Aoifinn Devitt, Chief Global Market Strategist

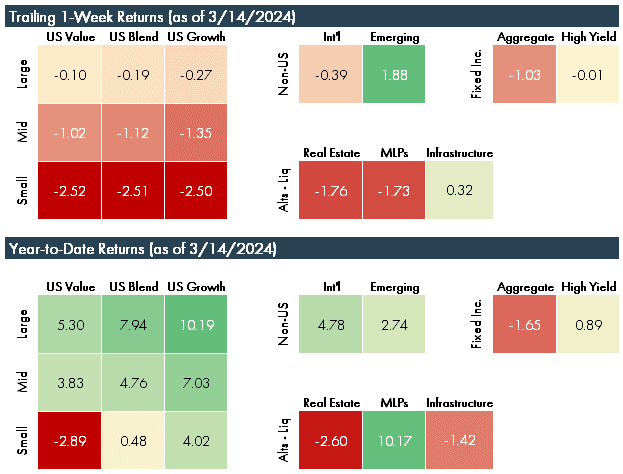

Coming off of the usual post-Oscars drama, the real original screenplays kicked off mid-week with inflation numbers and a concern that 2024 is already getting too hot to handle. And while it’s true that “some like it hot”, namely the consumer, indications of a higher-than-expected CPI report for February (a shade above market expectations at 0.4% month on month) sent expectations for rate rises downhill. There was some comfort taken from the supercore CPI (core services excluding shelter) coming in at 0.5% (compared to 0.85% in January), as well as other indications around deceleration of nominal wage growth.

In other data, there was a bit of editing on the prior two months employment numbers (they were revised lower by 167,000 – not trivial at all) leading to a small increase in the unemployment rate to 3.9%, which is still low, but the highest in 2 years. Markets were a little choppy in response to this mixed data.

As equity markets hover near their previously set all-time highs, the bubble analysis has entered a new phase, as connoisseurs try to determine whether there is a bubble just in AI and tech stocks, in the market as a whole or whether there is no bubble and this is just a healthy bull market (with thanks to John Authers of Bloomberg for this synthesis). The arguments for the first kind – this being an AI/tech bubble only would be supported by the concentration numbers, which suggest that the entire gain of the Nasdaq 100 in 2024 is attributable to the Fabulous Four – Amazon, Meta, Nvidia and Microsoft. There seem to be few takers on the suggestion that the entire market is in a bubble – particularly as the other 96 stocks in the Nasdaq 100 are actually, cumulatively, weaker on the year.

The argument for the “no bubble”, is justified on the basis of the “picks and shovels” analogy. While the prior internet bubble was a puff of unproven business models and pending profitability, the current surge rests on real orders. This argument relies on the fact that many companies, particularly the Fabulous Four, are enjoying resilient and growing earnings. It cites the overwhelming pent-up demand for the GPU chips hoped to power our AI future. There is convincing analysis comparing the current surge in chipmakers to other infrastructure-led cycles, but the question remains as to whether the current euphoria has gotten ahead of itself?

Meanwhile, gold remains a coveted trophy, and we have reached the point that commentators don’t quite know why. Risk remains on, and the dollar remains strong – these can often be counter-indicators for gold demand, which some have seen as a hedge. Inflation is still positive, but no longer sharply ascendant – the “inflation hedge” imperative has therefore lost some steam.

Also ascendant is bitcoin, now touching over $70,000 and riding a wave of more accessible ETFs, where nine “spot” ETFs have seen over $20 bn flow in since the trading started on January 11. This surge may be somewhat misleading though – as the new ETFs offer sweetheart early-bird pricing, some flows have switched out of more pricy trusts – as much as half possibly. The plot thickens indeed. Watch this space for our next installment of this year’s market drama.

DISCLOSURES

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.