reporting disappointing earnings is getting somewhat lost in translation. Large companies such as Meta, Apple, Amazon and Google missed consensus earnings estimates by 8% in aggregate but largely remained unpunished as investors instead focus on disciplined cost cuts, retained market share, and ambitious investments in areas such as artificial intelligence and ongoing innovation. The belief that these companies will continue to dominate their markets remains strong, even if there is still some “fat” to cut in terms of costs and some revenue drops to expect as post-Covid excesses are worked off.

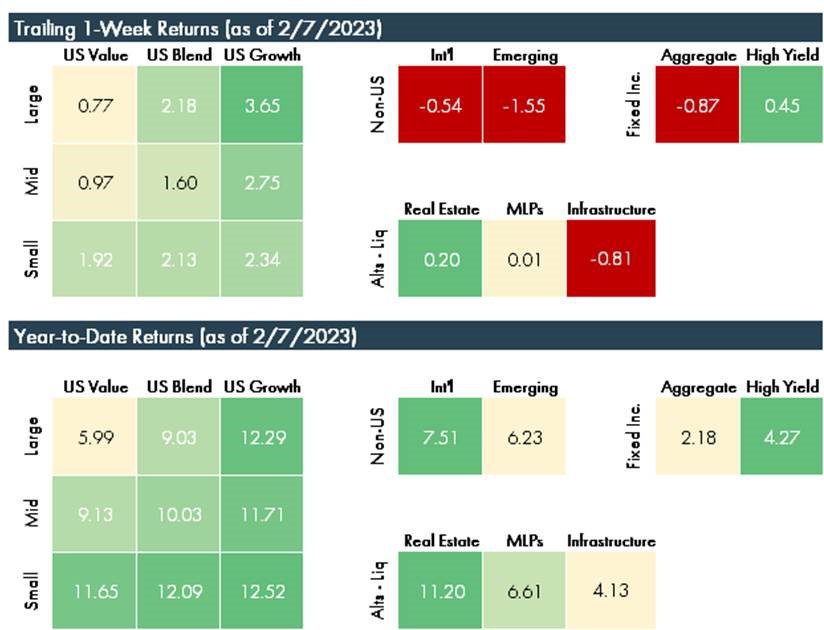

As the market statistics below show, the markets have remained well supported in recent days, with investors willing to look through earnings declines – maybe as there are few surprises.

The devastating earthquake in Turkey and Syria continues to reveal its sad toll, and with trading suspended in the Turkish market after days of precipitous losses, we are reminded of the propensity for risk in emerging markets to bring political instability. Other emerging markets are showing some slowing exuberance too after a bumper start to the year.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.