By Chris Kamykowski, CFA | Moneta Investment Consultant

Twelve long months ago, the world faced a truly unique uncertainty while coming to grips with the onslaught of a global pandemic and sharp economic contraction arising from unprecedented worldwide lockdowns. Markets responded in-kind with a swift move downward, adding fuel to the fire of concerns for investors – although it took a backseat to real fears over mortality, infections, business survival and job prospects.

In our Q1 2020 Investment Report, we noted the lack of a crystal ball to inform us on how everything would play out: the speed, depth and severity of a large contraction in growth and how long it would take until a viable medical solution for COVID-19 was available. One of the few things we did know was that things would not go back to normal soon – at least over the near-to-medium term – and there would be ramifications long-term.

Sitting here more than 365 days later, much has changed on several fronts and we certainly have more answers than questions – although concerns remain. Things look brighter each day from multiple perspectives, so we wanted to briefly review just how far we have come:

COVID

Given the average time to develop a safe, effective vaccine typically takes 5-10 years, the world was right to be concerned about how long COVID’s impact would last. However, by using an accelerated timeline and coordination between governments and pharmaceutical companies, the first vaccines were ready, approved and distributed in less than a year. While distribution did have its logistical hiccups, more than 125 million Americans have received at least one dose and more than 78 million have been fully vaccinated as of April 15, 2021. Importantly, 80% of the most vulnerable people aged 65 years or older have received at least one dose. To be sure, we are not finished as younger age groups remain largely unvaccinated and variants of COVID are being reported in the population. However, progress in the fight against COVID has been immense the last few months, firmly putting us on a clear trajectory of progress.

Economy

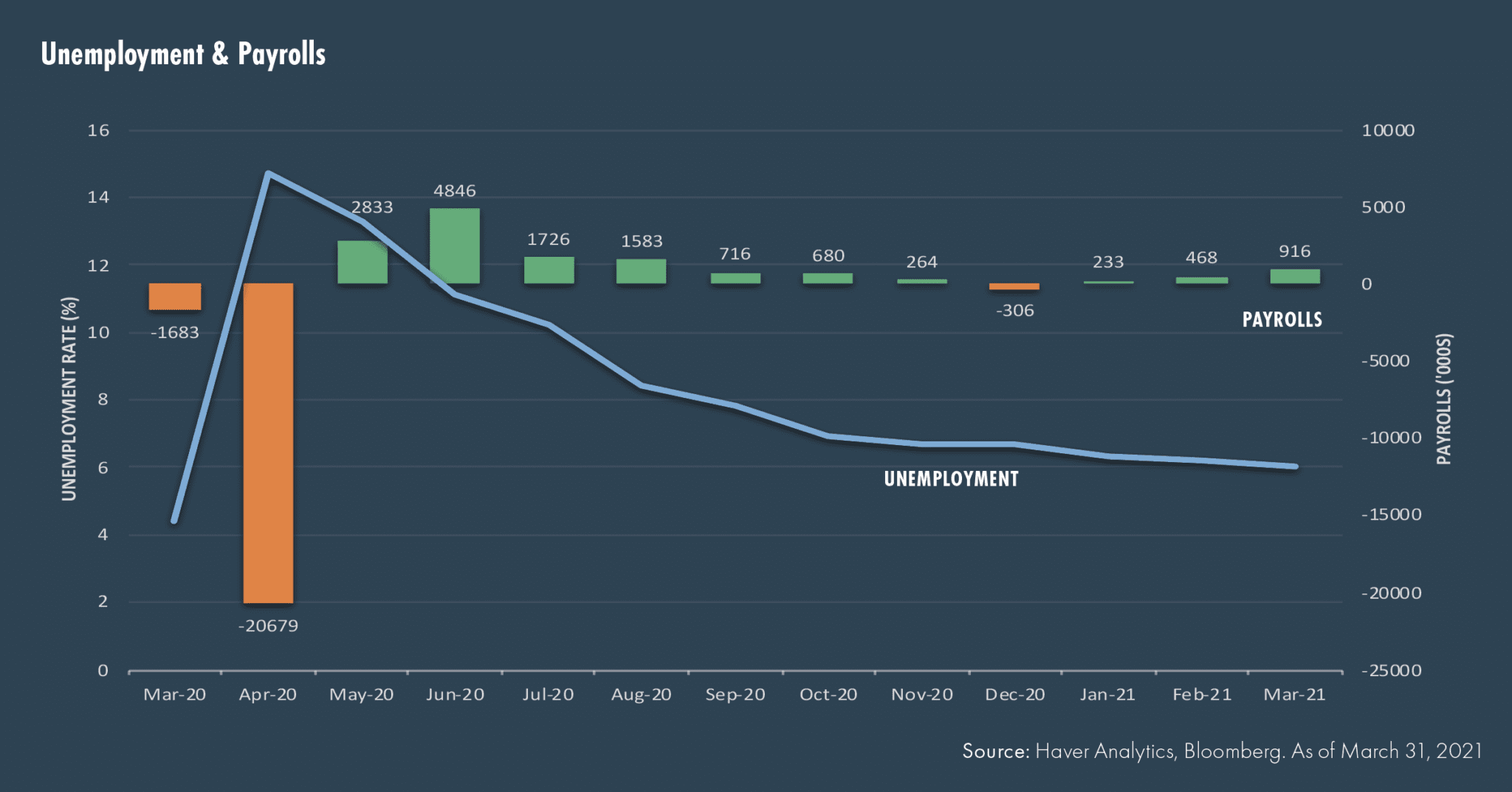

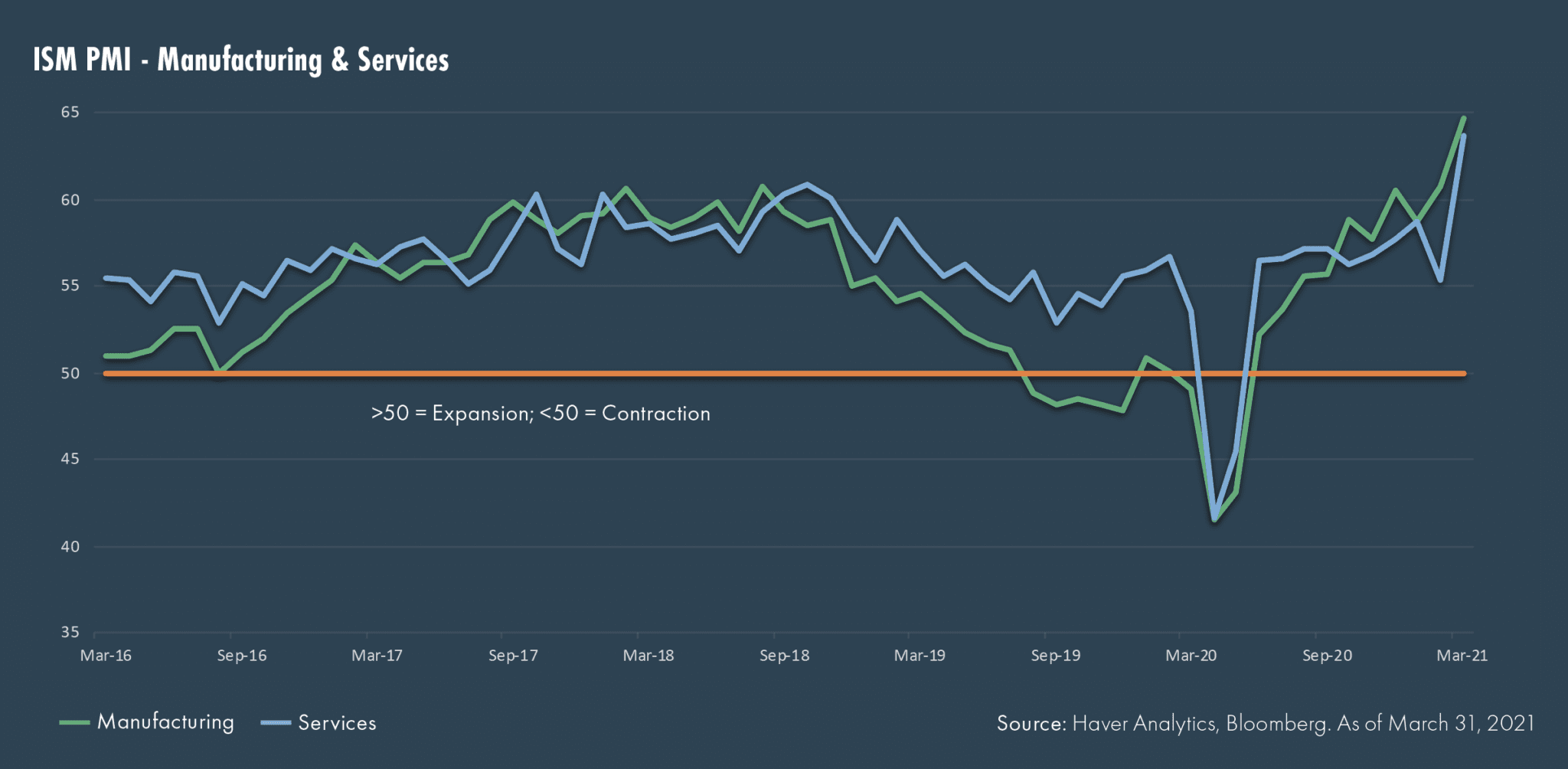

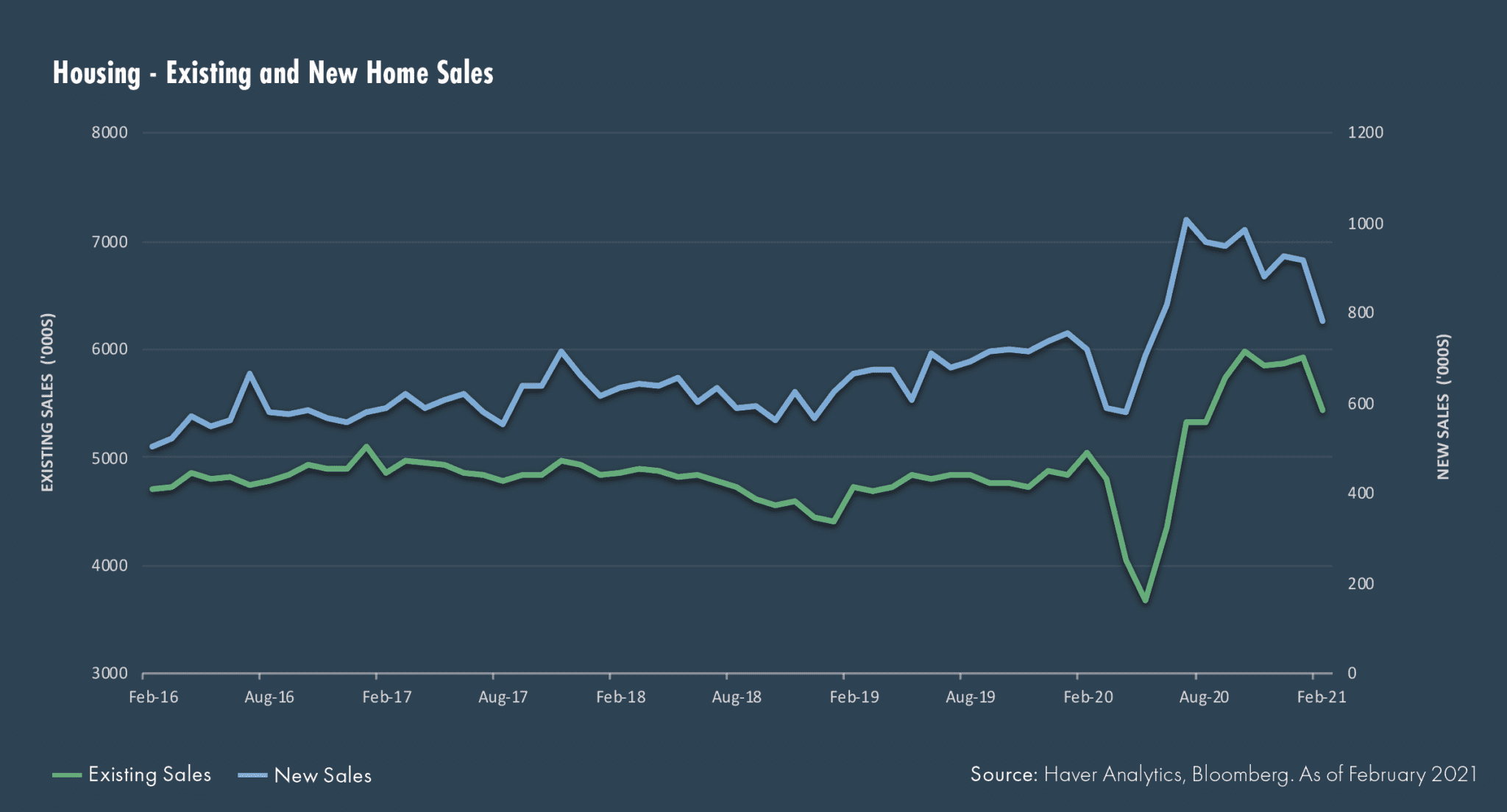

Our recovery from an induced recession has been nothing short of miraculous if one thinks to the days of skyrocketing unemployment in the US, thousands of shuttered businesses (many permanently) and disruption to whole industries. However, here we sit in a distinct recovery period as the broader economy comes back online. Employment numbers are improving and trending higher with 1.6 million added payrolls in the first quarter of 2021. The ISM’s Purchasing Managers Index (PMI), which has generally been a reliable economic indicator, is showing strength and distinct momentum with services and manufacturing expanding to 20+ year highs as of March. Industries which were severely impacted, like travel and leisure, are seeing a pop in activity as hotels reach pre-pandemic occupancy levels and airports now process more and more air travelers. The consumer continues to be a stalwart, no doubt helped by the influx of stimulus checks, and housing is benefiting from historically low interest rates, high demand and low inventory.

Fiscal Stimulus

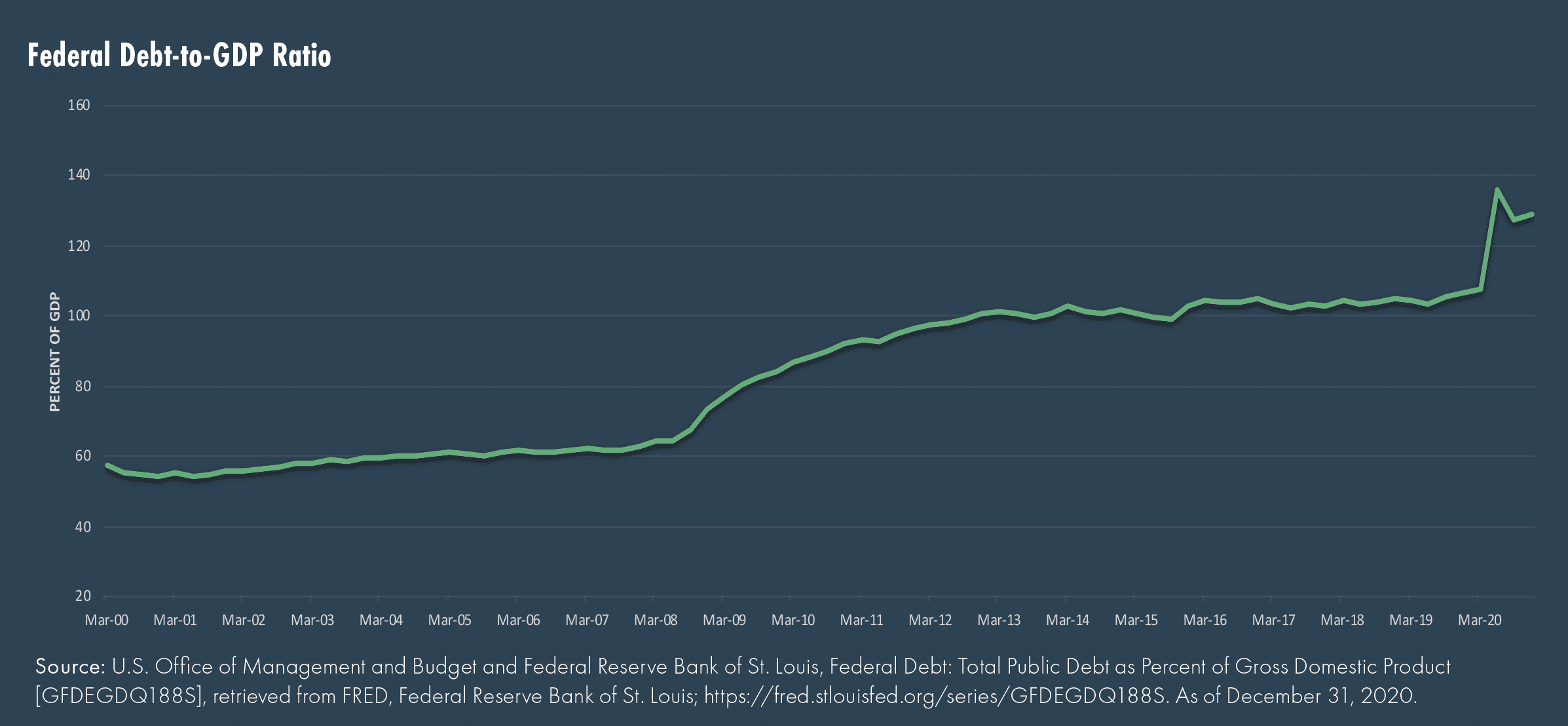

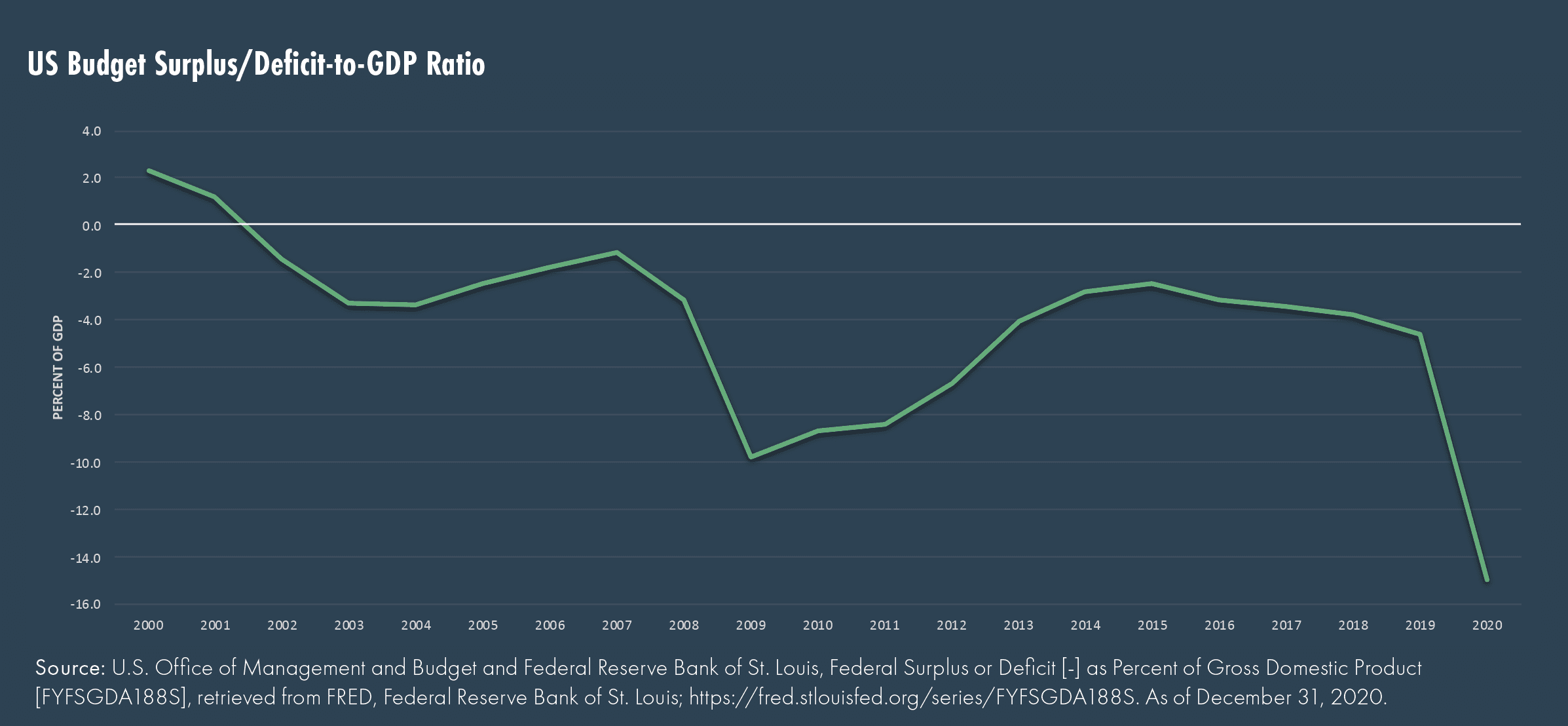

With so many people and businesses impacted by COVID lockdown policies during the last year, the US government embarked on unprecedented levels of fiscal stimulus alongside continued accommodative monetary policies to support workers and businesses. Whereas spending following the Great Recession of 2008-2009 topped out around $2 trillion, we have seen an injection of nearly $6 trillion in fiscal stimulus, which certainly fuels concerns over the levels of federal debt. Following the first quarter’s $1.9 trillion American Rescue Plan, the Biden administration is now seeking passage of an additional $2 trillion infrastructure package. While this will drive federal debt higher if passed and create long-term sustainability questions, our government is currently benefitting from a decline in the interest costs due to lower interest rates. At least in the near term, this should help mitigate the total costs of supporting the U.S. economy as we recover from the pandemic.

Interest Rates

After this past quarter’s steep rise in rates and steepening of the yield curve, the record lows of last year’s rate environment are a distant memory. While many quiver at the thought of higher rates – having been so conditioned to low rates the last 12 years – increases in interest rates in the early stages of a recovery are quite normal and should be welcomed, especially for savers. It speaks to confidence in the economy, an improving outlook and reduced reliance on the Fed’s need for extraordinary accommodative monetary policy. However, with the increased fiscal spending, economic growth momentum and higher federal debt issuance expected, markets have been suggesting the Fed may have to raise rates sooner than the Fed has communicated: one rate hike in 2022 and two in 2023. Part of this disconnect is due to the market’s concern over inflation. Some argue the immense amount of fiscal and monetary policy stimulus will lead to an overheated economy and inflation while others believe a pick up in inflation will be short lived–or, in the words of the Federal Reserve, “transitory.”

US Equity Markets

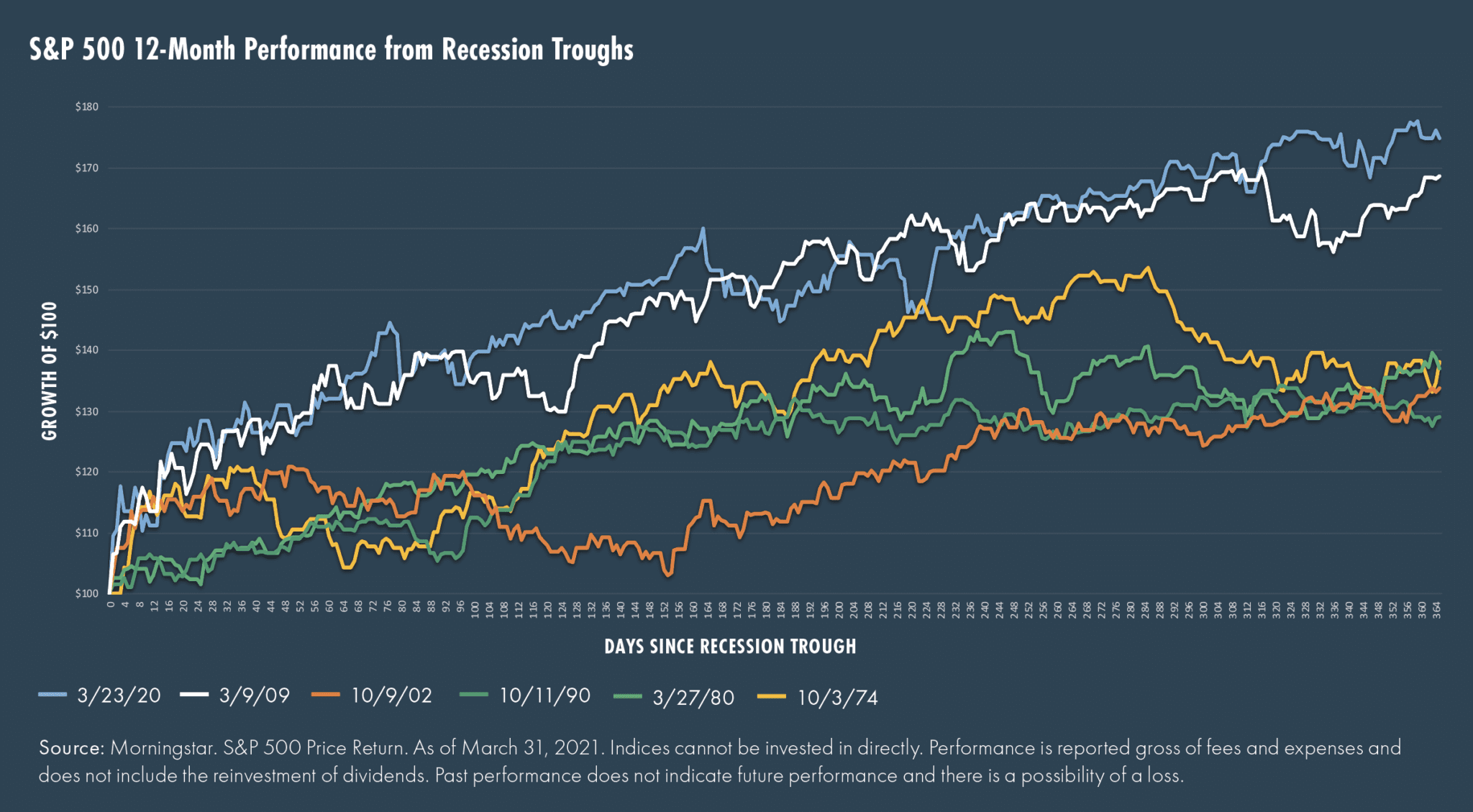

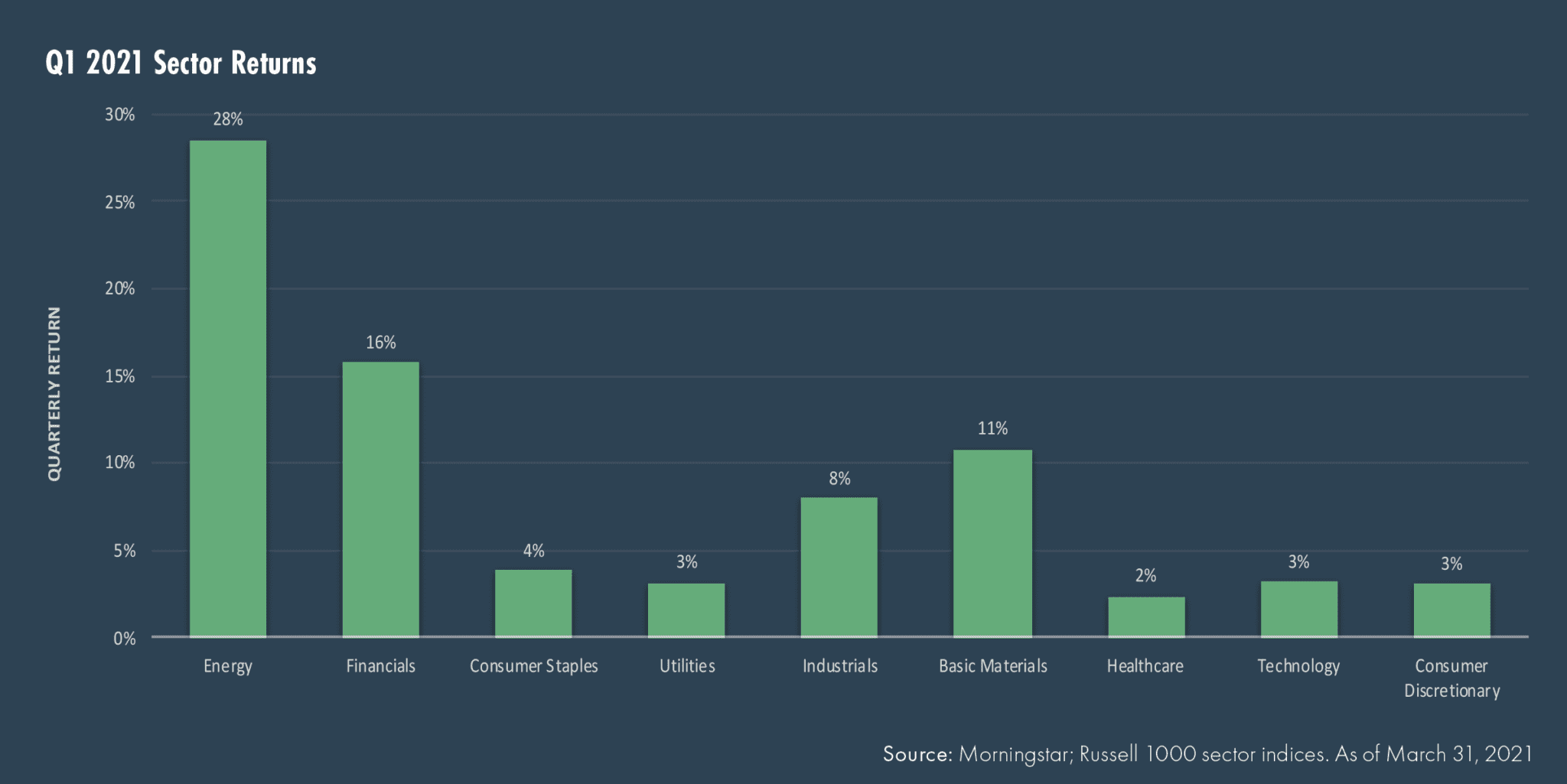

Fears over the outcome for equity markets should have been mitigated by the history of market returns following the lows of a past recession. Since 1974, the S&P 500 has typically recovered strongly following market lows of a recession with the last six periods averaging a 47% return one year later. The most recent market recovery was unique in both its speed and strength as the S&P 500 rose nearly 74% since March 23, 2020. While US growth stocks took the lead at the outset of the market recovery as investors paid for the relative certainty of future earnings, value stocks made a robust rebound and assumed market leadership, a theme that continued in the first quarter of 2021. As is typical in the early stages of a recovery, cyclicals (energy, financials, industrials) are benefiting from the turn in their expected profit cycle and the market is pricing in earnings momentum, a far cry from 2020. To highlight the extent of the market leadership change, relative to previous first quarters’ performance, value outperformed growth in the first quarter of 2021 by its widest margin since 2001 (+11.3% vs 15.0%, respectively).

Things are looking up in 2021 as the positive trends and momentum in the economy and markets suggest a welcome change from a year ago. Getting back to “normal” appears to be in the future, although we will likely incur the typical volatility markets throw at investors in any given year. In addition, it would be naïve to think there are no concerns still lurking, such as paying for all the stimulus, the impact on the tax landscape as fiscal liabilities pile up, the Fed’s and market’s reaction to unexpected inflation and pockets of frothy valuations. Still, while unknowns exist, what is known is timing market moves has proven incredibly difficult for wealth creation and preservation. Staying disciplined and maintaining diversified portfolio aligned with one’s return objectives and risk tolerances has proven to be the best course of action for most.

US Economic Update

- 916,000 jobs were added in March, which was the best monthly gain since August 2020. Despite the progress, total nonfarm payrolls remain more than 8 million short of pre-pandemic levels.

- The ISM Services survey hit an all-time high for the series dating back to 1997 as it rebounded off a drop in February. Manufacturing grew in March, as the Manufacturing PMI registered 64.7, 3.9 points higher. This is the highest reading since December 1983 (69.9).

- The housing market has been a foundation of support for the recovery, though, high housing prices and rising mortgage rates have slowed its momentum.

Government Spending

- Enormous amounts of fiscal stimulus spending due to the pandemic has driven US debt-to-GDP levels to all-time highs. While federal debt is higher, the U.S. government is benefitting from a decline in the interest costs due to lower interest rates.

- Federal budget deficits have widened substantially over the last year, and the trend looks to continue. Further spending packages are possible as President Biden seeks to garner support for the passage of a multi-trillion infrastructure bill this year.

Market Performance

- The 12-month equity market recovery from the March 2020 low was the best in both speed and strength relative to the recessions since 1974. As the U.S. experienced recessions in the modern era, fiscal and monetary policy adapted by implementing more aggressive responses to lessen the short-term impact of economic contractions. However, time will tell what the long-term consequences to this short-term relief will be.

- In response to the 2009 recession, the U.S. experienced nearly $2 trillion in economic relief. In response to the 2020 recession, we are nearly triple that amount, which certainly served as a catalyst for a swifter market recovery.

Market Performance

- From left-to-right, the chart above is in order from value-oriented sectors to growth-oriented sectors. After four calendar years of growth outperforming value, we are witnessing a leadership change with value sectors outperforming growth sectors. Energy and financials are leading the charge while technology and consumer discretionary begin to cool-off after an impressive 2020 year of performance.

- This is aligned with expectations as value tends to outperform growth during a recovery and rising interest rate environment. This is because:

- As market fear and risk decline, investors tend to look for investments that were disproportionately impacted during the recession, which are usually stocks with low price-to-earnings ratios.

- As interest rates and inflation rises, the value of a dollar today becomes relatively more valuable than a dollar in the future. Therefore, companies with more earnings-per-dollar today tend to outperform companies that are expected to grow into their earnings.

Market Performance

©2021, Moneta Group Investment Advisors, LLC. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. You cannot invest directly in an index. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.