By Luke Ferraro, Director of Investment Research

Many factors influence market returns: the economy, interest rates, business decisions, technology, worker productivity, sentiment and population growth – just to name a few. It is unfathomable to accurately predict all these factors with consistency, yet many market prognosticators will try again and again.

If anything is learned from 2020, one would hope a little humbleness has been accepted by investors. Early predictions for 2020 market returns would likely have centered around wholesale market carnage if one had known about the impending global pandemic, government-induced recession, swiftest equity market drawdown, increased social divisions and unending political strife. However, now given the benefit of hindsight, we can see predictions based on fears do not make for a robust investment regimen as fears do not always correlate to market returns.

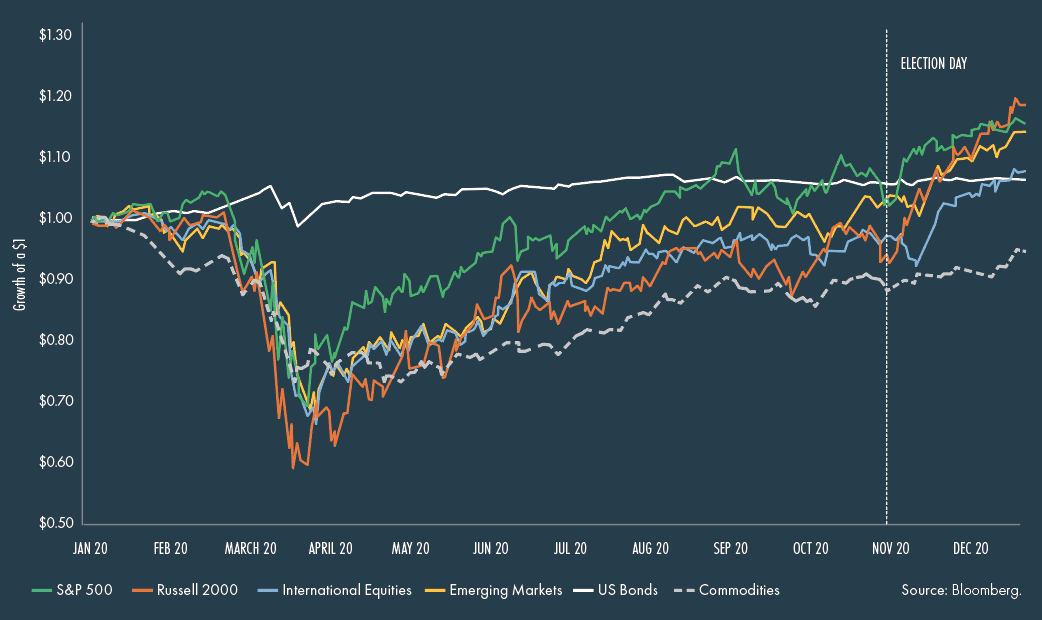

As one looks at the last 12 months of market performance, the pace and depth of the market decline are clear. What is also obvious is the amazing recovery that took hold.

For a while, the market leaders tended to be those that would benefit from a post-COVID world, such as ones with growth prospects (technology companies and online consumer services). Others with a more uncertain outlook, such as small businesses and energy, faced a slower recovery of valuations as the market contended with fears over COVID, lockdowns and the upcoming US elections. Yet, as noted, fear-based investing can lead one astray from a long-term plan.

As the early November election wrapped up and vaccines for COVID received approvals, the market’s optimism turned on a dime. Suddenly, the outlook grew brighter and those sectors that had meandered along through the market recovery took the lead. Year-end then became something much less feared and returns finished on a high note, helping to dissipate the concerns that once overwhelmed 2020 market predictions.

As we enter 2021, a new set of fears arrive: the logistics and execution of the vaccine rollout, stimulus from monetary and fiscal policies and their lasting impact on the national debt and continued political and social fragmentation – to name a few.

As investors, we must guard against overreaction to fears. Willfully seeking to avoid one particular risk can inadvertently introduce risks we never intended. For example, concern over equity valuations may force one into the safety of fixed income, but now the risk of outliving one’s assets increases.

In the end, staying diversified with your financial assets remains the best way to protect against a variety of risks, especially the ones informed only by fear.

Look Ahead: Investment Themes for 2021

For all the continued fears one may perceive in 2021, we see market conditions and economic growth primed for growth and further recovery given the continued monetary support, expected fiscal impulse and improvement in vaccine distribution. As we highlight below, we are encouraged by the increasing breadth of asset class returns witnessed in the fourth quarter of 2020; this may suggest a start to a broader and more sustained increase in global economic growth.

A few themes we believe will impact markets are:

1. The Pandemic’s Wake

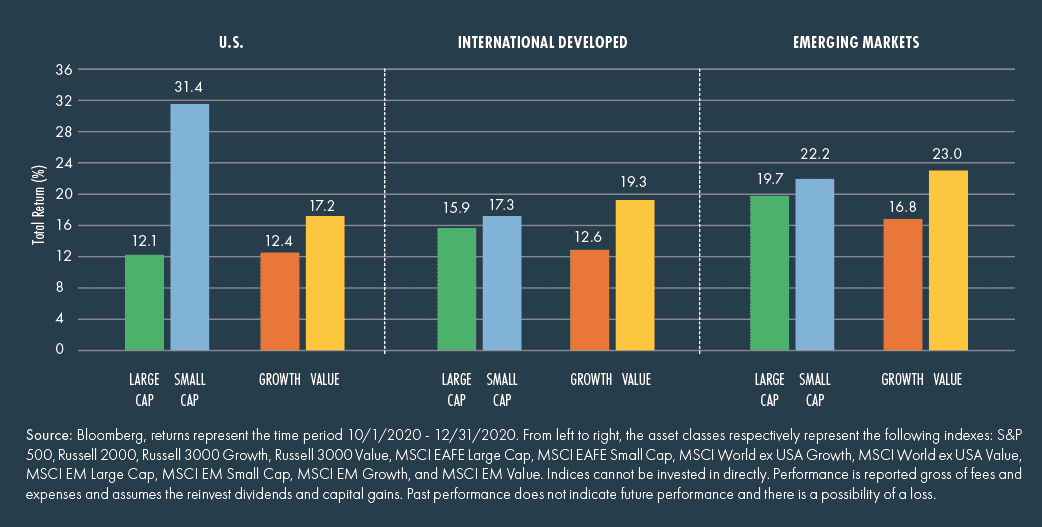

COVID-19 vaccine development and distribution efforts, once they fully take hold, boost the likelihood of harmonized economic growth normalization in 2021. Importantly, there is ample historical evidence that as the economy gains its footing and generates momentum, this positively impacts a broader set of asset classes. As highlighted below, activity in the markets in the fourth quarter of 2020 may offer a first hint for this potential moving forward.

Small cap and value-orientated equities produced substantial returns in the fourth quarter, improving market breadth heading into 2021.

2. Navigating a Low-Interest Rate Environment

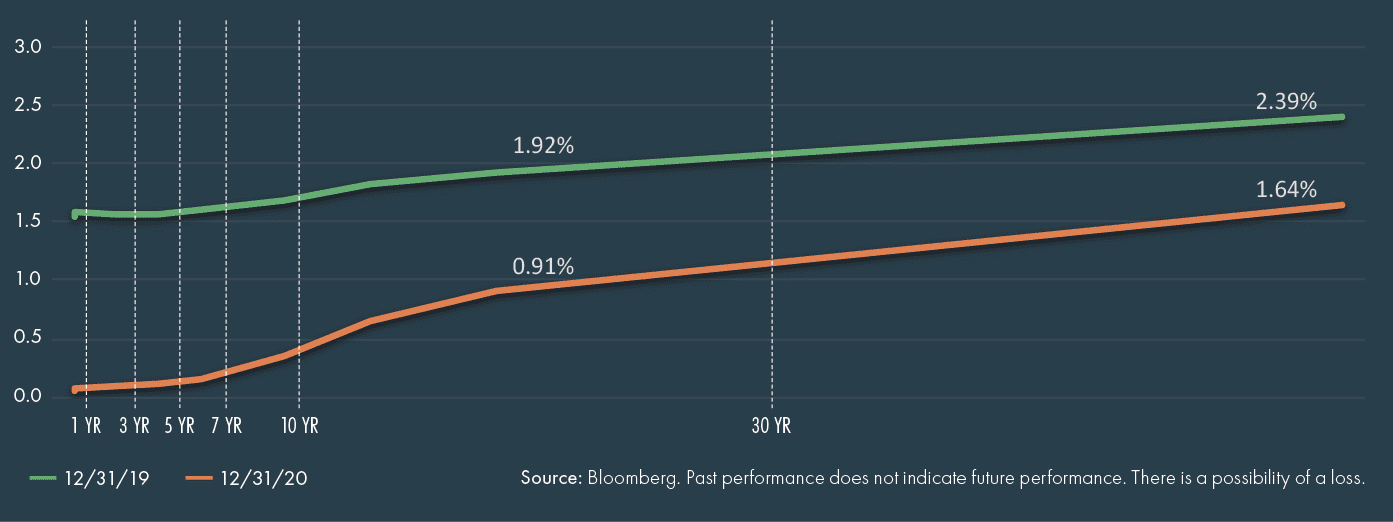

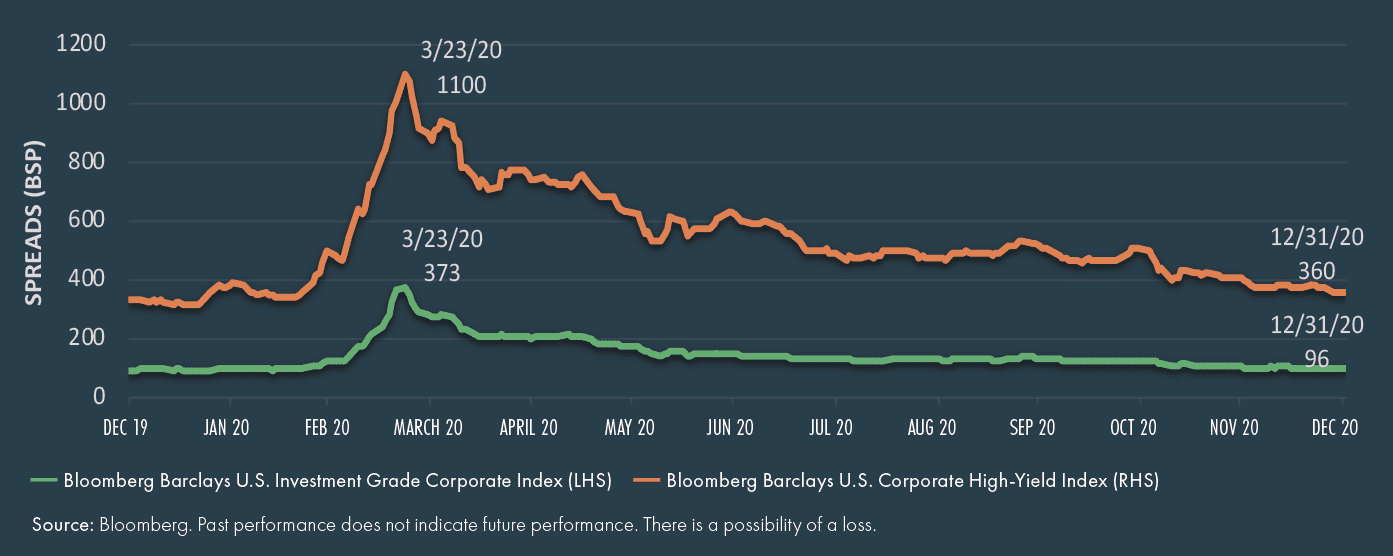

Monetary support across the globe continues to be extremely accommodative and warranted given the magnitude of the impact of COVID-19 on economic activity and functionality of the global financial markets. However, given monetary policy support typically leans on low interest rates, we now face a diminished return expectation across fixed income asset classes.

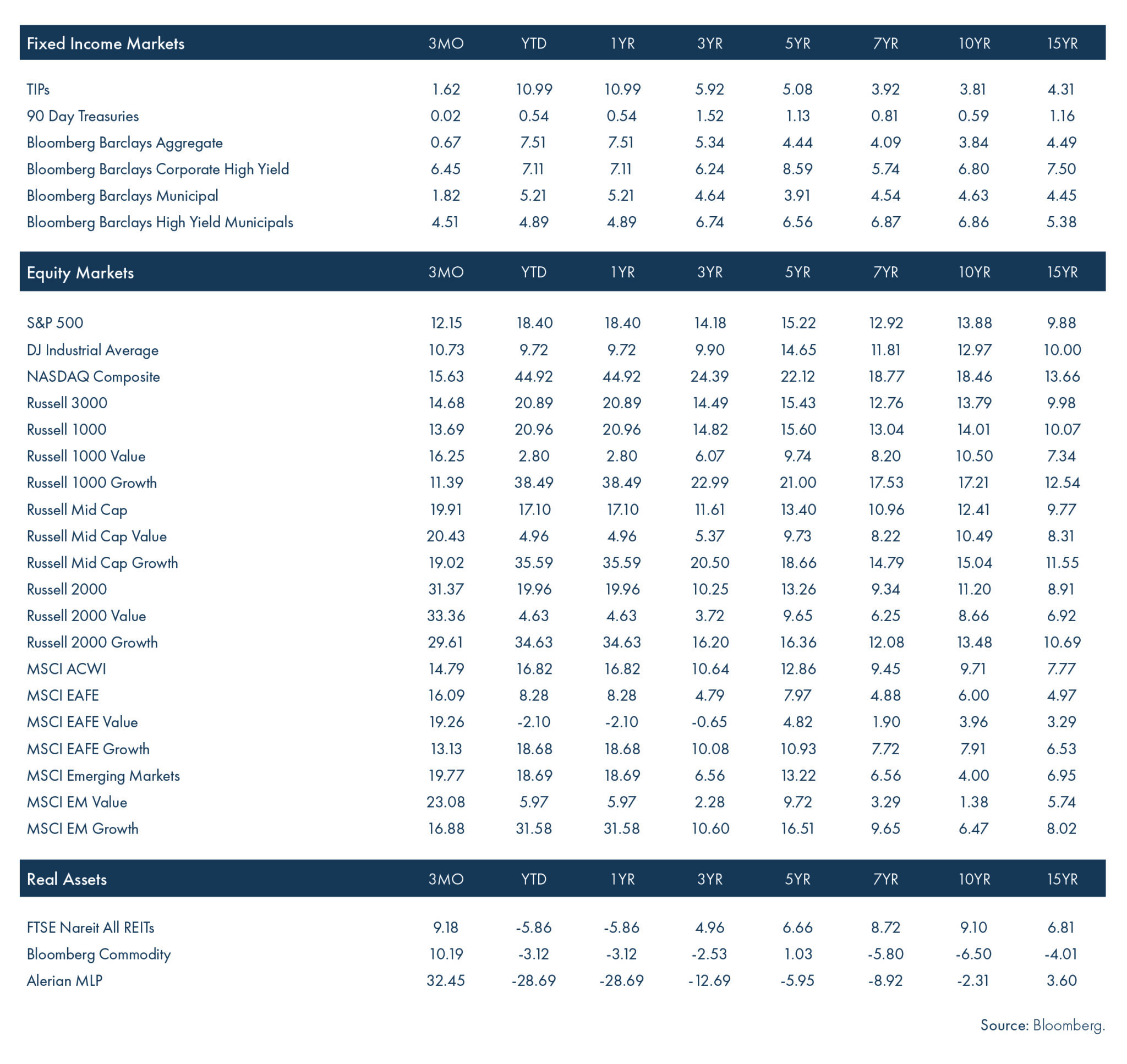

Low-interest rates and tight credit spreads portend lower forward-looking returns in traditional fixed income.

Historically low interest rates, uneven global economic recovery and the potential for modest inflation volatility require attention to one’s fixed income allocation as 2021 begins. Investors may want to consider adding or increasing their exposure to high-yield funds in addition to maintaining a bond ladder with maturities in the 7- to 10-year range. While difficult, we recommend resisting the urge to stay ultra-short where the Fed has pledged to keep yields at or near zero until 2023.

3. International Equity Exposure

Lockdowns to slow the spread of COVID-19 introduced an unexpected catalyst for increased demand for productivity and entertainment solutions. The domestic technology sector subsequently benefited immensely with significant earnings growth and returns in 2020.

However, as we look into 2021 and see the potential for economic growth and broader asset class participation, companies hit hardest by the pandemic could experience dramatic earnings growth in 2021, which could drive higher returns for equity sectors and investment styles that lagged in 2020. One only has to look at how small cap and value equities performed in November and December last year to see this theme in effect. The same can be said for international and emerging equity markets, which produced advantageous returns as 2020 ended.

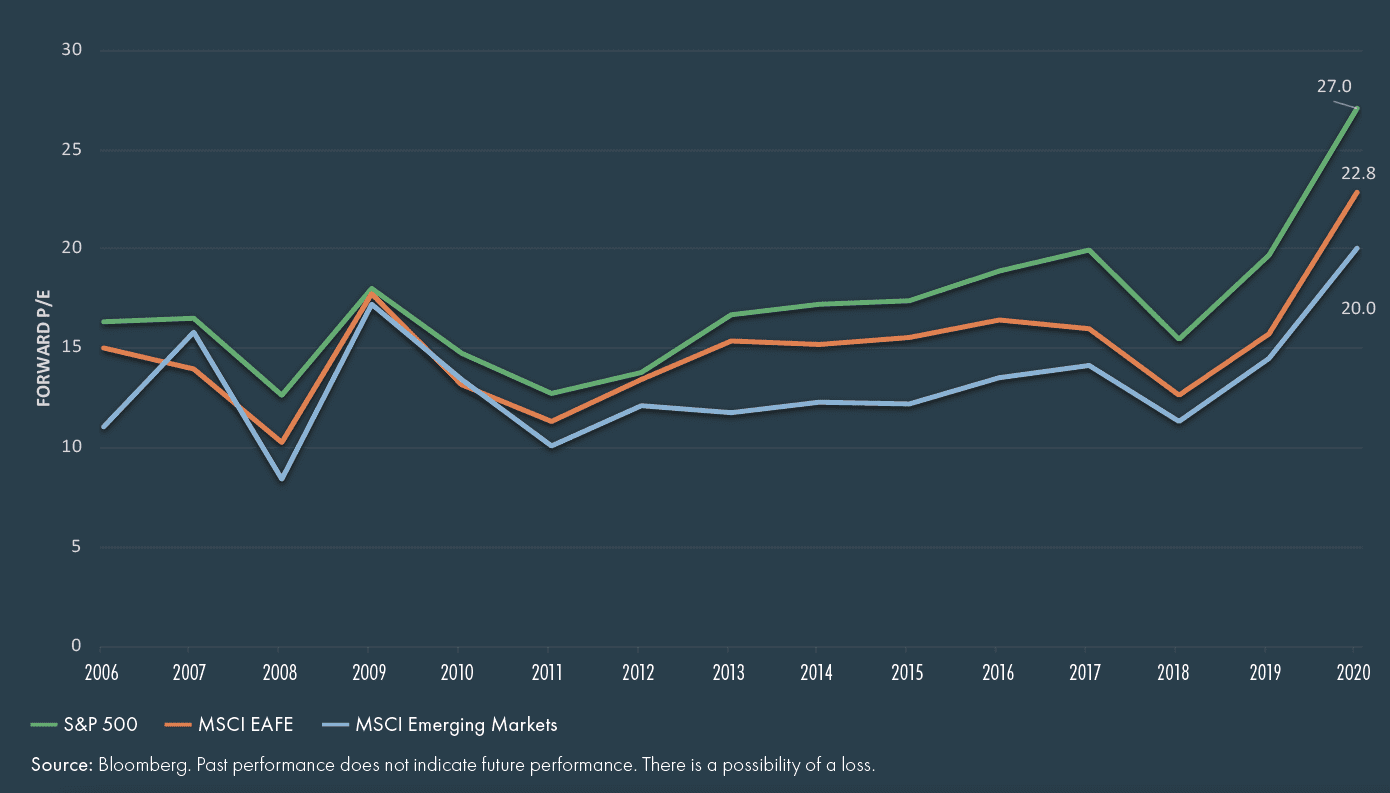

Relatively more attractive international valuations and the prospects of further U.S. dollar weakness support the prospects of international and emerging market equities.

A global economic recovery, prospects for further weakness in the U.S. dollar and stability within the commodity prices provide additional reasonings for improved prospects for international developed and emerging market equities. As highlighted above, relative valuation advantages persist across wide swaths of equity markets overseas, and the underlying composition of many of these markets sets them up to benefit in a prolonged global economic recovery.

Outlook Summary

As 2020 ended, the prospects for a broader economic reopening foreshadowed the benefits of portfolio diversification. Economic sectors and equity styles that lagged earlier in the recovery, such as small cap, value and international stocks, produced substantial returns in the last two months of the calendar year. The foundation for a continuation of this trend appears to be in place, although the path will be riddled with volatility as economic activity improves. As usual, portfolio diversification will still be key to helping portfolios achieve their investment objectives.

©2021, Moneta Group Investment Advisors, LLC. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. You cannot invest directly in an index. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.