By Bill Hornbarger, Chief Investment Officer at Moneta

March marked the 10th anniversary of the low on the S&P 500 during the Global Financial Crisis. Since then, the index produced an annualized total return of 16.7% during one of the best-performing decades for risk assets returns on record.

The market rebound in late December last year continued through March, but relied heavily on confidence in central banks to contain downside risks of slowing global growth. The most significant risk to this rebound and low volatility is central banks losing control of this narrative.

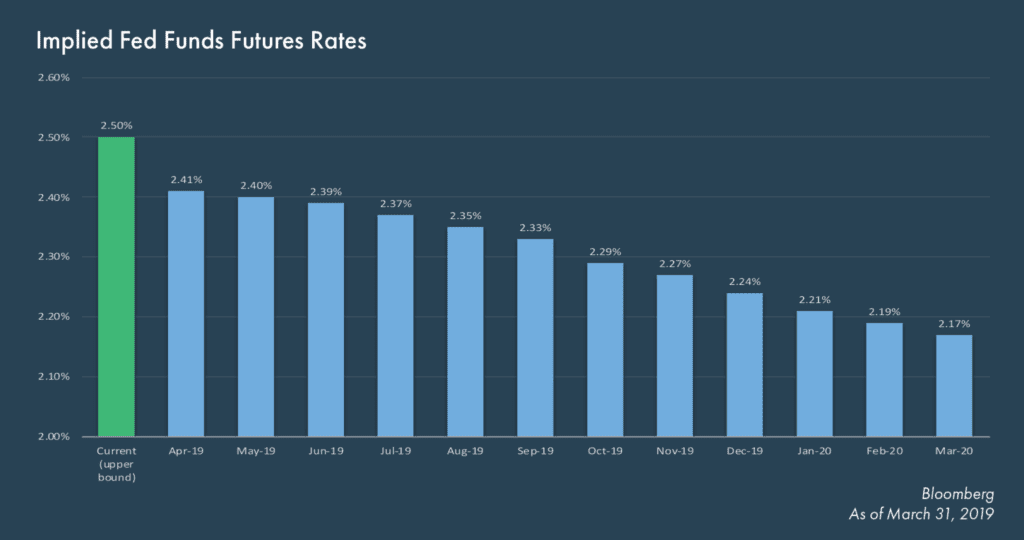

In his recent 60 Minutes interview, Federal Reserve Chair Jerome Powell said, “Growth has slowed in some major economies.” At the Federal Open Market Committee (FOMC) meeting in March, Fed policymakers signaled zero rate increases in 2019 and just one hike in 2020, down from the previous guidance of two hikes in 2019 and one in 2020. This change in forward expectations aligns interest rate expectations with the current, observed slower growth momentum. Federal fund futures signal an even more accommodative monetary policy stance, forecasting a full 25 basis point rate cut by year-end. (see chart below)

While March provided plenty for investors to digest, risk assets proved resilient. Ongoing protests in France, uncertainty around Brexit, back-and-forth U.S.-China trade negotiations and weaker domestic growth and inflation data did not deter the rebound in risk assets.

The S&P 500 Index rallied 1.9% in March and now stands 20.6% above its December lows. The forward price-to-earnings valuation multiple on the S&P 500 Index increased 1.6 to 17.1 during the first quarter and explained a large portion of those returns.

As earnings season unfolds, it will be instructive to focus on earnings growth and compare full-year earnings guidance to current estimates. Bloomberg consensus estimates lowered their earnings growth forecast for 2019 from 8.1% to 2.4%, but those forecasts also call for approximately 2.0% margin expansion from 2018(1).

Corporate profit trends will be particularly important since recent bank lending surveys indicated tightening of lending standards. If lending standards do not ease quickly, corporations will need to offset higher borrowing costs by reducing capital expenditures, labor costs or cutbacks in other areas. While we expect corporate profit margins to fluctuate over short periods, we acknowledge they are currently high by historical standards in the face of a slower growth outlook.

In contrast to the risk-on sentiment in the equity market, returns in fixed income markets were consistent with mounting growth concerns. High yield credit spreads widened 0.1% to 3.9%, and the 10-year U.S. Treasury yield fell 0.3% to 2.41%. The spread between two-year and 10-year U.S. Treasury yields fell 5.0 basis points to 13.9 in March.

This month, Fed policymakers outlined a roadmap for balance sheet normalization: slow the pace of reduction starting in May and conclude balance sheet reduction by the end of September. The yield curve continued to flatten in Q1. We believe inversion on the front end of the yield curve is still sending Fed policymakers a message that monetary conditions remain too tight.

While still a low probability, the yield curve could be signaling that monetary policy cannot generate sustained economic growth. For example, starting in mid-2018 (before the European Central Bank ended its asset purchase program), the rise in long-term Treasury yields began to slow as investors called the synchronized growth narrative into question. This indicates that accommodative monetary policy may need concurrent and forward-looking economic indicators to justify a further sustained rally in risk assets.

Market Outlook

Despite the rebound in equity valuations, we remain constructive on underlying fundamentals while acknowledging that elevated valuations likely reduce upside potential from here absent meaningful and sustained earnings growth.

Expectations still call for the U.S. economy to grow approximately 2.1% in 2019. Fed policymakers took steps at the March meeting to accommodate slowing growth momentum. Effects of fiscal and monetary accommodation are still working through China, and the European Central Bank recently announced a new term lending facility intended to spur loan growth in the region. Although the U.S.-China trade conflict remains fluid, U.S. officials extended the deadline for further negotiations. Both mounting populism in Europe and Brexit negotiations remain sources of headline risk for markets and bear monitoring.

Investors should be patient and adhere to a well-constructed, diversified investment portfolio anchored to their goals and time horizon. Despite elevated uncertainty, we do not find compelling reasons at this time to justify overriding our asset allocation methodology. While corrections like the one experienced in the fourth quarter of last year are unnerving, they are a natural part of the market cycle and often represent a process of resetting valuations.

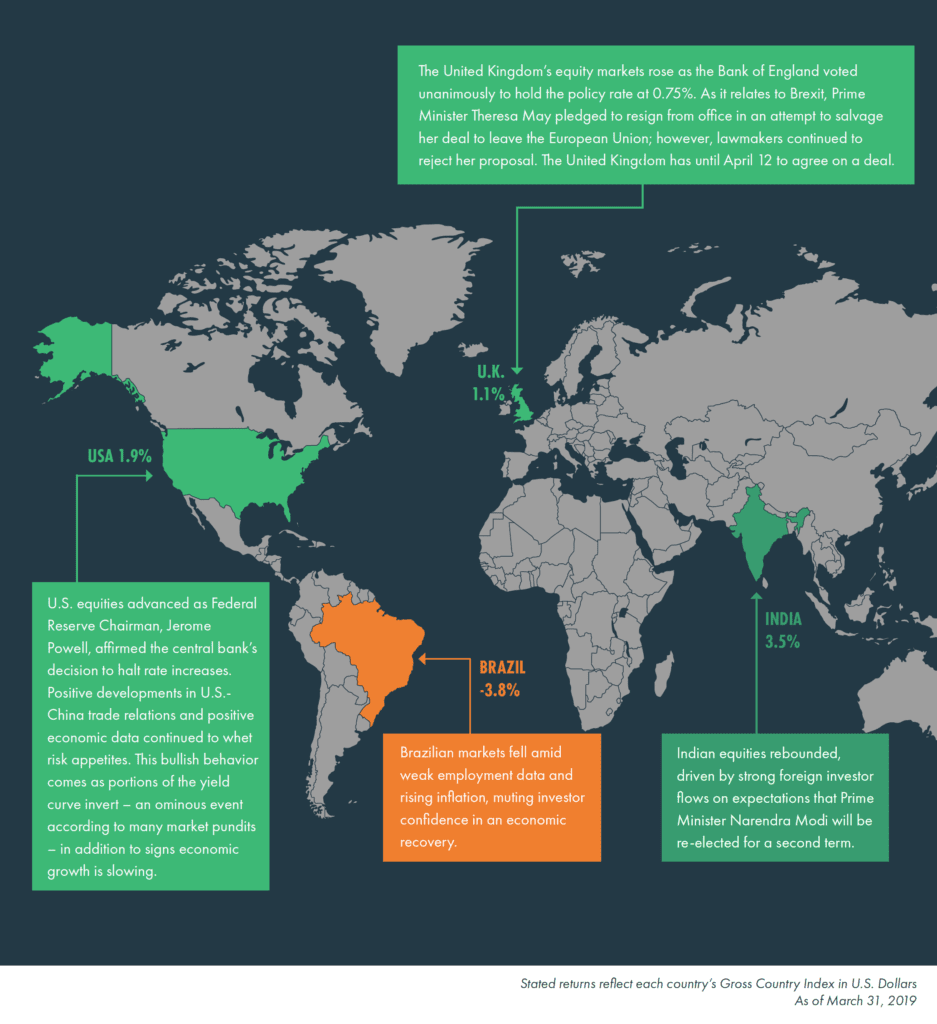

Global Highlights

Market Snapshot

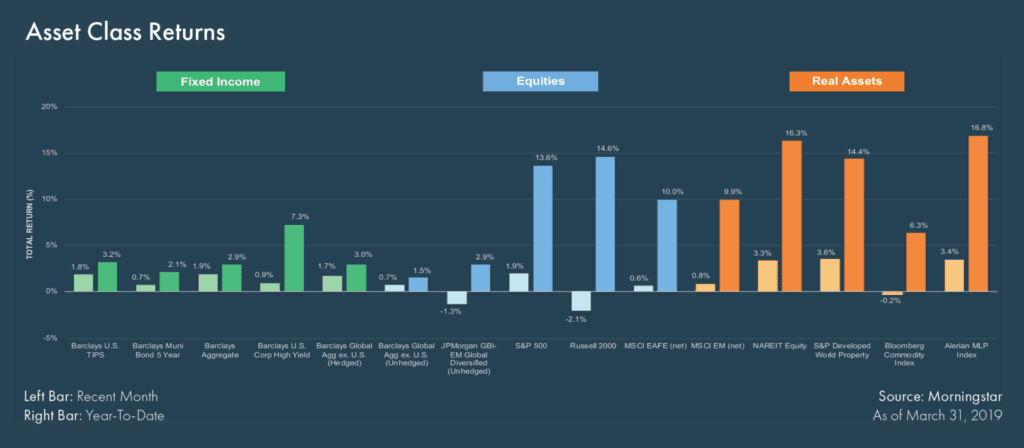

Fixed Income

- Longer-dated U.S. Treasury yields rose and the yield curve steepened due to stronger-than-expected GDP data and diminished concern over tariff issues with China.

- High yield corporate bonds were the best performing fixed income asset class as lower quality credits continued to benefit from healthy risk appetites. Municipal bond prices benefitted from constrained supply.

- International unhedged and emerging markets debt posted negative returns as the U.S. dollar rallied.

Equities

- U.S. equities continued their advance as fewer macroeconomic headlines resulted in positive sentiment.

- Growth broadly outperformed value during the month. Industrials, Utilities and Technology outperformed the broader index.

- Developed international equities advanced, but were subdued by weak economic data and concerns of slowing growth. Emerging market equities posted modest gains as attractive valuations and a backdrop of economic reforms in China supported returns.

Real Assets

- Real assets were higher for the month with the exception of international REITs, which fell moderately due to global growth concerns.

- Commodities were the best performing real asset class for the month. Lower-than-expected oil supply was supportive for prices throughout the period.

- Master limited partnership (MLP) business ventures advanced modestly on higher oil prices, but mixed earnings reports, rising interest rates and pipeline delays muted returns.

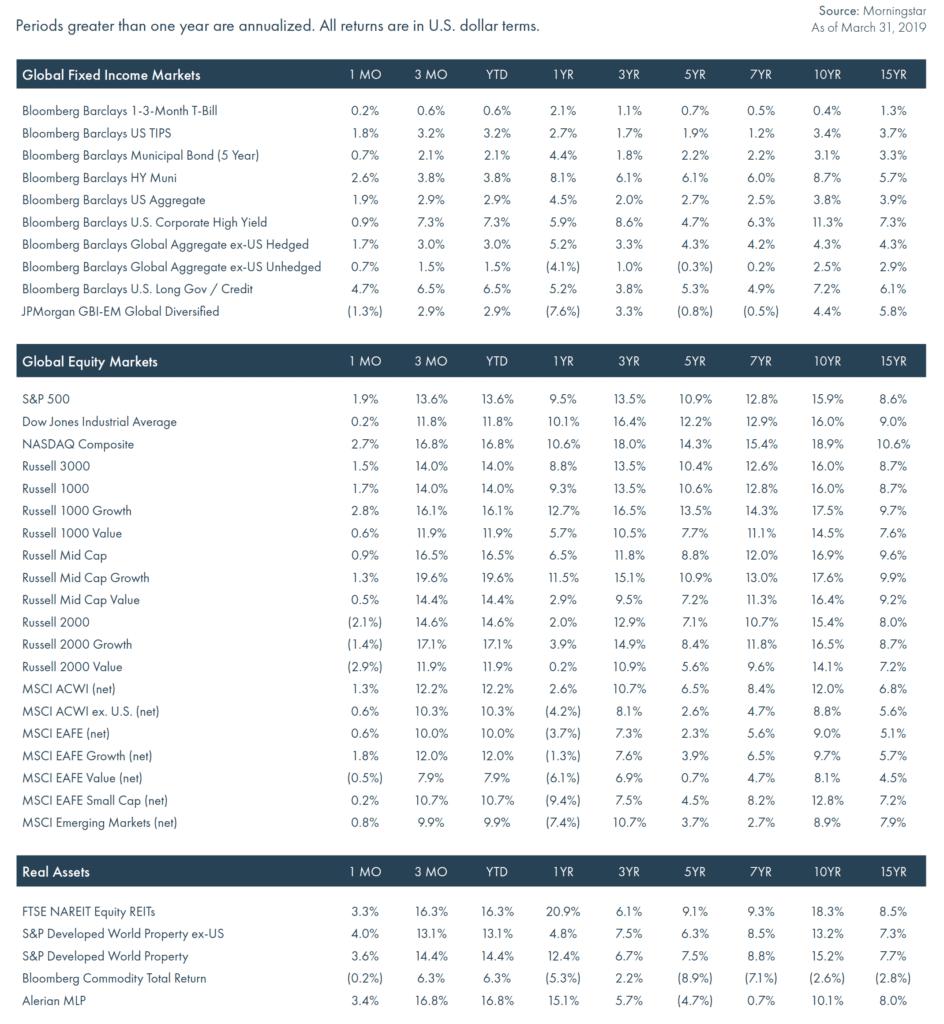

Financial Market Performance

1 Bloomberg

© 2019 Moneta Group Investment Advisors, LLC. All rights reserved. These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.