After a difficult and tumultuous end to 2018 for the markets, equities broadly rallied to start the New Year. The markets were buoyed by strong economic data at the beginning of the year, positive comments and developments related to trade and the temporary re-opening of the government.

2019 SO FAR

In 2019 through mid-February, the rebound in equities was broad-based with domestic stocks leading international stocks, small and mid-cap outperforming large cap and emerging markets leading international developed. By style, growth has outperformed value so far in 2019. As of February 11, 2019, the widely followed S&P 500 was up 8.32% vs. the long term (since 1926) annual average of 10.1%.

In more recent sessions, trading became choppier as the narrative changed slightly. Global macroeconomic worries increased related to the ramping up of U.S./China trade talks, the possibility of another government shutdown looming and some global data points leaning toward a global slowdown. The rhetoric from the Federal Reserve also changed in recent weeks, suggesting a change in direction away from tightening, at least for a period.

The concerns about slowing global growth are very visible when viewed through the prism of the bond market. After the latest increase in December, the Fed funds target range is 2.25% to 2.50%. The futures markets indicate that the market consensus currently is that the Federal Open Market Committee will leave rates unchanged for the balance of 2019. As recently as midDecember, 2018, futures were pricing additional rate increases this year.

In addition to the changes in the consensus view of monetary policy, global bond markets also reacted to concerns about the potential of slowing growth. The benchmark U.S. 10-year Treasury traded as high as 2.80% this year and more recently declined to the 2.65% area. Overseas, Japan and Switzerland 10-year government bonds have negative yields while German 10-year bunds also threatened to turn negative, trading recently at a paltry eight basis points. In the United States, the Treasury yield curve is inverted between one and five years – shorter bonds having higher yields.

THEMES TO WATCH IN 2019

After starting the year with a bang, recently the markets have been mixed and gains more grudgingly earned. Fourth quarter 2019 earnings are expected to be strong (double-digit gains), but the post-tax reform boost to the market is beginning to fade in Q1 of 2019.

Earnings growth is expected to be more moderate going forward. We expect downward revisions to be viewed as more likely than the opposite. We also anticipate guidance from management teams on sales and earnings more closely monitored.

U.S. interest rates are biased higher, but on a limited basis with the Fed signaling patience, the dollar “strong” and inflation seen as contained.

A U.S. recession is still seen as low probability in the next 12 to 18 months with economic activity, particularly employment, firm.

As we learned in late 2018, corrections and drawdowns are normal for the markets. For a correction to extend into something worse, investors would typically see a noticeable economic slowdown and/or other market-related issues. That does not appear to be the case currently.

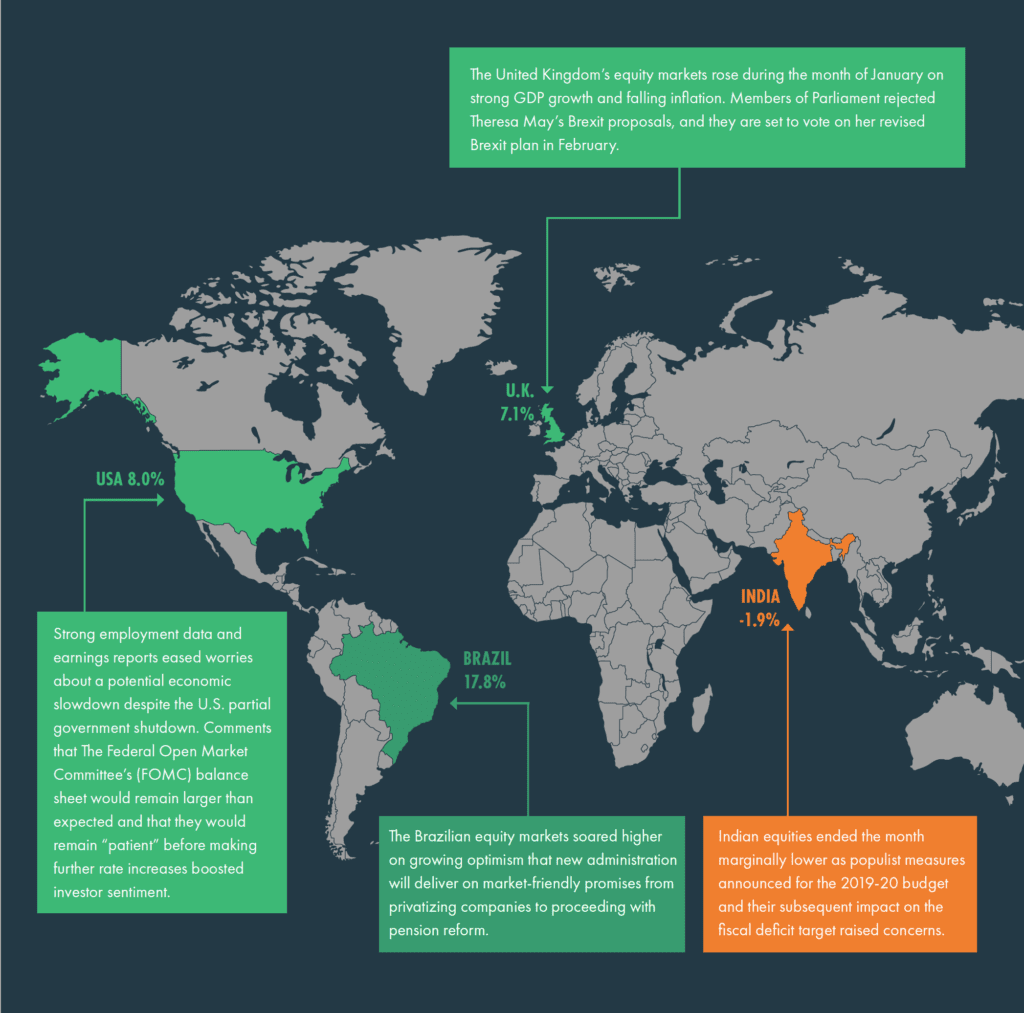

GLOBAL HIGHLIGHTS

MARKET SNAPSHOT

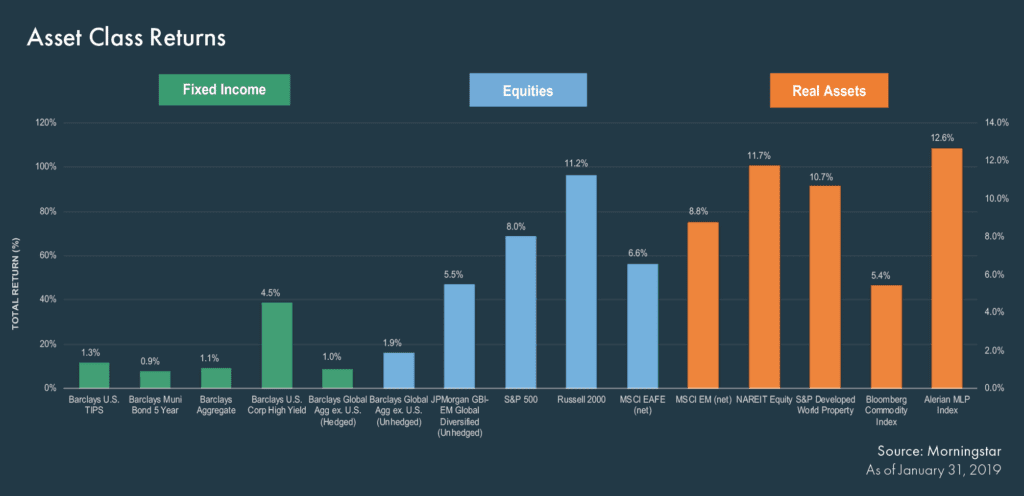

Fixed Income

◊ The 10-year U.S. Treasury yield ended flat for the month as investors closely watched developments in the partial government shutdown and U.S.-China trade relations.

◊ All fixed income sectors moved higher as spreads compressed along with falling benchmark yields.

◊ Emerging markets debt was the best performing fixed income sector with strong returns for both sovereign and corporate assets.

Equities

◊ U.S. equities started the year off positive on strong economic data, positive developments related to trade and a temporary re-opening of the government.

◊ Growth broadly outperformed value during the month. Communication Services, Consumer Discretionary, Energy, Financials, Industrials and Real Estate outperformed the broader index.

◊ Developed international equities rallied, but their advance was muted by weak regional data, an Italian recession and ongoing Brexit uncertainty.

Real Assets

◊ REITs benefitted from attractive valuations, falling rates and the “risk-on” sentiment across markets.

◊ Commodities were higher, driven by an increase in energy prices and industrial metals. They were subdued by a decrease in livestock.

◊ MLPs were the best performing asset class in January as tailwinds from higher oil prices boosted returns.

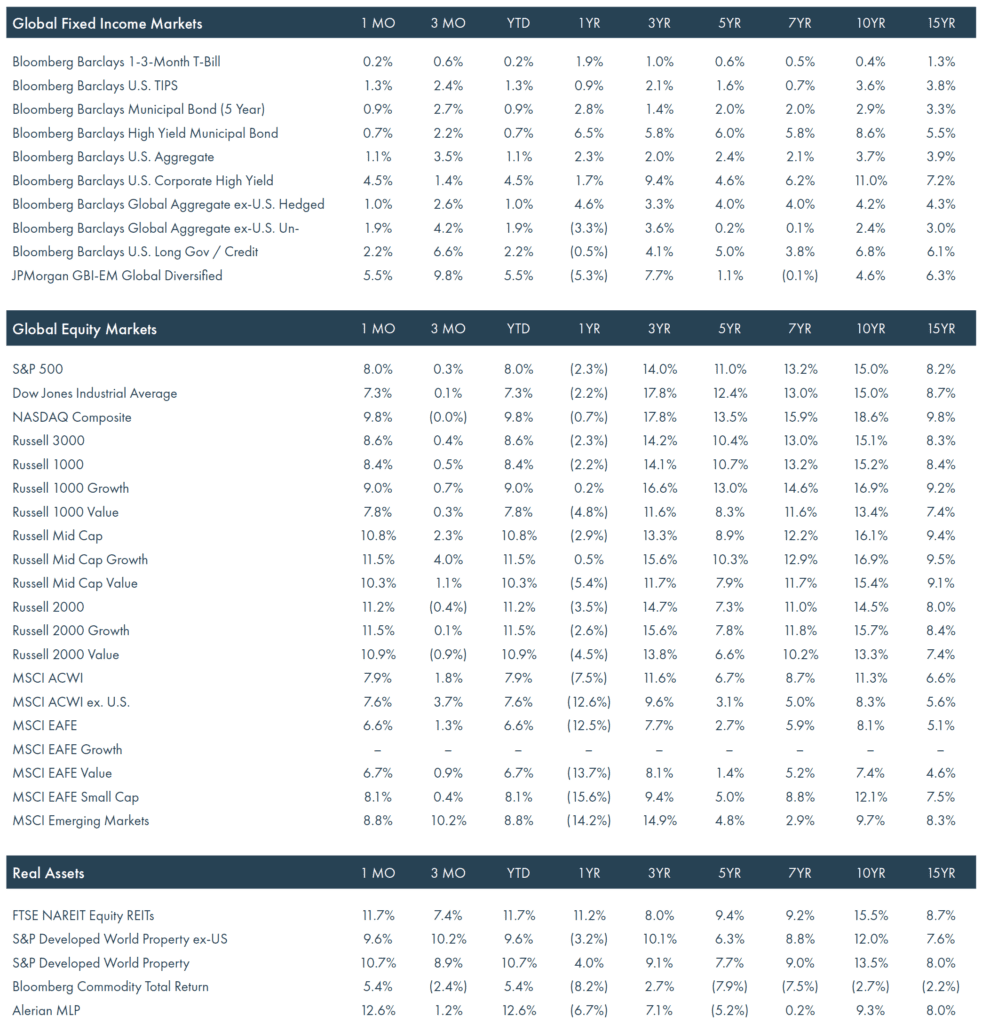

FINANCIAL MARKET PERFORMANCE

Periods greater than one year are annualized. All returns are in U.S. dollar terms

Source: Morningstar As of January 31, 2019

Bill Hornbarger | Chief Investment Officer

© 2019 Moneta Group Investment Advisors, LLC. All rights reserved. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.