What if I asserted that 2017 was a more “abnormal” year for stocks than 2018 (YTD)? Would that surprise you? Bear with me for a moment and consider this:

In 2017, the S&P 500 was up 21.83% and just about every market segment (size, style, geography) was up mid-teens or more. Both global stocks and the S&P 500 were higher in each individual month of the year for the first and only time in history. Volatility was abnormally low with the VIX averaging 11 for the year.

In 2018, the S&P 500 is down 9.6% or so, the VIX is averaging 16.3 and we are in the midst of a 15% plus correction (so far) in the S&P 500.

The long term average for the VIX is 19.4; one of the big themes of 2017 was how low volatility was. The S&P average annual return is approximately 10%. According to Yardeni Research (great stuff), equities experience a 10% or more correction once every two years.

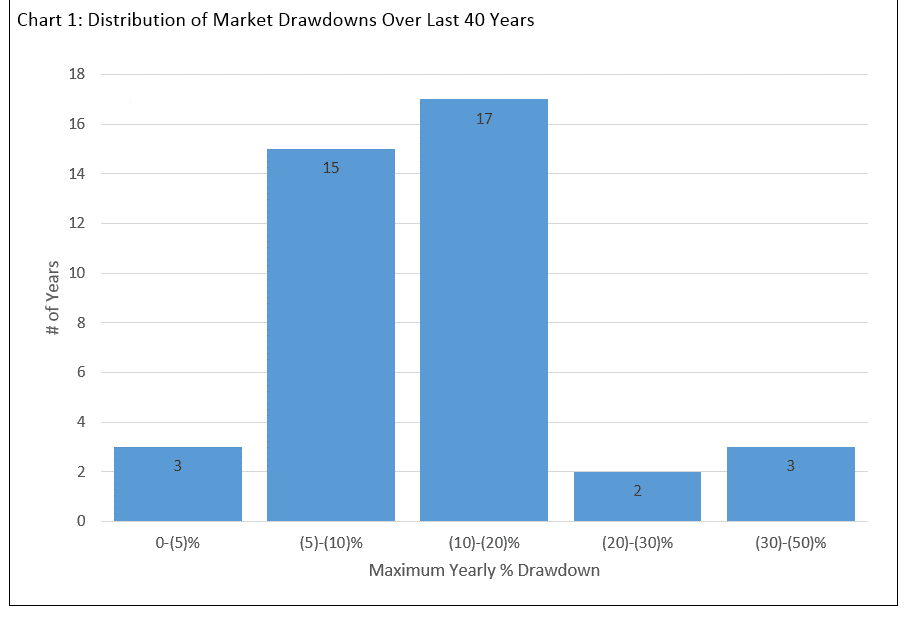

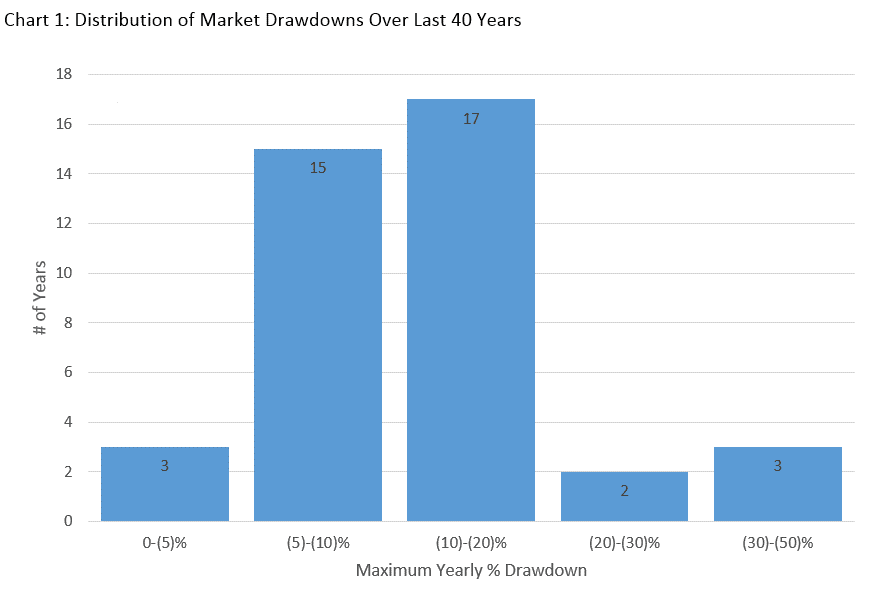

Below is a chart from Fact Set showing annual distribution of drawdowns over the past 40 years. As you can see, 10-20% drawdowns have happened 17-of-40 years (43%) and you hit more than 50% of the years if you add in larger drawdowns. The bottom line is that they happen. I suggest neither year (2017 nor 2018) has been normal, but 2017 was more of an aberration than this year.

Having said that, this year – and the end of it in particular – has not been fun. But as the data shows, these years happen, and in a relatively normal cycle. If you combine the two years (2017 and 2018) you get something that probably looks almost normal from a return and volatility perspective. Periods of corrections such as what we appear to be experiencing currently also tend to “reset” valuations, and I would argue they are healthy in the long run.

Sometimes we forget (particularly after multiple years of pretty good returns and below average volatility) that in order to capture the higher returns of the stock market you have to accept the higher volatility (risk) that comes with it. This year stinks and it’s understandable to be nervous after the 2008-09 experience. However, the economy is still in good shape and monetary policy is still pretty accommodative. I worry that with the lack of liquidity at year-end, this thing could get a little rougher. But unless everyone we talk to is missing something, we aren’t in recession, which is historically where the worst bear markets happen. I’m looking forward to turning the calendar to 2019 and putting this behind us.

Just a bit of food for thought on a Friday.

Happy holidays to all! As always, we are here to help with any questions.

Cheers,

Bill

Source: Fact Set

These materials were prepared for informational purposes only. Information has been obtained from a variety of sources believed to be reliable though not independently verified. This presentation does not represent a specific investment, tax or other recommendation or legal advice, and does not take into consideration your particular circumstances, financial or otherwise. Examples provided herein are for illustrative purposes only and do not represent actual or anticipated results. This is not an offer to sell or buy securities. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance.