Recent News

Leading into the weekend, the market expected the Organization of the Petroleum Exporting Countries (OPEC) to cut supply and support falling oil prices due to decreased demand as a result of COVID-19 (coronavirus).

In an unexpected turn, disagreements between Saudi Arabia and Russia led to the opposite outcome; both countries discussed increasing production to drive down energy prices in hopes of routing out competitors. Fears of additional supply at a time of weak and uncertain demand led oil prices lower on Monday, March 9 in one of its largest single day moves since the Gulf War.

Impact on Midstream Assets

While midstream assets are mostly in the moving business, not discovery and extraction, they are impacted by such a material change in crude oil prices. Weaker demand and lower prices could lead to lower volumes, which may negatively impact the cash flows of midstream businesses. As a result of these developments, we believe there are four key areas investors should consider.

Outlook

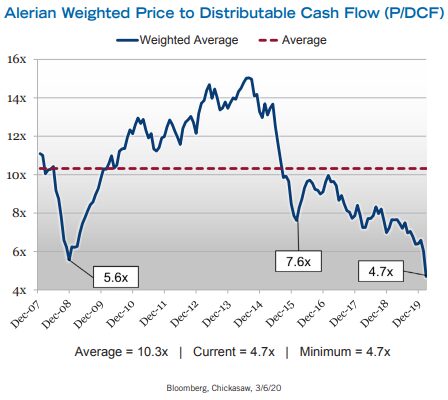

The standoff between Saudi Arabia and Russia and the demand impact from COVID-19 is likely to continue adding volatility among midstream businesses. Without perfect insight on how the country dispute or the epidemic will resolve we come back to fundamentals. The undisputable need for hydrocarbons in the economy, stronger balance sheets, considerable distribution coverage, more disciplined capital allocations and high current yields make midstream assets quite compelling. The weighted price to distributable cash flow, a measure of cheapness, now trades at valuations not seen since the financial crisis, a time period in which global demand was in free fall, capital markets were not lending and the quality of midstream businesses was not nearly as robust.

That said, it is likely these assets will be volatile during this period of stress. Many investors are painting all energy businesses with the same broad brush and selling first only to ask questions later. This is often coupled with news coverage that conflates concerns in parts of the energy complex with all other segments.

Misinformation coupled with fear can be a hard scenario to overcome when allocating capital. Therefore, investors’ sensitivity to price fluctuations or those with a naturally shorter time horizon should proceed with caution. However, we remain confident of the value midstream assets can provide to a thoughtfully diversified portfolio for those investors with the luxury to invest over longer periods of time.

Please contact any of the professionals at Moneta with additional questions.

Note: This report is intended for the exclusive use of clients and prospective clients of Moneta Group Investment Advisors, LLC, an SEC registered investment advisor and whole owned subsidiary of Moneta Group, LLC. Registration as an investment advisor does not imply a certain level of skill or training. Moneta is a service mark owned by Moneta Group, LLC. Content is privileged and confidential. Any dissemination or distribution is strictly prohibited. Information has been obtained form a variety of sources believed to be reliable though not independently verified. Any forecast represents future expectations and actual returns, volatilities and correlations will differ from forecasts. Past performance does not indicate future performance. The information presented does not represent specific investment recommendations and does not take into account your personal circumstances. Please consult with your advisor, attorney, and accountant, as appropriate, regarding specific advice.