Aoifinn Devitt – Chief Investment Officer

The 25 bps rate hike delivered yesterday by Fed Chairman Powell gave us some insight into the no-mans land that lies between a rock and a hard place.

This was where the Fed sat yesterday before its rate hike announcement. In the macro backdrop, inflation persisted – albeit having lost some of its steam – and job numbers as well as consumer spending all remained solid. Tech stocks were buoyed by bubbling excitement about Artificial Intelligence and new “flatter” structures (as touted by Mark Zuckerberg in his announcement of Meta’s “year of efficiency”) and remained resilient. This would have led to the expected 50 bps rate hike, had the environment not “changed, changed utterly” by the failure of SVB and Signature Bank, with mounting casualties elsewhere.

The Fed therefore sought to thread the needle by delivering the Goldilocks rate-hike – not too hot (50bps) to suggest they were ignorant of the jitters around bank safety but not so cold (0 bps) as to inject panic about a swift course reversal.

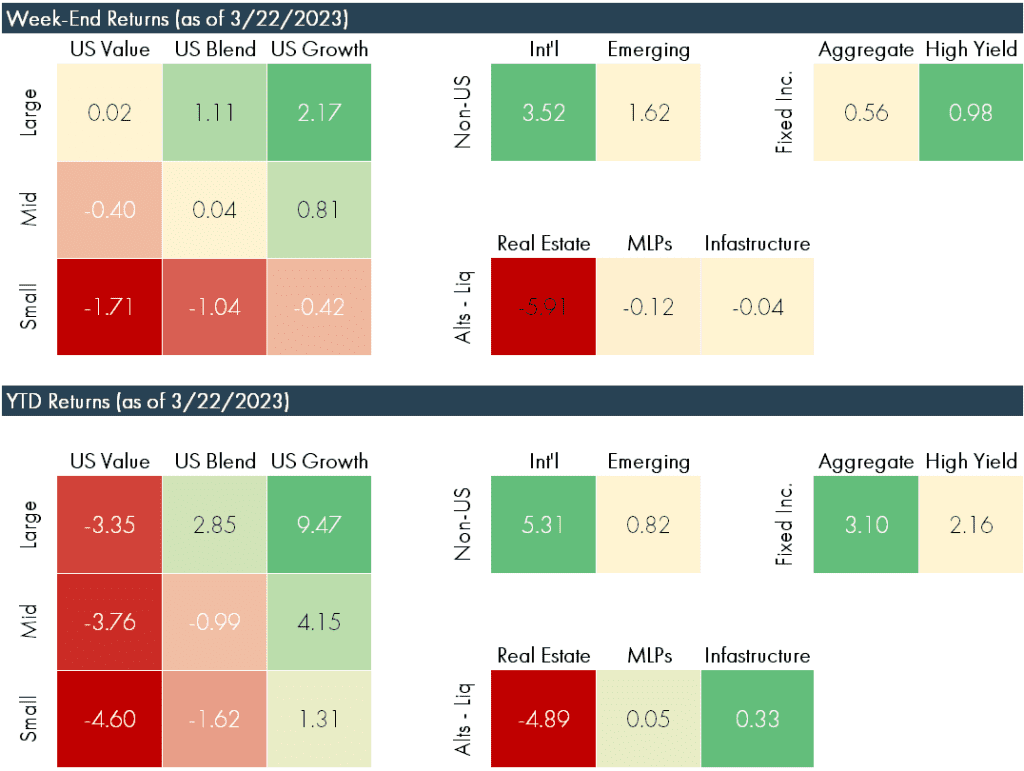

This “dovish” hike was accompanied by a nod to the growing uncertainty but a calm and measured tone. Clearly the desire was to stem panic at all costs and convey resolve yet sensitivity, and if market responses were anything to go by, the mission was accomplished. As can be seen below, markets overall have been quite resilient despite bank-induced turmoil – with the clear exception of financials:

Some of this recent leg down by financials was led by statements that suggested that Treasury Secretary Janet Yellen was non-committal about raising the $250,000 threshold for FDIC deposit insurance. This struck some as mixed messaging and if there is one thing that markets abhor today it is uncertainty around policy direction.

Unfortunately, the policy direction has already become muddied. The commitment by the Fed to extend emergency lending to banks was of a magnitude of balance sheet extension to essentially offset some of the monetary tightening in place since the current cycle began. On the other hand, if there is a wave of tightening in bank lending this may, in itself, provide the brake on the economy that the Fed is still seeking.

Uncertainty can also stoke a lack of confidence and trust, and the importance of trust – trust in banks, trust in regulators and trust that we can believe what we hear and what we read – is of critical importance to the type of “landing” that the economy is likely to see. This lack of trust – in fiat currency – has been manifest in the recent resurgence in Bitcoin, which has risen over 60% year to date, perhaps as a reaction to the jitters around bank deposits. Of course we do not know the breadth of the digital currency’s ownership, and it is likely that its price is being driven by a much narrower group of buyers today.

But this throws up another fascinating question as to trust in the characteristics of an asset – of its expected risk/reward and its speculative characteristics. Can we trust what we once thought? While Bitcoin has been (rightly) considered speculative and its behavior since demonstrated this, bank deposits were not. They cannot be considered speculative.

In a world which seems increasingly upside down, where yield curves are inverted, good news can be “bad” and bad news “good” – it is incumbent on regulators, management and industry participants to ensure our understanding of what is “safe” and assured can be trusted. It is essential to shore up confidence in the basic plumbing of our financial system. Otherwise we will find ourselves between a rock and a hard place.

Disclaimer

© 2023 Advisory services offered by Moneta Group Investment Advisors, LLC, (“MGIA”) an investment adviser registered with the Securities and Exchange Commission (“SEC”). MGIA is a wholly owned subsidiary of Moneta Group, LLC. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is not intended to be comprehensive or exclusive, and is based on materials deemed reliable, but the accuracy of which has not been verified.

Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. An index is an unmanaged portfolio of specified securities and does not reflect any initial or ongoing expenses nor can it be invested in directly. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.