Kaleb Doyle, CPA, CFP® | Advisor

For many investors, the traditional 60/40 stock and bond portfolio just isn’t the right fit anymore. Several equity investors would like to implement a growth alternative that breaks away from the volatility of the public markets. Some bond investors are willing to sacrifice liquidity in return for above-market cash flow yields that are invested in a conservative strategy.

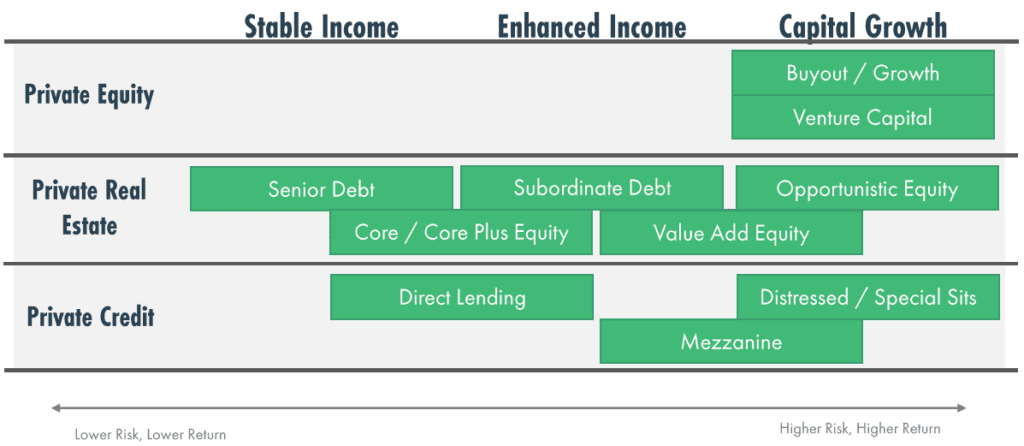

For investors seeking these alternatives, Private Investments are worth a look. We like to think of “Private Investments” within the following categories:

- Private Equity (Including Venture Capital and Buyout Firms)

- Private Real Estate

- Private Credit

These three categories of private investments have different features that work together to produce a risk-appropriate mixture of stability and growth.

To date, the glaring challenge with this class of investments is the high barrier to entry of becoming a LP-investor in a direct private fund. The typical stated minimum investment is anywhere from $1-10 million per fund. An investment in a single strategy at this level is typically only practical or advisable for endowment funds and dynasty families.

However, for our clients, that has now changed. Moneta – using its ability as a large, independent registered investment advisor – can pool clients’ funds and bring the minimum investment level down as low as $250,000. This becomes much more palatable and reduces concentration risk from a portfolio construction standpoint.

This opportunity developed largely because of Moneta’s recent commitment to expand our expertise in private and other alternative investments. We have built a dedicated Private Markets team that screens thousands of deals each year to ensure our clients are getting quality options at fair pricing terms.

Additionally, in October 2021, Moneta hired Andrew Kelsen as our Head of Alternative Investments. With 34 years of experience, Andrew has a deep network of relationships with private equity fund managers and top executives and leaders in real estate, sustainable investments, and co-investments.

Here is some additional information about these investments:

Q. How do Moneta clients get to participate in these funds at lower minimums?

Private equity firms usually designate a certain dollar amount to fund their strategy over a fund’s lifecycle. Here’s an example:

A Private equity firm decides to raise $10 billion to seed its new fund; it requires a minimum of $5 million to be invested over seven years. The firm agrees to accept $25 million from a pool of Moneta clients. With several clients investing between $250,000 and $1 million, $25 million is raised and our clients get to participate in the fund.

Q. How do I know if I’m qualified to make this kind of investment?

In general, an investor must meet the SEC’s definition of a “Qualified Purchaser” to participate. At a high-level, this means the investor has investable assets in excess of $5 million. We will work with each client to determine their eligibility and the amount that is appropriate to invest.

Q. If I’m interested and I qualify, how does the investment process work?

A client would work with their Moneta Advisor to determine which fund(s) and amount(s) are appropriate for their goals and investment timeline. Upon building their personalized strategy, the client would make a formal commitment to the fund.

Each fund is different. However, in general, each investor’s commitment is funded over a few years. For example, the fund may collect 50 percent of the commitment in the first year, then 25% years two and three.

Q. How do investors receive their returns?

Different strategies return capital at different stages. For example, an income-driven private credit fund might pay quarterly distributions to its investors. On the other hand, a venture capital fund might not return any amount to investors until the sixth of seventh year of the fund. In that case, the goal is to generate a sizable profit for each investor near the end of the fund’s term.

Q. What are the pros and cons to these types of private investment funds?

Pros: Targeted returns greater than the public markets, diversification away from stocks, access to investments in privately-owned companies, utilization of firms with long track records of success.

Cons: Limited or no liquidity within the fund’s lifecycle — meaning it’s difficult to access to your money; cash is distributed to investors at the fund’s discretion, and, of course, like many investments, the returns are not guaranteed.

We are always here to help and serve in the best interest of our clients. While this article specifically speaks to private investments, we also provide excellent management of assets in the public markets (similarly utilizing our advantage of scale for stronger pricing), as well as holistic financial advice.

Our clients lean heavily on us to not only manage their investment portfolios, but to help them optimize their Trust & Estate structure, consult on their tax strategy, and protect the family’s cherished assets. To explore whether a relationship as a Moneta client makes sense, feel free to contact me at KDoyle@monetagroup.com.

© 2022 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Examples contained herein are for illustrative purposes only based on generic assumptions. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise.