by Chris Kamykowski, CFA®, CFP® – Head of Investment Strategy and Research

“That is the sound of inevitability.”

With all the buzz about artificial intelligence (AI) these days, this quote from 1999’s hit movie, The Matrix1, seems an apt way to start a quick piece on the other topic du jour, that being recession risk. Coming into 2023, many market pundits assigned a high probability for a shallow-to-mild recession occurring in the first half of the year. The rapid tightening in monetary conditions and consternation over the Federal Reserve’s unwillingness to “pause” was exacerbated by a crisis of confidence in March. However, as well-resourced and knowledgeable these entities are, recession calls have clearly been a big miss on the part of professional forecasters thus far. Just this last week, investors received second quarter U.S. GDP readings which showed real GDP grew at 2.4% in the U.S., much higher than expected and well clear of past economic contractions.

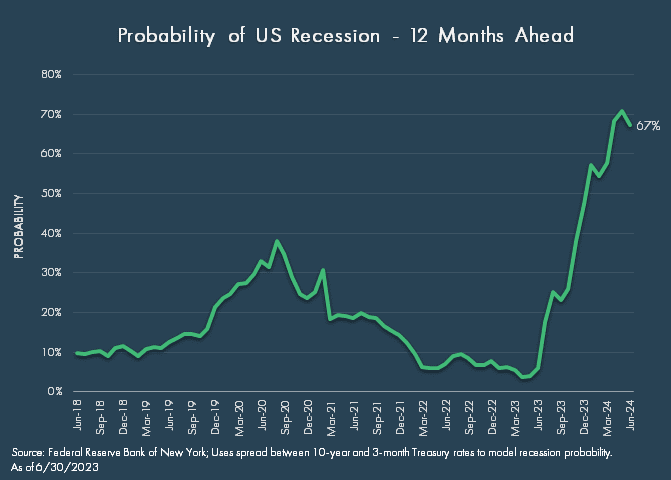

At this point, a fair question for investors is what gives and how inevitable is a recession? In this brief piece, let’s dig in on this topic that is causing much reflection and debate in markets. To begin, let’s look at what recession probability indicators are saying. A key measure investors have been pointing to in terms of an elevated recession probability is the inverted yield curve. The Federal Reserve’s rapid tightening of its Fed Funds rate has led to short term rates being significantly higher than long-term rates. As we noted in our March 2022 piece, Should an Inverted Yield Curve Concern Investors?, since 1978, the spread between the 2-year U.S. Treasury yield and the 10-year U.S. Treasury yield has inverted every time prior to the last six recessions; typically, each recession occurred within six to 36 months of the inversion. Today, over a year since the curve first inverted, the spread sits at -0.90%, pointing to a recession at some point, according to historical precedence. Additionally, the New York Fed’s 10-year Treasury /3-month T-Bill yield spread recession probability model has come off its peaks but still shows a 67% recession probability over the next 12 months. Yet so far, we have continued to stave off a recession.

Given the continued surprising strength of the economy and falling inflation, recession expectations have come in somewhat as of late for several market strategists and economists. For instance, the National Association of Business Economics’ July survey noted “almost three-quarters of panelists (71%) report that the probability of the US entering a recession in the next 12 months is 50% or less”2. What was “fear” from the beginning of the year is now turning more optimistic. A “soft-landing” for some appears to be more and more possible, despite the significant degree of monetary tightening that has occurred.

If one were to look at equity markets today, it would be hard to envision that there is any concern about a looming recession. The S&P 500 is up 20% and equity volatility is near 10-year lows, indicating either a positive view on the future trajectory of economic conditions or dangerous complacency with building economic stresses.

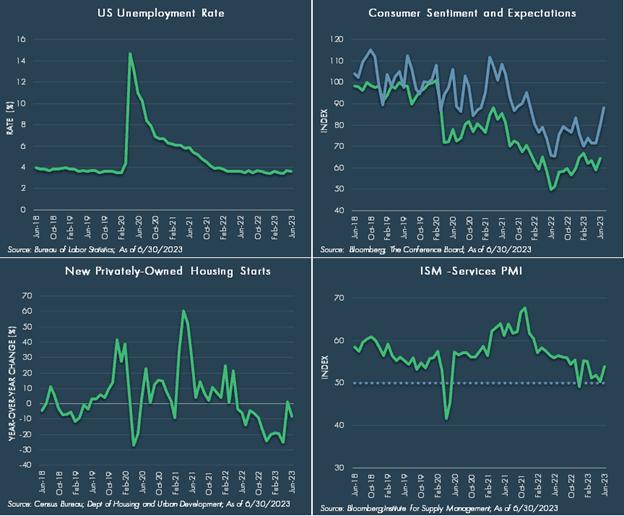

Still, today’s economic data presents investors with a mixed picture; one’s optimism or pessimism depends on what data one is relying on to inform one’s view. To highlight this, we have selected a few data points that either show continued strength or negative trends. In the case of the former, here are four sample data points:

- Labor Market: A resilient labor market is a key support of overall economic trends since consumers are a dominant component of GDP growth. Job openings continue to outpace the number of workers available, keeping wage growth steady. Companies’ desire to keep workers given the lack of available labor could mitigate some of the downside pain of an economic slowdown.

- Consumer Sentiment and Expectations: Falling inflation has helped consumers see through the recent 40-year highs in inflation, although general expectations have been trending higher. This optimism bodes well for consumer spending, which has cooled but continues to be a major driver of economic growth.

- Housing: The key here is that the market has stabilized after the rapid surge in mortgage rates last year and instant impact on home affordability. New homes sales recently beat estimates, for instance. The lack of supply remains a key reason why the residential market could continue to provide a positive influence on economic growth.

- Service Sector PMI: The post-pandemic surge in demand for services shows no slowing as it remains solidly in an expansion state according to the ISM Purchasing Managers. June marked the sixth consecutive month of expansion with an uptick in business activity, new orders, and employment driving the survey higher.

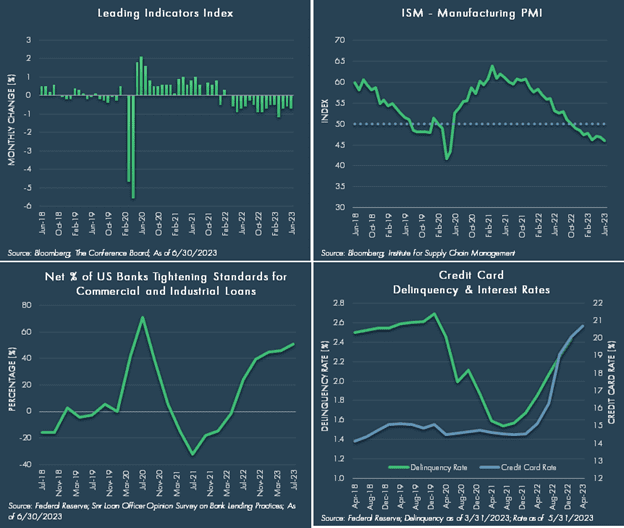

However, not all indicators are pointing toward a rosy picture as seen below:

- Leading Economic Indicators: Trends in the Conference Board’s Leading Economic Indicator (LEI) measure have been negative for 15 straight months, marking the longest streak of consecutive declines since 2007-2008. This points to slowing economic activity and signals a recession is ahead; historically, the LEI has anticipated turning points in the business cycle by about 7 months.

- Manufacturing Sector PMI: Contraction is the ongoing concern in manufacturing as the ISM Purchasing Managers Manufacturing PMI contracted for the eighth consecutive month; this followed more than two years of expansion. The weakness is driven by demand softness, slower output, and falling headcount.

- Bank Lending: The most recent Senior Loan Officer Opinion Survey highlighted further tightening via elevated lending standards and weaker demand for commercial and industrial loans to large, middle-market, and small firms. Concern over the credit quality of borrowers, an uncertain economic outlook, and deteriorating collateral values all impacted lending standards. While the survey was conducted in the midst of the recent domestic banking concerns, this represents additional tightening of liquidity in the economy.

- Credit Card Debt: As pandemic-related stimulus and accumulated savings fall, consumers have continued to use credit cards to fund spending, especially as inflation surged. Spiking credit card rates could lead to a retrenchment in the use of credit cards. Additionally, delinquency rates are rising off recent lows which could be pressured higher by the upcoming resumption of student loan debt repayments.

As one can see, the economic data above presents a mixed picture with some data points trending in a positive direction while others are trending in a decidedly negative direction. Is a recession “inevitable”? To be blunt, yes; no one has mastered the art of upending the natural economic cycle, not even AI. The issue is really around the timing and degree of the next recession, neither of which is easy to forecast.

An investor might ask whether a portfolio can ever be “recession proof”? It has been our experience that investing one’s assets along a market-timing regimen intending to miss a recession is very challenging at best. A better approach has been to remain fully invested in the market through its various ups and downs without seeking to time entry or exit. However, if this recession is inevitable, shouldn’t we try to insure against it or build in resilience to the portfolio to ensure that it protects capital throughout the downturn?

Just as the timing and depth of the expected recession is not easy to forecast, sizing and scaling the amount of protection needed in a portfolio is difficult. For this reason we do not advocate more tactical styles of protection – such as options or other derivatives strategies, which, themselves, depend on market entry and exit and can be at their most expensive just at the time that recession risk is higher.

Instead, we advocate integrating resilience into a portfolio from inception – by including some strategies – such as fixed income, that remains a ballast when there is a flight to safety or away from risk assets. We include real assets such as infrastructure and real estate, that are typically more aligned to inflation and robust and defensive when markets turn. Real estate may, at times, follow equity markets in terms of investor momentum and move in and out of favor accordingly. For this reason we advocate a blend of both public and private real estate in order to smooth this equity-like behavior and build a portfolio that is firmly rooted in real estate market fundamentals across sectors and geographies.

When it comes to recommending equity portfolios that are resilient in the event of a recession, we believe that the key to this is diversification by geography, as not all global markets are synchronized in terms of their economic growth, as well as sector. Including a strong component of recession resistant defensive stocks such as healthcare, consumer staples and utilities should provide an offset to the more growth sensitive sectors such as technology which might sell off more in the event of a recession.

Overall, despite the mixed messages of the degree and timing of the next recession, investors should remain committed to a long-term, strategic approach following an investment plan designed with their goals and risk tolerance in mind. This can bring a higher degree of confidence in the “inevitability” of meeting your investment goals.

1 Plot revolved around a dystopian future in which humanity is unknowingly trapped inside the Matrix, a simulated reality that intelligent machines have created to distract humans while using their bodies as an energy source.

2 https://nabe.com/NABE/Surveys/Business_Conditions_Surveys/July-2023-Business-Conditions-Survey-Summary.aspx

Definition

The S&P 500 Index is a free-float capitalization-weighted index of the prices of approximately 500 large-cap common stocks actively traded in the United States.

Disclaimer

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.