Chris Kamykowski, CFA®, CFP® (Head of Investment Strategy and Research)

Rich McDonald, MBA (Head of Portfolio Management and Fixed Income)

Per the announcement yesterday (1/19), the US Treasury Department is beginning the use of “extraordinary measures” to keep paying government bills especially monies owed to government bondholders. That message sounds ominous but has been well known for some time now and these measures have been used before. Prior to today, “extraordinary measures” has been a common occurrence and has been enacted 9 times since 2010:

- May 2011

- December 2012

- May 2013

- February 2014

- March 2015

- March 2017

- December 2017

- March 2019

- August 2021

US Treasury Secretary Janet Yellen has stated that the Treasury can pay all obligations until at least early June using these accounting maneuvers. These allow lawmakers about 5 months to figure out the debt limit – either by suspending or raising the debt limit. Republicans oppose raising the debt limit unless Democrats agree to spending cuts. The Democrats control the Senate and have the support of President Biden in saying they won’t be bullied into making cuts. It’s up to lawmakers to produce a resolution as soon as possible but at this point the two sides seem very far apart. That said, according to the US Treasury, Congress has always acted when called upon to raise the debt limit. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents.

Many have bad memories of the debacle of 2011’s debt ceiling debate. It led to major consternation in the markets and ultimately, one of the major rating agencies, S&P, downgrading the US one notch from AAA to AA+ based on concerns of budget deficits and congressional inaction. Today, one can hope that politicians have learned it is bad policy to mess with the “full faith and credit” of the US which should be enough motivation to work together toward a solution. However, politicians being of a sort to regularly haggle, there will be plenty of back and forth between parties. Motivation to negotiate in good faith may be linked to the fact the Fed is not in the same position to calm markets as it was in 2011 when it enacted QE3; today, we are staring at a Fed set on reducing inflation through tighter monetary policy, something they will likely be reluctant to budge from due to Congressional ineptitude or stubbornness.

Any failure by the U.S. to make interest payments on time could cause havoc in the financial markets as markets prefer certainty to uncertainty; when we are talking about THE risk-free rate that underpins global financial markets, this is even more apparent. Clearly, the closer we get to June without a resolution, the more perilous the situation could become. However, at this point, compromise is the likely outcome if one looks to history but the path there will see potential for market volatility. It’s also extremely possible this drags out until the very last moment.

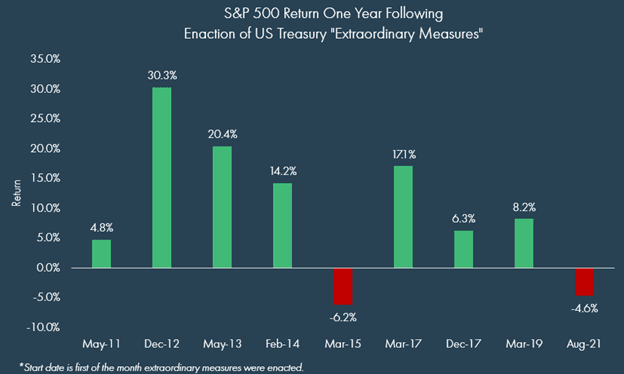

Finally, for perspective as markets fret about the debt ceiling, below are one year returns for the S&P 500 index following the initiation of previous “extraordinary measures”; past is not indicative of future returns, but more often than not, the market has moved past the debt ceiling concern to higher levels one year later.

Sources:

Morningstar

https://bipartisanpolicy.org/debt-limit-through-the-years/

https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/debt-limit

Definitions:

The S&P 500 Index is a free-float capitalization-weighted index of the prices of approximately 500 large-cap common stocks actively traded in the United States.

Disclaimer

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.