Mark Webster, CFA – Senior Investment Research Analyst

Artificial Intelligence (AI) is thriving these days to speed up analysis, sift through noisy information, create procedural efficiencies, and enable human workers to improve their productivity. Within the world of investment manager due diligence, numbers and reams of data are key components analysts must sift through to help identify, monitor, and make important decisions regarding the hiring and firing of investment managers. However, for all the potential upside of AI’s impact on manager selection, there still exists a distinct human element within the manager due diligence process that AI cannot yet replace: the human element. All investment managers are made up of people tasked with exercising a philosophy and process consistently to garner a return and alpha for fee-paying clients. Quantitative techniques may help to retrieve data, speed up analysis, or help identify opportunities to “buy” or “sell”, but humans are still driving the process. While machines might one day fully run the investment process with autonomy, for the near future it remains important for manager due diligence to include deliberate attention to common human-centric ingredients that underpin successful investment managers.

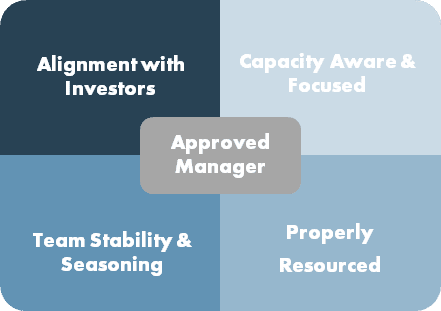

At Moneta, our manager research professionals assess investment managers from all angles but there are specific qualitative elements on which we spend deliberate time regarding the professionals running the investment strategies. We care immensely about successful strategies maintaining their edge and to do so requires attention by firms to more than technology and analytics. We follow a disciplined and rules-based approach to investment manager due diligence based on tenets believed explanatory and repeatable in producing successful outcomes. While few managers are perfect, there are four primary aspects where humans have a direct impact which we discuss below.

Core Tenets of Moneta’s Manager Selection

Alignment with Investors

We believe firms who have “skin in the game” through broad employee ownership and/or investments side-by-side with their clients provide a tangible alignment to the benefit of clients. Employee ownership by key investment professionals can provide an enormous incentive for putting client interests first. Benefits of employee ownership primarily accrue based on satisfied clients; to achieve the latter, employees must focus on achieving excellence in alpha generation over the long term and superior client service. Additionally, when employees have a significant ownership stake, they are more likely to be committed to the success of the fund over the long term, which often reduces personnel turnover and can improve consistency in the investment strategy and decision-making process. On the compensation front, managers who succeed only as their underlying clients succeed will naturally make decisions that are in the best interest of investors. If their compensation is based on the fund’s long-term performance, they have a strong incentive to maximize returns and minimize downside risks such as adding unwarranted short-term volatility to the return stream. Otherwise, they may seek to exploit unproven or short-term techniques in search of short-term rewards, such as immediate performance bonuses and the like. Overall, alignment with investors is important because it promotes trust, accountability, and improved decision-making, and could ultimately lead to optimal outcomes for investors and the investment manager alike.

Team Stability & Seasoning

The performance an investor is attracted to when evaluating a manager was ultimately generated by a group of professionals. To expect high probability of the same success going forward, investors should also expect stability in the seasoned professionals running the strategy. A firm that strives to develop and retain talent is a firm that values the institutional knowledge accumulated alongside the long-term success of investment strategies. With deep expertise in a market segment, asset class, or product come efficiencies and understanding of the idiosyncrasies inherent in that market, through market and economic cycles. This stability can improve an experienced manager’s ability to separate noise from something that requires attention and potential action. Drawing on historical experience (success and mistakes) can help a manager adapt to current events and trends enabling them to add alpha above a naïve index. The fact that a team is comprised of tenured investment professionals is a signal to the marketplace that the firm values their investment professionals. A cultural recognition for the importance of current leadership and, importantly, the next generation of leadership, further enhances the trust that client money will be managed consistent with history.

Capacity Aware & Focused

Asset gathering is a prominent temptation practically all successful investment managers will experience. Consistent alpha production naturally attracts new assets which also improves the underlying manager’s revenues. Investment managers are a for-profit endeavor and greed can overcome even those with the best of intentions. To assess a manager’s proclivity to asset-gather, we dig deep into the underlying motivations of managers’ capacity parameters, especially as it relates to past manager statements when growth is experienced. For example, a small cap public equity manager who allows “hot money” to flow into their portfolio without limit could find it increasingly difficult to invest larger dollar amounts reflective of their portfolio philosophy and guidelines. This behavior can be detrimental to the expected returns as the manager seeks investments outside their stated universe. Capacity-aware managers with a focused approach to specific asset classes are vigilant in recognizing and resisting the risk of style drift which can be harmful to fund returns. This pairing of capacity-awareness with a focused approach are attributes of managers we find very attractive. In our opinion, a manager who intimately understands a specific sector or asset class may be better equipped to select outperforming investments and avoid common pitfalls within that area of focus. Specialization can also enhance risk management as it allows for more effective risk assessment and diversification approaches tailored to that sector or asset class’s unique characteristics.

Properly Resourced

Finally, we seek investment firms who have properly built their investing infrastructure, analytics, and support to allow for an experienced team of professionals to execute the strategy. We seek to ensure the team has access to the pertinent tools (market data, databases, research reports, analytical tools, and yes, evolving AI solutions) to adequately source opportunities, monitor investments and make informed investment decisions. Whether the firm be a boutique asset manager or a large, multifaceted entity, we want to ensure the investment professionals are front and center and that the strategy is a focal point for the firm’s long-term strategic initiatives. As assets grow, investment managers need to scale their operations accordingly. At the end of the day, it is important for the firm to focus more on investing and less on marketing, because investment performance is the key component impacting our clients achieving their objectives.

Conclusion

Manager due diligence is not just about numbers on a page that AI can easily collect, sort, analyze and assign probabilities for expected outcomes. It is a multi-faceted discipline involving qualitative components we believe support repeatable alpha-generating characteristics of investment solutions. Following a rigorous, rules-based selection and monitoring process can help tilt the odds in one’s favor. No rational and self-reflecting investor expects to have a perfect selection record. What we seek to do is make decisions and follow steps that incrementally tilt the odds in our clients’ favor. It takes resolve to avoid chasing past performance, but it takes conviction to remain invested during challenging times. A few simple but effective qualitative aspects can help us in identifying successful strategies. While managers who flawlessly possess the four tenets are a rare breed, these qualitative factors allow us to efficiently guide the selection process in helping us spend as little time as possible on misaligned prospects. The value we strive to bring to the table, day in and day out, is the trust that a team of experts is working very diligently to answer the question, “Why would a client invest their money with us?”

© 2024 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.