Last week we saw small investors flex their collective muscle, starting 2021 with its own set of unprecedented story lines. Last week’s moves in a select set of heavily shorted stocks caused a stir on Wall Street, got the attention of the Securities and Exchange Commission (SEC) and left investors asking some questions.

What Happened?

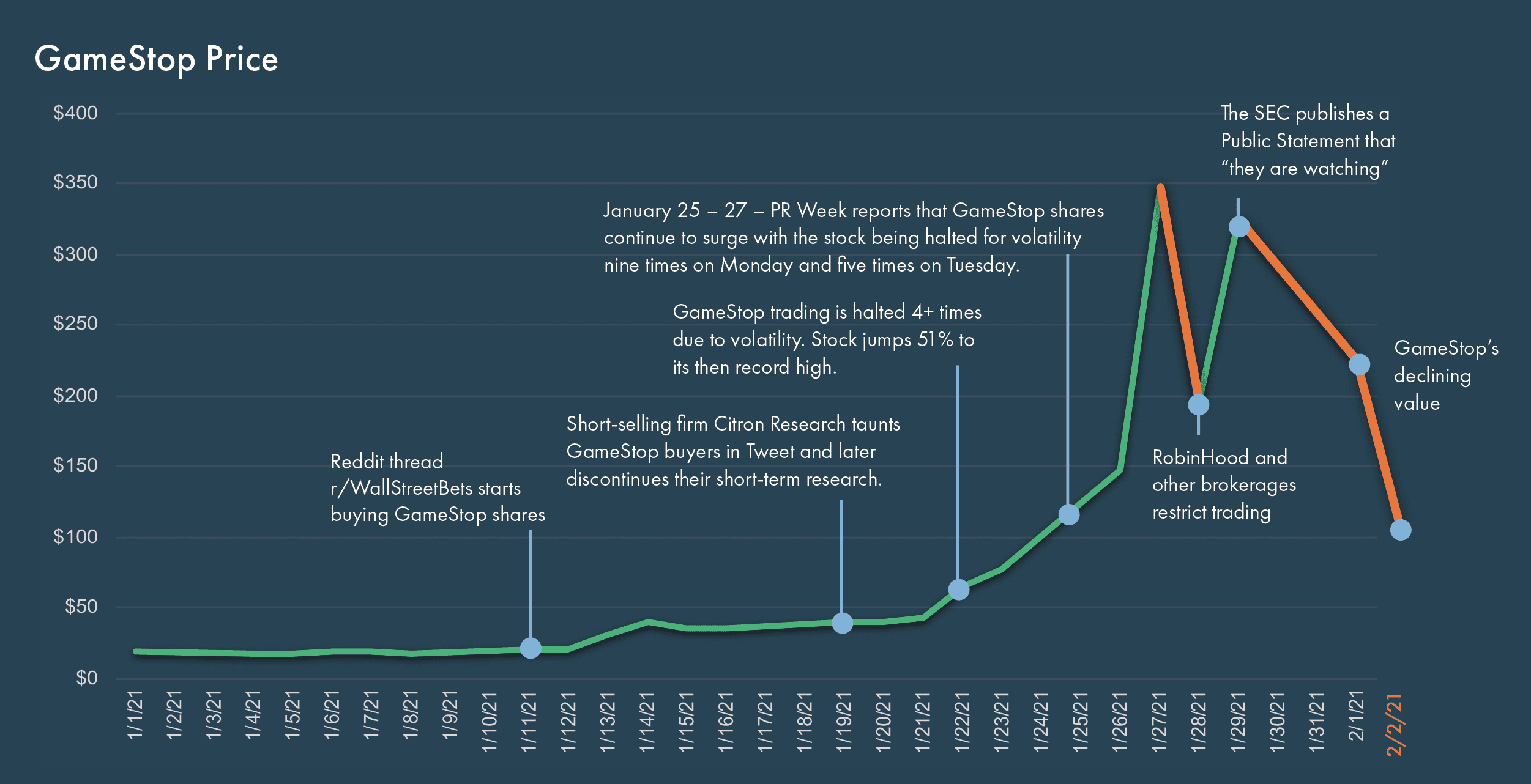

GameStop Corp., a brick-and-mortar retail store that specializes in video game sales, grabbed most of the media attention. Their share price surged 400% last week, bringing the stock’s year-to-date total return to 1,625%1. Other examples of large upward price adjustments were in shares of AMC Entertainment and KOSS Corp. AMC’s stock gained 277% last week while Koss’s gain was 1,816%2.

It is difficult to suggest that these sudden price moves were warranted with these stocks. Efficient Market Hypothesis (EMH) would assume that stocks always trade at their fair value. GameStop’s naming of Ryan Cohen to the board in early January and his expected impact to move the retailer online started what appears to be their process of moving toward true price discovery; however, subsequent events are what raised eyebrows.

GameStop Stock Growth 2021

How Did It Happen?

Social media and online chat groups empower people to connect quickly with others to mobilize action. Last week, users of the Reddit forum r/WallStreetBets attempted to beat hedge fund managers at their own game. GameStop is a stock that some hedge fund managers heavily betted upon losing value, known in the financial industry as “shorting a stock” – where hedge fund managers provide collateral to borrow shares of that stock, sell the borrowed shares for cash and wait for the price to fall so they can buy them back at a lower price. If a hedge fund manager’s borrowed shares increase in value instead of declining, they have to find more collateral to satisfy the lender. If they run out of collateral, or the lender runs out of patience, the fund must buy back those shares at the higher value and take a loss.

In this instance, the r/WallStreetBets-inspired buyers purchased GameStop stock en masse via the RobinHood investment app, hoping for one of two things to occur: either the actual fundamental value of these securities is realized to be at these new and higher levels, or the flow of demand from other new buyers behind them would continue to increase the stock’s value to their benefit.

This rise in GameStop’s value created a rush among hedge fund managers to buy back shares to limit their losses. Yet, this collective scramble to buy increased the upward pressure on the stock’s price – referred to as a “short squeeze.” Similar to turning up the flow of water through a garden hose and seeing the water shoot out further, the volume of buying in shorted stocks can overwhelm the diameter of the hose, shooting the water extremely high. This is what happened with GameStop, leading to collateral damage to Robinhood, which required a multi-billion dollar injection of cash, and direct damage to hedge funds caught on the wrong side of the short squeeze.

How Does It Impact Moneta Clients?

While not a major market driver, there could be side effects for the overall market in the short-term. Moneta Director of Investment Research, Luke Ferraro, CFA, said, “The forced buyers [the hedge funds] in these securities may need to raise cash elsewhere to fund their purchases. Some say this explains why the overall market traded lower last week. If leveraged buyers were forced to cover their bearish bets, they may have had to sell some of their more well-known stocks.”

Liquidity driven moves in the market could work in long-term investors’ favor. We witnessed last March how an overwhelming amount of sell orders can drive securities down in a short period of time. For an individual who is cash short and needs to transact in such a market, finding liquidity can be a struggle and costly as they are forced to sell at disadvantaged prices. One needs only to think about the individuals who are forced to buy GameStop at these levels. But for the long-term investor, who provides liquidity in the market, the dramatic moves in the market may present the opportunity to rebalance their portfolios at more advantageous prices.

Can it Happen Again?

Moneta Investment Consultant, Chris Kamykowski, CFA, said, “Short squeezes happen and will continue to, but I would not expect it to occur again in the same way. Ultimately, the market is largely efficient and will course correct.”

While we expect periods of elevated volatility such as this in 2021, we continue to have a positive outlook for the economy and believe our portfolios continue to be well-positioned to balance risk and return while navigating the continued economic recovery from the pandemic.

What’s Next?

The funny thing is that even as dramatically and rapidly as the stock and story took off, we are already seeing an unwinding as GameStop and other stocks caught in the recent upward vortex, now fall from their commanding heights from only a short few days ago.

What is certain to linger are many unanswered questions about who, what, why and how all this happened, which will certainly be around longer than the lifetime of this event (though the lingering effects of the event may be seen for quite some time).

It’s too soon to know the long-term impact for sure. There is a high probability that litigation will follow, demands for accountability and regulatory changes will arise, and a few investment firms may close shop.

Kamykowski said, “At the end of the day, fundamentals matter. While the market’s response to this event is evolving, the events have limited, if any, impact on the fundamental drivers of the economy. We still have more vaccines on the way; improving distribution and administering of said vaccines; a successful transfer of power complete; continued monetary policy support; and additional economic stimulus likely on the way. We’re still moving along a solid trajectory and getting back to a new ‘normal.’ None of that has changed because of the drama seen over the last couple weeks between retail investors and professional investors. Remaining diversified in your investments, aligning your portfolio to your objectives, and focusing on the long-term still remain key considerations even as events like this catch the attention of markets.”

Your Moneta investment team will continue to closely monitor the events and their impact. Please speak with your Advisor about your specific portfolio.

[1] https://www.bloomberg.com/news/articles/2021-01-29/historic-week-for-gamestop-ends-with-400-rally-as-shorts-yield

[2] https://www.marketwatch.com/story/dow-futures-rise-250-points-as-the-stock-market-tries-to-shake-gamestop-angst-11612182450

©2021, Moneta Group Investment Advisors, LLC. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Given the dynamic nature of the subject matter and the environment in which these materials were prepared, they are subject to change as additional information comes forth. Past performance is not indicative of future returns. You cannot invest directly in an index. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision.