Aoifinn Devitt – Chief Investment Officer

As the year hurtles to a close, it is turning out not to be a season of “Out of the Office” emails and Silent Nights. We continue to face a barrage of news flow from all quarters, and the “good news being bad news” theme is continuing to the point that we think it needs to be challenged.

There was further evidence of this last Friday, when positive employment numbers (where the US added 263,000 in non-farm payrolls, which was higher than estimated) sent commentators into a tailspin. They spoke of losing hope of a soft landing, and worried that the Fed would need to see unemployment ticking up before it achieved its inflation-dampening objective. Wage inflation was portrayed as the demon that would force inflation firmly out of the transitory arena and into “sticky” territory. It would bolster the consumer, supporting demand and driving prices higher.

There are a number of troubling things about this narrative.

Firstly, it ignores the fact that wage inflation is typically a lagging indicator of pricing pressures – the hiring process is rarely a fast one – there may be notice periods to be worked and other delays, and by the time a new hire is on board, the negotiated salary may be months old.

Secondly, it ignores the recent wave of job cuts and scaling back that has been telegraphed by companies in both the new and old economy – this won’t yet be evident in the numbers, and it may never be – but it will likely change the narrative around the strength of the job market, which should reduce the negotiating power of new hires.

Thirdly, if the bulk of the jump in wages is due to people moving jobs and not staying in their existing role, how sticky can we expect this to be? After all, if we are past the wave of the “Great Resignation,” we cannot expect the same level of movement, and those “movers” will ultimately gain less leverage as they convert to staying.

Finally, we are hearing about rising levels of consumer debt, which suggests both a consumer that is stretched and one that is optimistic about the future. While the latter part of this is what concerns commentators, I am more focused on the fact that debt is what is being used to make ends meet, suggesting that savings (from Covid) have been depleted, and indeed debt did get lower in the immediate aftermath of Covid. The New York Fed [1]recently released figures showing that the year-on-year increase in credit card debt (15%) is the highest in 15 years, while consumer debt levels themselves now sit at $16.2 trillion, higher than pre-pandemic levels. Mortgage origination was down, as we might expect and back to pre-pandemic levels. This has been well documented by the Fed as it watches the transmission mechanism of its rate rises.

It seems premature to conclude that the strong employment number will lead the Fed to second-guess its carefully orchestrated messaging around the terminal rate and slowing the pace of rate rises. This comes at a time too when 2023 forecasts are being issued, with most forecasting a recession in 2023 – whether the shallow kind, the “rolling” kind or the traditional deep kind.

It would seem that both cannot be true – the consumer as a group cannot both be robust and impaired – and therein lies the tremendous uncertainty of where we are as the year comes to an end. We would caution therefore about jumping to any conclusion based on a single month patrol number. It might be more enjoyable to focus on the Peace and Goodwill side of the season.

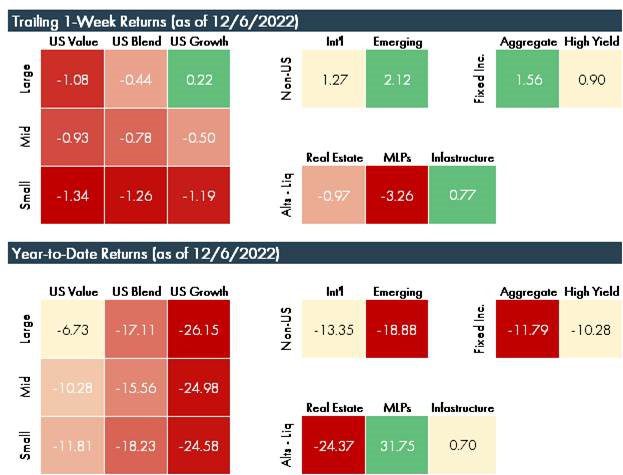

Source: Morningstar as of 12/6/2022

[1] https://www.newyorkfed.org/newsevents/news/research/2022/20221115#:~:text=The%20Report%20shows%20an%20increase,2019%2C%20before%20the%20pandemic%20recession.

© 2022 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.