Aoifinn Devitt – Chief Investment Officer

As earnings season moves into high gear, the mixed bag of results seems to be leaving markets in a state of some confusion. While earnings have been mixed even within the same sector, greater than 60% of companies reporting have still beaten estimates, which either suggests a stronger than expected economy or an exceptionally fine-tuned telegraphing of expectations by companies.

That said, the index is reporting a year-over-year decline in earnings for the first time since Q3 2020, and the spread by which companies are beating estimates is lower than the 5 and 10 year averages. There is an indication of a slowing of demand from the real economy to the online economy (e.g., cloud services) and transaction volume being more muted has eroded investment bank earnings and trading activity. The employment picture remains strong, though, with only 190,000 initial jobless claims in the last report. So, a mixed outlook indeed.

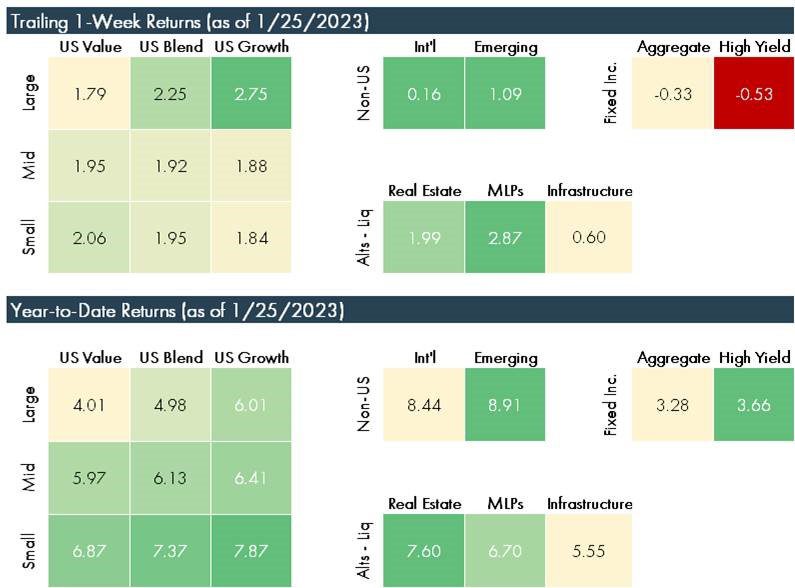

News of sizeable cost cutting and layoffs, as was announced by Microsoft and 3M this week as well as Wayfair and Alphabet last week, has been greeted generally positively – both Wayfair and Alphabet rallied following their cost-cutting announcements, as if markets were pleased to see the dose of reality and discipline descend. Overall returns have been solid year to date – especially for the growth sector, as the chart below shows:

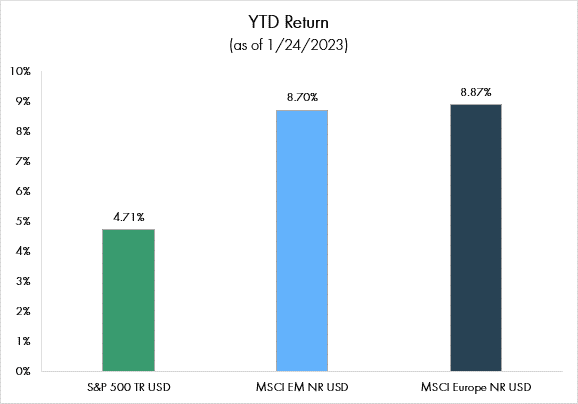

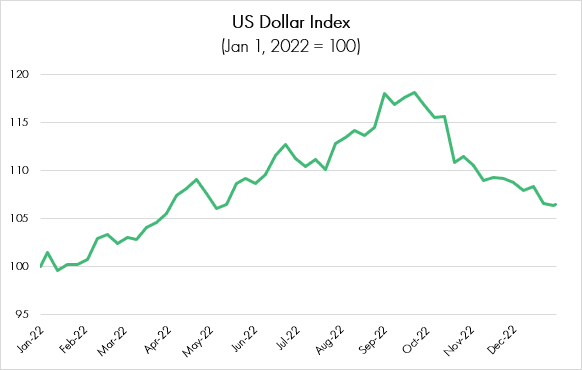

One distinct trend emerging in markets year to date is the steady outperformance of non-US markets, including Emerging Markets. There was a suggestion this past week that Europe would skirt recession, having shown modest positive growth in January based on the Purchasing Managers’ Index, as the continent continues to enjoy a warmer than usual winter which has reduced the severity of the energy crisis there and led to a drop in the price of natural gas. [1] This positive surprise has been reflected in European markets as well as in Asia, where the faster than expected emergence of China from its protracted Covid restrictions has taken many commentators by surprise. The weaker dollar, which has continued to slip from the 20 year highs it displayed at the end of the year, is further driving the relative attractiveness of non-US markets.

The MSCI Europe Index is a float-adjusted market capitalization index that captures large and mid-cap representation across 15 Developed Markets countries in Europe.

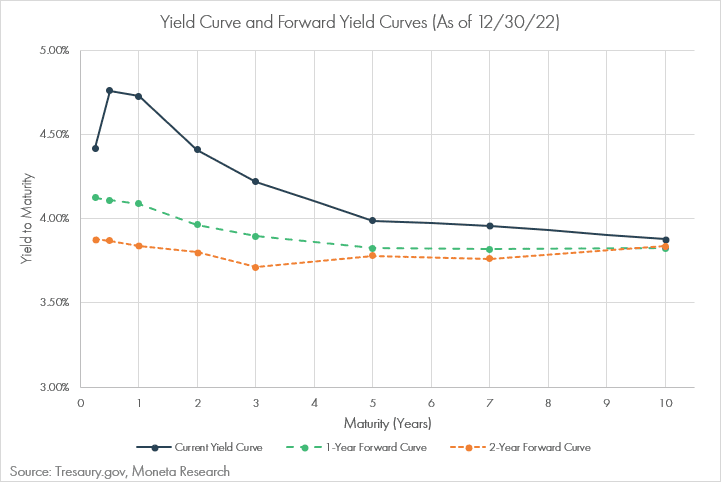

The other twist in the start to the year was the stark inversion of the yield curve. As the chart below shows, there is considerably more yield available in the front end of the yield curve than in the medium to long end, which is typically strongly suggestive of a pending recession. It underscores the attractiveness of short-term yields at the moment, why holding cash no longer has to be a drag, and the uncertainty that lies in the medium to long term around the direction of Fed policy. We have noted, however, that the forward yield curves are significantly flatter, suggesting that this is a short-term phenomenon which will shortly phase out.

Many of our clients obtain their fixed income exposure via bond ladders, which are designed to provide stability to a portfolio’s returns over time. Because the goal is to stay invested in fixed income, a portfolio that is heavily weighted in the front end of the curve will face reinvestment risk when it matures- as clearly, the portfolio will need to be reinvested at lower yields at that stage. We encourage clients and advisors to stay the course and keep bond ladders intact.

[1] https://www.reuters.com/markets/europe/euro-zone-january-business-activity-returns-growth-pmi-2023-01-24/

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.