As of the close of the third quarter 2018, the S&P 500 index (U.S. Large Cap equities) continued to show dominance over international equity peers. In fact, over the past 10 years, the S&P 500 index outperformed the MSCI ACWI ex USA index (international equities) in 70% of the calendar years and by 6.2% annualized, the widest margin in the last 20 years (1). So the question investors are rightly asking is, “Will the U.S. equity freight train ever stop?”

The Elephant in the Room

We do not often look to past returns to build future forecasts, though it can be a helpful exercise to provide a reasonable baseline when setting future expectations.

Today, we are sitting atop the most outsized 10-year return period of domestic vs. international equities over the last 20 years. How do we use history to take stock in that fact and to set a foundation for future expectations?

First, let’s start with the elephant in the room: do U.S. equities ever underperform? This is a comical question to some, but when you look back over recent years, the anecdotal evidence suggests they do not.

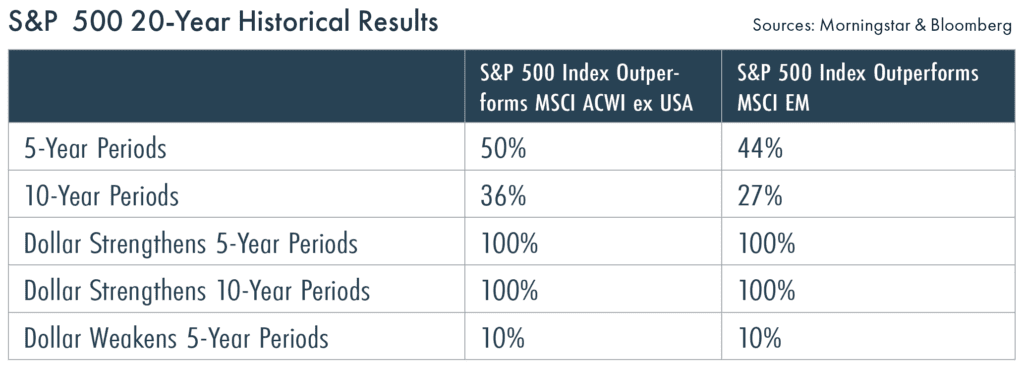

To limit the bias of our starting point and short-term market swings, we evaluated various rolling periods over the last 20 years. That means we look back in time and evaluate longer trailing return periods such as five or 10 years, rather than just a single calendar year.

Unlike what the last few years lead us to believe, U.S. equity markets do go through periods of underperformance. In fact, the U.S. underperformed both the MSCI ACWI ex USA and MSCI Emerging Markets indexes half the time or more over the last 20 years on a rolling 5- and 10-year basis.

There are many components to return, such as dividends, valuation and earnings growth. However, when it comes to U.S. versus international markets, currency can play an important role.

To that end, we evaluated returns over periods of U.S. dollar strength and U.S. dollar weakness. In 100% of the trailing periods since 1998, when the U.S. dollar strengthened, the U.S. equity market also outperformed (2). Conversely, there are similarly strong statistics for U.S. equities underperforming when the dollar weakened.

So if U.S. equities do not consistently stack up as well as you expect over the long-term, why have they performed so well since the financial crisis?

The Modern Regime

The global financial crisis changed many things, but one of the unintended results was the U.S. market becoming the darling of the globe. Faster and more aggressive responses to the financial crisis coupled with headwinds unique to international markets – like the Greek debt crisis, “Brexit” or political unrest – put domestic markets ahead of global peers.

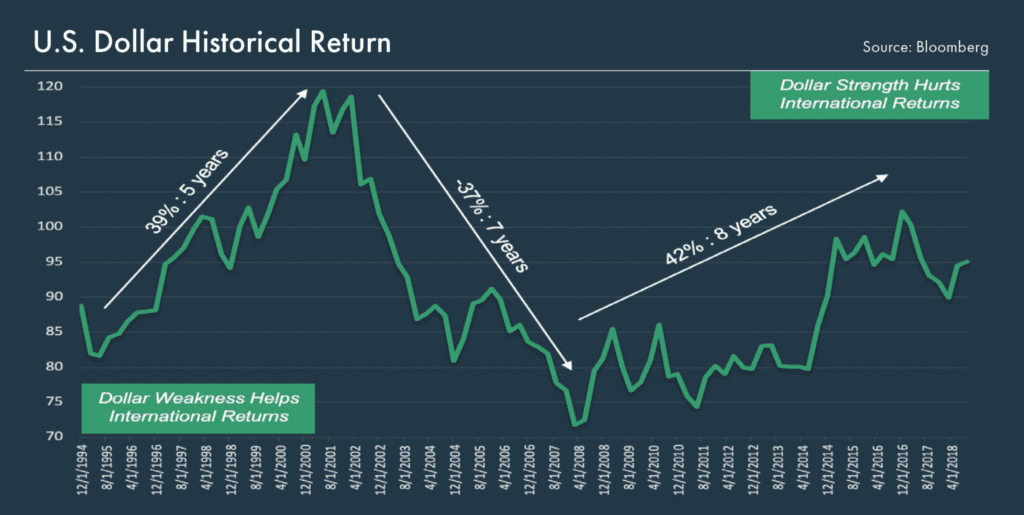

These factors also created a strong tailwind behind the U.S. dollar. Since the beginning of 2008, from trough to peak, the U.S. dollar strengthened by 42%, its longest and largest period of appreciation since June 1995 when the U.S dollar rallied a similar magnitude of 39% before falling 37% over the subsequent years (2).

As you can see from the chart below, the U.S. dollar tends to go through prolonged periods of strength and weakness. As the U.S. dollar strengthens, that typically detracts from international asset returns; conversely, as the U.S. dollar weakens, it adds to international asset returns.

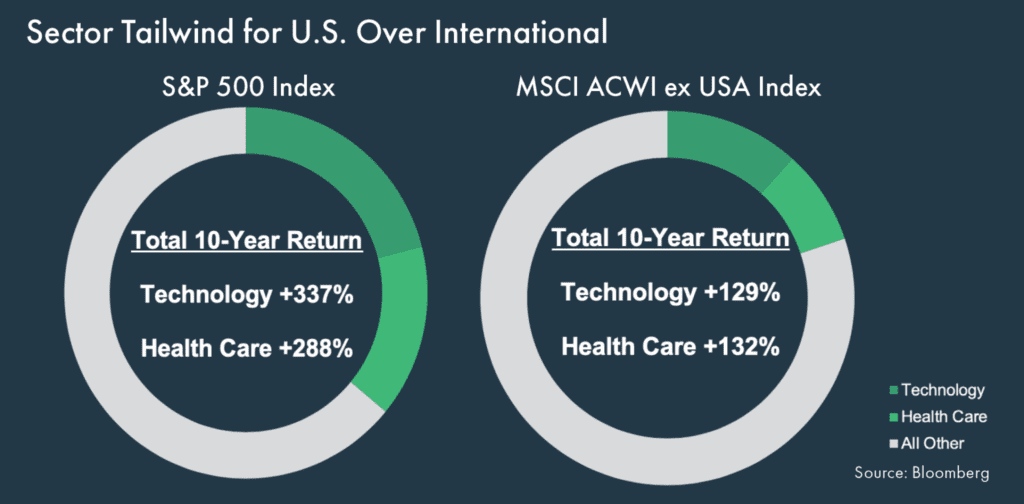

In addition to the strength of the U.S. dollar helping domestic markets, the sectors that led the way since the financial crisis made a much greater impact in the U.S. than outside its borders.

Technology and health care became leading sectors since the financial crisis and contributed meaningfully to return. The U.S. has more exposure to these sectors, and there has been a divergence in success between each sector over the last 10 years.

U.S. technology returns outperformed their global peers by a factor of 2.6x (2). While the above total returns include the effect of a stronger U.S. dollar over the last 10 years, domestic sectors still produced outsized return premiums above their foreign peers.

So where do we go from here?

Outlook

First, let’s cover the basics of why to own any assets outside of the U.S.

The U.S. makes up 52% of the global market and only 24% of global GDP (3, 4). A portfolio without international allocations ignores much of the opportunity set and the vast majority of the global economy.

Allocations to international markets reduce the reliance on a single country to provide return. They have the potential to lower overall portfolio risk while increasing return.

But why now?

Valuation – Our allocation philosophy is rooted in the long-term. It focuses on finding relative opportunities. We seek these opportunities on a forward-looking basis where a dollar invested offers as much value as possible and with the highest probability of success.

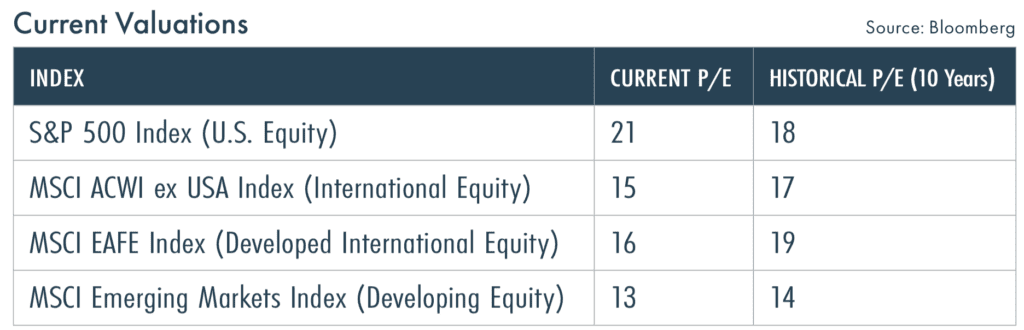

Today, valuations are lower outside of the U.S. It is where we see the greatest opportunity going forward. Current domestic valuations sit above long-term averages and above international peers, while the opposite scenario exists outside of the U.S.

We broke down the MSCI ACWI ex USA, which includes 22 developed countries and 24 emerging market countries, into developed and developing country indexes to demonstrate that lower valuations are not occurring because of one particular region. Both the MSCI EAFE (developed international equity) and the MSCI Emerging Markets (developing equity) exhibit more favorable valuations.

Additionally, we don’t only care about the absolute valuations, but also the differences in valuation between regions when allocating capital.

Today, the S&P 500 Index trades at a 43% price-to-earnings premium compared to the MSCI ACWI ex USA, the largest premium since 1997 (2). The last time such a premium existed, we observed a reversal where domestic markets fell behind as international markets outperformed by 4.2% annualized over the next 10- year period (1).

Currency – “Trees don’t grow to the sky” is a proverb communicating natural limits to growth. We do not expect the recent strength of the U.S. dollar to continue indefinitely for the following three reasons: interest rate differentials, deficits and policy.

Interest rate differentials, an important component of currency returns, are likely to moderate as the U.S. finds a natural top to rates or the rest of the world responds to higher growth by raising their interest rates to keep inflation in line.

The next factor is deficits. The U.S. currently runs a trade deficit of 2.5% and a budget deficit of 3.5%, which weigh on the strength of the U.S. dollar (2) over the long term.

Lastly, the current administration signaled interest in a weaker dollar, favoring the potential for export growth rather than showing concern for inflation on imported goods. This also weighs on the potential for U.S. dollar strength.

While none of these factors change the value of the U.S. dollar overnight, they do leave clues to the currency’s long-term direction, which we believe is more likely to be lower.

1) Morningstar, 2) Bloomberg, 3) MSCI, 4) International Momentary Fund (IMF)

© 2019 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise.