by Trent Rieger, Associate Investment Analyst

All-time highs, brand new spot ETFs, and an upcoming halving has Bitcoin continuing to make headlines, sparking curiosity in those with fear of missing out (“FOMO”). Both speculation and skepticism run rampant for those evaluating the merits of Bitcoin. The recent uptick in conversation is not without merit and now seems like a good time to see what has evolved, what is the same, and offer up some reflection on what we noted about Bitcoin and cryptocurrencies three short years ago.

EVOLUTION #1: REGULATORY UPDATE

Regulation, or the lack of, has been an ongoing talking point with bitcoin. Even though direct investment in bitcoin was not regulated, the Securities Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC) were regulating bitcoin in the United States via the futures market. For years, Grayscale’s Bitcoin Trust, GBTC, was the only SEC-registered vehicle for gaining exposure to bitcoin by buying shares of the trust. The road to formal regulation of cryptocurrencies in general was bumpy and littered with events that created even more reason for the SEC to act: the Terra-LUNA crash in May of 2022 and the FTX collapse in late 2022. Additionally, up until recently, the SEC(2) had disapproved more than 20 exchange rule filings for spot bitcoin exchange traded products (ETP).

This all changed on January 11th, 2024, with the SEC’s approval of spot bitcoin ETFs, allowing everyday investors to have easy access to investing in bitcoin. This also eliminated the hassle of investors using a crypto exchange and digital wallet to hold bitcoin. While technically approved by the SEC, the statement of approval noted “fraud and manipulation” many times, highlighting a key reason behind the SEC’s original hesitation. With the ETFs now being listed on registered national securities exchanges, existing rules of exchange will be enforced to prevent manipulation, conflicts of interest, and schemes/scams that utilize social media platforms. While the SEC’s approval of the ETF product did see this as an improvement to access of bitcoin to retail investors, investment advisers are still bound by a fiduciary duty under the Investment Advisers Act of 1940 which requires they exercise a duty of care and fully understand the risks, benefits, and conflicts (if any), that apply to any underlying investment that is being recommended. Individual advisors should not recommend cryptocurrency (whether accessible by ETF or not) without meeting this standard, among others.

EVOLUTION #2: NEW SPOT ETFs & INVESTOR FLOWS

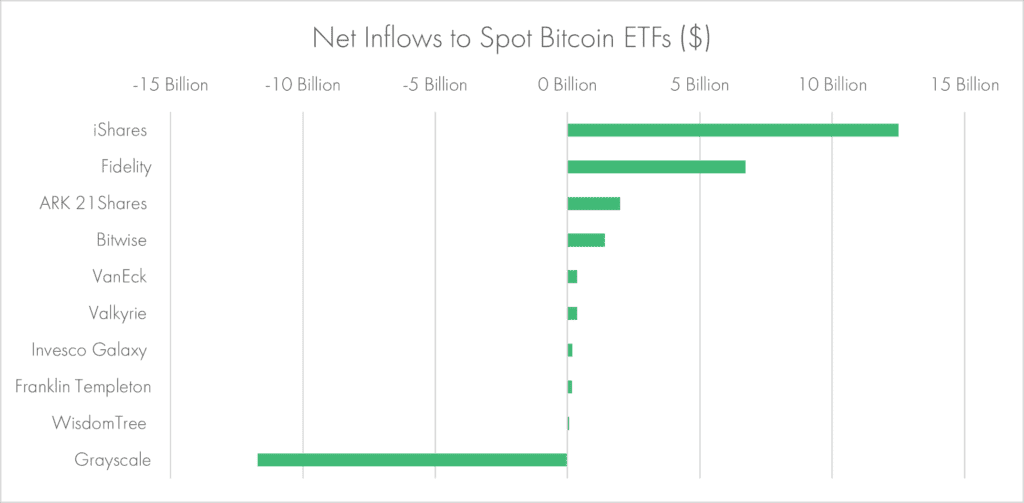

Following the SEC announcement, 9 new spot ETFs were immediately launched and made available to investors. These quickly garnered assets, with Fidelity and iShares winning the clear majority of assets, taking in over $15 billion as of 3/15/2024. BlackRock’s iShares Bitcoin Trust ETF became the quickest fund to $10 billion in assets, just seven weeks after its January 11th launch. To put that into context, the previous record, held by SPDR Gold Shares, took more than two years to reach this amount. More than $4.6 billion of shares across 10 spot bitcoin ETFs changed hands on the first day of trading.

These inflows hurt GTBC, which witnessed over $10 billion in outflows due to its relatively pricey expense ratio of 1.5%. Simple speculation would argue that it is likely the outflows from GBTC were directly related to the new ETFs offering more compelling expense ratios. Several of the new offerings are promoting a 0% expense ratio for a limited amount of time. Once the fee waivers end for the ETFs, the challenge of securing a competitive, yet profitable, expense ratio may be the ongoing battle for many of these funds.

EVOLUTION #3: UPCOMING HALVING

On approximately 4/20/2024, bitcoin will experience its periodic halving. While not unusual or new per se, it will impact the underlying supply and required efforts to obtain more bitcoin. First, to fully grasp what this means, it is important to understand the basics of bitcoin “mining”. Bitcoin is an incentive rewarded to the computers that are helping secure and verify the ongoing ledger that we know as blockchain. These bitcoin “miners” are compensated with transaction fees and the possibility of receiving bitcoin.

Back at bitcoin’s inception, 50 bitcoin were rewarded per block mined. Following three halvings, 6.25 bitcoin are currently issued per block. Halvings occur after 210,000 blocks are mined, which takes roughly four years. Future halvings will continue to cut in half the number of bitcoin issued to miners, even as their cost to mine remains the same. Additionally, as more bitcoin miners come onboard, it becomes more difficult, and thus slower, to mine the block.

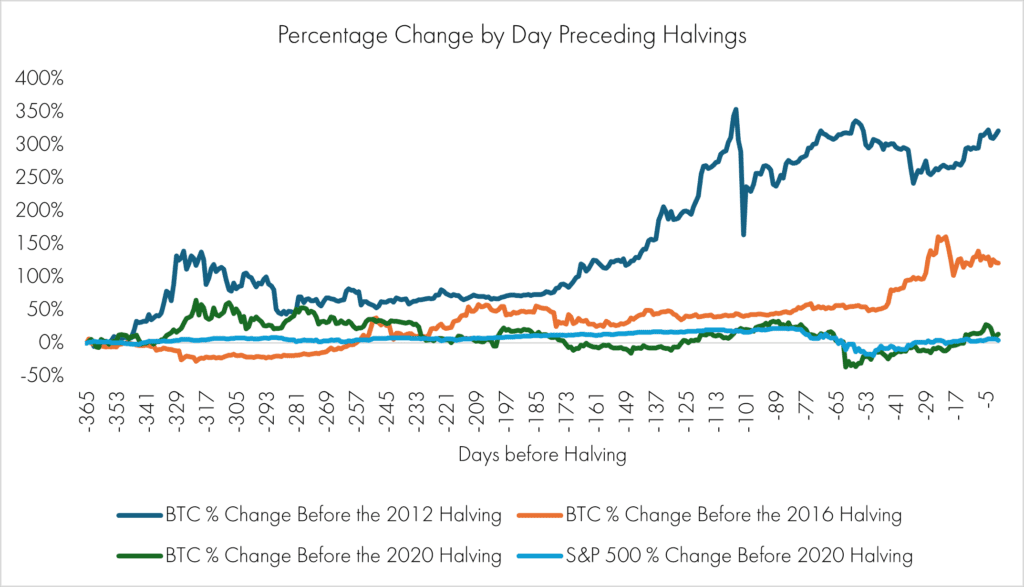

Even as demand for bitcoin grows, the mining network cannot increase production of bitcoin in the same way that other goods can. With each future halving, less bitcoin will be issued until an eventual finite limit of 21 million bitcoin are issued. While there have only been three halvings so far, the most recent halvings have seen gradually reduced volatility leading up to the event. One thing to keep in mind is that the 2020 halving occurred on May 11th, 2020, which means the days leading up to the event were very irregular for markets as they were impacted by the onset of the COVID-19 pandemic. Comparing bitcoin and the S&P 500 leading up to the 2020 halving, not only was bitcoin more volatile leading up to COVID, but just as volatile as the S&P 500, if not more, following the initial COVID shock and leading up to the halving. So while the bitcoin price data does look calmer for each sequential halving, it’s wise to reflect on the context of the pandemic as to how it may have impacted the demand of bitcoin around the 2020 halving.

While it is too early to say that this trend of easing volatility will continue around future halvings, it is promising, especially with the spot ETFs being passed. Adoption of the spot ETFs and an increasing market cap would mean it should take more capital to move the bitcoin market, potentially helping volatility. Even with the possibility of price stability, it is hard to ignore the drastic swings in price we still see today. A recent example is when bitcoin surpassed $68,000 on March 4th, a new all-time high at the time. Bitcoin saw an 8.10% increase from March 3rd to March 4th, only to drop -6.08% the next day; a perfect example as to why bitcoin should not be thought of as a currency. Currency should serve as a store of value and as a medium of exchange.

COMPARING VIEWS FROM 2021

As we wrote back in 2021(1), there were several key items noted about investing in bitcoin we thought should give investors hesitancy.

- Financial Regulation – While the significant changes in regulation were discussed earlier on, it is important to note what has not changed. The SEC(2) continues to not approve or endorse bitcoin trading platforms or intermediaries, while also making it very clear they do not approve or endorse the underlying asset of the new ETFs, bitcoin.

- Cyber Security – Cyber security’s role with bitcoin is critical and ever evolving. This importance has only continued to grow over the last few years. The same risks still apply for individual bitcoin investors, one click of a malicious link and your digital wallet could be drained and transferred to a hacker. Spot ETFs have to be cautious with transactions as well, as any sort of misstep at the exchange level could be disastrous when dealing with large amounts if bitcoin.

- Taxes – Investing in the bitcoin spot ETFs compared to bitcoin directly does have some differences when it comes to taxes, but these differences should feel familiar to other ETFs and prove beneficial. According to Morningstar(3), owning a bitcoin spot ETF is just like owning any other traditional ETF. The investor will receive their Form 1099-B at the end of the year from their broker, which is much simpler than the process for bitcoin. Generally, selling a bitcoin ETF is a taxable event, just like selling bitcoin. The main difference is that the bitcoin ETF is subject to wash-sale rules. Overall, these changes should be welcomed.

- Use in Portfolio – Possibly the largest overhanging question related to bitcoin is simply, “What is it?”. Perhaps bitcoin should be thought of as a commodity, falling in the footsteps of gold spot ETFs. Or maybe it is similar to land, as there is only a limited amount of it. But does bitcoin provide any of the benefits of gold, land, or any other traditional commodity? It does not generate cash flows like real estate or pay dividends like stocks. There is no appreciation based on talent like art or social benefit like gold jewelry. When it becomes a challenge to identify the value and benefit of an investment, is it a reliable investment? As previously stated in our(1) 2021 original post, “valuations are derived from an investment’s sum of its future cash flows discounted to today, and crypto has no cash-flow properties.” Bitcoin’s incapability to store value, the lack of cash flows, the reliance upon supply/demand to drive price means it should not be thought of us a long term, wealth accumulating investment.

CONCLUDING THOUGHTS

Between the ETF approval, the upcoming halving, and the surge in price, bitcoin has continued to stay in the spotlight and will likely remain in the sights of speculators who envision higher highs. That said, many of the headwinds bitcoin has faced early on are still present, while accessibility and efficiency provide potential tailwinds. While these recent and upcoming events have potential to improve certain quantitative aspects, investors should still look at investing in bitcoin as a speculative play and not an asset class that can provide long-term wealth generation and stability. Even though the SEC(2) approved spot bitcoin ETP shares, they made it clear they do not approve or endorse bitcoin as “bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing.” It has been a long, hard-fought battle to get to where bitcoin is today, and there is no guarantee on what the SEC may decide going forward. We continue to recommend investors tread lightly when engaging bitcoin or any other cryptocurrency. Wealth creation is best achieved by a diversified portfolio aligned to one’s investment objectives, time horizon, and risk tolerance.

Sources and Disclosures

- https://team.monetagroup.com/investment-report-what-to-know-about-cryptocurrencies/

- https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023

- https://www.morningstar.com/news/marketwatch/20240309357/what-you-need-to-know-about-taxes-on-bitcoin-etfs-before-you-buy-or-sell

DISCLOSURES

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.