Aoifinn Devitt | Chief Investment Officer

As we write, markets are in the middle of a broad-based retreat, and this week started with the worst day in global markets since 2020. While technology and high growth sectors have been in the crosshairs of investor disdain all year, the current equity sell-off has been indiscriminate, and has included the energy sector. Ongoing stringent Covid lockdowns in China and faltering economic growth have sparked concerns of a more severe global slowdown, causing the price of oil to falter (as we write it is at $106, down 6% on the day.)

Investors are grappling with a chaos of concerns, which today include the highest inflation in years, rising interest rates, supply chain restrictions driving higher prices and constraining demand, tech stocks past their pandemic peaks, geopolitical turmoil, and the uncertain legacy of Covid and its variants.

While that list of woes is not exhaustive, dealing with them is certainly exhausting, and investors fled stocks, bonds, and risk assets as sentiment turned decidedly more sour since the Fed meeting of last week. Commentators spoke of “capitulation” and “throwing in the towel” while the market conditions were likened to the “sum of all our fears.” Markets have been markedly more volatile and fragile since the end of 2021, when, it should be remembered, markets were setting multiple all-time highs in a single month. The cascade of economic surprises that 2022 has brought has simply been more than many investors can bear.

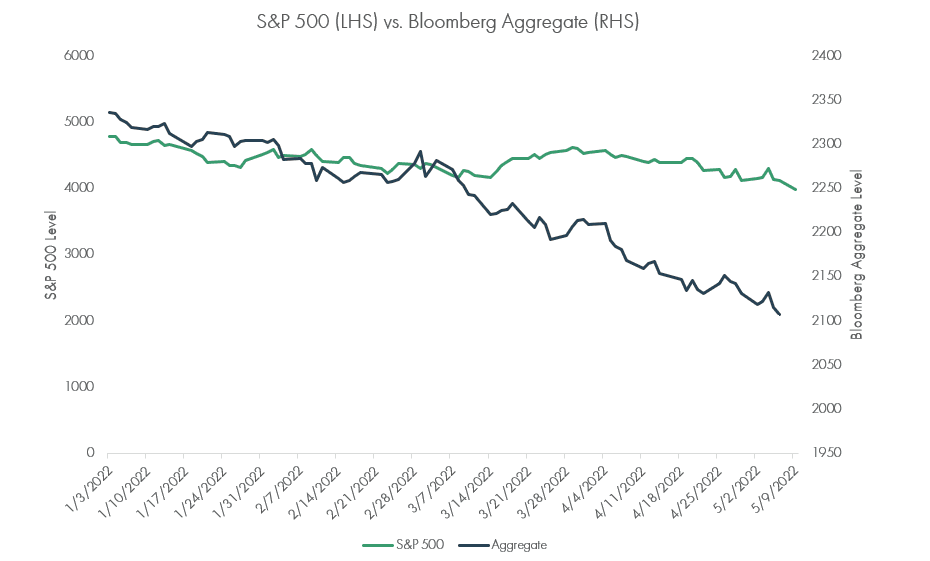

As bonds and stocks moved in the same direction and portfolios were bruised on all sides, it does indeed seem that there was “nowhere to hide” in recent weeks. Cryptocurrencies – a bellwether for risk appetite – also sold off (with the market down $1.6 trillion since its November high), while REITS – an equity proxy for real estate – were caught in the general equity sell off and sold off in line with the market.

With sentiment so roundly negative, it seems that the market neither wants to have its cake, nor eat it. Career bond investors call the end of the bond bull markets and expect a steadily rising rate environment – but other forecasters are also foreseeing an economic slowdown. Why would we expect global central banks to blindly follow a rate rise trajectory if growth is sluggish? Unless of course, inflation becomes unstoppable – but won’t slower rates of economic growth choke off some of the demand that drives prices higher?

So, with “nowhere to hide,” what do we know? At the current levels of volatility, timing market entry and exit is challenging – a well-balanced core equity portfolio will have sold off in unison, but as some of the investor fear subsides and markets return to fundamentals, areas such as dividend paying stocks, consumer staples, and utilities – these should start to recover.

Despite the overwhelmingly negative tone in markets today, the fundamentals around consumer sentiment, employment, and the probability of a recession are all positive. As of May 9, 2022, bond markets have endured their worst performance in a year since 1842[1], according to the Wall Street Journal, and with the 10 year Treasury note trading at over a 3% yield and investment grade bonds currently trading at levels last seen after the global financial crisis, some bond experts are seeing attractive yields and buying opportunities. Even during the depths of Covid slowdowns, default rates never ticked upwards, and it would seem unusual that this environment should see more turmoil than at that time.

Today, assessing investor sentiment, the glass is half empty. It may feel uncomfortable, hopeless, and unsettling. In times like this, we advise patience and a return to long term investment principles such as long-term thinking, diversification, and taking advantage of market conditions to selectively tax-loss harvest and rebalance on schedule. One characteristic of periods like this is that they feel like they will last forever. They do not.

[1] https://www.wsj.com/articles/its-the-worst-bond-market-since-1842-thats-the-good-news-11651849380

© 2022 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index and/or Style returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax, or legal decision. You cannot invest directly in an index. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.