Earlier this week we saw record-high closes for the NASDAQ and the S&P 500. Some people might be asking, “Where do we go from here?”

The short answer is that no one knows, but we do know equities have created wealth and outpaced inflation over long periods of time. Up to Tuesday’s record close, the S&P 500 has always managed to eclipse the previous high-water mark.

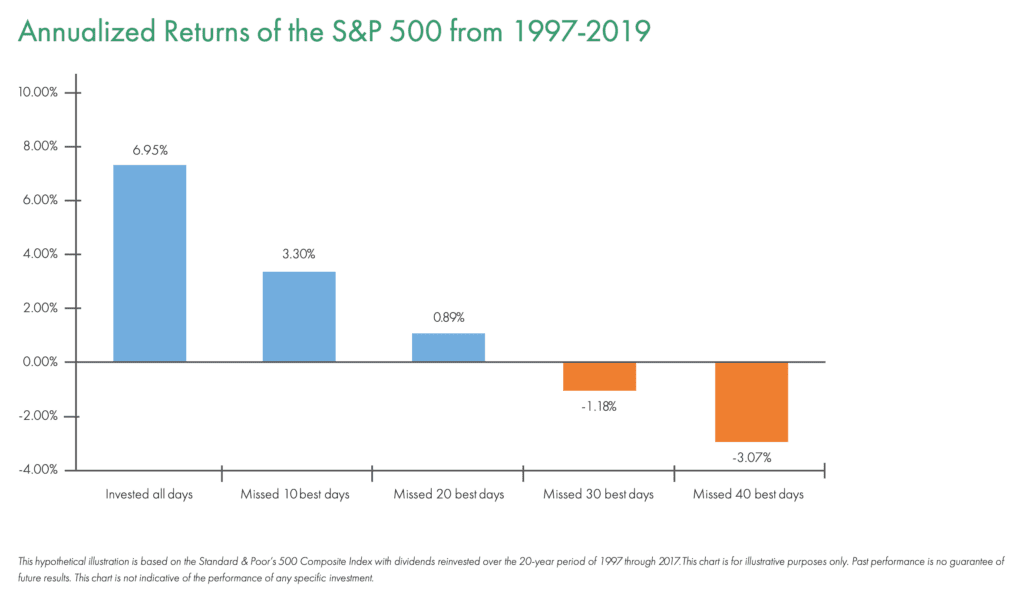

Here is a simple reminder of the perils of being out of the market. Most of us have probably seen some variation of this chart at one time or another.

Taking profits with the idea of getting back in at an opportune time requires two correct decisions: when to get out and when to get back in.

A better use of time is thinking about risk in the context of asset allocation. A moderate or an aggressive investor should be a moderate or aggressive investor regardless of what the market is doing. Identifying how much risk one is willing to take is the most important investment decision.

© 2019 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise.