By Bill Hornbarger, Chief Investment Officer at Moneta

“In a genuinely diversified portfolio, something is always ‘underperforming.’ That’s how you know you’re adequately diversified.” – Nick Murray

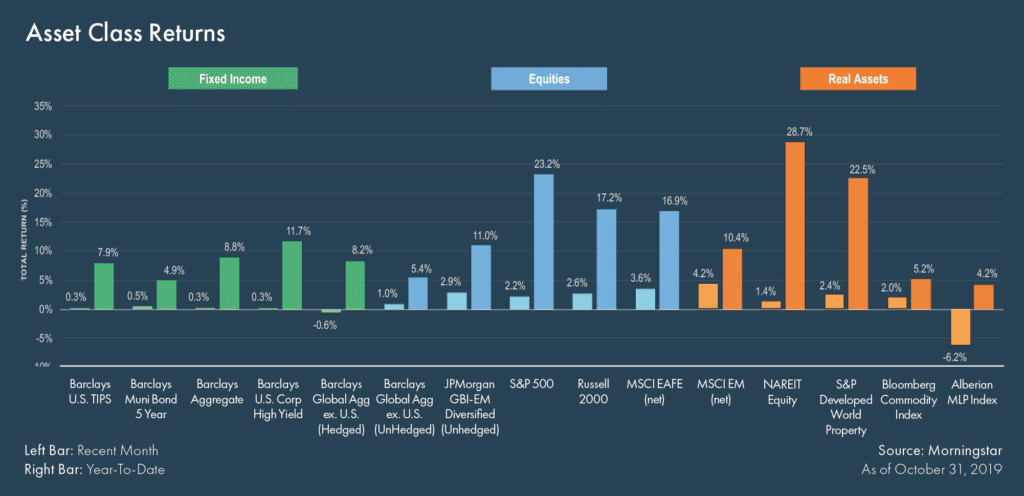

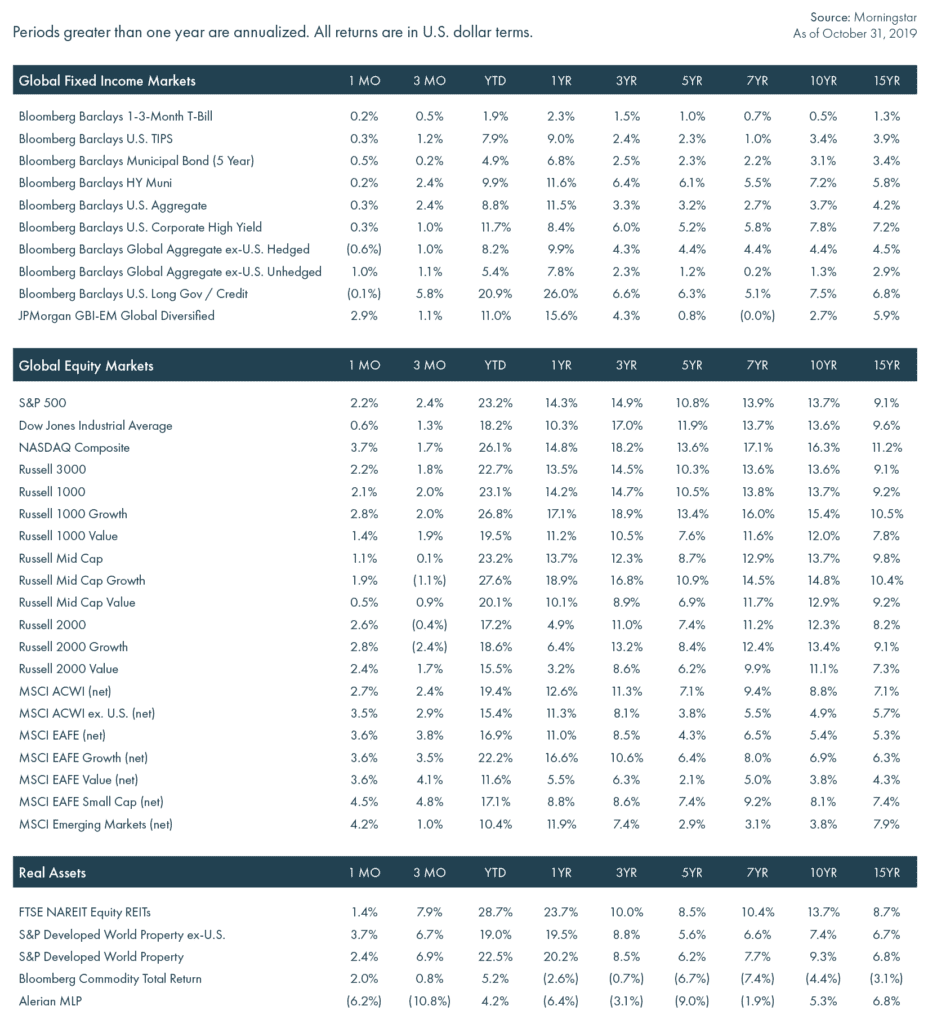

To date, 2019 has been a banner year for the financial markets. Through the end of October, all the asset classes we track boast positive returns, from cash to international and emerging market equities.

The markets steadily climbed through most of the year, although a few asset classes stalled in recent months, and even weakened in a couple of cases. Master Limited Partnerships (MLPs) struggled with three- and six-month returns of -10.76% and -9.62% respectively (through the end of October). This is consistent with the broader trend in anything energy related in the public markets seeing investor demand decrease in recent years.

MLP Funds Caught in Tug of War

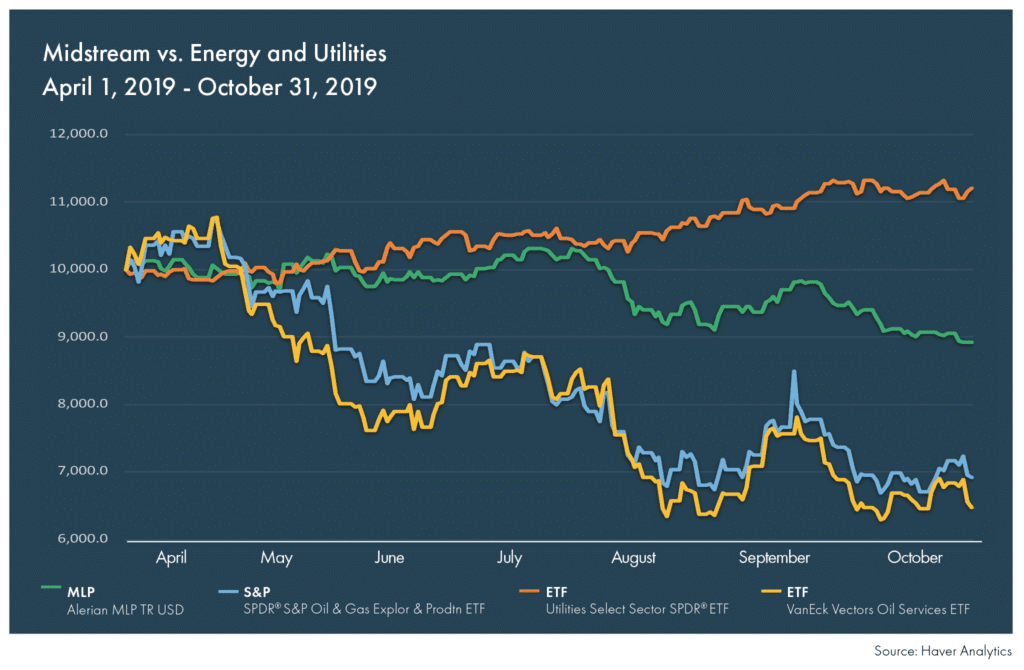

Moneta recommended Master Limited Partnership (MLP) managers invest in midstream assets that are involved in the transportation, storage and processing of natural resources (primarily crude oil and natural gas). Historically, these midstream assets have had business models that are more sensitive to energy volume than energy prices over the long term. Think of them as similar to a toll road with longterm contracts tied to the Consumer Price Index (CPI). Periodically, MLPs will trade with a high correlation to energy prices for a period.

MLPs exhibited strong performance through the first two quarters of the year. More recently, MLPs have been caught in a tug of war between utilities and energy (see chart). Generally, investment options with income components (bonds, equity dividend strategies, utility stocks) have been stronger, while MLPs have declined despite healthy distribution rates (in many cases >7%). After a strong first half of 2019, the shift occurred during the third quarter, catalyzed by the drone attack on Saudi oil fields. This was one of the largest disruptions the energy markets have experienced with the largest one-day move in the nearby Brent oil futures contract in history. In the immediate wake of the attack, consensus was that it would benefit U.S. energy. However, as Saudi production came back online quickly, energy prices declined below pre-attack levels.

October and November have also been difficult months for MLPs. Through mid-November, the Alerian MLP index has been down eight consecutive weeks, including 15 of the last 18. The more recent selling has been more technical in nature, with several factors standing out:

- Tax loss harvesting – MLPs are one of the very few asset classes where this is possible.

- Forced selling by closed end funds (CEFs) – CEFs are large holders of MLPs and must maintain strict leverage ratios, which are pressured when the underlying investments (in this case, MLP shares) decline.

- Momentum and poor investor sentiment surrounding the space.

- Heightened correlation to energy prices – Oil prices have stabilized in recent trading while MLPs have remained under pressure.

Potential Advantages

Despite the recent weakness and poor trailing returns, we remain positive on MLPs as a strategic, long-term holding. In an investing environment where most asset classes are fully valued, MLPs stand out for several reasons. The industry has undergone a restructuring/retrenching in recent years. Incentive Distribution Rights (IDRs) have been eliminated and balance sheets are stronger. Leverage levels continue to decline and distribution coverage ratios continue to rise, all positive for long-term stability of the asset class. Companies continue to see underlying cash flow growth and second quarter earnings (latest available) were 17% higher year over year. In the past, MLPs were managed to distribute a high level of cash, thus relying on the capital markets to fuel growth. Today, MLPs do not distribute as aggressively and they are able to self-fund projects.

Private equity has noticed the improving fundamentals and stronger balance sheets of the midstream MLP industry and has been active in the space. Private market prices are higher than those in the public market. Private equity is on pace to invest more than 2.5 times the capital in MLPs it did in 2018 and private transactions are happening at a roughly 25% premium to the public market. On a price to distributable cash flow basis (the MLP version of price to earnings ratio) MLPs are trading at levels approaching those of the Global Financial Crisis. Few, if any, other asset classes can make a similar claim.

The MLP industry has undergone significant changes in recent years, leaving it on stronger financial footing and with a much broader investor base as institutional investors have gravitated to the improving fundamentals. With attractive valuations, improving fundamentals and very attractive distribution levels, we remain positive on the asset class as part of diversified, strategically focused and allocated portfolios.

Given today’s valuations, an investor is able to have higher yield when compared to a few years ago even though the capital structure is

safer and the fundamentals are stronger.

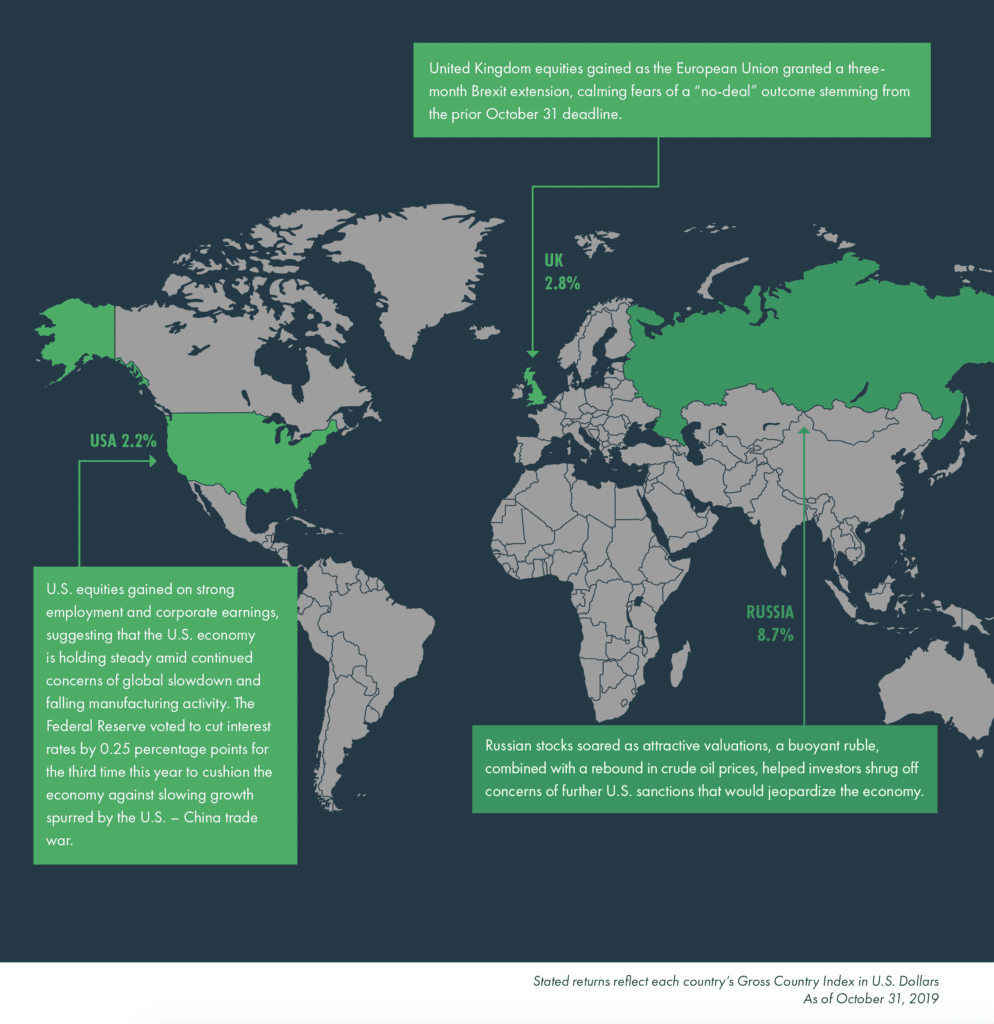

Global Highlights

Market Snapshot

Fixed Income

- U.S. Treasury yields rose marginally across longer maturities with the ten-year rate finishing at 1.69%. Shorter maturities fell, steepening the yield curve. Although yields at the close of the month modestly changed, volatility was significant with the 10-year rate exhibiting more than a 30 basis point range.

- Rising rates during the month muted domestic fixed income sector returns despite the U.S. Federal Reserve’s third rate cut since July.

- Unhedged international bonds outperformed hedged on U.S. dollar weakness. Emerging markets debt increased amid the risk-seeking environment.

Equities

- Domestic equities posted positive returns on strong corporate earnings and positive economic data.

- Growth broadly outperformed value during the month. Technology and health care led, while utilities, industrials and energy lagged.

- International equities advanced as a dovish European Central Bank and Brexit extension quelled investor anxiety. Emerging markets gained as investors sought risk assets.

Real Assets

- Commodity prices improved as precious metals rallied on expectations that the U.S. China trade war will continue beyond the 2020 election.

- Domestic and international REITs generated positive returns influenced by U.S. monetary easing and low interest rates globally.

- MLPs dragged sharply on interest rate volatility and general aversion to domestic energy stocks.

Financial Market Performance

© 2019 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise.