By Sarah Bishop, Retirement Plan Advisor – Learn more about our Retirement Plan Service

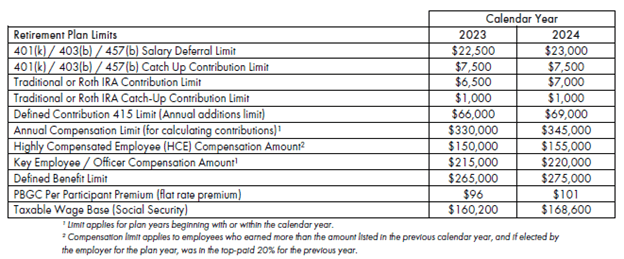

The Internal Revenue Service (IRS) announced increases to retirement plan limits for tax year 2024. These cost-of-living adjustments were published on Wednesday, November 1, 2023. Although not as significant as the increases provided for 2023, they provide workers with an opportunity for greater savings next year.

In 2024, workers can contribute $23,000 pre-tax to a 401(k) or other similar retirement savings plan – a $500 increase from 2023. Workers aged 50 or older can also contribute $7,500 in catch-up contributions in 2024, which remains unchanged from 2023.

What Does This Mean For You?

If you already maximize your annual contributions and have the ability to save more, you may be able to lower your taxable income by $500 in 2024. If you will attain age 50 in 2024, don’t forget that you’re eligible for the catch-up contribution, an additional $7,500 savings opportunity.

Only pre-tax contributions will reduce your current tax burden; however, the increased limits apply to Roth contributions in these plans as well.

(Limits for other types of retirement plans will vary. See IRS Notice 2022-55 for details.)

What If Your Retirement Plan is Not a 401(k)?

The increases are not limited to employer sponsored retirement plans like 401(k)s. For those eligible to make contributions to a pre-tax or Roth IRA, the limits will increase to $7,000 – a $500 increase. The age 50 catch-up contribution in these accounts remains unchanged at $1,000.

Is There a Compensation Limit With These Changes?

The compensation limit for 401(k) or other similar retirement savings plans will increase from $330,000 to $345,000. If your income is above this level and your plan matches on a percentage of pay, you may also see a greater dollar amount in employer matching contributions for 2024.

Make sure to adjust your payroll deduction in January 2024 to ensure that you are taking advantage of the increased limit.

WHAT OTHER CHANGES ARE INCLUDED?

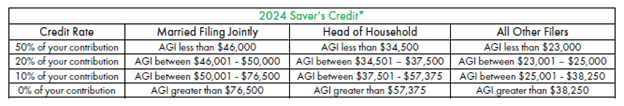

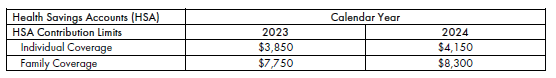

Increases for several key retirement related items including the Saver’s Credit and Health Savings Accounts (HSA) take effect in 2024. See below tables for a summary.

The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). The chart above can be used to calculate the credit.

Are you a business owner without a retirement plan?

Small employers are now eligible for enhanced tax credits to offset the start up costs associated with sponsoring a retirement plan for their employees.

If you have 100 or fewer employees, you may be eligible to claim start up tax credits up to $5,000* for 3 years when establishing a new retirement plan.

You may also be eligible to claim tax credits up to $1,000* per employee to offset the costs of employer match or profit sharing contributions for 5 years when establishing a new defined contribution retirement plan.

A $500 tax credit is also available for 3 years for including an automatic enrollment provision in your plan.

*Tax credits are calculated based on the number of eligible non-highly compensated employees.

Sources:

Internal Revenue Service –

https://www.irs.gov/pub/irs-drop/n-23-75.pdf

American Retirement Association –

FOR FULL DETAILS ON THE 2024 RETIREMENT PLAN LIMITS, VISIT THE IRS WEBSITE (IRS.GOV). THESE MATERIALS ARE OFFERED FOR GENERAL INFORMATIONAL PURPOSES ONLY AND NOT AS TAX OR LEGAL ADVICE. INFORMATION IS BASED ON SOURCES BELIEVED TO BE RELIABLE BUT THE ACCURACY OF SUCH INFORMATION HAS NOT BEEN INDEPENDENTLY VERIFIED.

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.